Tanaonte

Affirm Holdings, Inc. (NASDAQ:AFRM) fell 21% on Friday after the fintech business published a dismal prognosis for the coming fiscal year.

The stock market fell 1,000 points on Friday as a result of Federal Reserve Chair Jerome Powell’s comments on inflation, presumably exacerbating the effects of the fintech’s sales estimate.

Having said that, the fintech is facing new hurdles, including a slowdown in the buy now, pay later business and the potential of increased delinquencies, both of which might result in Affirm stock plunging to new lows in the near future.

Given the sales expectation for 2022, I do not propose that investors buy Friday’s significant decline.

Widening Losses And A Soft Outlook For 2022

In recent years, buy now, pay later suppliers have been all the rage, and I, too, have had great hopes for firms like Affirm Holdings, which bring fintech promise to the eCommerce sector.

Unfortunately, fintechs like Affirm are having their development opportunities constrained in a sector that has been severely impacted by excessive inflation. While the job situation is not yet indicating a recession, inflation is having a significant negative impact on consumers.

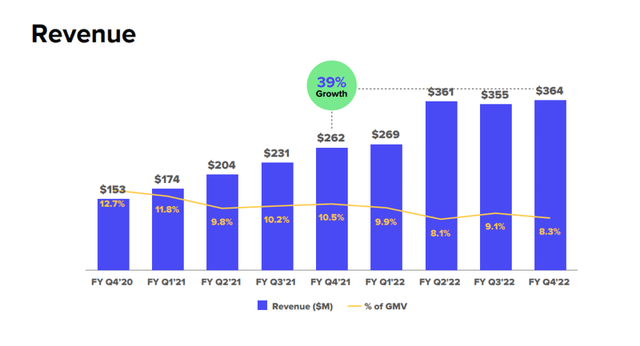

Affirm’s growth is slowing rapidly as customers cut back on their spending. Affirm’s fourth quarter revenues increased by 39% YoY to $364 million, but QoQ sales increased by only 3%.

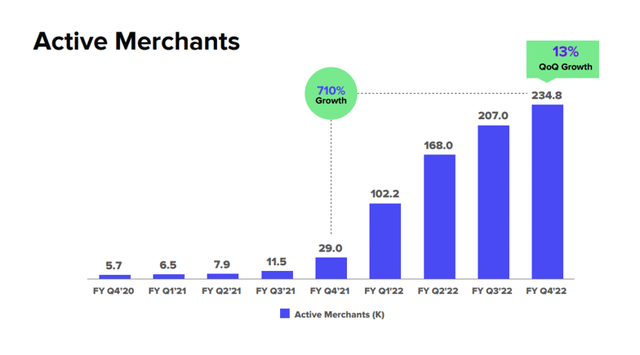

A significant issue for Affirm is that the number of new merchants embracing BNPL services is slowing. Affirm’s active merchant number climbed only 13% QoQ to 234.8 million in the most recent quarter, indicating that growth is slowing.

Active Merchants (Affirm Holdings)

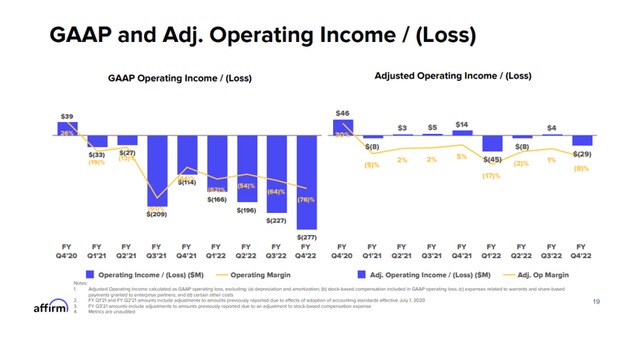

Furthermore, Affirm has failed to meet lofty profit growth forecasts in recent quarters. The fintech’s operating income losses extended significantly in the 2022 fiscal year, with a loss of $277 million in 4Q-22.

GAAP And Adjusted Operating Income (Affirm Holdings)

BNPL And Credit Risk

Buy now, pay later services are likely to face increased delinquencies in a recession, and I believe that this anticipation is beginning to be reflected in investors’ expectations of Affirm.

Inflation is also a growing risk for the BNPL industry as a whole, because consumers with limited financial resources may be the first to default on their BNPL obligations.

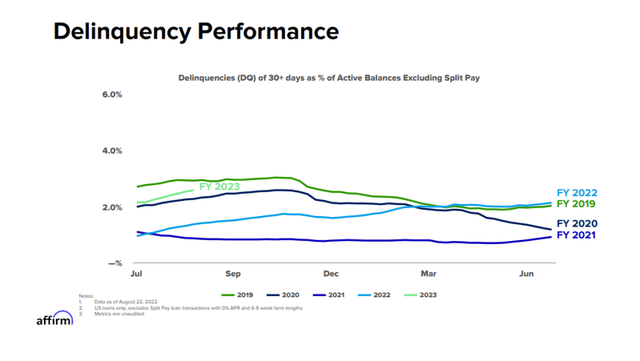

Affirm’s delinquencies are increasing, but they are still lower than before the epidemic in 2019. A recession would almost certainly result in an increase in bankruptcies and delinquencies, which could lead to harsher lending requirements being applied to consumers who qualify for buy now, pay later options. Stricter lending requirements would almost certainly result in decreased lending volumes, especially in the market for subprime borrowers with less than stellar credit histories.

Delinquency Performance (Affirm Holdings)

Deteriorating Business

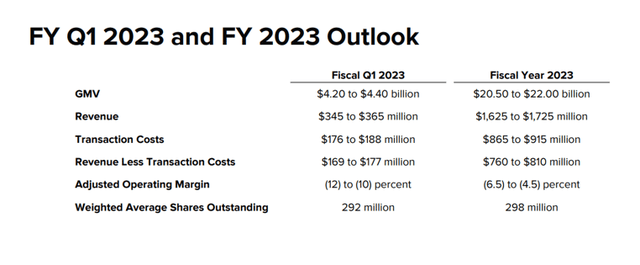

Affirm’s forecast for 2023, the fiscal year that has just begun, predicts sales of $1,625 million to $1,725 million. Total revenues for the fiscal year ending June 30, 2022 were $1,349 million, implying that the fintech forecasts sales growth of 20% to 28% YoY.

FY Q1-23 And FY 2023 Outlook (Affirm Holdings)

The market predicted $1.91 billion in sales for the current year, but the forecast was 12% lower. According to the fintech’s forecast, Affirm’s estimated YoY sales growth rate is 24%, while the market expects 42% sales growth.

This is a significant difference, and as investors adjust their growth expectations in the face of mounting headwinds in the BNPL business, the stock could hit new lows in the near future. The stock of Affirm now has a sales multiple of 5.5x.

Revenue Estimates (Affirm Holdings)

Why Affirm Holdings Could See A Higher Valuation

Buy now, pay later options will continue to be important for expanding eCommerce services and increasing online sales. Affirm’s sales prospects in the BNPL market, on the other hand, are intrinsically related to a larger valuation.

Given that the fintech has shattered high sales estimates and that its losses are widening, the stock’s sales multiple may not be sustainable. Right now, I don’t see anything other than a significant retail relationship or a takeover that might send Affirm’s shares higher.

My Conclusion

Another 21% decline was painful. I believe the fintech has a fantastic business model and is still seeing positive progress in merchant acquisitions, but the sales potential in the near future may not be as high as predicted.

Affirm’s recent sales projection, which came in 12% below expectations, is a major disappointment that could result in a larger valuation haircut in the future.

Given the lower sales projections, Affirm’s stock, with a sales multiple of 5.5x, may be expensive, especially if growth expectations are reduced further.

Given the increasing dangers in BNPL, such as rising delinquencies and inflation, I don’t recommend buying Friday’s drop.

Be the first to comment