Dejan Marjanovic

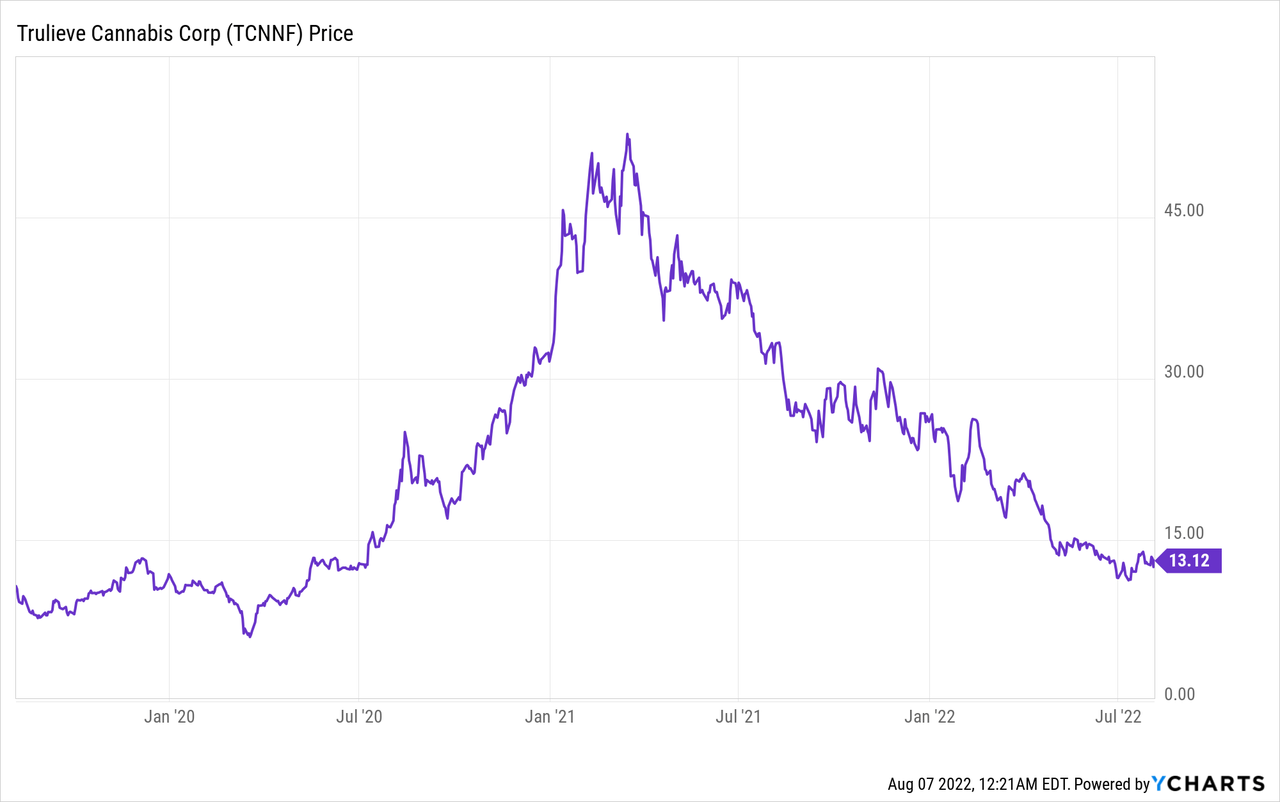

Trulieve (OTCQX:TCNNF) has fallen so much that investors can be forgiven for thinking that this is just a loser. Seriously – it’s fallen over 70% from all-time highs, in spite of rapid growth. The stock trades as if this secular growth story has come to an end, but that is far from the case. TCNNF continues to invest aggressively in its core markets, directing cash from its profit driver state of Florida toward future adult-use opportunities like Pennsylvania. Regarding Florida, investors are underestimating the long-term adult-use opportunity in that state, where TCNNF is strongly positioned as the clear market leader. TCNNF is trading at distressed value multiples in spite of having a strong secular growth story.

TCNNF Stock Price

TCNNF peaked above $50 per share in early 2021, as investors grew optimistic regarding the possibilities for federal legalization of cannabis in the United States. The stock has since slid around 74% and now trades around $13 per share.

Nowadays, it isn’t difficult to find stocks with this kind of stock chart, as many tech stocks have seen their bubbles pop. But TCNNF was not trading at demanding valuations at the peak, and is now trading at unrealistically pessimistic levels.

What is Trulieve

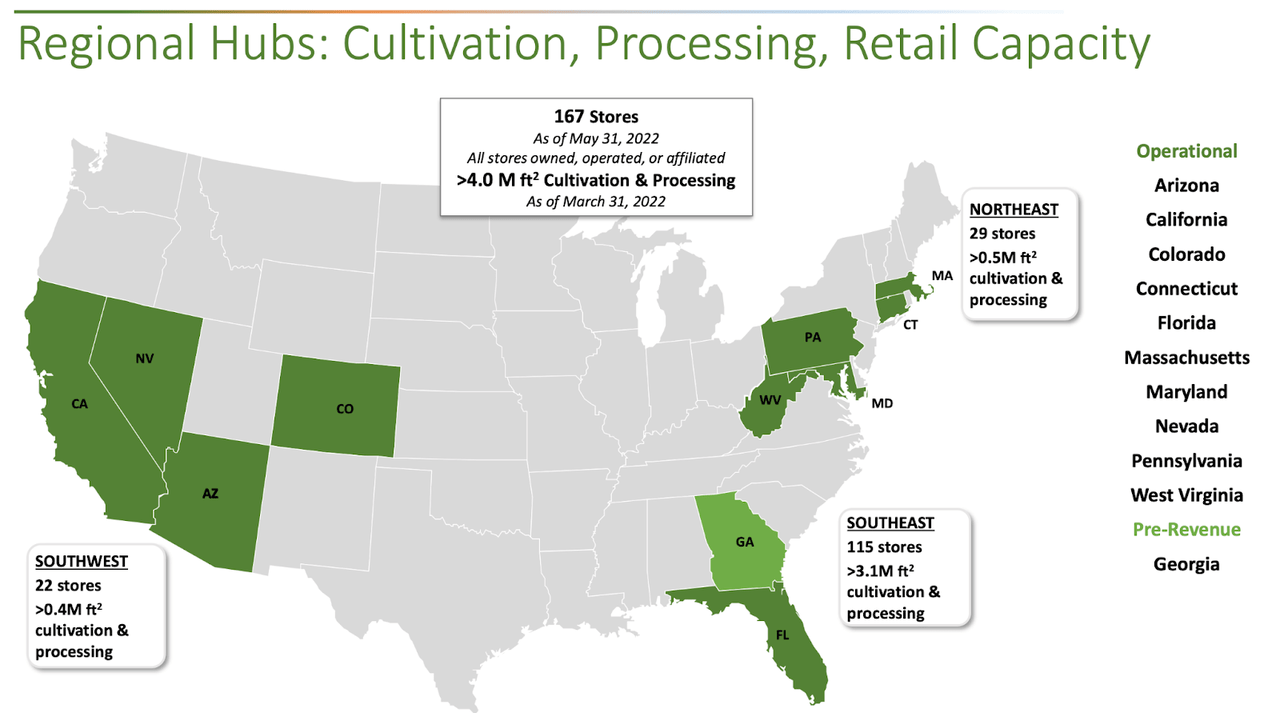

TCNNF is a US cannabis multi-state operator (‘MSO’) which means that it sells cannabis in many states. As of the latest quarter, TCNNF operated 167 stores with over 4 million sq ft of cultivation spread across 10 states.

June 2022 Presentation

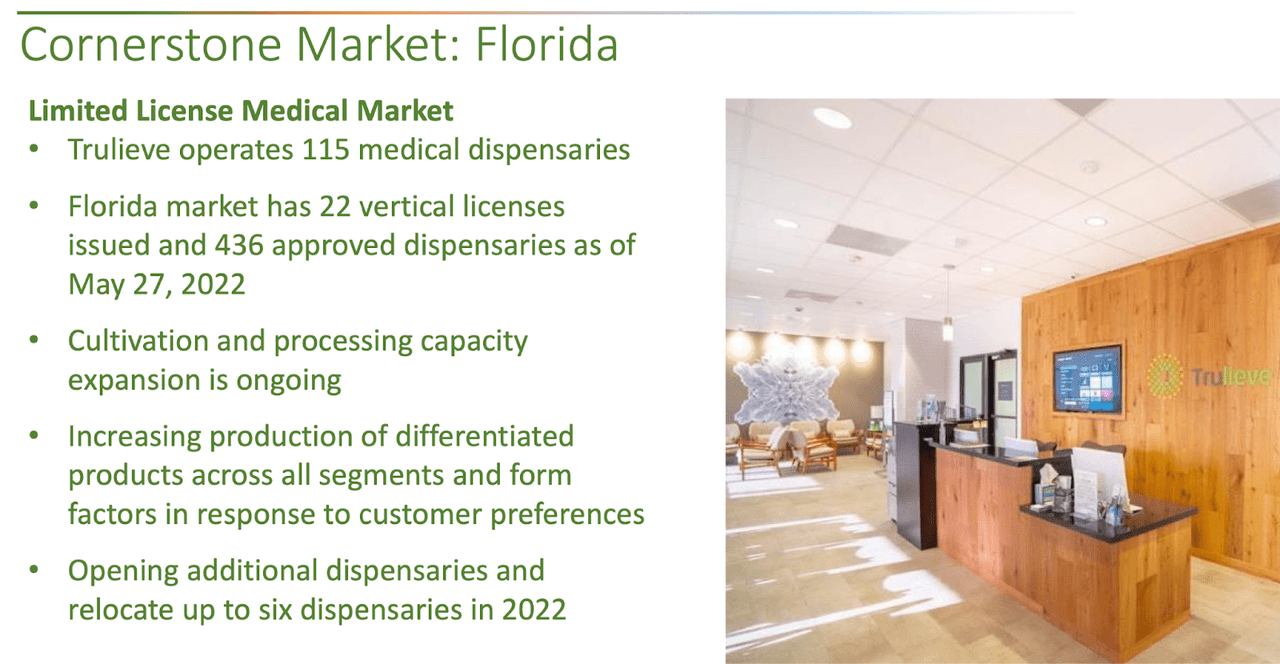

Most of that is located in their cornerstone market of Florida, where the company operates over 100 dispensaries. The company has consistently sustained around 50% total market share in the state, showing its dominance. As of July numbers, there were 736,212 medical patients in the state. That represents only 4% of the adult population in the state. In comparison, around 20% of adults use cannabis in the country. My personal use of the plant has led me to appreciate the wide ranging medical applications from chronic pain to insomnia – that leads me to believe that adult use can increase towards the 70% level of alcohol use over the long term. When Florida inevitably legalizes adult-use sales, I expect TCNNF to experience substantial growth as it would be able to target a substantially wider consumer base.

June 2022 Presentation

Another key state for the company is that of Pennsylvania. With neighboring states New York and New Jersey having already legalized adult-use sales, Pennsylvania may be the next Northeast state to follow suit.

June 2022 Presentation

While the Harvest acquisition reduced its profit margins, it gave the company many markets in which it could reinvest its cash flows as well as giving it geographic diversification.

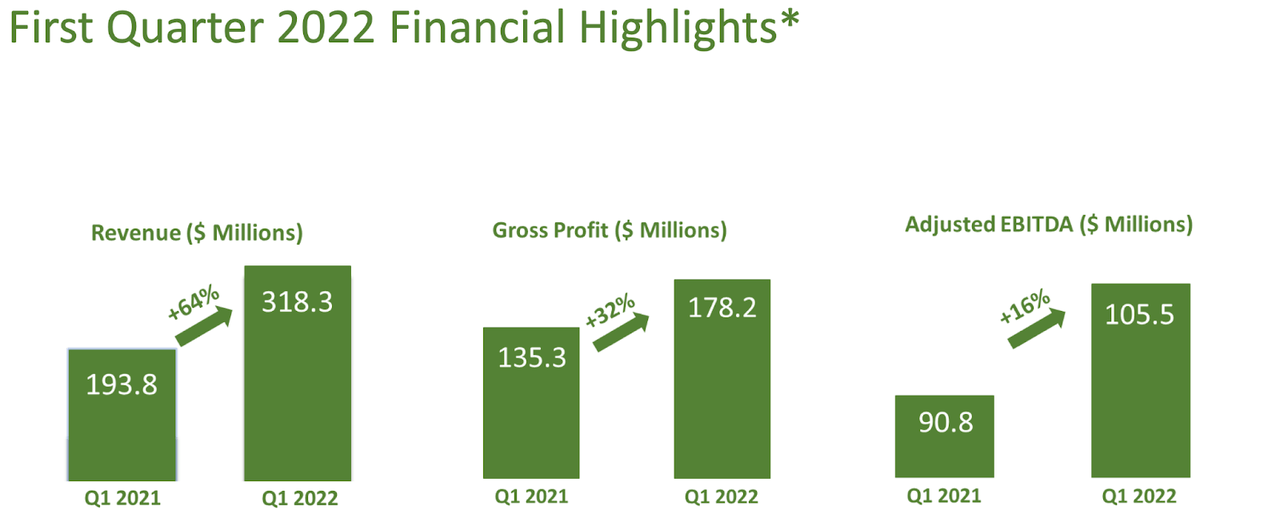

TCNNF Stock Key Metrics

In the latest quarter, the company reported strong year-over-year growth on revenue, gross profits, and adjusted EBITDA. Those strong growth rates should be taken with a grain of salt because they are primarily due to acquisitions – the per share growth rate was much lower.

June 2022 Presentation

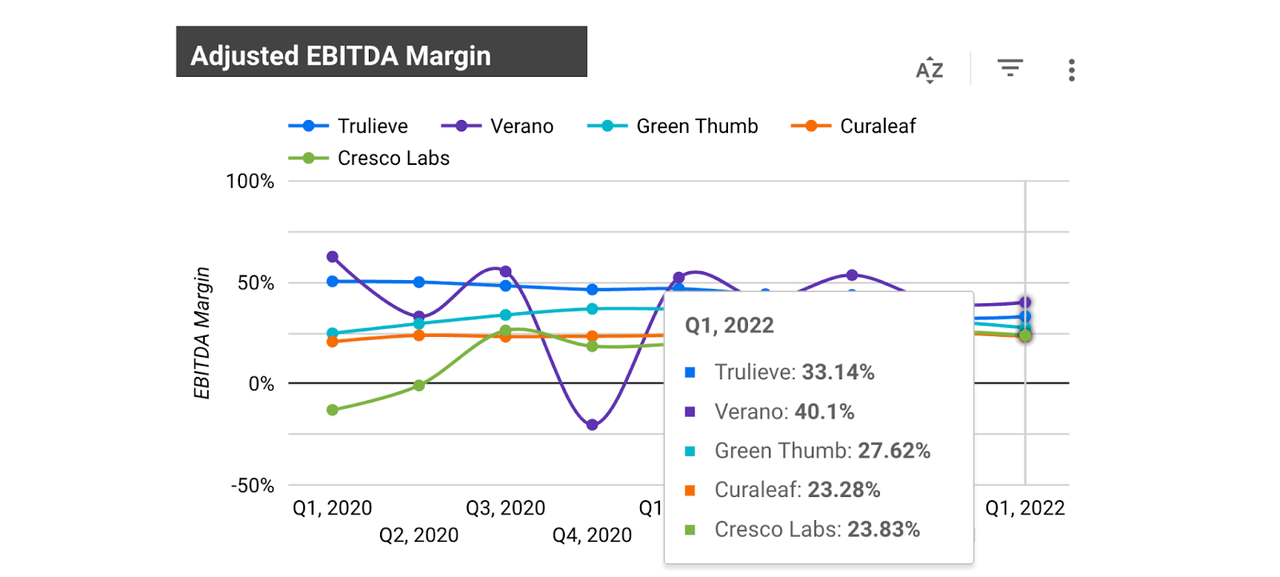

Adjusted gross margin declined from 72% to 58% and the adjusted EBITDA margin declined from 47% to 33%. The margin contraction was expected due to the acquisition of Harvest – the company has iterated its goal to bring EBITDA margin back up to 40% at the very least. TCNNF remains one of the most profitable operators in the US cannabis sector.

Cannabis Growth Portfolio

TCNNF was not profitable on a GAAP basis, but I note that it did generate $9.8 million in income before income taxes (imagine paying a 432% income tax rate). Recall that US cannabis operators need to pay “280e taxes” which restrict them from deducting operating expenses from operating income (interest expenses, rent, employee wages). Excluding $17.2 million of Harvest acquisition costs, $13.8 million in asset impairments, and $2.7 million in divestiture costs, TCNNF generated $1.7 million in adjusted net income (or $44 million prior to income taxes). In a sector where most operators struggle to generate GAAP profits, TCNNF remains profitable even while it digests its Harvest acquisition.

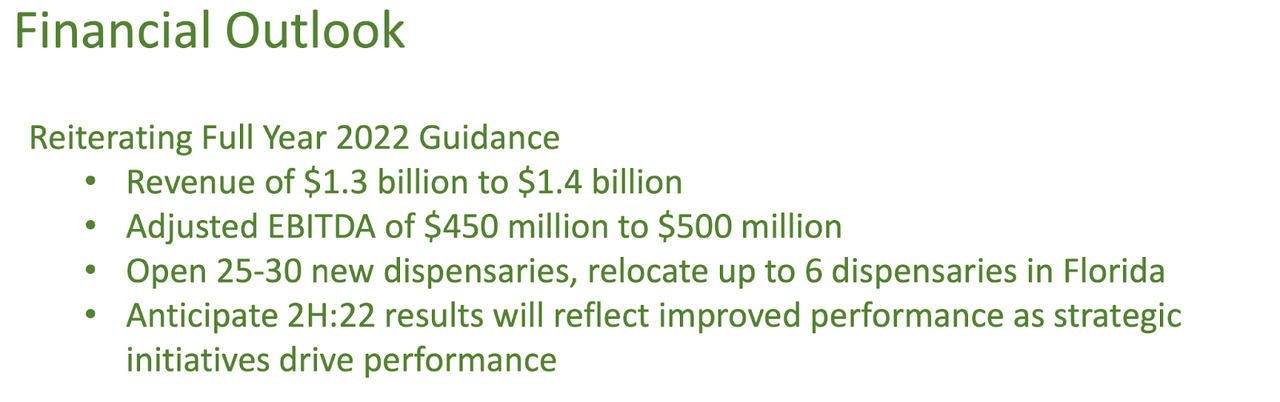

TCNNF has reiterated guidance of $1.4 billion in revenue and up to $500 million in adjusted EBITDA, with much catch up expected in the second half of the year. I would not be surprised if the company falls short on that guidance, as cannabis companies have been disappointing on the guidance front for many quarters now.

June 2022 Presentation

Substantially all multi-state operators have significant leverage after various capital raises in 2021. TCNNF is no different, with $267 million of cash versus $553 million of debt. There are also $190 million of lease liabilities and $243 million of deferred tax liabilities. The company could support this debt load with its ample cash flows, but the high leverage remains a risk that investors should not ignore.

Is TCNNF Stock A Buy, Sell, or Hold?

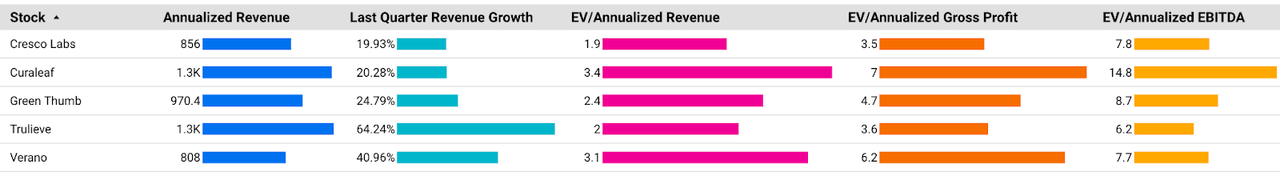

TCNNF is trading at only 2x annualized revenues – an astonishingly low multiple for a company with this kind of secular growth story.

Cannabis Growth Portfolio

Based on 2023 estimates, TCNNF is trading at around 4.2x adjusted EBITDA – also very cheap. In comparison, alcohol companies like Constellation Brands (STZ) or Brown-Forman (BF.B) trade at around 20x EBITDA in spite of having only single-digit projected revenue growth. It is not a stretch to say that TCNNF should be valued at 25x adjusted EBITDA at the very least, which would still be relatively undervalued as compared to alcohol companies due to the stronger growth outlook. At that valuation, TCNNF might trade at $73 per share – representing 5x upside.

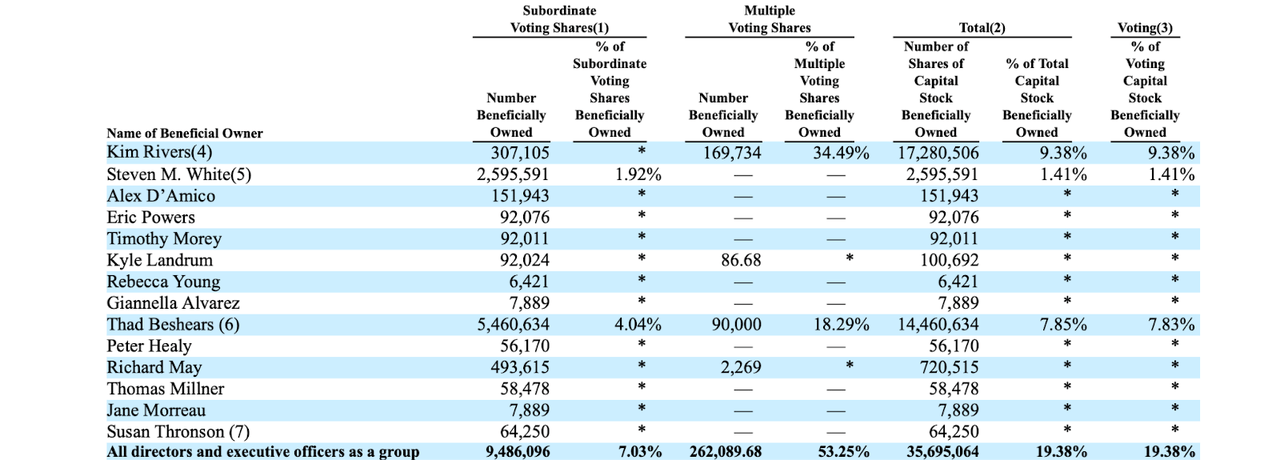

Like many US cannabis companies, TCNNF is founder-led with tremendous insider ownership. CEO Kim Rivers owns 17.3 million shares and insiders collectively own 35.7 million shares.

2022 DEF14A

CEO Rivers also made a token purchase of 14,000 shares in May for around $202,300. The high insider ownership may be a bullish characteristic as it shows that the management team is highly aligned with shareholders to drive strong returns over the long term.

The key risks here remain potential regulatory risk – CEO Rivers’ husband was found guilty of corruption in Florida – as well as a cannabis market downturn which would exacerbate the high leverage loads. Further, it is possible that TCNNF’s high margins relative to peers may suggest that it has more room for margin compression than peers. My view is that margins are likely to remain volatile for a long time as legal operators compete among both the illicit market and themselves. The current cannabis market is artificially limited due to the negative stigma associated with the plant – I previously mentioned how alcohol use stands at 70% among adults versus the only 20% for cannabis. As the negative stigma surrounding cannabis fades, I expect the demand side of the equation to improve like a secular growth story. Over the long term, that should help stabilize margins. The near-term risk is the likelihood that US politicians continue to fumble efforts to pass cannabis reform which may continue to weigh on shares. While I do not personally agree, many investors seem to hold legislative reform as being the main and only bullish thesis. For investors with the ability to hold for the long term, TCNNF remains a compelling buy as it combines high secular growth with dirt cheap valuations.

Be the first to comment