ImagineGolf/iStock via Getty Images

Introduction

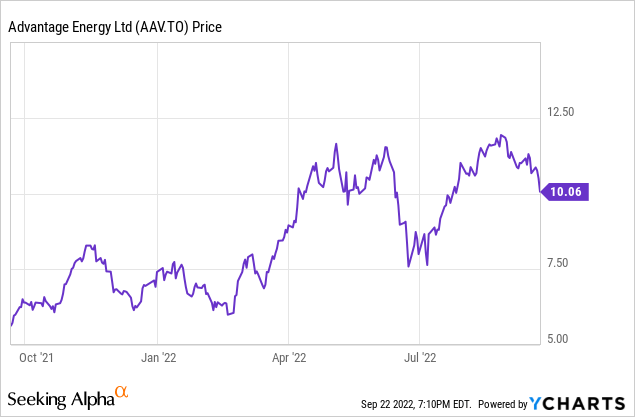

As Advantage Energy (OTCPK:AAVVF) is one of my favorite natural gas plays in Canada, I try to keep close tabs on the company’s performance. I like the strong production, the low sustaining capex and the robust balance sheet. Additionally, the Entropy carbon capture asset is a substantial ‘hidden asset’ on the balance sheet. As I have discussed the Entropy asset in the previous article, I will solely focus on the performance of the natural gas assets in this update. You can re-read all my older articles on Advantage here.

As Advantage is a Canadian company I would strongly recommend trading in the company’s securities using the Canadian listing where Advantage is trading with AAV as its ticker symbol on the TSX. The average daily volume is just under 900,000 shares per day. With a current share count of 189.4 million shares, the market capitalization comes in at C$1.9B.

As expected, the Q2 results were strong

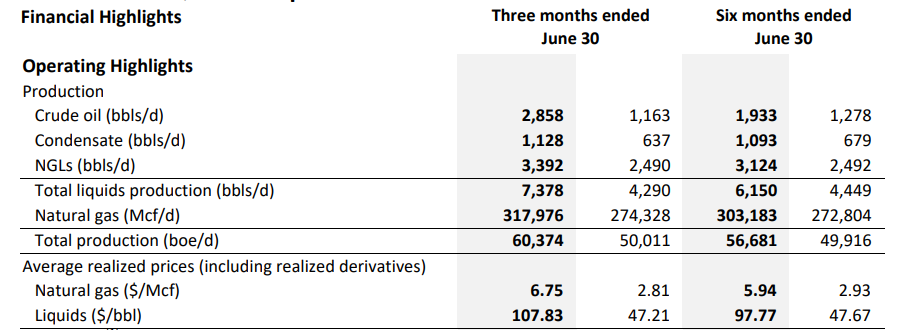

The investments in the assets are paying off as Advantage Energy was able to increase its production rate to just under 60,400 barrels of oil-equivalent per day. As you can see on the image below, almost 90% of the oil-equivalent production consisted of natural gas so investors should definitely consider Advantage to be a natural gas pick.

Advantage Energy Investor Relations

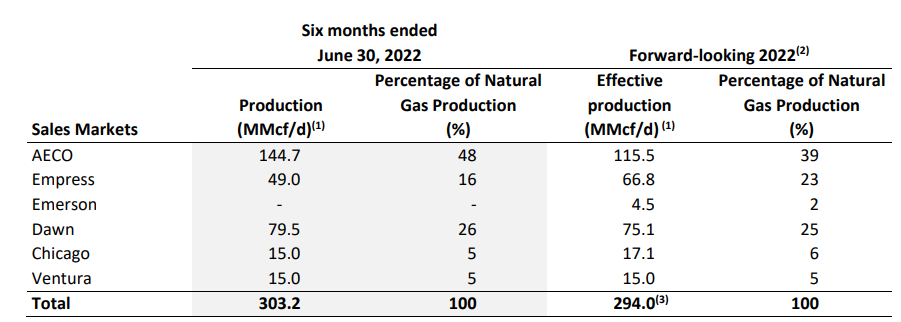

Of course having the oil and condensate production helps as well, but the very high natural gas price in the second quarter was obviously the main driver behind the average revenue of in excess of C$57 per barrel of oil-equivalent. Another important element is the nice diversification Advantage Energy offers when it comes to the markets it is selling its natural gas in. As you can see below, less than half of the natgas production is sold based on AECO prices while the USA also represents an important market for Advantage. As the Canadian natural gas price is more volatile than the US natural gas prices (as recent as August, the AECO price actually turned negative on a spot price basis), it’s good to have this diversification.

Advantage Energy Investor Relations

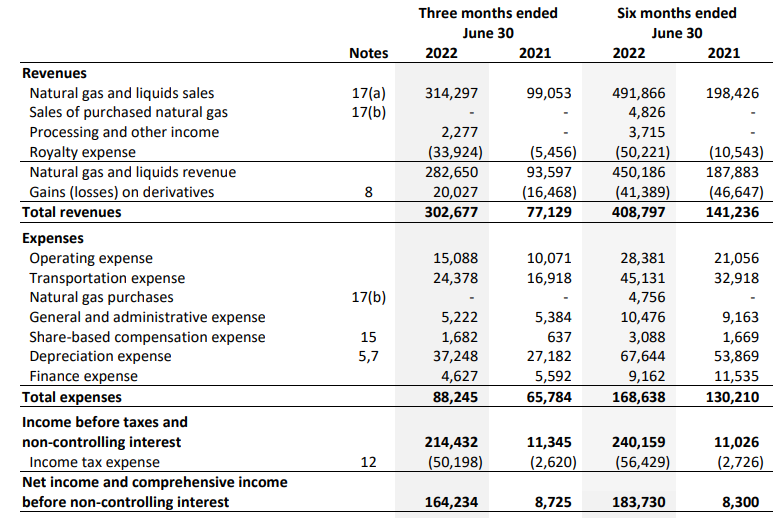

The total revenue in the second quarter came in at just over C$314M and after taking the royalty expenses and the gains on derivatives into account, the net revenue was C$303M. The operating expenses remain very low at just over C$88M of which about 40% is represented by the (non-cash) depreciation expenses.

Advantage Energy Investor Relations

During the second quarter, Advantage reported a net income of C$164M for an EPS of C$0.86 per share. The EPS in the first six months of the year came in at C$0.96M, mainly because of the C$60M+ hedging loss in the first quarter of this year.

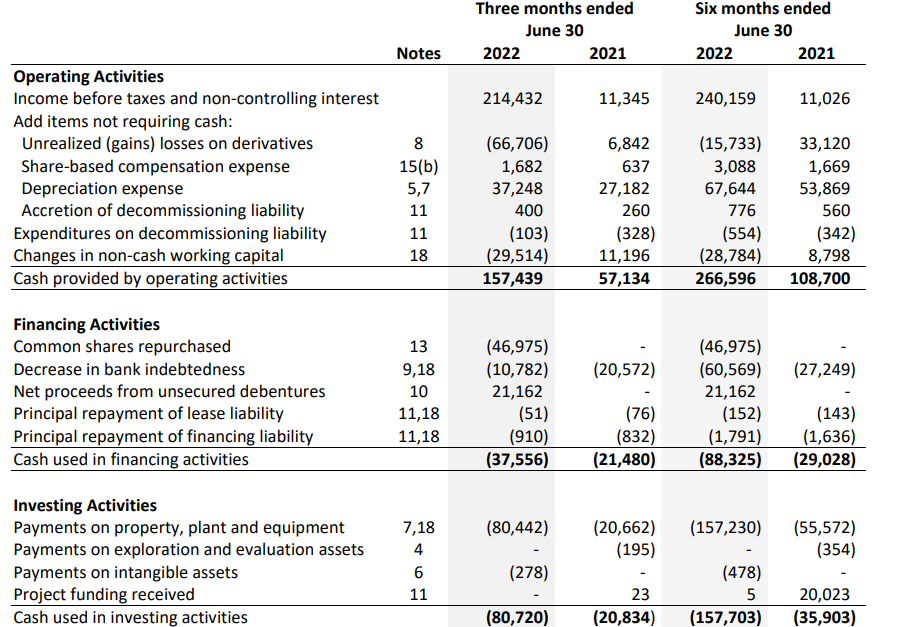

The cash flow statement shows the C$20M in reported gains actually includes about C$67M in unrealized gains. Those are deducted again from the cash flows and the reported operating cash flow in the second quarter was approximately C$157.4M. We still need to deduct the C$1M in lease and financing liabilities but also need to add back the C$29.5M in working capital investments. This means the underlying operating cash flow was approximately C$186M (excluding taxes as the company has access to C$1.4B in tax pools so it won’t pay any sizeable amounts of taxes in the next few years).

Advantage Energy Investor Relations

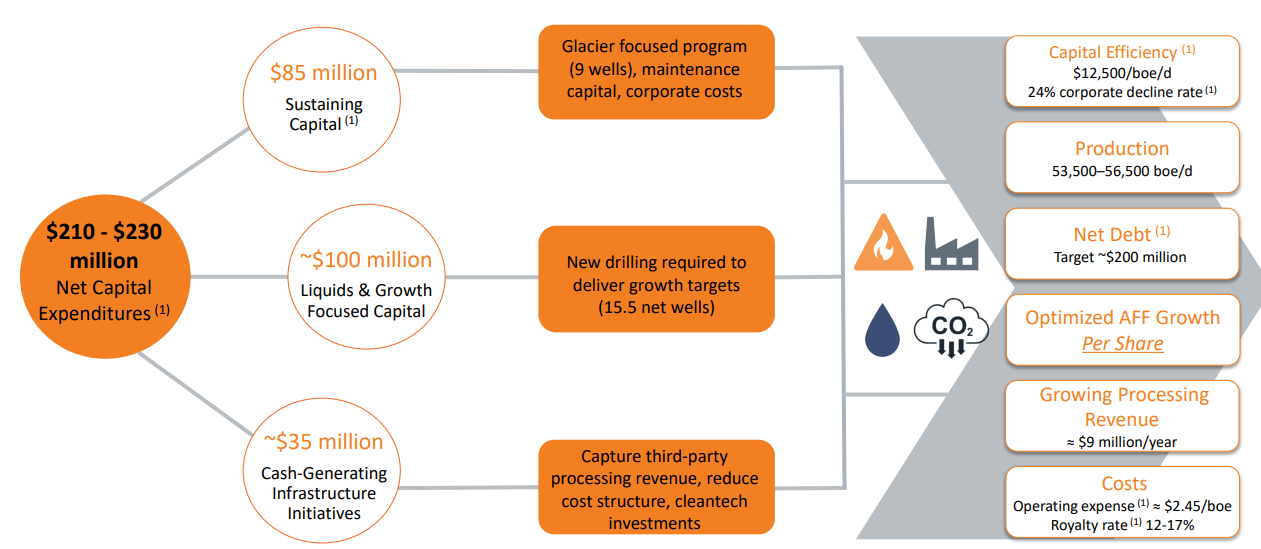

The total capex in the second quarter was approximately C$80M but I think it’s more interesting to use the sustaining capex. And according to the company’s presentation, the sustaining capex is just about C$85M per year, which is just over C$21M per quarter. Even if we would use the C$30M in quarterly average based on the sustaining capex plus the ‘cash-generating infrastructure initiatives’, the free cash flow result in the second quarter would have been C$156M or C$0.82/share based on an average realized natural gas price of approximately C$6.75 per Mcf.

Advantage Energy Investor Relations

As the remaining hedge positions (see below) remain strong, we should expect Advantage Energy to continue to release strong cash flow results in the next few quarters.

Investment thesis

The strong cash flow result helps Advantage to rapidly improve its balance sheet. At the end of June, the company had just under C$46M in cash on the balance sheet while the total debt decreased to C$122M resulting in a net debt position of less than C$100M. This allowed Advantage to aggressively repurchase shares during the second quarter and I do believe this will add value on a longer term basis.

I have a long position in Advantage Energy and wouldn’t mind adding to this position on weakness but I am in no rush. The third quarter will most definitely be worse than the Q2 performance but the strong balance sheet and low sustaining capex make Advantage Energy quite interesting anyway.

Be the first to comment