hapabapa/iStock Editorial via Getty Images

Investment Thesis

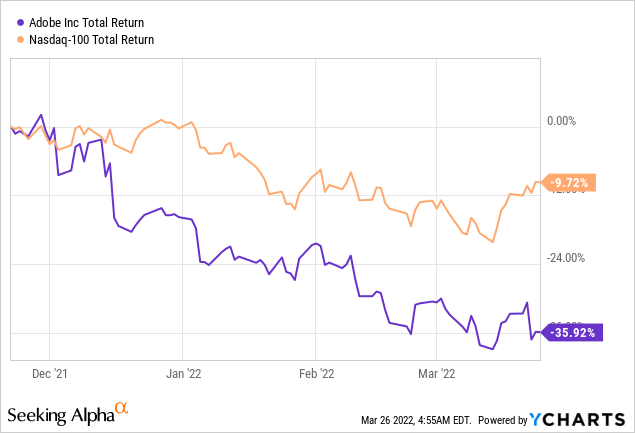

The last few months were not so easy to take for Adobe Inc. (NASDAQ:ADBE) shareholders. After the stock had performed very well until the end of November 2021 with year-to-date performance of 43%, there was a strong sell-off afterwards. The share price gain melted down to 20% by the end of the year and the sell-off continued in the new year. In Year-to-date terms, the share price is currently down 25%, and from its all-time high, it is down 35%. Adobe thus significantly underperformed the benchmark Nasdaq 100 (NDX), which is somewhat surprising given the fact that the correction of the last few months has primarily weighed on the smaller tech stocks and less on the large established companies.

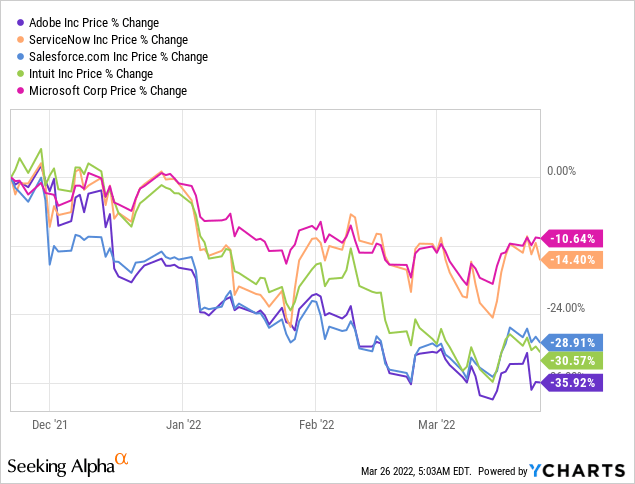

With a market capitalization of nearly 200 billion, Adobe is one of the largest 50 companies in the world, so the large discount is somewhat surprising. Even if you compare the share price performance with other SAAS providers, the drop in Adobe’s share price was the largest.

I don’t think this is justified given the solid set of numbers and other high-quality factors and expect the current price level to offer a very attractive entry point or a compelling post-buy opportunity. I explain the specific reasons below:

Company Overview

Adobe Inc. is one of the largest software companies in the world, specializing in the development of software for creative design, the creation of web pages and the visual distribution of this content. The company can be roughly divided into two segments: Digital Media and Digital Experience. The Digital Media segment comprises the Creative Cloud and the Document Cloud, which offer customers a range of services, products and tools to market their content more efficiently. Digital Experience offers users a wide range of options with a platform to oversee, control and optimize their customers’ experience.

While Adobe’s services used to require the purchase of expensive licenses until 2014 the company shifted its business model to a subscription model due to declining revenue. This decision turned out to be extremely value-enhancing, with an annual revenue growth rate of 22% over the past five years. In 2021, Adobe achieved a revenue of 15.78 billion dollars. With its services and tools also for the masses, Adobe has established itself as a strong brand and was one of the top ten most valuable technology brands in the world in 2021.

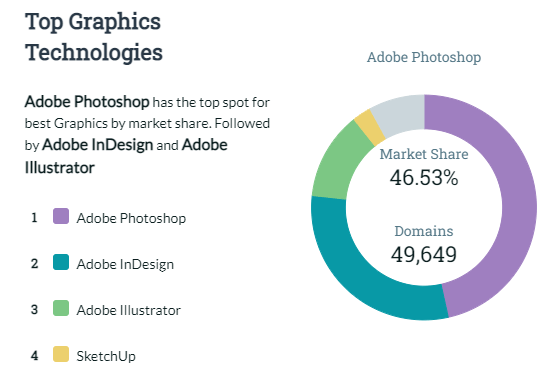

This is also reflected in the strong market position Adobe has in some areas. In Graphics Software, the three applications of Adobe Photoshop, InDesign and Illustrator occupy the first three places and together account for a share of almost 90%.

Datanyze

Financial Analysis

Q1 Summary

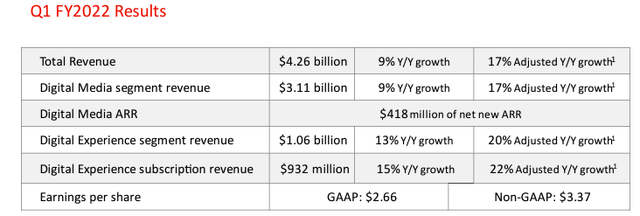

A few days ago, Adobe announced its figures for the first quarter of 2021. Revenue increased by about 9.14% to $4.26 billion and earnings per share increased minimally by 2% to $2.66. Adjusted earnings per share were still up 7.3% to $3.37. These numbers were slightly above analysts’ expectations, as we’ve come to expect from Adobe. 9% revenue growth looks a bit disappointing at first, but it must be taken into account that the first quarter of 2021 was excellent for Adobe because of an extra week, so comparing it to 2022 gives a false impression. Adobe, therefore, has adjusted the figures separately to illustrate the sharp difference in growth. Adjusted growth was 17% instead of 9%, which fits better for a growth company.

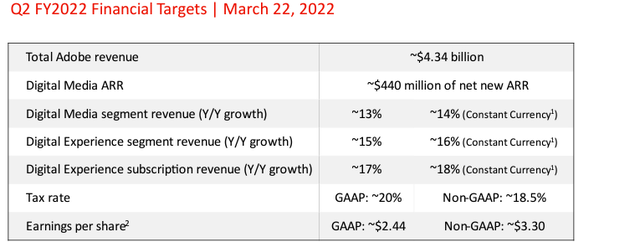

The reason for Wall Street’s disappointed reaction followed the outlook for the second quarter. Management expects revenue of $4.34 billion and non-GAAP EPS of $3.30, which would represent 13% and 9% growth, respectively. Analysts, on average, had expected slightly higher earnings and revenue figures. Part of the subdued outlook can be explained by the impact of the Ukraine war, as Adobe has stopped selling all products to Russia and Belarus. This is expected to weigh on revenue in 2022 by $75 million, which was probably the main reason for the missed expectations.

However, that doesn’t change the fact that Adobe is still on a growth path and continues to expand its market position, even if the days of growth rates above 20% are probably now a thing of the past. A positive aspect of the company’s financials is the high margins. With a gross margin of 88% and an operating margin of 40%, Adobe operates very profitably with a constantly rising trend. Due to very low capital expenditures, the company also shows comfortable free cash flow margins of around 40%, which is quite impressive.

Distribution policy and balance sheet

As Adobe slowly approaches the end of its strong growth phase, it has reached a point where investments only pay off in moderation. Therefore, it makes sense to distribute a part of the profits to the shareholders, which Adobe does not do traditionally through a dividend, but through share buyback programs. In December 2020, management announced plans to conduct share buybacks of $15 billion through 2024. In this way, a return of about 2% has been distributed to shareholders in recent quarters. In the last quarter, 3.8 million shares worth approximately $2 billion were repurchased. There will likely be more programs of this type in the future, considering that in 2021 alone, free cash flow was nearly $7 billion and should continue to grow in the coming years.

There is also little to find fault with on the balance sheet. While there are financial liabilities of $3.6 billion, these are adequately covered by the cash balance of $4.7 billion. On a positive note, debt was reduced by around 500 million in the last quarter, which makes perfect sense because of rising interest rates. The only disruptive factor in the balance sheet is the high goodwill share of 12.8 billion, which is mainly due to acquisitions. If the acquired companies cannot be integrated as planned, there is a risk of high write-downs here, which would then impact the Group’s earnings.

Valuation

Comparison with the peer group

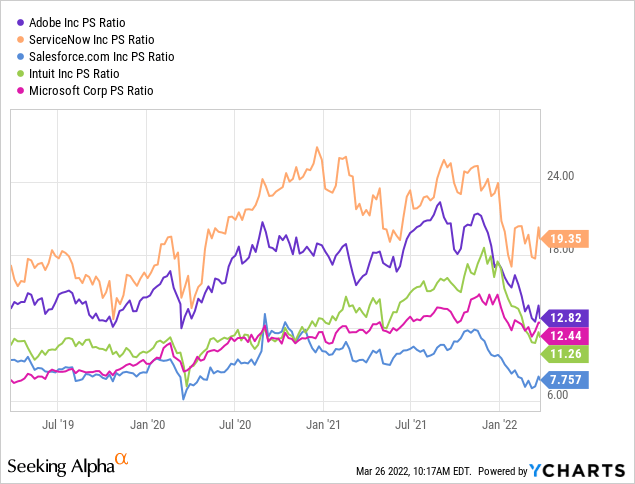

Quality has its price. That has always been the credo of the Adobe bulls in recent years. Even after the sharp decline in the share price, the stock is far from the valuation of a classic value stock. The current P/S is still 13, has been over 20 in the fall of 2021. While Adobe was still trading at a significant premium to its peer group there, the value has now become very similar to the average industry valuation. As a peer group, I have taken the SAAS companies Microsoft (MSFT), ServiceNow (NOW), Salesforce (CRM) and Intuit (INTU).

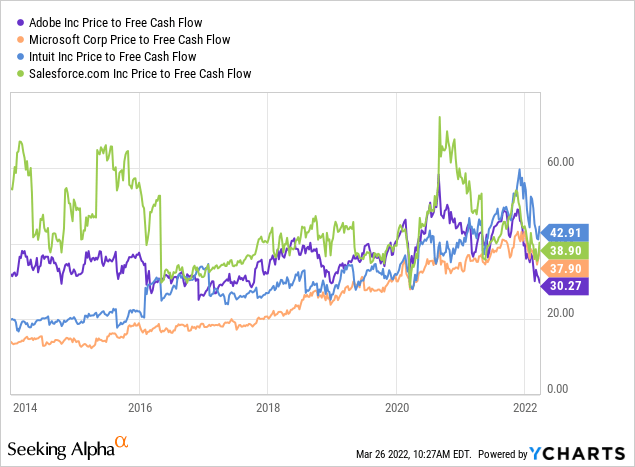

Classically, one also looks at the P/E in addition to the P/S, but I believe that the Price/Free Cash Flow metric is much better suited for valuing Adobe. This metric is currently at 30, which seems quite cheap compared to recent years. The last time Adobe traded at this level was in late 2018 when recession concerns and the trade dispute led to panicked selling in the financial markets. Not even during the Corona crisis was Adobe valued so cheaply relative to free cash flow.

This becomes even clearer when you compare this value with the peer group, which trades on average at 40 times free cash flow (ServiceNow is not shown in the chart because the high values from 2015 would distort the chart). This is the first time Adobe has been cheaper than Microsoft in the period under consideration, which is quite remarkable. I therefore currently consider Adobe’s valuation to be very attractive.

Fair Value

Free Cashflow Model

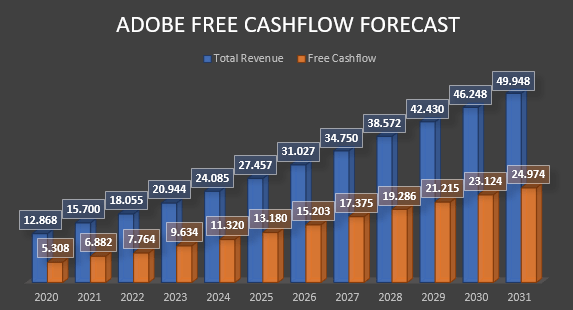

Especially for SaaS companies, I think a discounted cash flow analysis is very relevant, as the higher valuation usually has to be justified precisely because of the high free cash flows. Therefore, I now review how much Adobe’s future cash flows are worth today. To do this, we first need to make some assumptions.

- Revenues grow at an average annual rate of 11.5% through 2031

- The operating cash flow margin improves to 53% in 2031

- CAPEX 3% of total revenue

- Shares outstanding 475 million (share buybacks are not considered)

- Discount rate 8% (deliberately chosen higher to include rising risk-free rates)

- Terminal growth rate 2.5%

Author´s calculations

Based on these assumptions, the fair value of the stock is $638, which is a good 48% above the current price. This is a decidedly strong result for the fact that this is only a base case scenario and not a bull case scenario. Adobe stock looks very attractively valued.

Risks

It is kind of obvious that a company valued at 13 times annual revenues has a certain obligation to deliver convincing results to ensure a sustained increase in the share price. Adobe has done so in the past: In the last 17 quarters, earnings estimates have always been exceeded or at least in line, and there has only been one small miss in terms of sales. Nevertheless, there is currently a slight tendency for the beats to become smaller and smaller, and the outlook is not always convincing.

This either shows that analysts are raising their expectations more and more or that the core business no longer leaves much room for surprises. A flattening of growth rates in recent years is unlikely to have escaped the notice of any investor. As long as annual growth rates are still in the range of 10-15% per year, a premium valuation can still be justified. However, there is a risk that Adobe, the disruptor, will become disrupted in the medium term.

The company’s market position is impressive, yet several competitors want to take market share from Adobe with significantly cheaper creative solutions. With Canva, for example, a company has been able to establish itself in the last few years that represents an alternative to Adobe services for some users in the field of image editing. It is therefore not surprising that Canva is already valued at 40 billion by the market. Should the competition take hold and the narrative that Adobe is expensive and no longer delivers the best product prevails, growth could slow down much faster.

This would also likely hurt margins, as Adobe would then either have to adjust prices or invest more. If growth rates were to sustainably go below 10%, a fair P/S would only be 6-8, instead of 11-13.

Summary

Adobe is a base investment for me in the tech sector thanks to a mix of a strong moat, high profitability, share buyback programs and growth. The stock usually trades very expensively, which is why you may often miss a good entry point. The current correction is a rare chance to get into this high-quality company at an attractive price. The stock is not a bargain, but it is currently valued as cheaply as it was last in 2018, even though the company is in a much better position today and there is no recession to fear.

The old highs are likely to be tackled again in the next 12-24 months. However, investors should keep an eye on the stability of growth rates and see how much the competition can take market share from the company. For the time being, however, I am sticking to my bullish rating.

Be the first to comment