blackdovfx

Sapiens International (NASDAQ:SPNS) delivers another solid quarter to our surprise. Last quarter they guided for earnings headwinds as a consequence of investments into brand awareness associated with building new business in their emerging geographies. However, gross margins grew and operating profits grew in line with revenue. For now, the onset of macro headwinds are not visible. Sapiens continues to qualify as a steady grower, and still with levers for margin expansion. Their strategy works, but we’re unsure about the environment continuing to support their growth multiple. Any let-up in growth and we’d be worried about our capital in the business.

Sapiens Q1 Earnings Results

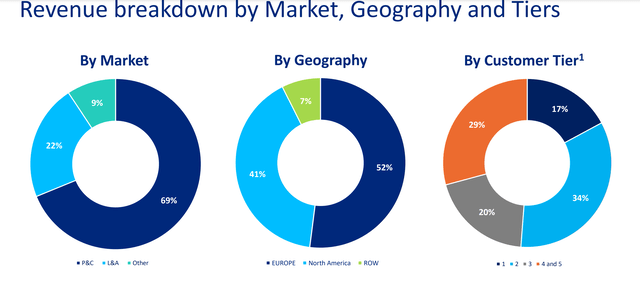

Things look pretty good for the company. Without considering the negative currency effects as a consequence of a stronger dollar on the European business, organic growth managed to eke out a double-digit figure, and likewise did operating earnings. At 11% organic growth, down to 9% including currency effects, the company continues to perform well. The growth is being driven YoY by the US segment and the RoW segment, with the European segment, which had a blockbuster 2021, stalling a little more, but still producing a bit of growth.

Geographic Breakdown (Q1 2022 Pres)

Tier 1 customers are being won in Europe and RoW, while reinsurance customers dominate the US segment. Ultimately, this bifurcation between the US and the EU segments remains the key issue for the company. In short, the EU business is quite progressed. Tiers of the customers are higher and a majority of the customers buy from Sapiens as their main insuretech vendor for a comprehensive offering, while in the US it is more 50:50, where half the customers are looking for products from Sapiens that only cover a specific function.

So far management doesn’t recognise that there are any issues with hesitancy from customers in light of the economic environment. Deals are coming to conclusions as one would expect. So far, the investments into building higher tier client base in the US are not appearing in the bottom line too evidently, but they should eventually. In fact, when we first covered Sapiens they were talking about offshoring effects. This was some quarters ago and only now are the gross margin effects visible with a pretty remarkable gross margin expansion seen from 44.7% to 45% despite the fact that costs including labor are generally rising. Offshored workers are only 50% of the headcount, so incremental benefit can still be expected here which is nice to see. Otherwise, the company continues to execute on its land and expand strategy with 90% of revenue coming from existing customers as they sell them into more of their cloud hosted products.

Conclusions

The company continues to have attractive tech economics. Its cloud based offering generates a lot of recurring revenue and is a modular basis for building up a client offering and upselling them into more of Sapiens products. Customers are committed to Sapiens and generally buy ancillary products on top of core offerings.

The issue with the company is that it is somewhat expensive. At almost a 30x PE, the earnings yield is around 3.5%. That’s not high especially against a rising risk free rate that is almost approaching 3%. This isn’t a riskless business. While growth this quarter was impressive, they are still struggling to level-up in the US markets, even though that’s where Sapiens’ growth came from this quarter, and the macro environment has been seen in other industries to be starting to weigh on tech spending. Insurance is a stronger end-market than most of course. In many ways insurance companies benefit from the current environment where they have already locked in price increases in 2021 for a large covered pool that offer consistent cash flows, and are now able to invest rolling over funds from money market instruments are higher fixed income rates to improve low-risk investment yields. Nonetheless, if there is enough of a macro hit where policy growth will be more limited, the utility of some of Sapiens’ products will fall and this will likely halt growth. With a 30x PE multiple in equity markets reflecting an expectation of growth, we’ll pass on this company despite margin levers with offshoring, especially when 14x PE Asseco Poland (OTCPK:ASOZF) is on the table. Also we expect it to eventually cost the company to produce further growth in the US, unless the references really do enough for them among their lower tier customers to higher tier companies upstream.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment