DNY59

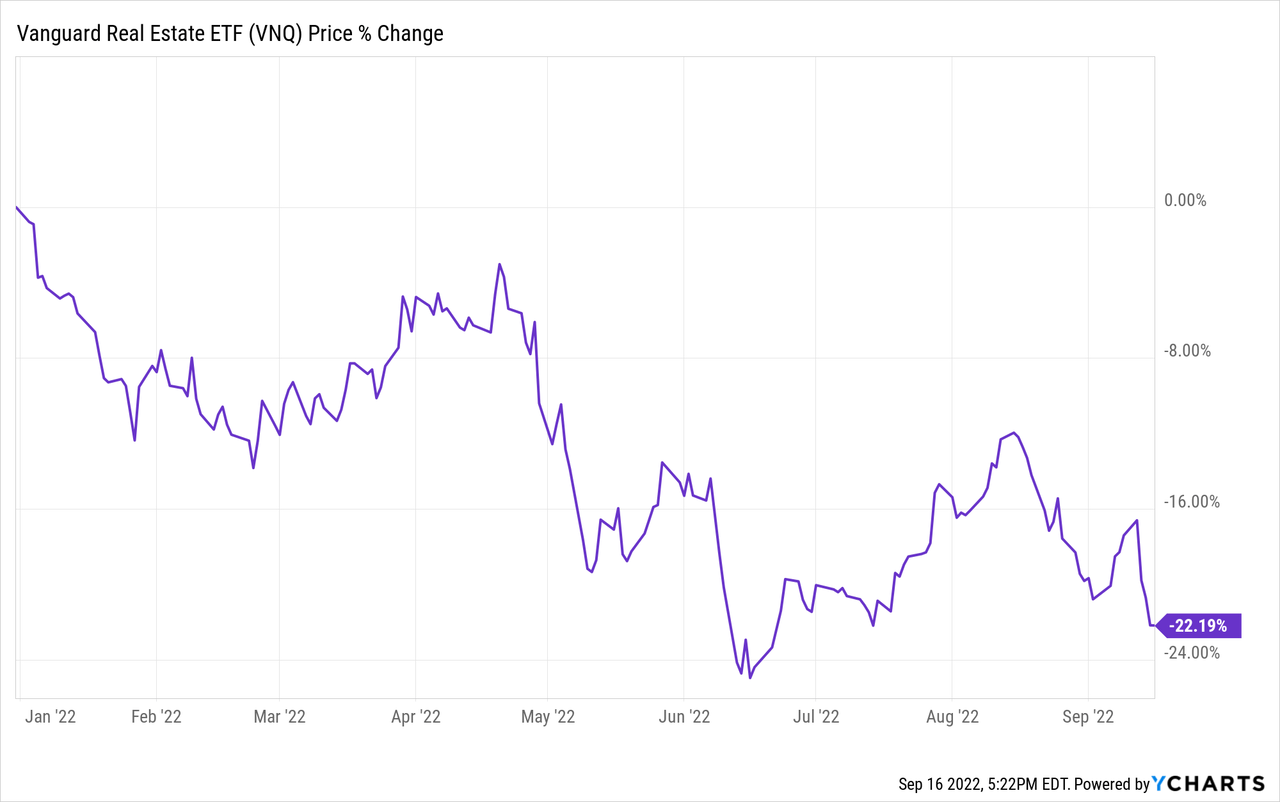

The past month has been quite volatile in the real estate investment trust (“REIT”) market.

Just as it looked as if the market was beginning to recover, it was hit with another dip that put it right back into a bear market:

What’s causing this volatility?

In short, it appears that the Fed is even more hawkish than many had feared.

They are prepared to keep hiking interest rates for as long as it is needed to bring inflation back under control, and they will not hesitate to hike interest rates even if it pushes us into a recession. In fact, the recent commentary of the Fed made it seem as if a recession could be even their objective.

They are trying to reduce inflation by destroying demand. Powell predicted that there would “very likely be some softening of labor market conditions” and “some pain” for households and businesses, but “a failure to restore price stability would mean far greater pain” in the long run, he added.

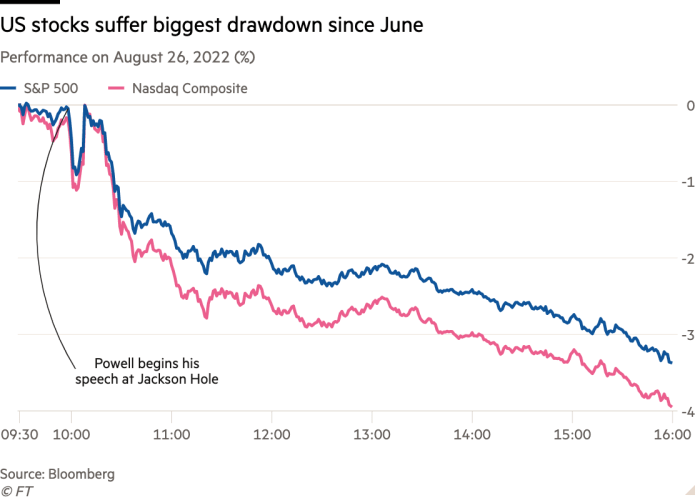

Investors fear recessions… and so, naturally, it sparked a big selloff:

Bloomberg

But as we explained in a recent market update, a recession could actually be a good thing for REITs (VNQ).

I know it may sound counter-intuitive, but hear me out:

REIT investors are mainly concerned about rising interest rates at the moment, and this is the main reason why REITs are down 20% year-to-date.

Interest rates are rising because inflation is high, but a recession could resolve all of this. It would likely cause inflation to cool down and therefore, it would also stop interest rates from rising and quite possibly, even lead to a drop in interest rates.

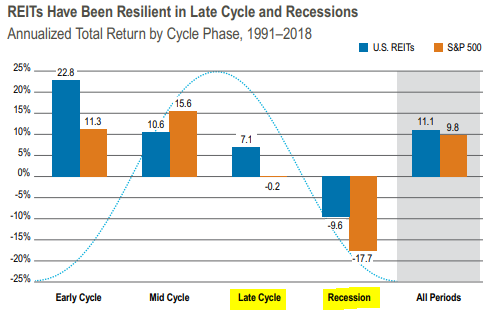

In that sense, a recession could actually be a blessing in disguise for REIT investors. It would remove the primary concern of the market, which is rising interest rates. REIT investors don’t worry much about recessions anyway since REITs are notoriously resilient to them (contractual income and low leverage).

Historically, REITs have only dropped by 9% during recessions on average. Today, REITs have far stronger balance sheets than in the past, their rents are growing the fastest in years, and valuations are also at a multi-year low, all of which should afford better downside protection. Despite that, REITs are down by 20% at the moment:

Cohen & Steers

So, bad news for the economy could be very good news for REITs.

It is a case of short-term pain for long-term gain, and as weird as it may sound, a recession could be the catalyst to higher valuations in the near term.

This is particularly true for those REITs that:

- Earn recession-resistant cash flow.

- Are heavily discounted already.

- Would gain a lot from declining interest rates.

Typically, we don’t mix trade alerts in our monthly portfolio review article, but today, we exceptionally make small additions to a number of our holdings that enjoy such characteristics.

As always, we would like to remind you that we don’t have a crystal ball and can’t predict for long this bear market will last. But historically, high-quality REITs always eventually recover, and those who have the courage to buy them while they are discounted, are richly rewarded.

Here are 3 of our favorite REITs to accumulate in this environment. We expect to share exclusive interviews with their management teams in the coming weeks:

REIT #1 – Essential Properties Realty Trust, Inc. (EPRT): It earns steady, recession-resistant cash flow from 15+ year-long leases, has a clear path to 6-8% annual long-term growth, and yet, it is priced at just 13x funds from operations (“FFO”) and pays a 5% dividend yield. This year, the company has actually guided for even faster growth at 13%, but the market doesn’t seem to care. Between the yield and the growth, you can expect to earn a 12-15% annual return, but we also expect 40%+ of upside to fair value. We are currently working on a management interview that we expect to share with members in the near term.

Essential Properties Realty Trust

REIT #2 – STAG Industrial, Inc. (STAG): STAG’s portfolio of industrial facilities is currently enjoying the fastest rent growth in its history with new leases being signed with 15-20% rent bumps. Its biggest tenants are companies like Home Depot (HD) and Amazon (AMZN). Its balance sheet is the strongest in its history with significant capacity to buy additional properties to push for growth. Despite that, the shares are down 36% year-to-date and now trade at an estimated 25% discount to NAV, which is exceptional for industrial real estate. We expect at least 30% upside, but likely closer to 50% in a future recovery. While we wait, we earn a monthly 5% dividend yield.

REIT #3 – NewLake Capital Partners, Inc. (OTCQX:NLCP): Cannabis consumption does not change materially in a recession. In fact, it may even grow, just like alcohol, as people look for a relatively cheap escape from their daily stress. Cannabis landlords are of course even more resilient as they earn steady rental revenue from triple net leases. Moreover, NLCP has almost no debt and it just recently tripled the size of its credit facility, which should allow it to acquire a lot more assets at large positive spreads over the coming quarters. Despite that, NLCP is down 50% year-to-date as its share price collapsed with the rest of the cannabis sector, and as a result, it now trades at a near 10% dividend yield. The high yield, coupled with its rapid growth prospects, could realistically provide investors with 20% annual returns in the coming years.

NewLake Capital Partners

These 3 REITs are all good examples of recession-resistant companies that are undervalued and set to gain a lot as we finally hit a recession and interest rates stop rising once inflationary pressures cool off.

We will keep accumulating these REITs and others in many phases with small weekly additions. We think that this is the best approach since we know that prices will eventually recover, but cannot time the market.

Will we be right on every single one of these picks? Probably not. But on average, these REITs are so heavily discounted that we should earn attractive returns even if we suffer a few losers along the way.

We are currently working on a number of exclusive management interviews to double-check our theses and we are also preparing a few new investments that we look forward to sharing with you in the coming weeks.

Be the first to comment