metamorworks/iStock via Getty Images

Ouster (NYSE:OUST) has released its second-quarter results. Unfortunately, there was no miracle in times of recession. The forecast, confirmed in May, got chopped by 36% from $85M to $55M at the high range and by 39% from $65M to $40M at the low.

Ouster is diversified across industries and customers, but startups are the company’s main clients. Lidar products remain a future for many industries. Companies that buy Ouster sensors are at the top of technological advancement, but their cash is funded and not earned. Organizations like this will be the first to curtail spending when the economy turns.

While the company has messaged that it is facing delays and no cancellations, CFO Anna Brunelle, during the conference call, highlighted a focus change on the customer profile:

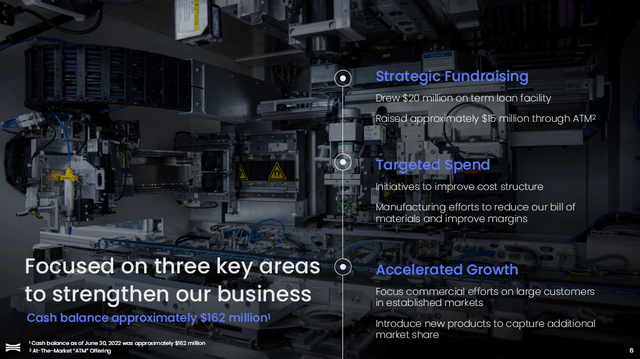

“And then lastly, just really focusing on ways to accelerate our growth, to focus on our commercial efforts on our largest customers in our most established markets.”

Ouster focusing on large customers will perhaps eliminate variables from the forecast. When I think big, those with their revenues will have cash for the projects, not restricting Ouster’s revenue streams. Further, the improved cost structure mentioned in the presentation and call would indicate lower overhead and savings.

Still, it isn’t pleasing to see this happening as it is a loss for the industry. Ouster and Velodyne (VLDR) are the only two public companies with meaningful selling efforts for lidar sensors. The other six have their deals, where they mainly sell samples for their future design deals. Reading Aeva’s (AEVA) accomplishments for the second quarter with $466K product sold and achieving $1M in professional services are a reminder of this condition.

Not measured by the revenue, the Q2 report was a win for Aeva. The market value increased by 10% or $100M since the quarterly results were published on August 3rd. The company boosted its image by adding Sick, a German company in the direct path of Ouster products, as a distributor. While samples continue to flow, the scaled production is still two years away, limiting understanding of what those ventures will deliver.

Whether Ouster has no names to reveal or chooses not to drop them is an honest debate, but the fact is not dropping names does not help the share price. As a result, Ouster never climbed to an overvalued status or became recognized for its revenue generation efforts. Before the Q1 release, I attempted to highlight Ouster’s acquisition of Sense Photonics as a missing piece of valuation enjoyed by others. In my article, I also highlighted revenue generation as a leg up on peers declaring the company the best pick for lidar in 2022.

Did the forecast change destroy my recommendation?

The technology thesis remains intact. Inadvertently, Velodyne’s lawsuit in a federal court and complaint to International Trade Commission confirms that Ouster is making it work. No longer ex-chairman speaking of losses to competition sounds ambiguous. Velodyne has alleged Ouster to be responsible for it.

Even more significant is the complaint filed by Ouster against Velodyne, revealing an attempt by Velodyne to buy Ouster in 2020. The fragment describing the reasons is in the quote below. Ouster’s complaint can be accessed here.

“Velodyne expressed to Ouster at the time that Ouster’s products and underlying technology were a pathway forward for the future of lidar – filling important gaps in offerings and engineering that would allow it (Velodyne) to meet customer demands that it was not able to and would not be able to address.”

While both companies will defend their actions, which may take years, things got undoubtedly complicated. From the biggest to the smallest companies, lawsuits are part of business and testimony of success in many cases. They are also costly.

The stock lost 47% since my original article was published. That happened almost instantly from the point of the announcement of $50M LOC and $150M ATM. Borrowing was okay, but selling shares seemed unnecessary then, so having the facility was just a formality of creating options. To learn that the company did sell 6.7M shares at $2.16 felt like a punch. The $14M received from equity was added to inventory and prepaid expenses. It also reduced the accounts payable line.

All $33M raised in the quarter got spent in operating activities, but now $19.1M shows in the debt line from a $20M draw of the line of credit. At the end of the quarter, the company had the same amount of cash as it did in Q1, about $160M excluding restricted cash.

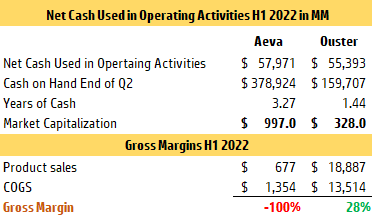

The table below shows that the cash runway was shortened by two months from the one I posted in Q1 due to a 50% increase in net cash spent in Q2. I do not expect Q2 spending to be the pattern; to confirm my hopes, I will need to find confirmation in Q3.

Aeva, while it cannot talk about revenue generation, has used little more cash than Ouster in the year’s first half. A research business looking for partnerships to evolve into revenue, Aeva’s spending is, therefore, mostly on R&D, focusing on improving the qualities of its sensor.

Net Cash Used in Operating Activities H1 2022 MM (Author from financial statements)

Turning back to Ouster, outside my speculation, the company did not offer the answer to why they triggered ATM.

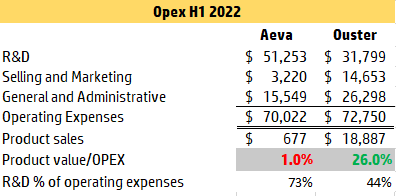

Because of the increase in inventory, I am guessing a commitment to the manufacturing partner and no purchases by startup-profile companies created a gap to fill. Bills got paid as well, perhaps reflecting the tightening credit. The table below illustrates the summary of expenses for the first part of the year, which also illustrates no average change in them, so that was not the reason.

Opex H1 2022 (Author from financial statements)

To conclude the second quarter review, I see that the conditions of my original recommendation have not changed at the fundamental level. Revenue and the forecast are a matter of timing as long as a product offering is intact, so no fault of the company that the economy turned sour.

The company is still implementing the L3 chip, which has an almost 90-degree vertical line of improvement from L2X. The CEO, Angus Pacala, spoke about a string of new products and focused on large customers. I hope the biggest ones are yet to be announced. The words of the CEO indicate forthcoming news:

“This, in combination with the most exciting string of upcoming product releases in Ouster’s history, gives us confidence that we will continue to win deals in head-to-head competition, capture market share, and maintain our long-term growth trajectory.”

Q2 Ouster presentation (The company, Ouster, Inc.)

Finally, I like the idea of focusing on large customers and improving cost structure, leading to or already having personnel adjustments in selling and marketing. Everything on the company’s slide is fine, except for clarity on how the company plans to use its $135M ATM.

Unfortunately, the signal that cash is needed, and selling shares to supply it is a reaction suggests that dilution is here already. Way too soon for my expectation. Dilution was always possible as long as it was at the right time. Not being able to understand the gravity of triggering the ATM and not being able to understand how the company plans to use it going forward, I am putting Ouster on hold until clarity comes back to the picture.

Be the first to comment