bjdlzx

Introduction and Overview

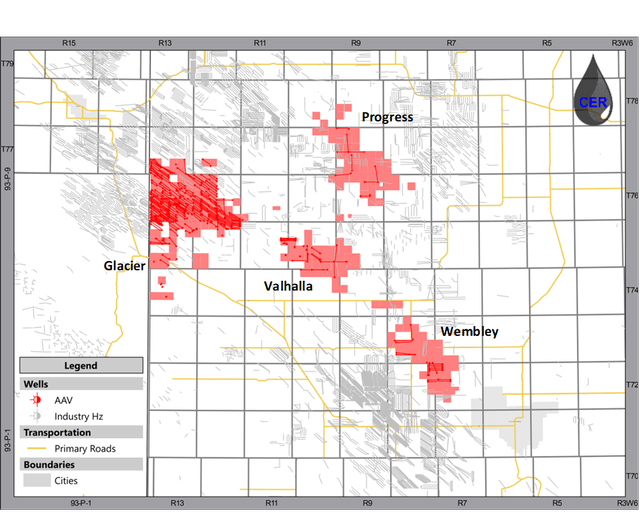

Advantage Energy (OTCPK:AAVVF) is a gas-weighted intermediate Canadian E&P focused on liquids growth in the near term, with operations concentrated in the Glacier, Valhalla, Wembley and Progress strikes of the Montney. The company has set itself apart given its prolific top tier acreage, depth of inventory, owned and operated infrastructure, top decile operating costs, and investments in carbon pricing revenue upside through its CCS investments. In the assessment below, we will provide our perspectives on Advantage’s operations in Alberta and highlight the meaningful upside that has yet to be priced into the company’s stock price.

Operational Assessment

Advantage Energy is a natural gas-weighted producer with operations in Northwest Alberta, with current production around 60,000 boe/d. Advantage is a growth focused player with operations primarily targeting the Montney formation and holds roughly 228 net sections in the Glacier, Progress, Valhalla and Wembley strike areas.

Given the company’s concentrated operations, its operational activity and drilling results will be compared to other peers in the same area to ensure we are comparing companies targeting the same geological formations. The map (Figure 1) below illustrates the extent/boundaries of our operational analysis and includes a total of ~14,000 wells (~11,000 of which are horizontal).

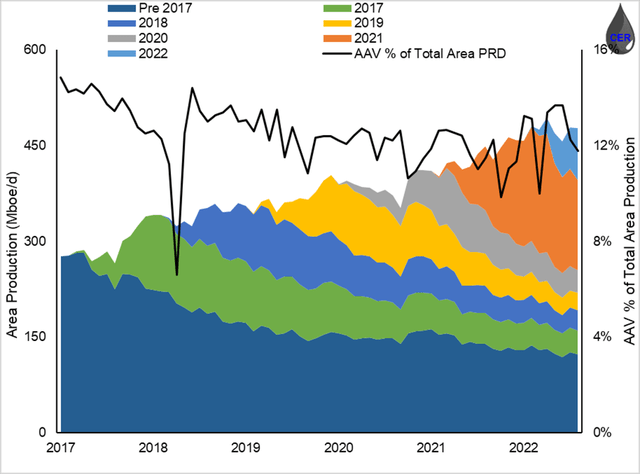

As illustrated by Figure 2, production in the area has nearly doubled since 2018 (currently at ~475 Mboe/d, vs ~310 Mboe/d in 2018) given the appealing well economics, industry advancements and potential for the attractive exposure to LNG Canada in the future. Over the last five years, Advantage has consistently comprised ~12-14% of the production in the area, as it too has accelerated development in the area.

Figure 1: Map of Acreage Position and Well Locations (Source: XI Technologies, GeoSCOUT, generated and formatted by CER)

Figure 2: Production Profile in the Area (Source: XI Technologies, GeoSCOUT, generated and formatted by CER)

Production and Drilling Activity

The company has allocated C$230 million towards capital expenditures this year, C$85 million of which is sustaining capital targeting 9 net drills at Glacier and another C$35 million of which will be deployed towards infrastructure gas processing facility upgrades in order to capture 3rd party gas processing revenues as well as other pure play cleantech investments (see next section).

The company is planning to deploy another C$100 million as liquids-focused growth capital and is planning to drill 15.5 net wells in order to deliver its revised liquids growth targets (liquids production 6,200 bbl/d at YE exit, vs. original 2022 guidance of 5,800 bbl/d liquids production). Currently, the company only has 95 wells in liquids-rich regions (25 – 100 bbl/MMcf), out of 119 booked locations and an additional 650 unbooked locations. Management has also re-iterated their objective to grow liquids production to balance gas production by 2025. In the free cash flow forecast in the next section, we have incorporated a more conservative forecast of the company being able to accomplish this a year later in 2026.

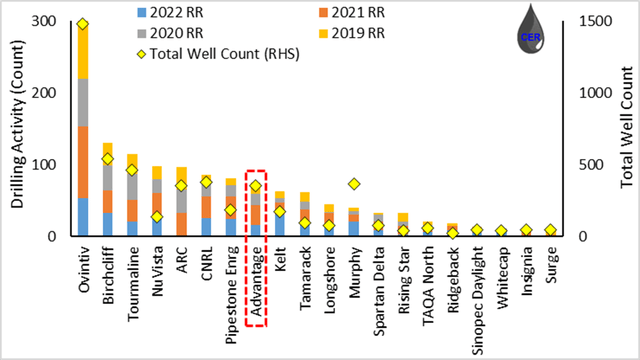

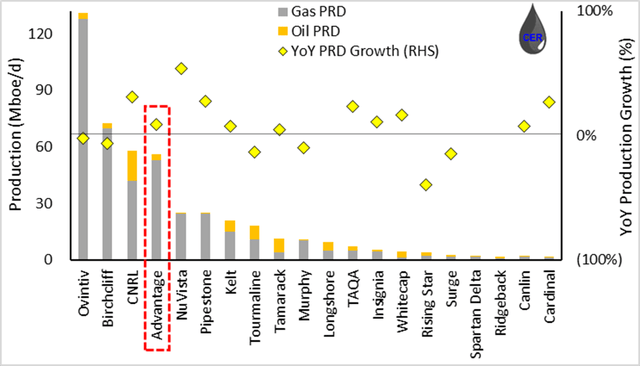

As illustrated by the figures below, Advantage is not the most active driller in the region falling 8th place behind Pipestone (OTCPK:BKBEF) in terms of total drilling activity since 2019. More impressively, the company ranks 4th behind CNRL (CNQ) in terms of production in the region, illustrating that the company does not need to deploy as much capital in order to maintain or grow its production relative to peers in the area. Furthermore, as illustrated by Figure 4, the company has increased its production ~12% from a year ago, compared to both Ovintiv (OVV) and Birchcliff (OTCPK:BIREF), who, despite having higher production and drilling activity in the area, have actually seen a decrease in production from a year ago.

This is an important consideration given field service, tubing and casing costs have all increased over 20% since a year ago, drilling activity has lagged what would be expected during an >US$90/bbl WTI pricing environment. Operators are finding it more difficult to grow or maintain production given the escalatory pricing pressures. As such, shallow declines are a meaningful differentiator reserved only for the top performing operators, who will then be rewarded by having the option to delay future drilling activity until tubing/casing/service prices retract from their current highs.

Figure 3: Net New Drills (LHS) and Total Well Count (RHS) by Operator (Source: XI Technologies, GeoSCOUT, generated and formatted by CER)

Figure 4: Production (LHS) and YoY Production Growth/Decrease (RHS) by Operator (Source: XI Technologies, GeoSCOUT, generated and formatted by CER)

Well Results and Decline Comparison

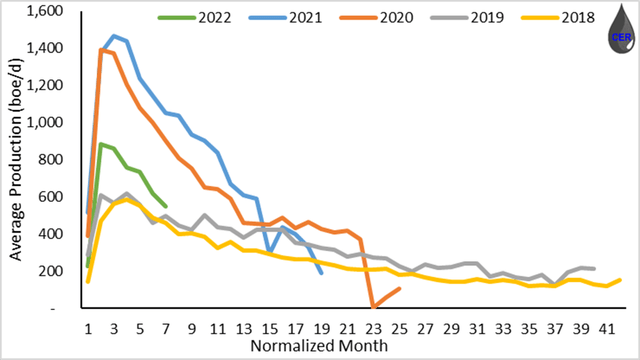

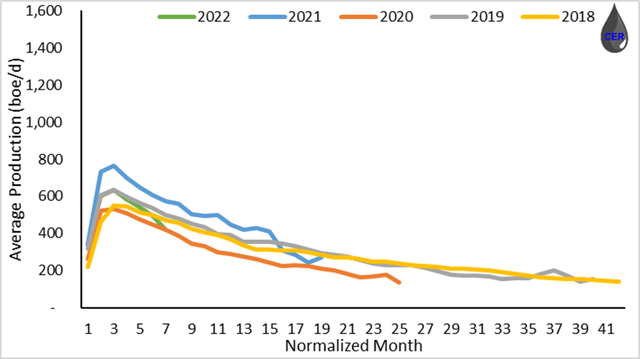

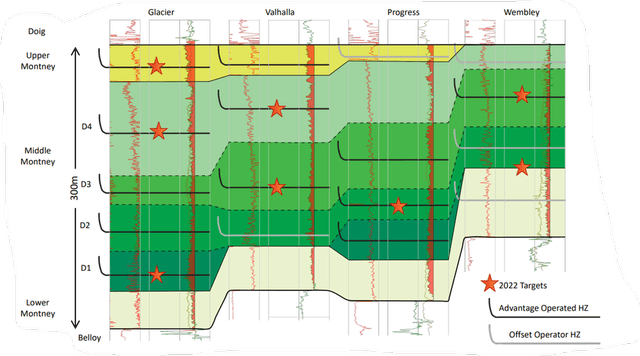

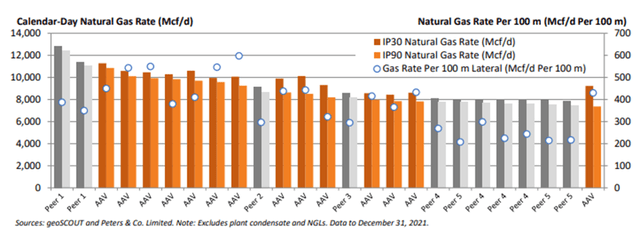

The fundamental basis of our bullish outlook is highlighted below as we explore the company’s well results, relative to other peers in the area whose wells are subject to a similar geological environment. Figures 5 and 6 illustrate average well production by rig release vintage year, normalized by lateral length. The company has consistently outperformed peers in the area every year since 2018, with absolutely exceptional well performance from 2020 and 2021 drills. Now despite the 2022 drills underperforming relative to 2020 and 2021 wells, production has on average exceeded offsetting peers by ~30%. Moreover, the company is also privy to a stacked pay environment as illustrated by Figure 7 in each of its core operating areas (Glacier, Valhalla, Progress and Wembley). Allowing the company to perf at various depths and produce from multiple benches from the same well bore. An opportunity that will meaningfully decrease D&C costs, prolong well life, and increase operating netbacks.

Figure 5: Advantage – Average Well Production (Hz Wells Only) by Vintage (Source: XI technologies, GeoSCOUT, generated and formatted by CER)

Figure 6: Other Operators – Average Well Production (Hz Wells Only) by Vintage (Source: XI technologies, GeoSCOUT, generated and formatted by CER)

Figure 7: Advantage’s Multizone stacked pay (Source: Advantage Corporate Disclosure)

Recently, the company has also shared a series of successful results. At Valhalla, two well pads delivered total IP30 of 2,837 boe/d (11 MMcf/d natural gas, 769 bbls/d condensate, and 231 bbls/d NGLs), further validating the quality of this early‐stage asset. At Wembley, production averaged 6,293 boe/d (15 MMcf/d natural gas, 2,664 bbls/d oil, and 1,135 bbls/d NGLs) after a successful six‐well winter program. At Glacier, new wells significantly outperformed expectations including the 16‐36 well which achieved 300% payout after just 4 months of production. As illustrated by the figures below, the company holds the overwhelming majority of the top tier wells in the area further validating the quality of the company’s assets, and supporting the company’s development growth plans.

Figure 8: 2021 Montney IP30 and IP90 Natural Gas Rates (Source: Advantage Corporate Disclosure (Q2 2022))

Strategic Infrastructure

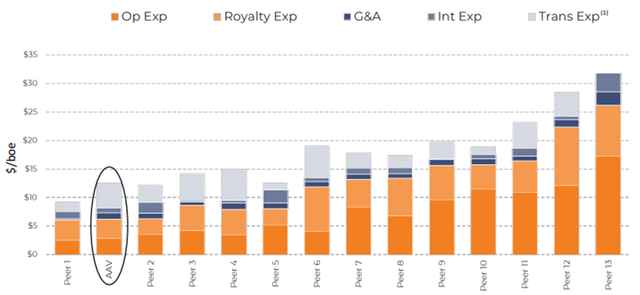

The company maintains and operates gas and liquids processing capacity in each of its core areas (Glacier, Progress, Valhalla, and Wembley). More importantly, the company also has contracted long-term pipeline commitments for up to 262 mmcf/d via Empress, TC LTFP, and TC Mainline. This allows the company to realize US pricing on the majority of its natural gas while supporting its production growth plan in the future. Moreover, by owning and operating its 3rd party processing infrastructure the company is currently generating ~$9 million of stable contracted midstream and marketing revenue, while also being able to deliver on top decile operating costs of $2.45/boe (Q2 2022). To further drive down its operating costs and retain safe and stable 3rd party processing revenue, the company has planned to deploy $35 million of its CAPEX into infrastructure facilities in 2022 increasing processing capacity at Glacier and upgrading its other facilities for future liquids handling.

Figure 9: Operating, Royalty, G&A, Interest and Transportation Costs by Operator (Source: Advantage Corporate Disclosure (Q2 2022), Scotiabank April 14 2022 cash costs $/boe.)

Commercial Carbon Capture and Storage

As part of its mission to be net-zero by 2025, Advantage’s Glacier Gas Plant is home to Entropy’s Phase 1 carbon capture and storage [CCS] project which recently completed its first month of operations. Entropy (a subsidiary of Advantage) is a cleantech pure play as a dedicated full service industrial CCS company, which allows Advantage to gain exposure to rising carbon prices. Moreover, Brookfield (BAM) has recently invested $300 million to fund near-term projects (including Advantage’s Glacier). Entropy’s technology is second to none. Their CCS units are able capture over 90% of industrial emissions, while requiring 3.85x lower heat duty compared to conventional CO2 absorbing technologies [MEA] driving down operating costs, have 66% higher absorption rate compared to MEA and 85% higher cyclic capacity compared to MEA which drastically reduce equipment size and cost. Given the promising results from the pilot and first month of operations, we remain bullish on this technology and potential carbon pricing revenue upside available to Advantage shareholders.

Economic Assessment

In the following five sections we consider Advantage’s latest earnings and breakdown its intrinsic valuation; starting with a commodity pricing outlook, production forecast, calculating field and corporate netbacks, and finally by discounting free cash flow back to present value.

Earnings and Return of Capital

In Q3, the company announced quarterly production of 54,168 boe/d with liquids coming in higher than expectation at 6,447 bbl/d. The results drove adjusted funds flow of $0.52 per share or 53% higher than the same quarter last year. The company remains committed to distributing 100% of FCF via share buybacks, which will fully satisfy its NCIB commitments (10% of float) by year end. The company is positioned to generate between $280 and $300 million in FCF in 2022, of which $140 to $160 million will be apportioned to its share buyback program ($47 million repurchased during the quarter). This will leave plenty of FCF for other ROC initiatives such as SIB.

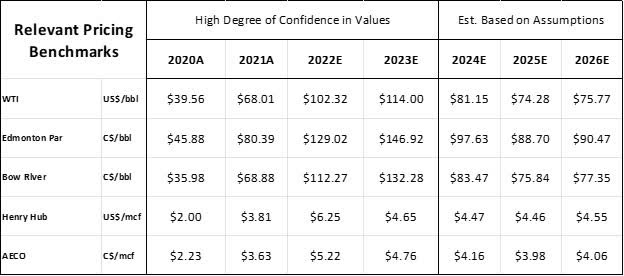

Pricing

Advantage’s production can be separated into two main streams: light oil (~11%) and natural gas (~89%). Historically the company has had gas 30-40% of its production realized at US natural gas pricing and the balance at Canadian natural gas pricing, moreover the company has made significant efforts to isolate itself from relative AECO weakness and was able to only have 42% of its gas exposed to AECO in Q2, falling to 32% in Q3 and estimated to decrease to 13% by next summer. In our forecast we have assumed 65% exposure to US gas pricing, in order to remain conservative. In terms of benchmark pricing forecasts we have taken the 3 Consultant’s Average (GLJ, Sproule, McDaniel) pricing as of September 30, 2022.

Figure 10: Commodity Price Outlook (source: McDaniels, GLJ, Sproule, generated and formatted by CER)

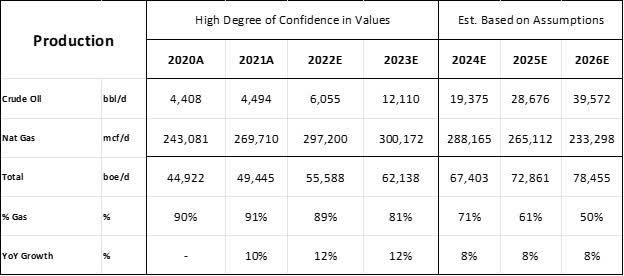

Production

The company has shared a medium-term objective of growing its liquids production to balance its gas weighting by 2025. Furthermore, its latest MD&A has re-iterated on the company’s focus towards liquids-rich growth in the near term while targeting 12 – 15% organic growth. In our forecast below we have remained on the low end of this guidance, and forecasted annual growth of 8% per year after 2023. Additionally, we have forecasted the company to reach liquids-gas parity one year later than expected in 2026 in order to remain more conservative. We believe the liquids growth is realistic, given the company’s Wembley acreage (currently producing 50% of the company’s liquids volumes) is directly offsetting Pipestone’s condensate-rich acreage. Moreover, Advantage only has 95 liquids-rich wells drilled to date, representing only 6% of inventory based on Sproule’s YE 2021 reserves report.

Figure 11: Production Outlook (source: 2022 Management Presentation, generated and formatted by CER)

Netback

Advantage has made significant progress in isolating itself from relative AECO weakness, which continues to plague Canadian producers due to expansion delays, maintenance disruptions, and market inefficiencies on TC Energy’s NGTL system. The company shared that by summer 2023, only 13% of its natural gas production will realize AECO pricing, with the balance delivered to Empress, Dawn, Chicago and Ventura. The company also has 34% of its production hedged throughout the winter at US$4.98/MMbtu, establishing a healthy floor in the unlikely event of a price collapse while leveraging the remainder of its unhedged production to realize meaningful cash generation in light of the constructive pricing backdrop heading into winter. In terms of royalties, transport, and operating costs, we have incorporated the top end of the company’s guidance in order to remain conservative. Moreover, the company noted that it $1.4 billion in tax pools, providing near-term cash tax deferral. At the current forecast, we expect these to be depleted in 2024 after which the company will be subject to cash tax.

Figure 12: Operational Netback (All figures in CAD) (source: 2022 Management Presentation, generated and formatted by CER)

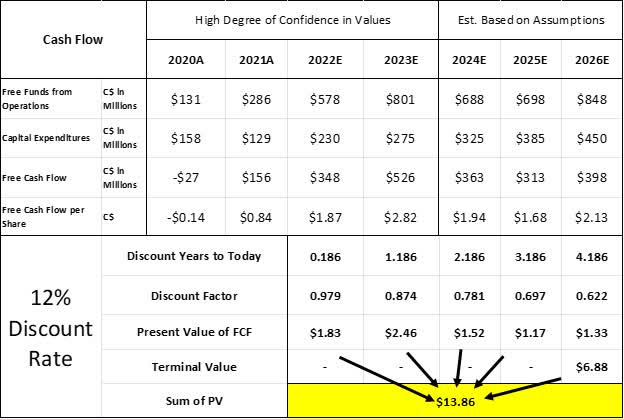

Cash Flow

Despite the various conservative estimates, the company is poised to generate meaningful free cash flow which will be returned via buybacks in the near term, and likely an SIB or special dividend heading into 2023. Moreover, the company’s Entropy CCS project provide additional upside exposure as the Canadian government gradually increases carbon pricing to $170/tCO2e over the next decade. (Note that additional CCS / carbon credit revenue has not been incorporated in the forecast below). At a discount rate of 12% the company’s value lands at $13.86/share, implying a 40% upside from current pricing.

Figure 13: Free Cash Flow and Present Value (All figures in CAD) (source: 2022 Management Presentation, generated and formatted by CER)

Conclusion

Advantage is an incredibly versatile operator with excellent top tier acreage, outstanding well results and a depth of inventory. Moreover, the company has also positioned itself to continuously drive down operating costs (through its owned and operated infrastructure) and potentially capture meaningful carbon pricing revenue over the next decade with its Entropy CCS project. The company is currently allocating 100% of its FCF to share buybacks, which remains an attractive option for medium to longer term investors seeking to realize equity accretion in a tax-effective manner. Moreover, given the company will likely reach its NCIB fulfillment in the upcoming quarters, the company will have meaningful excess FCF likely to be deployed as SIB. As far as intrinsic valuation, Advantage falls at around C$13.9 per share given current commodity, production, and free cash flow outlook, implying an attractive 40% upside from the current valuation and as such warrants a buy recommendation.

Be the first to comment