Ivan Chertok/iStock Editorial via Getty Images

Thesis

Adams Diversified Equity Fund (NYSE:ADX) is an equity CEF. The fund is a Large Cap – Blended Equity CEF, and as per the fund’s literature:

ADX seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies. The Fund seeks to generate returns that exceed its benchmark and consistently distribute dividend income and capital gains to shareholders.

ADX falls in the “old-school” CEF cohort, having been around since 1929. The vehicle has only 92 holdings and it utilizes the S&P 500 and the Morningstar U.S. Large Blend Category as a benchmark indices. ADX pays dividends quarterly and employs no leverage, which, in our book purely translates into the fund managers utilizing the CEF structure to distribute equity returns to investors in the form of dividends. And this is where the interesting part starts, and what attracted our attention to ADX. On the Seeking Alpha summary page ADX shows up with a 17% dividend yield:

Dividend Yield (Seeking Alpha)

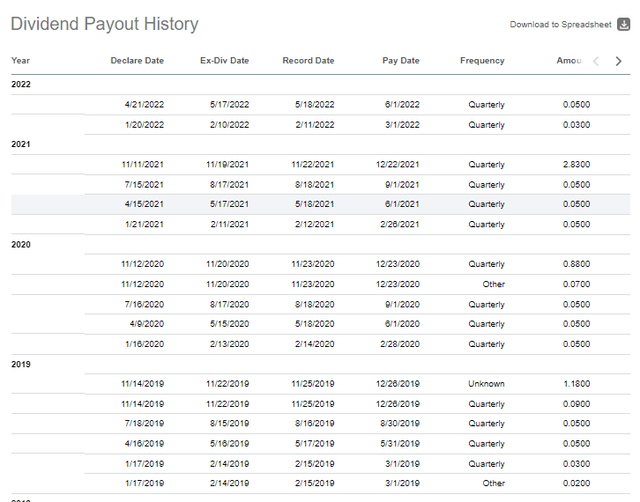

If we drill down into the details and go to the Dividends – Dividend History page we will notice the following:

Dividend Payout History (Seeking Alpha)

The website utilizes a trailing-twelve-month methodology and the fund pays a regular quarterly distribution targeting 6% of market value (calculated as of the end of each October) plus a yearly distribution correlated with annual performance. When the portfolio and NAV are doing well the fund disburses that performance to investors. In lean years, the distribution is minute or non-existent (look at 2020 for example). This is normal and we like this organized way of tallying up the fund performance at year end and following up with a distribution as applicable (“Coffee’s for closers” they say).

This goes back to the entire existential reason for un-leveraged equity CEFs – at the end of the day as an investor you are paying the management team to generate alpha and to give you a high yearly dividend yield when the market performs. Otherwise, you could just buy a mutual fund. Long story short the answer to the question “Is the fund really paying a 17% yield?” is no. The current outsized dividend yield is the result of the trailing twelve months methodology that adds last year’s outsized capital distribution and divides it by the current market price which has decreased substantially in 2022. We expect this year’s capital gains distribution to be trifling.

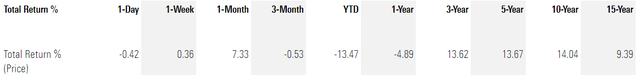

ADX is a very robust, profitable vehicle that has posted outstanding long-term results:

We can notice that on a 3-, 5- and 10-year basis the fund has annual total returns exceeding 10%.

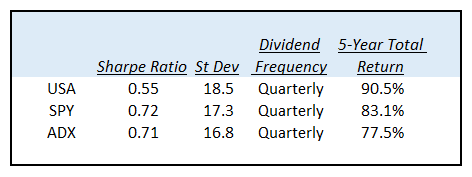

We are going to look at some analytics next and compare the fund to the index and a premier CEF in the equity space, namely Liberty All-Star Equity Fund (USA):

Analytics (Author)

We can see that on a 5-year timeframe USA outperforms both the index and ADX. USA does that by utilizing a higher risk framework (i.e. it takes more risk) as observed in its higher standard deviation and lower Sharpe ratio. When compared purely to the index, ADX has a similar Sharpe ratio and a lower standard deviation, but a slightly lower total return.

So should an investor buy ADX or USA? It is a difficult decision to make since USA is the “prettier” girl in the room with a higher total return, but at the same time, continuing our metaphor, it is also riskier and more volatile as shown by its standard deviation. Let us not mince our words – if an investor is comfortable with long-term capital gains, then just buy the S&P 500 outright, ADX will not do anything extra for you, in fact it trails the index. If you need quarterly dividends from the equity market and prefer lower risk then ADX is the better choice over USA given ADX’s higher Sharpe ratio and lower standard deviation. The fund does not offer a lot of “buy-the-dip” potential via its discount to NAV since it is one of the most range bound discounts we have ever seen. We like ADX and its analytics, and the fund has an outstanding track record in almost 100 years of existence. We however believe we are currently witnessing a bear market rally and we would wait for the next leg down in the equity market to enter ADX.

Holdings

The fund has only 92 holdings that fall in the Large Cap category:

Holdings (Fact Sheet)

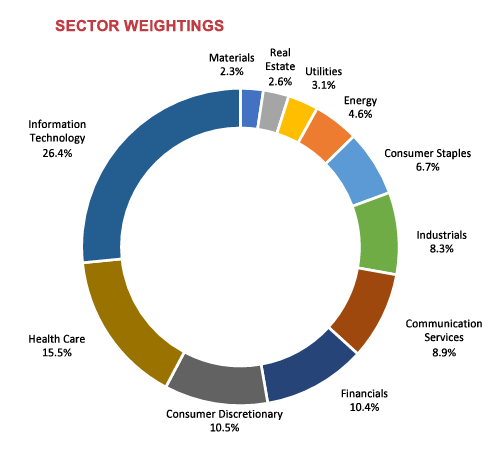

From a sectoral standpoint ADX mimics the S&P 500 but with a basis (i.e. the weightings are not exactly matching by any means):

Sectors (Fund Fact Sheet)

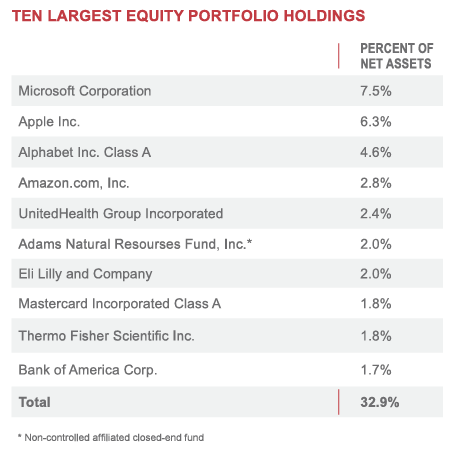

The top ten assets contain a mix of large technology stocks, financials, and internal funds:

Top Ten (Fund Fact Sheet)

What an investor should keep in mind is that ADX does not just buy-and-hold, in fact it has a very high annual portfolio turnover rate:

Turnover (Morningstar)

The management is fairly active in positioning the fund as they see fit in new market environments.

Performance

ADX is down -14% year to date, in line with the S&P 500 and the Liberty All-Star Equity Fund:

YTD Total Return (Seeking Alpha)

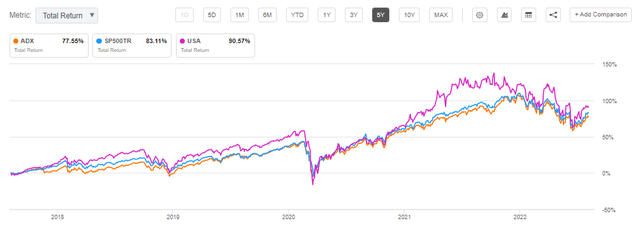

On a 5-year basis USA outperforms both the index and ADX:

5-Year Total Return (Seeking Alpha)

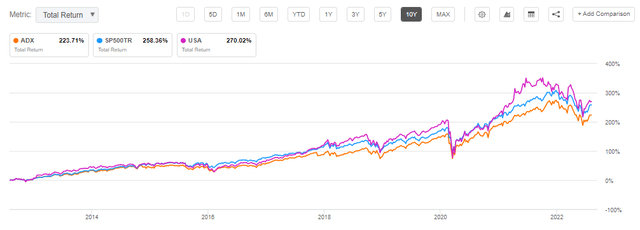

We can see the same result on a 10-year time range with USA having smoked the competition and its benchmark:

10-Year Total Return (Seeking Alpha)

Let us not mince our words, ADX has a strong performance on all time-frames, however it trails both the index and the premier equity CEF USA.

Premium / Discount

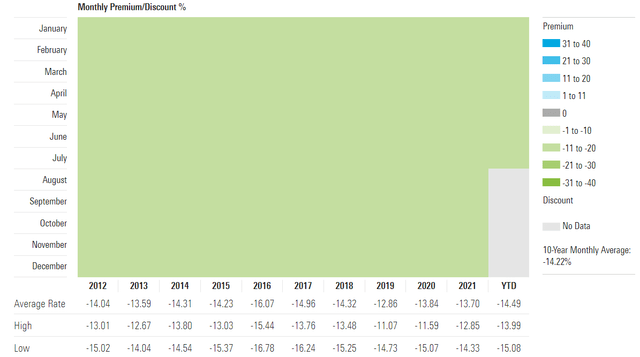

We have never seen such a “well-behaved” discount box since analyzing CEFs:

Premium / Discount to NAV (Morningstar)

If we look at the above table, we can see that the fund’s discount to NAV barely budges throughout the past decade! The fund usually trades at a 14% discount to NAV and it has moved in a -11% to -15% discount range in the past ten years. Impressive!

Our assertion is that given the fund’s tenure the investor community is extremely comfortable with the manager, the trading style and what the fund will or will not do, hence the stability in the discount and the narrowness of the range. Just look at 2020 when the world was falling apart – most of the CEFs in the equity universe saw massive increases in discounts to NAV. Not here.

Distributions

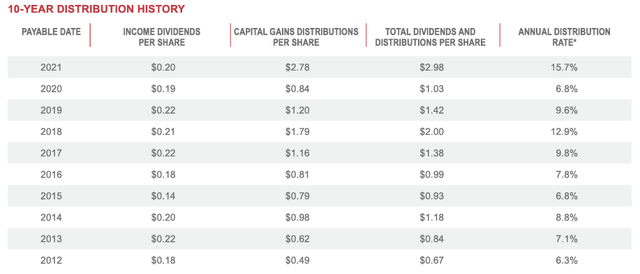

We briefly discussed the dividend yield above, but let us have a closer look at the fund distributions:

10-Year Distribution History (Fund Fact Sheet)

We can notice that in the years with strong equity market performances the fund has high capital gains distributions, and in “lean” years those numbers are fairly low. The fund does what it is supposed to do – convert equity market performances into dividend distributions for investors.

Conclusion

ADX is an equity focused closed end fund. The vehicle does not employ any leverage and has 92 holdings. The fund has been around since 1929 and has generated outstanding results in the past decade. The vehicle disburses quarterly dividends targeting 6% of market value and an annual November distribution consisting of capital gains, if applicable given the fund’s yearly performance. Do not expect a 17% dividend yield here but more of a 7% to 8% one, depending on how 2022 ends up in terms of equity market performance. ADX benchmarks favorably against the S&P 500 and the Liberty All-Star Equity Fund via its analytics and metrics. It is our opinion we are currently witnessing a bear market rally and we would wait for the next leg down in the equity market to enter ADX.

Be the first to comment