hapabapa

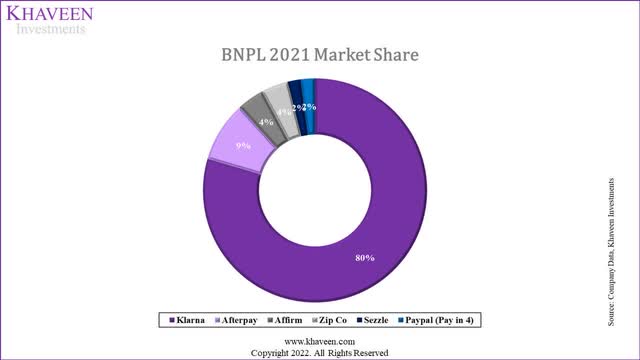

Affirm Holdings, Inc. (NASDAQ:AFRM) is a company that offers Buy Now, Pay Later (“BNPL”) service to merchants. We analyzed the company as it has strong merchants and active customer growth. To understand the potential impact of its partnerships on its future growth, we analyzed its partnerships based on 3 segments, which are: e-commerce; fintech; and travel and ticketing. As seen in the chart below, Affirm is the third-largest BNPL platform among its top competitors, with a 4% share of active users in 2021.

Company Data, Khaveen Investments

Company Data, Khaveen Investments

Partnership With Market Leaders Amazon, Shopify and WooCommerce in E-Commerce

In the e-commerce segment, Affirm partners with Shopify (SHOP), Amazon (AMZN) and WooCommerce. Amazon and Shopify are the leaders in their respective markets. As of Q1 2022, Amazon had the largest market share of 30.6% in the e-commerce market. In the global e-commerce software market, Shopify has the largest market share of 29%, followed by WooCommerce with a 23% market share.

With Affirm, the buyers of the e-commerce partners have a BNPL option during checkout. For example, Affirm’s partnership with Amazon provides an add-on to Amazon Lending by providing more payment options to buyers. Moreover, the company mentioned that Affirm is exclusively providing BNPL for Shopify’s Shop Pay installment, and the 16x growth in active merchants was due to the “scaling of partnership with Shopify,” showing the significance of Shopify as Affirm’s partner.

The company also mentioned that they would expand their product rollouts for their partners. For instance, Adaptive Checkout provides buyers with more flexible BNPL payment options on Shopify, as well as the recent release of the Chrome browser extension.

We believe that the opportunities for Affirm are through the active users of Amazon and merchants of WooCommerce and Shopify. For instance, Amazon has 310 mln active users, Shopify has 1.75 mln merchants, and Woo Commerce has 3.7 mln merchants. In comparison, Affirm has 7.1 mln active users as of Q4 2021.

Based on Valuates Reports, the global e-commerce market is forecasted to increase at a CAGR of 17.4% until 2028. We believe that the company’s large partners in the e-commerce segment would continue to drive merchants and active customer growth.

Opportunities To Benefit From Fintech Partnerships

For the fintech segment, Affirm partners with Verifone, Adyen (OTCPK:ADYEY, OTCPK:ADYYF), Fiserv (FISV), Global Payments (GPN), and Stripe. We believe Affirm could benefit from its partnership market leadership position in the merchant acquiring market. In 2021, Fiserv was the largest payment facilitator with an estimated 41.3% market share of the top 8 companies while Global Payment is the 3rd largest with a 17% market share. Moreover, Adyen has a 12.05% market share in the payment processing market.

Through the partnerships, customers of these payment processers’ merchants are provided with a BNPL option with Affirm. The fintech companies provide online and offline payment processing services. Customers of these payment processers’ merchants are provided with Affirm’s BNPL option at checkout. Additionally, this partnership decreases the friction for merchants to include BNPL as a payment option. For example, Fiserv‘s merchants are not required to construct a new tech integration for the BNPL option with Affirm. while its partnership with Adyen provides the BNPL “online and in-store via QR code.”

|

Company |

Active Users (‘mln’) |

2021 Transaction Volume ($ bln) |

|

Fiserv |

10 |

2,600 |

|

Global Payments |

5 |

1,069* |

|

Stripe |

3.1 |

640 |

|

Verifone |

– |

10.4 |

|

Adyen |

– |

590 |

*forecast

Source: Company Data, Khaveen Investments

We believe that the opportunities for Affirm to expand its reach are through the active users of the fintech companies’ merchants. For instance, Fiserv alone has 10 million users while in comparison, Affirm has 7.1 mln active users as of Q4 2021.

Furthermore, we believe this would also provide an opportunity for Affirm to additionally sell their add-on products to the merchants’ users. For instance, Affirm is also offering Adaptive Checkout to Stripe users. Based on Valuates Report, the fintech market is forecasted to grow at a CAGR of 13.9% until 2028. We believe that Affirm’s partnerships with the fintech companies would provide growth driven by the opportunity to tap into the fintech companies’ users.

Growth Opportunity With Partners in Travel and Ticketing Market Segment

In the travel and ticketing segment, the partners are Expedia, Priceline, and American Airlines. The company also mentioned that Expedia, Vrbo, and Priceline were “all in the top 10 by volume”. The partnerships enable buyers to make bookings and pay for it over time.

|

Company |

Active users (‘mln’) |

|

Expedia (EXPE) |

24 |

|

Priceline (Bookings.com) (BKNG) |

240* |

|

American Airlines (AAL) |

140 |

*Annualized

Source: Expedia, BeBetter Hotels, American Airlines, Khaveen Investments

Based on the table above, Affirm’s partners all have a higher number of users when compared to its active users 7.1 mln active users in Q4 2021. Thus, we believe that a large number of Affirm partners’ active users in the travel and ticketing segment would provide Affirm the opportunity for future growth. In addition, we believe that the high-value items in this segment would drive the demand for BNPL. For example, the average daily room rate in July 2022 was $139.84, while the average price for a domestic flight is “$330/round trip” and is forecasted to continue to increase due to inflation which would be an opportunity to Affirm. Furthermore, we believe that as most payments in the travel and ticketing segment are non-cash transactions (e.g. debit card, credit card, e-wallet), it will be easier for Affirm to capture users during the checkout process.

|

Revenue By Geographic Region ($ mln ) |

2019 |

2020 |

2021 |

|

United States |

264,367 |

506,212 |

857,222 |

|

Growth % |

– |

91.48% |

69.34% |

|

Canada |

– |

3,316 |

13,242 |

|

Growth % |

– |

– |

299.34% |

Source: Company Data, Khaveen Investments

In Q1 2022, the company launched its first Canadian travel merchant. Affirm has presence in Canada since 2020 based on its annual report. As shown in the table, in 2021, Canada has a higher 2021 revenue growth (299.34%) than the United States (69.34%). We believe this justifies Affirm’s expansion of Canada’s roadmap.

As mentioned by the company, Travel and Ticketing had increased by 122% from last year, and the company mentioned that this high growth was due to the ease of travel restrictions. Subsequently, we believe the U.S. market will continue to grow as the company mentioned that the “market penetration in the U.S. is still in the low single digits.” Based on FnF Research, the travel industry has a projected CAGR of 12.2% by 2028.

Risk: Non-exclusive Partnerships

Some of Affirm’s partners also have partnerships with other BNPL providers. Hence, this indicates that Affirm’s partnerships with its partners are non-exclusive. We believe that this poses a risk to Affirm by reducing the significance of Affirm’s partnerships if the company is unable to capture the users of its partners’ merchants and users choosing to use other BNPL providers. For example, Affirm’s fintech partner Adyen also partners with Affirm’s competitors, Afterpay, for BNPL. Besides that, Afterpay is the 2nd largest in the BNPL provider market with a 9% market share as compared to Affirm with a 4% market share.

Verdict

|

Projected Growth by 2028 |

CAGR |

|

E-Commerce |

17.40% |

|

Fintech |

13.90% |

|

Travel and Ticketing |

12.20% |

|

Average |

14.50% |

Source: Valuates Report, FnF Research

To conclude, we believe that Affirm’s future growth could be driven by its partnerships in three segments: e-commerce; fintech; and travel & ticketing. We believe these partnerships with large companies (i.e., Amazon, Shopify, Fiserv, American Airlines, Priceline) would contribute to Affirm user base and support its growth. Among all markets its partners are in, the e-commerce market has the highest projected growth with a CAGR of 17.4%. The 3 markets have an average CAGR of 14.5%.

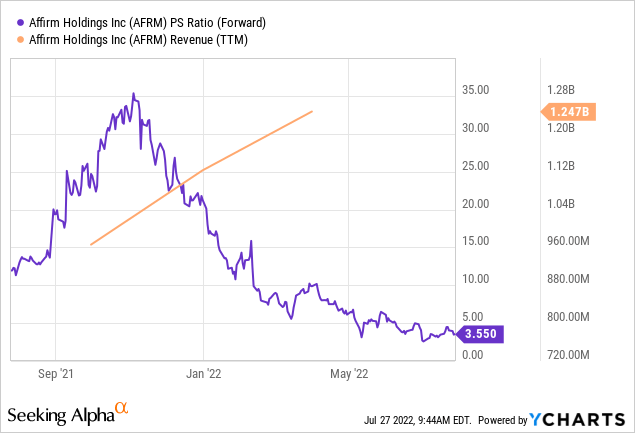

Despite its revenue increasing, the stock price has fallen well below its historical P/S ratio implying mispricing of its stock. Based on analyst consensus, Affirm has a price target of $35.

Be the first to comment