imaginima

(Note: This article was in the May 22, 2022, newsletter and has been updated as needed.)

Africa Oil (OTCPK:AOIFF)(AOI:TSX) is a Lundin Group Company with some important interests that will provide some diversification of income from the current source. The company has an income interest in a Chevron operated project offshore Nigeria. Nigeria does support the industry and the country certainly needs the income. But that country has to be regarded as above average risk as a place to do business. Being offshore may eliminate some of the problems that the country is noted for. But it would be a whole lot better if this company had more than this source of income.

The first quarter benefited from the very strong commodity prices. This is a Canadian company that reports in United States dollars. Debt has been repaid. When you do business in a foreign country like Nigeria, there is absolutely no way to “safely” leverage. So, it is very common for companies whose primary business is in countries like this to have no debt or very little debt.

It should be noted that the joint venture, Prime, which is the source of the company’s cash flow, does have debt that is not consolidated to the balance sheet of Africa Oil. Prime has been repaying that debt at a decent pace (though some was reborrowed). The Prime debt ratio remains at a conservative 0.4.

South Africa

Management announced a major discovery off the coast of South Africa. That discovery will likely take several years to evaluate and build the structure needed for production. But the possibility of production and income from a far more stable country like South Africa with much better supporting infrastructure and a far more effective government is promising.

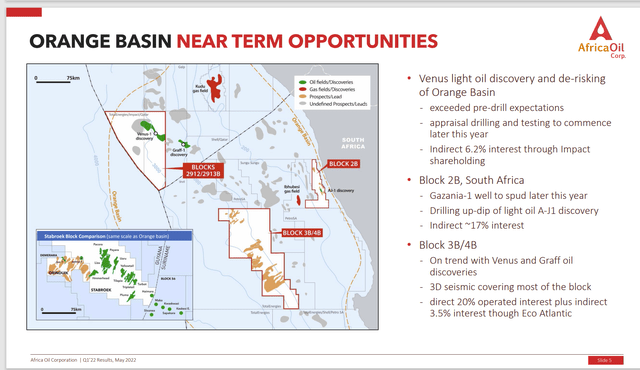

Africa Oil Description Of Major Orange Basin Discovery Off The Coast Of South Africa (Africa Oil First Quarter 2022, Corporate Slide Presentation)

A discovery makes a future vision of lots of money far more believable. Exploration offshore is very costly, and it is risky as well. This company has got itself insulated from really bad results through the interest in Impact. On the other hand, the company stands to collect dividends from the hoped-for result. If the worst happens and Impact has to liquidate, the company has plenty of other opportunities. Right now, that discovery, with Total (TTE) as the operator, has way more upside than downside.

It is going to be awhile (as in years) before the operator suggests a production strategy. But a discovery is a big step in the right direction to future income.

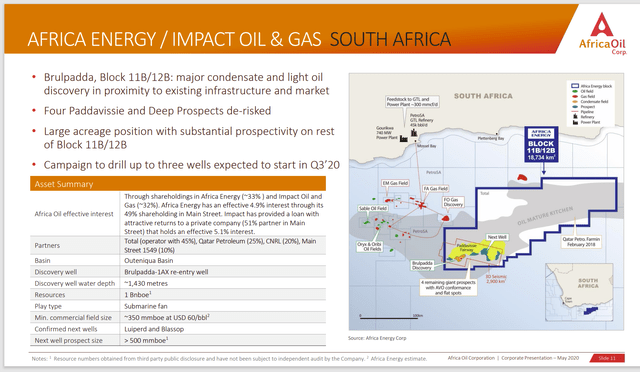

Africa Oil Interest In Discovery Now Proceeding Towards Production (Africa Oil May 2020, Corporate Presentation)

In the meantime, another discovery in South Africa is now proceeding to the permit request stage so that the operator can begin future production. The onset of future production is likely to interest Mr. Market. This market tends to respond to cash flow increases as opposed to discovery announcements. The slide above is one of the more recent descriptions with some detail that I could find (even though it is “old”).

The age of the slide gives the investor some idea as to how long it takes these discoveries to get to the cash flow stage. Generally, a five-to-seven-year time frame from the initial discovery to production is not unusual. In fact, that time frame can lengthen if there is no supporting infrastructure in the area of the discovery. It is one of the reasons that the market really does not respond much to offshore discovery announcements.

When the production application is approved, then the operator may have a schedule as to when first production is expected.

Nigeria

The Nigeria interest is the source of all of the company’s cash flow. The company got a good deal in obtaining this interest because Nigeria is considered a higher risk place to do business and because selling such interests have a limited market. What has made this purchase a “deal” is the rising commodity prices. This is yet another management that was purchasing an interest when oil and gas prices were far lower.

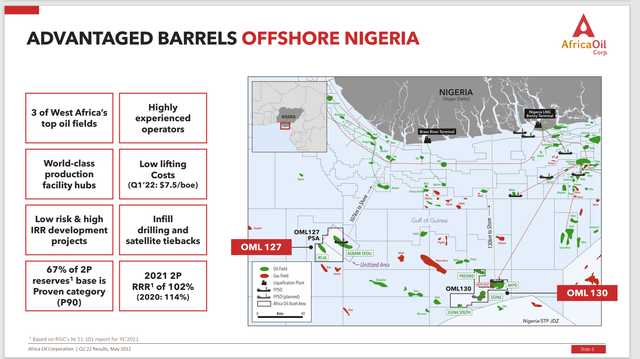

Africa Oil Presentation Of Nigeria Operation Characteristics (Africa Oil First Quarter 2022, Corporate Slide Presentation)

The operators here are all well-established large companies. Chevron (CVX) operates the leases that produce the cash flow to the company. That gives a small company like this a credibility it otherwise would not have. There are a lot of small companies that literally drown offshore because they have no idea about what to do. Here, the advantage of the Lundin family interests is obvious.

Management has obtained a cash flow giant for the size company. The purchase price of the company’s interest has already come back (for the most part) and there appears to be a decent amount of cash flow in the future to fund other projects.

The debt needed for the initial purchase has been mostly repaid. Africa Oil itself has no debt left to pay from the original deal. But, the company’s dividends come from Prime and there is still a fair amount of debt there that is extremely well covered by the cash flow.

In summary, this cash flow appears to be secure for the time being. The presence of Chevron as an operator and the location offshore appear to offset a lot of my worries about doing business in Nigeria. However, as far as I am concerned, more cash flow from other areas cannot happen fast enough. So, this investment idea has to be classified as above average risk (at least).

The Future

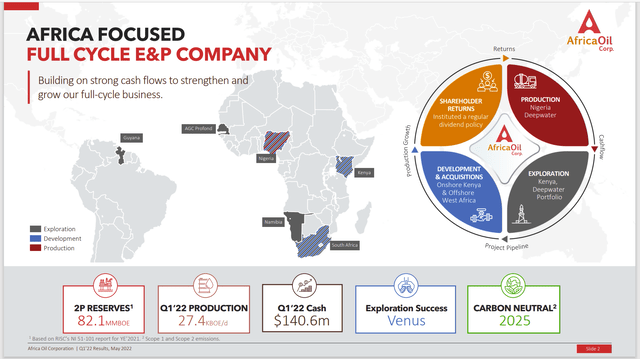

Africa Oil has a lot of interests in other parts of the world both directly and indirectly through holdings in other companies.

Africa Oil Worldwide Prospects Summary (Africa Oil First Quarter 2022, Corporate Slide Presentation)

Thanks to the acquisition of the interest in Nigeria, the company now has a cash flow source to help fund future requirements. That moves the company from a development stage company to a company with cash flow that the market can evaluate as a going concern.

There are a lot of projects here that have the potential to materially add to the current share price. But this is one very risky company even though it has cash flow. The stock is definitely not for everyone, and positions should probably be part of a well-chosen basket (rather than loading up on a company like this).

Investors should expect that cash flow distributions to the company will be “lumpy” and irregular. That should change as the company grows and diversifies. In the meantime, this company clearly has an above average chance of success.

Management recently announced that another Prime dividend was received. This now meant that total receipts since the 2020 purchase have exceeded the purchase price. This is definitely a good deal for shareholders. But it also points to the riskiness of doing business in Nigeria.

The association with the Lundin family organization provides a lot of resources not available to companies of this size. The experience alone is worth a lot to shareholders in terms of reducing the risks noted above.

In the current environment, the upside potential appears to exceed the downside risk. But investors should expect a lot of volatile price movements in a stock like this “for no reason at all”. That too will lessen as the company grows. This idea will take some patience as delays are common and the oil and gas business itself has low visibility.

Be the first to comment