Vladimir Vladimirov/E+ via Getty Images

ADMA Biologics (NASDAQ:ADMA) is my personal largest biopharma holding, so it’s a company I follow particularly closely. The company is now in a critical transition period as ADMA’s vertically integrated business model seemingly starts to bear some fruit. ADMA just reported full-year 2021 earnings and provided guidance for 2022, so I’m writing this as an update on how I view the company’s overall investment thesis.

ADMA’s Full-Year 2021 Numbers Delivered on Promised Growth

To me, ADMA’s investment thesis is all about management execution and how we’ve seen continued steady progress towards clearly stated goals for several years now. That was evident again in the solid revenue and earnings beats just announced for ADMA’s second full year of marketing its plasma products.

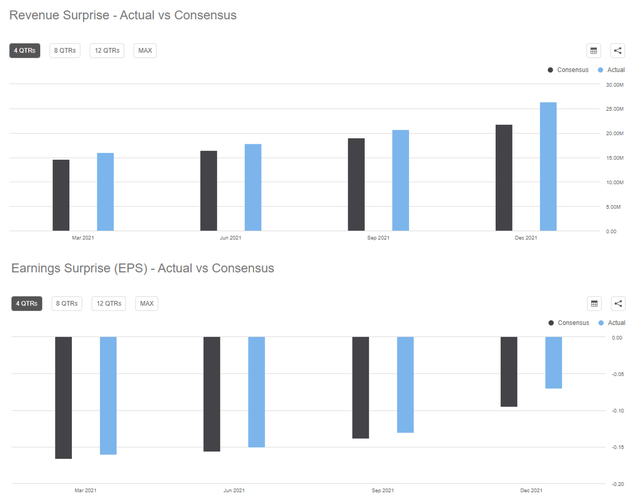

ADMA announced that it had recorded $80.9 million in revenue for the full-year 2021 versus $42.2 million in 2020. This beat expectations by $4.61 million, and earnings also beat expectations by $0.01. The company has now beaten analyst estimates of both revenue and earnings each quarter for the last year.

Quarterly Revenue and Earnings Surprise (Seeking Alpha)

The 2021 full-year revenue number represented 92% growth over 2020, largely due to increasing adoption of ASCENIV and the supply chain and efficiency improvements ADMA has implemented. ADMA has actually provided specific guidance for full-year 2022 revenue for the first time, saying it will exceed $125 million in revenue which would be in excess of 50% year-over-year growth.

ADMA’s gross margin was positive on a full-year basis for the first time as well. Gross margin went from negative in every prior year to 1.4% for the full-year 2021 and 13.3% in Q4. On top of that, the CEO said on their conference call that he expects gross margin to continue to improve throughout 2022, and in later answers to questions, management said they expected to see gross margin of 40% to 50% by the end of 2023.

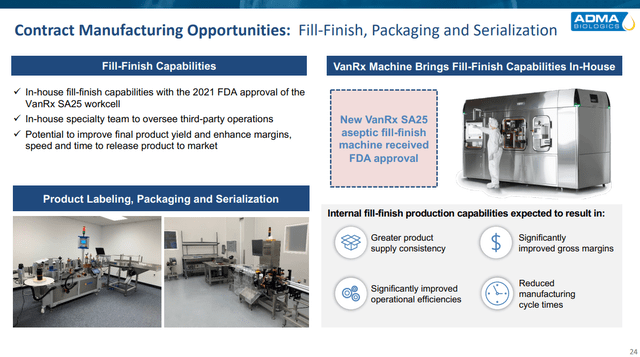

A lot of this is due to the increasing efficiencies the company is starting to see with its vertically integrated business model. One great example of this is the VanRx machine that the CEO discussed frequently on analyst calls in 2021. This machine allows ADMA to do the fill-finish process (last step in producing a finished product) itself, which saves the company time and money over contracting it out to a third party.

VanRx Machine Description (ADMA’s Corporate Presentation)

The company also utilizes a proprietary plasma collection system from Haemonetics at its collection facilities that is specially designed to boost collection yields. Such an emphasis on increased efficiency through all facets of its business seems to be increasingly paying off for ADMA.

Haemonetics’ Persona System (Haemonetics’ Website)

Another part of the improving gross margin is also due to an increasing percentage of ASCENIV sales vs BIVIGAM in ADMA’s total sales mix. This is noteworthy because ASCENIV has a higher price and margin for ADMA due to its hyperimmune nature ($900/gram ASCENIV vs $133/gram BIVIGAM). Management said on their year-end call that they expect this trend to continue and have even started to increase the relative amount of ASCENIV they are producing.

ADMA is also still on track with its buildout of a plasma collection network. Management is now reporting that nine facilities are already in the works, including six in Tennessee, South Carolina, and Georgia that are already operational and collecting plasma. Two of these centers have actually received FDA approval during Q1 2022, and at 30,000 liters to 50,000 liters in expected collections per facility per year, ADMA should relatively soon be collecting the majority of its own plasma itself. In fact, ADMA’s management has guided that this is likely to occur by year-end 2023.

This vertical integration of supply does come at a cost though with expenses related to this build-out rising by $2.5 million in Q4 and about $8 million for the full-year 2022. Given that ADMA now has about half of its facilities in operation, I’m personally expecting to see the current $12.5 million annual expense level eventually double. In addition to the additional security of generating its own plasma supply, ADMA also expects that its cost per liter of plasma should start declining as ADMA’s collection volumes increase and its reliance on third-party deals decreases.

Another part of that vertical integration is ADMA’s Boca Raton, Florida processing facility which the company now says is likely worth $400 million on its own. That plant’s 600,000-liter capacity should easily be enough to support management’s goals of a $250+ million annualized run rate by the end of 2024 and $300+ million in yearly revenue by 2025 given that ADMA’s plasma yield is ~3.5-4 grams/liter (translates to revenue of roughly $600-$800/liter given ADMA’s pricing).

ADMA’s Balance Sheet Is Improving But More Cash Is Needed

ADMA had two primary issues from a balance sheet perspective, and it has now taken steps to address one of them. That one is the debt overhang it had from its deal with Perceptive Advisors. ADMA just announced a $175 million debt refinancing with Hayfin Capital Management. The first $150 million of that went to fully repay Perceptive, and the last $25 million can potentially be drawn down this year to fund operations. Most important to me is that maturity was pushed out from 2024 to 2027. This should allow ADMA time to accumulate some cash flow to help pay down that debt rather than having to raise dilutive cash for the entirety.

ADMA’s other big balance sheet issue is that it will still need at least one more sizable cash infusion prior to achieving profitability. The company only had $51.1 million in cash and equivalents at the end of 2021. Although ADMA’s net loss decreased in 2021 to $72 million from $76 million the year prior as revenues nearly doubled, it’s clear that current cash levels aren’t even sufficient for the remainder of 2022, not to mention 2023. Expenses have increased somewhat with SG&A expenses rising about $8 million in 2022, and plasma center operating expenses also rising about $8 million.

Management has promised profitability by the first quarter of 2024 at the latest, but I still expect losses of at least around $50 million in 2022 and $20 million in 2023 just estimating based off of projected revenue, gross margin, and expense growth. To me, that suggests the company could still need around another $100 million. $25 million of that could potentially come from the existing Hayfin debt deal, but $75 million would have to come from somewhere else. If that’s an additional dilutive raise, it would clearly hurt existing shareholders.

Management is aware of that risk though and is still engaging in a review of strategic alternatives in conjunction with Morgan Stanley (MS). While I hope something useful comes out of that, I personally am factoring in the additional dilution and currently believe that I will still make money as a long-term shareholder regardless.

ADMA’s Risks

ADMA has two major risks to me. One is management execution, and the other is the high degree of capital investment required in building a vertically integrated business model and the resulting risk of meaningful dilution of existing shareholders. As I’ve already said, I view management’s recent execution as the largest reason I own the stock. They’ve been very clear about the game plan and have consistently met or exceeded expectations. This gives me a high degree of confidence that the company will continue to progress towards its goals, but it’s certainly worth being aware of how reliant the company is on continued execution.

If execution falters, it could mean ADMA continuing to lose money for far longer than just the next two years as is currently projected because there’s no obvious way for the company to cut costs as it continues to build out its infrastructure. Given that ADMA lost an amount of money equal to about a fourth of its current market cap in 2021 and has debt around half of its market cap, it wouldn’t take many more years of losses to produce huge dilution. I’ve personally factored some additional dilution into my valuation of the stock, but I’m comfortable that I will still make a strong return despite it if things go the way they currently seem to be headed. That said, this is certainly not a stock without risk, and anyone considering investing in it needs to do their own diligence on this issue and make sure they are comfortable with the level of especially potential dilution risk they are taking.

ADMA Is A Strong Long-Term Story

While I could be pleasantly surprised with a near-term rally, I really expect to have to hold on to my ADMA shares for several more years to get full value out of them. I’m comfortable doing that though because management has been transparent and efficient in its execution and because ADMA has several broader market trends in its favor.

First, the plasma market isn’t an easy one for new competitors to enter. As ADMA itself has shown, a huge degree of capital investment is required and the pay-off time is long. The production cycle is seven to 12 months before revenue could even begin to be recognized, and it’s hard for plasma companies to get buyers to consider their products before a fairly large amount of inventory has been built up. ADMA also has solid IP protection on its process for screening hyperimmune donors for ASCENIV through 2035, more than a decade after the company will likely achieve profitability. This could also allow time for a potential expansion of ASCENIV use into patients at high risk for an RSV infection.

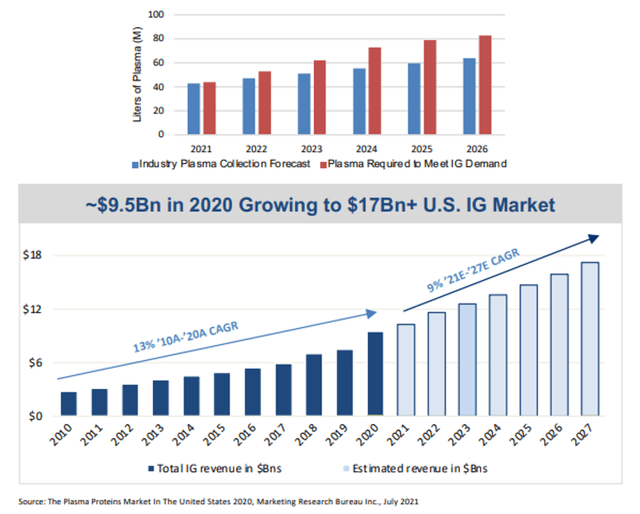

Second, the immune globulin market is a highly undersupplied market which should lead to strong growth over the coming years. ADMA is one of only six manufacturers in the US market, and supply growth is not currently expected to keep up with demand.

Plasma Industry Growth Trend (ADMA’s Corporate Presentation)

ADMA will likely be well-positioned to turn that demand into big revenue growth and eventually free cash flow for shareholders.

This is personally my largest holding, and I have a cost basis of about $1.90. I’ll likely consider adding on any major pullbacks from here, but mostly I’m just planning to hold my current position for the next few years as ADMA’s business makes the transition to a cash-flow positive company. I eventually expect that ADMA’s market cap will likely revert to at least two to three times its annual sales, if not higher. Given that would imply a market value of nearly two to three times above where ADMA presently trades, I feel fairly confident that I will still make a good return even if ADMA is unable to avoid further dilution from here so long as the current level of management execution persists.

Be the first to comment