Comstock/Stockbyte via Getty Images

AGNC Investment Corp. (NASDAQ:AGNC) just hit a home run at its latest earnings conference. It appears that investors missed watching the DH at the plate. In our view, managers foster home runs when their business performs according to plan. In past articles, we warned investors not to judge this company by its stock price because the main driver, Net Asset Value, isn’t hedged, being subject to significant drops under periods of Federal Reserve rate hikes. Management then left both an asset warning with a promise of increased cash generation usable to rebuild the business on the other side. Grab some peanuts and a cold drink, go sit back down, and watch the replay on the giant screen. It was one of the longest ever.

The Quarter in Summary

We begin with the quarterly results. In the prepared remarks, management noted:

“In the early stages of market downturns, it is not uncommon for the U.S. Treasury and Agency MBS markets to underperform other fixed income products because these securities are the most liquid and thus easiest for investors to convert to cash.”

They continued reminding participants that this two-edged weapon cuts the asset value and strongly improves the return on the other side.

A few key financial markers reported at the call:

- Lost $2 per share or 20% in asset value. (The stock price followed something management fully expected.)

- Dividends remain unchanged at $0.36.

- Opportunistically issued $290 million of common equity at approximately $10 per share.

- Issued $150 of fixed rate equity.

- Leverage moderately increased to 8.1x.

- Cash and unencumbered Agency MBS totaling $3.6 billion (54% of tangible equity). (Note: this places a highly probable stock price floor near $5.)

- Dollar roll income came in at $0.84 slightly up from the last quarter.

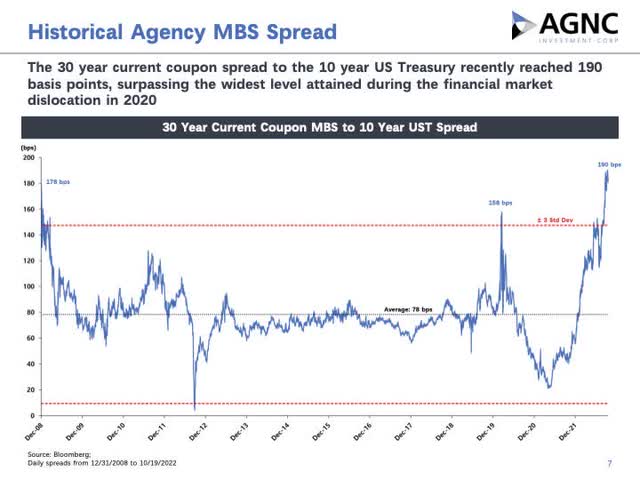

Next, we include a slide showing a 14-year history of the Agency MBS Spread. This indicator drives asset value and other important indicators, both positively and negatively.

Management also noted that:

“[a] significant portion of this widening occurred late in September following an unforeseen episode of instability in the U.K. bond market that led to a significant repricing and risk-off sentiment in our treasury….”

This drove the quarterly results.

The Length of the Home Run

Without a radar system following the hard-hit ball, the length of the drive must be determined using softer criteria. When looking at it, management stated that this craziness created “a once-in-a-lifetime return opportunity.” With leverage comfortable and liquidity position strong, AGNC is posed to begin its about-face. It is a balance between both offense and defense, how to protect and poise for the drop in spread and take significant advantage of the reversal. The spread changes when strong inflows begin. Management again noted that Bloomberg wrote that last week the Agency MBS market had the largest single-day inflow.

Management discussed the difference between 2008 and now, stating:

“The Agency MBS market is not the problem here. There’s no liquidity problems, there’s no selling problems. There’s no prepayment risk problems. There’s no risk out of the Fed.”

The discussion follows an important hedging belief. Management hedged multiple points drastically, positively affecting the risk. Hedging all 10 years gives a completely different and significantly higher risk outcome. AGNC made it clear, “we wouldn’t be []comfortable.” Adding detail:

“So the combination of about 15 basis points wider in spreads, particularly in the belly of the coupon stack load to the belly…, plus that [3%] gives you about 15%. That’s why we’re looking at returns today that are the best we’ve ever seen.”

Concerning an important investor concern on being paid, Bose George asked, “Given the current dividend, about 44 on your implied book value…, suggest the dividend yield, I guess very high teens. I mean, does your portfolio generate that to cover that dividend?”

Peter Federico, the company CEO, answered the high yield came because of lower asset values not changes in cash generation. Adding (emphasis supplied):

“So the decline in our book value is driven primarily by wider spreads. So while it hurts your book value currently because the decline in book value came from wider spreads, it also enhances the go-forward return on our portfolio. So said another way, as our dividend yield has gone up with the decline in our book value, the return on our portfolio has gone up in a commensurate way.”

On another issue, the cost of funds, management noted that increased repo costs that increase with increasing Fed rate, are offset on the return leg on the swap moves at the same rate, resulting in relative stable cost of funds minus a small timing difference. This is how hedges perform.

One final measurement, the purpose of the recently issued Series C preferred shares. One of the AGNC preferred just went floating. When asked about thoughts on retiring the floating shares, Peter Federico answered that the company made some investments which offer future returns as the stock price moves upward. It is a wait-and-see before they decide to sell the stock or call the floating preferred.

The home run reached 500+ foot. The model thus far has performed accordingly. This is what investors should be watching for.

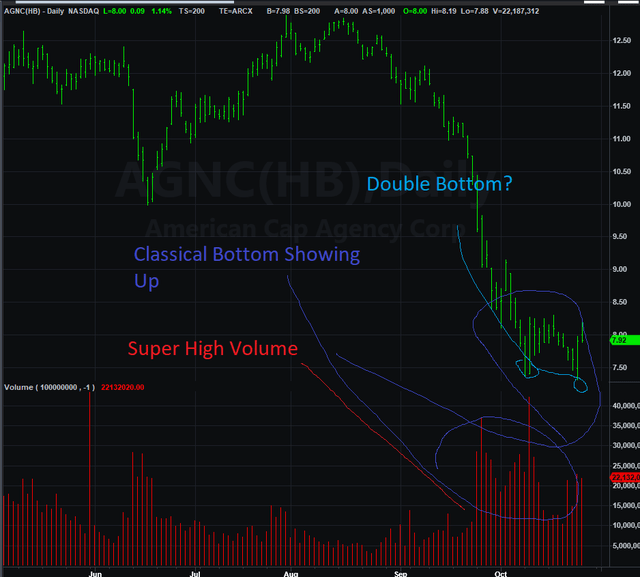

The Chart

Next is a day chart made from TradeStation Securities of AGNC.

The high volume accompanied by two touches near the same price is a classical sign of a bottom. Coupling this chart with the results from the strong quarterly results should leave investors with a level of real confidence.

Risk

Management noted during the call enough times to make it clear, higher dislocations in the MBS spreads are possible. With higher MBS values, assets will drop and so will the value of the stock. It is also clear that the Fed isn’t finished raising rates. But, don’t forget, investors will still receive a dividend. Lower spreads are also possible, resulting in higher asset values lifting the stock price. It is a two-edged sword. Investors must be aware of this risk or reward.

The Investment

Perhaps the most important statement in the whole conference came from Vilas Abraham’s of UBS question (emphasis supplied):

“At the end of the day, when you invest in AGNC today, for example, you are investing in a pool of Agency MBS at current valuation levels at the widest spreads on a risk-adjusted basis that I would say we’ve ever had. So the investment today stands on its own that there is certainly risk the spreads could widen further, and there are certainly risks and spreads could tighten a lot and the economic experience will be just as good, whether we take more leverage or not. . . You would expect us to generate our best returns following huge widening events. And this obviously is one of the most historic widening events that the market has ever experienced.”

In management’s view and ours, this is the best time to open a position in this type of business. We wouldn’t buy AGNC all at once. Waiting for the November FOMC meeting announcement might be a place to begin or add. We are still slowly adding to our AGNC position, slowly. The DH hit a monster shot over center field; the fans seemed to have missed it.

Be the first to comment