MStudioImages/E+ via Getty Images

Dear readers,

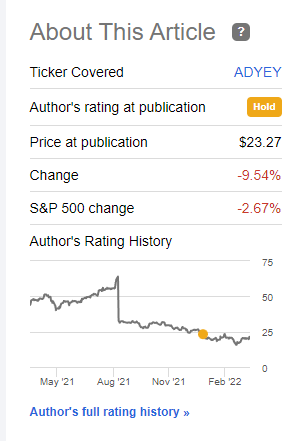

In my last article, I did some work on the Netherland company Adyen (OTCPK:ADYEY) (OTCPK:ADYYF) as part of my work in looking into more European IT. The “HOLD”-thesis that I established as part of my fundamental thesis proved to be the right way to go for Adyen.

Adyen Performance (Seeking Alpha)

Adyen has underperformed most indexes since that article. Let’s look at where the new valuation puts us in terms of company appeal.

Adyen – Revisiting the company

The Dutch payment processing company Adyen is a business that I reviewed initially in this article.

Since that article, the company has declined nearly by double digits. There’s no particular reason for this overall decline, at least not fundamentally, and the company has slightly recovered since the worst of its dip. Adyen reported 2H21 results, and these results looked positive.

In fact, Adyen was one of the companies that recorded gains in its share price while PayPal (PYPL), Visa (V), and other companies slipped back in 2021, giving them a positive correlation (at least historically) in the sector.

The processing volume for 2H21 spoke volumes about the company’s overall appeal, up 72% YoY for 1h21 and 70% for the full year, with net revenues up around 46-47% and EBITDA up 51-57% at margins of 63-64%. With the backdrop of results like these, the company should be flying – but it isn’t. In fact, since those results were posted, the company is down further.

This is despite regional growth with a 40% non-EMEA revenue share, ongoing expansion, and ongoing new targets for the company. In my original article, I made it clear that Adyen isn’t a bad company – it’s just incorrectly valued.

However, since the last article, that valuation has improved by double digits, while at the same time the company’s results have improved in turn. Typically, this would call for a change in the target price.

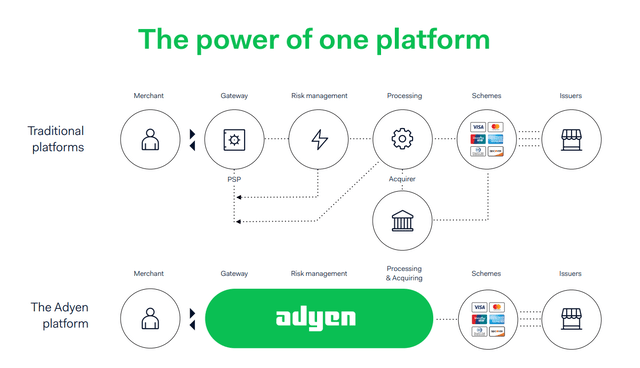

Adyen has built super-efficient and premium software and is seeing positive results with this across the globe. The market seems very well aware of this fact and is pricing several years of positive and impressive growth when pricing Adyen.

The model has already garnered the business of many world-leading brands and businesses and has operations reaching four continents of the world. In my original article, I also go through the fundamental strengths of its model and the transaction capacities. It also has an A- credit rating, with a net negative debt position, giving it massive amounts of capital to spare.

The problems with Adyen are not in its current business, its fundamentals, or its theoretical appeal as a model or business. It’s the same thing that allowed Adyen to grow in the first place – combined with the high valuation for its shares.

The payment processing/solutions business is an extremely competitive space. It’s driven by technological innovation – an innovation that allowed Adyen to grow in the first place and is currently sidelining competition such as PayPal. PayPal is a very good example of a declining model, because of its focus on consumers as opposed to merchants, which are far quicker to switch services (and already are switching services, as the company lowered its guidance).

This inherent innovation-led segment is also the main risk for Adyen. Businesses such as this are not only potentially disrupted by further innovation in the space, it’s even likely that such disruption through innovation is about to take place over the next few years. This makes investing in growing payment processors outside of the very main ones (such as Visa, Mastercard (MA)) a risky proposition to me that needs to be carefully evaluated.

The rise of the company Wise (OTCPK:WPLCF), which I myself now use above PayPal, is a very good example of a newcomer displacing an incumbent. Wise actually looks very similar to Adyen in terms of its operating model, plugging software into local schematics and taking advantage of the economics of scale in a way that PayPal just doesn’t.

The view for Adyen’s future and valuation is based on the market’s view of the risk-adjusted cash flow rates that are likely for the next few years. The crisis in Ukraine has narrowed some of the markets for the company – albeit not significant ones – but chaos such as this is never good for a company such as Adyen. Some of the normalizations in valuation can be laid at the feet of these trends.

If you recall, my original target share price for Adyen and its common share was closer to €1,400. Bulls have argued for a return of the days of over €2,300 per share, and perhaps that will happen – but I remain cautious in touching Adyen above anything close to €1,500.

To be clear – recent results were excellent, and the trends continue to seem excellent for Adyen. However, my issue with the company is the high premium that’s being forecasted in terms of valuing its growth. I have bullish assumptions and expectations for 2022-2023 for Adyen, but I have conservatively moderated/adjusted these for the coming few years.

Let’s look at the updated valuation for Adyen.

Adyen – The valuation

It might seem odd to some readers, how cautious I am being with how I’m valuing Adyen. After all, if the company climbs back up on the bare assumption of continued cash flow growth, that’s an impressive RoR right there. But this is how I invest. I’m fine missing out on outsized “growth opportunities” if that means I’m staying conservative.

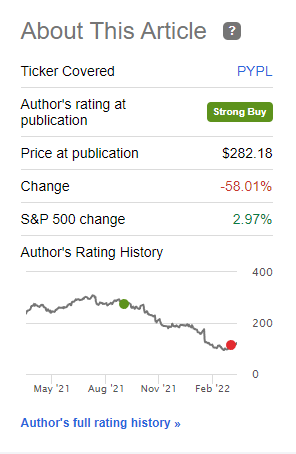

I stayed conservative on PayPal when almost everyone else said “BUY”, and it allowed me to avoid capital destruction of nearly 60%.

That’s the upside of being conservative. Your gains may be lower, but your losses are way lower as well, and you tend to have a far lower overall beta than your peers.

This is something I am comfortable with.

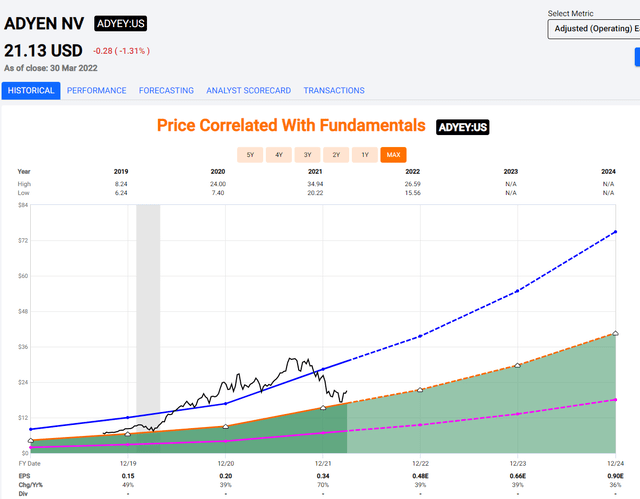

With that in mind, I’m updating my DCF assumptions for Adyen. On a conservative basis, I’m assuming a top-line growth of 10-12% per year, but I’m now on board with the EBITDA margin improvement, up to a terminal margin (5-year basis) of 72%. I’m assuming a double-digit or close to double-digit EPS increase. However, even with these result-increasing assumptions, the DCF shifts only to around €1,550 on the low end and €1,750 on the high end – and I don’t just use DCF when investing here.

Adyen remains, at its heart, a highly-valued company with P/E multiples on an average basis of over 50X. FactSet currently expects EPS growth rates of 30-40% for the coming years, and these are growth rates I don’t agree with, impacting the way I view the company – even if Adyen has historically been able to beat FactSet estimates, not underperform them.

The nature of growth investments is that they grow – until they don’t. Equating Adyen to something like Amazon (AMZN) or Alphabet (GOOG), which are different beasts altogether would be flawed, to my mind. Adyen needs to be put into relation to other payment processors. This group includes Wise, Nexi (NEXPF), and Worldline (OTCPK:WRDLY). All of these European companies are currently trading at far more attractive valuations than Adyen is – but neither of them has the appeal that Adyen has either.

Adyen Valuation (F.A.S.T graphs)

Evaluating a company such as this is extremely complex because of the weight and accuracy demand of the outlying, forward views of earnings and revenues as well as margins.

It’s extremely easy, as many growth-bullish investors do, to take a “Bullish” view on these companies with the simple explanation “growth will continue to grow”.

History has, in many cases, proven this to be false.

The only argument that I really have “against” Adyen, representing the more conservative camp of the discussion, is the degree to which growth can continue. PayPal has proven very recently that there’s a breaking and deteriorating point, and it’s my stance that PayPal is approaching it. This area of business is driven by technological innovation, and Adyen does not have a monopoly on innovation in the business. There are dozens of capable payment providers on the market at this time.

All merchants need do is pick the one that suits their needs and that is the best at the time.

I liken it a lot to the influx of “project planning/management” software that have been crowding the market for the past few years. Every week, some new platform seems to be hawking its product as the “next thing” in project management, and why everyone should switch to “them”.

There’s only so much room for profit in this space. And the space already has massive competitors. Your chance for a profit with Adyen, to my view, was buying it years and years ago.

The highest possible bullish thesis if everything positive comes to pass are annualized RoR of 20-35% for the next few years. While this may sound appealing, and indeed is appealing, you also need to consider the risk you’re taking by putting, say $50,000 in Adyen instead of putting $50,000 in a company like Bristol Myers (BMY) or Munich Re (OTCPK:MURGY).

Both of these mentioned investment alternatives have realistic dividend-included annualized RoR of over 20-30% over the next 3-5 years.

But they lack the fundamental risk of innovation that’s inherent to Adyen.

Look – to me, it’s all about the math. I’m binary about my investments. Profit or loss.

I want the highest potential profit at the lowest potential risk.

That’s all.

Adyen offers a high potential profit. But they come at a risk that we’ve recently seen in PayPal and have historically seen in other payment processing companies. Unless I get the company cheap, I’m not that interested. I’m the type of investor that would rather go for an undervalued pharma or reinsurance company with a similar-level upside than the next “tech thing”.

I’m not saying the other way is wrong. What we all want to do, in the end, is turn $100,000 into $1M. We all want this, but we have different ways of going about it, and different time frames for our investments.

S&P Global targets for Adyen remain difficult. 27 analysts have a range of €1,500 at the low end and €3,600 at the high end.

I know how these analysts got to those targets. It’s all about expected cash flow growth and what those growth rates in cash flow are worth/valued at. A majority of the analysts trend toward a more positive growth view, holding a €2,480 average target, with around 40% of analysts currently holding a “BUY” rating at a native share price of just south of €1,900.

Based on my adjusted growth estimates, I’m adjusting my target share price to €1,650 for Adyen. At that valuation, the company could deliver growth of around 10-11% annually and still have room for good expansion. I might even buy it at that level if nothing else is attractive.

But understand my stance towards investments like this. It’s not that they’re unattractive or “impossible” to forecast. Most growth investors and contributors bullish on companies such as these, however, fail to mention clearly how much hinges on those growth rates.

They also don’t mention how bad things can go if you invest at the “wrong” price, and growth rates come in below par, and how long it can take for you to even recover from such a crash.

Many are happy PayPal now is up – even just slightly.

PayPal Article Ratings (Seeking Alpha)

How exactly, does that slight uptick help investors who bought according to these “BUY” and “Sell” stances? You’ve lost nearly 60%, and that’s money that would take years to get back, even if you picked good investments from now on.

Too many investors take “growth investments” like this far too lightly. It’s upsetting for me to see because I have immense respect for money/capital- not just my own, but especially that of others who read my articles and follow my work.

When you invest in companies with 30-60X P/E multiples, your potential risks increase by the factor of those valuation heights. This is why I mostly stay in the low multiple ranges, and stay with “safe”/r companies.

It’s not because I don’t like Adyen, or don’t believe they can grow. The risk inherent to that growth is so high, that I’d rather put my money to work in other businesses that could appreciate similarly, but at a lower risk.

Remember, dear readers. Valuation and quality.

One is useless without the other – and if pushed to pick one, I’d pick valuation.

Thesis

Growth investing with companies like Adyen is tricky. I love the company and its products, but I’m always hesitant to put capital at work at dream-level multiples.

The risk is too great, and I have too much respect for the money I make. At the same time, I’m very well aware that these companies have value, and try to give them a fair shot. Look at my work with Prosus (OTCPK:PROSY) for instance. I believe had you followed my stances there, you would have done alright.

I may not be everyone’s favorite growth investor, but I believe I do fair work in the segment. On the basis of this, I give Adyen my new PT of €1,650 based on double-digit 5-year growth rates, EBITDA margin growth to upwards of 70%+ and continued positive momentum. This is well below the market’s mark, but if you buy the company here, I believe you will actually come away with 20-30% annually.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment