Gerasimov174/iStock via Getty Images

Introduction

After two turbulent years throughout the Covid-19 pandemic, it was hoped that 2022 would provide a break but only two months into the year and sadly, war erupted in Eastern Europe for the first time in decades as Russia invaded Ukraine. Apart from sending long-lasting geopolitical shock waves across the world, it has also seen companies rush to sever ties, such as the British oil and gas supermajor, BP (NYSE:BP), whose 19.75% stake in the Russian state-controlled oil company, Rosneft (OTCPK:RNFTF), suddenly became toxic. Despite weighing down their share price as they rushed to divest their stake, thankfully investors can ignore Rosneft because even at worst, their stake was effectively was only worth $3 per barrel of oil.

Background

After years of suppressed prices and underinvestment, the oil markets were looking very strong when heading into 2022 with many analysts predicting oil prices to reach $100 per barrel. Following the now heavily discussed Russian invasion of Ukraine, this once bullish outlook suddenly appears rather bearish as the shock waves rippled through the market and sent oil prices surging to heights not seen in a decade with geopolitical implications that will last for many years to come. Whilst this remains a highly uncertain and evolving situation, it compounded an already very strong outlook for oil and gas prices as companies scramble to sever ties with Russia, thereby seeing Europe expediting their shift away from Russian energy exports, as my other article discussed in detail. This saw BP as well as their peer, Shell (SHEL) rushing to exit Russia at an inopportune time, which sees the former staring down the barrel of headline-grabbing impairments that could reach a massive $25b.

Looking Ahead

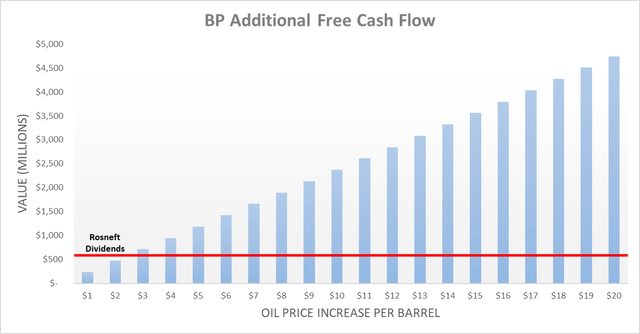

Thankfully their medium to long-term strategy did not hinge upon their Rosneft stake, in fact, if anything it actually ran contrary to their clean energy future, not to mention the ESG implications from holding a stake in a company that is controlled by an authoritarian government. Whilst their massive $25b of impending impairments are anything but ideal, the more important impact is the loss of free cash flow, which was received via their dividends net of foreign withholding tax that were $785m, $480m and $640m during 2019-2021 respectively, thereby seeing an average of $635m. These comprised circa 18% of their aggregated free cash flow during these same years, although thankfully this loss should be quickly surpassed by the benefits of higher oil prices following the sanctions levied upon Russia, as the graph included below displays.

It can be seen that their additional free cash flow grows very quickly as oil prices increase, rather unsurprisingly given their oil production was 995mb/d during 2021, which was assumed to remain a neat 1000mb/d or 365 million barrels per annum for this analysis given their 2022 guidance forecast broadly flat production year-on-year, as per slide sixty-three of their fourth quarter of 2021 results presentation. This means that each time oil prices increase by $1 per barrel, it should add $365m to their free cash flow before income taxes, which their guidance also indicates should be approximately 35%, thereby leaving approximately $237m. Since their Rosneft dividends averaged $635m during 2019-2021, this means that they only require oil prices to increase between $2 and $3 per barrel to recoup the loss of dividends.

Admittedly there may be other relatively smaller moving parts to this situation, such as royalties and operational costs that may increase slightly with oil prices, although these are difficult to quantify and thus to roughly account for their possibility, it seems prudent to round the estimation up to circa $3 per barrel. Even though the future remains highly uncertain, as of the time writing oil prices have already surged from around $90 per barrel to consistently well north of $100 per barrel, often even trading for $120 per barrel, thereby more than offsetting the loss of Rosneft dividends and thus they are actually better off in the short-term.

When looking further afield into the medium to long-term, it remains to be seen exactly how much Russian oil production will ultimately be lost as a result of the sanctions but the recent estimation from the International Energy Agency places the figure around 3,000mb/d, which is the equivalent of approximately 3% of forecast global demand during 2022. Initially, this may not sound substantial but in the oil market, such a loss is very significant and roughly equal to the spare capacity of OPEC to increase production, thereby potentially leaving the world short of oil. This makes it almost certain to consistently see oil prices at least $3 per barrel higher than otherwise would have been if Russia had not invaded Ukraine, if not even more, which by extension, should at least consistently offset the loss of dividends from Rosneft.

Whilst this is already positive, this analysis only quantified the benefit via their oil production, thereby excluding their comparably sized gas production that also stands to benefit in the medium to long-term as Europe seeks more supply outside of Russia, not to mention their clean energy operations that will likely see a benefit as higher fossil fuel prices make clean energy more attractive. These were purposely excluded because they are more difficult to quantify due to the longer-dated nature of any benefits, especially with gas prices tending to vary more significantly between geographic regions than oil prices, thereby complicating estimations. Nevertheless, considering the very minimal circa $3 per barrel increase to oil prices required to counteract the loss of their Rosneft dividends, it would not pose any significant downside even if their gas and clean energy operations saw no benefit.

Apart from the loss of Rosneft dividends, the other impact will be felt within their capital structure and thus their gearing ratio as the impairments slash the equity on their balance sheet. They ended 2021 with equity of $90.439b and thus if $25b is lost through impairments, this would be pushed down to $65.439b, which given their net debt of $30.495b would see their gearing ratio climb from 25.22% to 31.79%. Whilst once again not ideal, it still nevertheless remains safe in these very strong operating conditions and should also be partly counteracted by their earnings and deleveraging during the first quarter of 2022 with subsequent quarters further recouping losses, thereby lessening the impact upon their capital structure and financial position.

Conclusion

Thanks to their large oil production outside of Russia, even at worst they only require oil prices to average circa $3 per barrel higher than otherwise would have been the case to counteract the loss of their Rosneft dividends. Following the circa $30 per barrel increase already seen thus far, this appears extremely likely and thus even without any medium to long-term benefit to their gas and clean energy operations, they likely stand to actually benefit despite their massive impairments, notwithstanding the tragic loss of life. Since this stands to support and possibly even grow the immense shareholder returns expected for 2022 and beyond as discussed within my previous article, it should not be surprising to see my buy rating is maintained.

Notes: Unless specified otherwise, all figures in this article were taken from BP’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment