Pere_Rubi/iStock Editorial via Getty Images

Investment Thesis: adidas AG has strong potential to rebound given continued sales growth and a potential undervaluation on a P/E basis.

adidas AG (OTCQX:ADDYY) has had a tough time of it over the past couple of years. The stock has been buffeted by the effects of supply chain concerns and inflation, the effects of COVID lockdowns in China, as well as the recent ending of the Ye partnership.

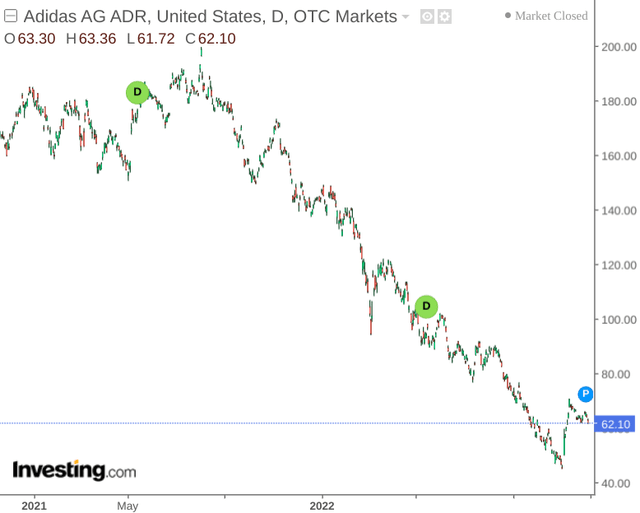

We can see that the stock is down sharply since mid-2021:

In a previous article, I made the argument that investors are likely to pay more attention to earnings and cash flow growth going forward in spite of continuing sales growth.

Given that adidas AG has faced a range of macroeconomic and company-specific pressures, the purpose of this article is to investigate whether the stock could have scope for a rebound from here.

Performance

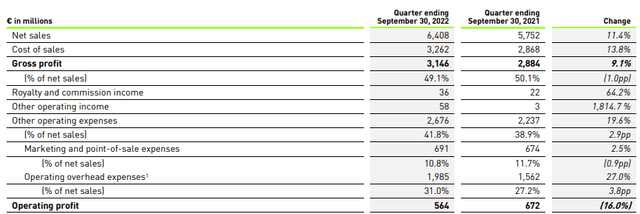

When looking at the company’s most recent earnings results, we can see that adidas AG has continued to see double-digit growth of over 11% in net sales as compared to September 2021. Gross profit also came in at above 9%, with higher operating expenses ultimately resulting in a decrease in operating profit:

adidas AG Q3 2022 Quarterly Results Release

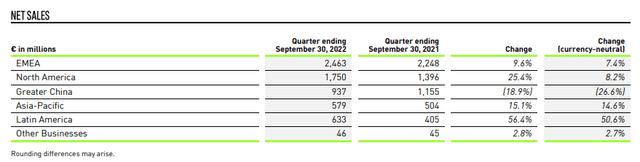

Notwithstanding higher expenses, net sales continued to see a strong increase in spite of lower consumer demand across Greater China as well as the revenue hit from suspending Russian operations.

Additionally, we can see that EMEA and North America accounted for 66% of total net sales in September 2022 (up from 63% in September 2021) with performance across these regions continuing to remain strong.

adidas AG Q3 2022 Quarterly Results Release

In terms of the company’s balance sheet, we can see that the quick ratio has fallen below 1 in the past year – indicating that adidas AG is in a less favourable position to service its current liabilities with existing liquid assets:

| Sep 2021 | Sep 2022 | |

| Total current assets | 14,142 | 13,217 |

| Inventories | 3,664 | 6,315 |

| Total current liabilities | 8,517 | 10,605 |

| Quick ratio | 1.23 | 0.65 |

Source: Figures sourced from adidas AG Financial Supplement January-September 2022. Figures provided in € millions, except the quick ratio. Quick ratio calculated by author as total current assets less inventories all over total current liabilities.

With that being said, the company’s long-term borrowings relative to its total assets has decreased slightly which is encouraging – as it indicates that even despite the numerous business pressures that the company is facing – adidas AG has not had to increase its long-term borrowings to continue funding its business:

| Sep 2021 | Sep 2022 | |

| Long-term borrowings | 2,469 | 1,958 |

| Total assets | 21,946 | 21,750 |

| Long-term borrowings to total assets ratio | 0.11 | 0.09 |

Source: Figures sourced from adidas AG Financial Supplement January-September 2022. Figures provided in € millions, except the long-term borrowings to total assets ratio.

Looking Forward

Despite the pressures that adidas AG has faced to date, I take the view that the company has the resilience to see upside once again.

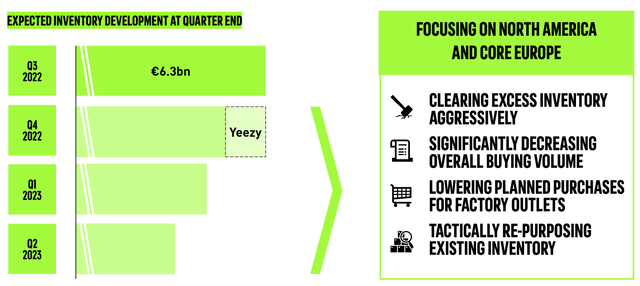

One of the primary reasons that the company’s short-term cash position has taken a hit could be in significant part due to the excess inventory of Yeezy products accrued as a result of the termination of the Ye partnership.

However, the company has stated that it intends to sell off existing Yeezy inventory in 2023 under a re-branding strategy and has the ability to do so given the company continues to own the rights to the Yeezy designs. The company anticipates that inventory levels should significantly decrease from Q1 2023 onwards.

adidas AG Q3 2022 Presentation Results

Of course, there remains the risk that sales of re-branded Yeezy inventory may still be lower than expected given the recent controversy surrounding Ye. Sales performance in this regard remains to be seen and the re-branding strategy is likely to play a key role in determining how quickly the company can sell off its existing inventory.

However, I take the view that adidas AG has continued to show strong performance across its product line more broadly, and clearing excess inventory should significantly improve the company’s cash position going forward.

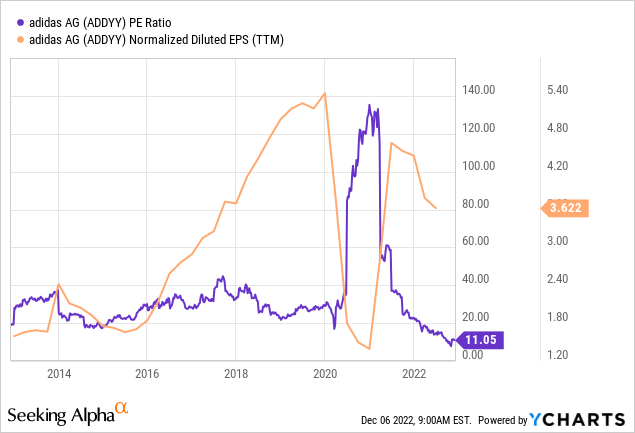

ycharts.com

When looking at the company’s 10-year P/E ratio – we can see that the stock is currently trading near a 10-year low – while earnings per share (on a normalised diluted basis) has seen a strong recovery and remains higher than levels seen pre-2018.

In this regard, my view is that should sales performance continue to remain strong and the company can reduce its excess inventory, price could conceivably see a rebound.

With the P/E ratio having historically traded up to a level of 40x (with the exception of 2020-21 where earnings fell sharply during COVID lockdowns) – here is a scenario analysis of potential target prices as the P/E ratio increases.

| P/E Ratio | EPS (Normalised Diluted) | P/E x EPS (Potential Target Price) |

| 11.05 | 3.622 | 40.0231 |

| 20 | 3.622 | 72.44 |

| 30 | 3.622 | 108.66 |

| 40 | 3.622 | 144.88 |

Source: Calculations made by author.

Assuming that the P/E ratio were to increase between a range of 20x to 40x, then I estimate that the potential target price for Adidas could range between $72 to $144 – the high end of which would bring Adidas back to the price range seen at the beginning of this year.

As it stands, investors seem to be apprehensive of the stock given macroeconomic pressures and the recent fallout surrounding the termination of the Ye partnership. However, I take the view that should investors regain confidence in the stock – then price could have substantial upside given that the P/E ratio is trading below the historical range as seen in the past ten years.

Conclusion

To conclude, adidas AG has seen significant pressures in the past couple of years which have substantially impacted its stock price.

With that being said, I take the view that the drop we have been seeing in the stock may be an overreaction and the business remains strong in spite of recent pressures.

Be the first to comment