ayo888

In March here, I wrote about the likelihood of government regulators (especially the U.S. FTC) nixing the January announced Activision Blizzard, Inc. (NASDAQ:ATVI) takeover offer from Microsoft Corporation (MSFT). My logic was to buy Activision after the deal was halted and the stock quote sank back to $65-$70 a share.

Well, governments in both the U.S. and Europe appear to be slowing the deal’s approval, while asking more questions from both companies. Many investors have become bored with the whole process or increasingly worried about the proposed transaction’s final closing prospects. So, Activision’s price has drifted lower along with the stock market generally the last eight months.

Below is an excerpt from my original piece:

With a current quote of $79 vs. a bid value of $95 in cash for each ATVI share ($69 billion in total), experienced analysts and investors are not quite sure the transaction will be completed. I personally place the odds of a final takeover approval by U.S. regulators under 50%, perhaps closer to 25%.

It has been reported a deal breakup fee of up to $3 billion will be paid to Activision if the FTC and Department of Justice refuse to allow another Big Tech merger that would necessarily consolidate the gaming industry and reduce competition.

Fast forward to November 2022, and the deal is still under review. Price has drifted back into the low-$70s. Retail investors have largely moved on, leaving shares in the hands of arbitrage players gambling on government approval of the marriage with Microsoft and a $95 per share payoff.

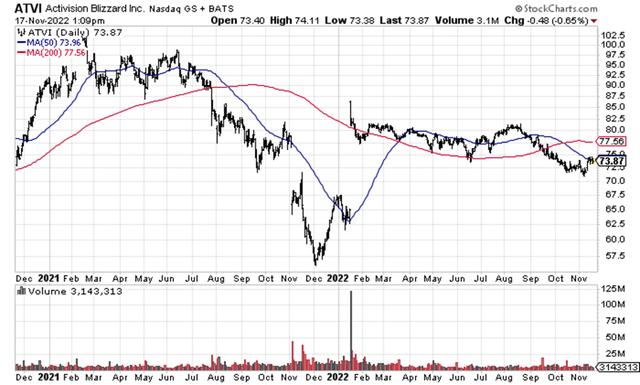

StockCharts.com – Activision Blizzard, Daily Price and Volume Changes, 2 Years

At the current price point, valuations as a standalone company are more than “fair” in my mind, while the greying odds of approval still provide a potential kicker for quick gains approaching 30%. My research suggests the immediate downside is limited to $60 on the deal’s demise (less than a -20% potential loss), with Activision again discounted on slightly weaker operations in 2022.

Yet, an expected $3 billion breakup fee and stronger 2023 operating forecast may make the stock an interesting buy idea right now. Weighing all the investment pros and cons from sliding 2022 game industry sales as the pandemic demand surge ends, to improving valuation variables on better estimated company comps next year, I am projecting the share price could easily trade as high as $90 to $100 by the end of 2023.

Deal May Be Approved Soon

Follow me for a minute. What if the transaction review decision was intentionally delayed until after the November U.S. midterm election just ended? After promising not to allow Big Tech to engage in large mergers reducing competition, it was next to impossible for President Biden’s administration to give the green light to this proposal. But, with the election out of the way, major Democratic donors like Warren Buffett – his Berkshire Hathaway (BRK.A, BRK.B) ha built a sizable Activision position, its 9th largest outside holding at the end of September – and Bill Gates (through his Microsoft shares) may now get their wish in late 2022. Now may be the best time for the U.S. Federal Trade Commission to flash thumbs up and approve the merger.

In the end, management teams from both companies continue to project the transaction will close between April and June of next year. If this is the future, investors purchasing ATVI today at $74 can capture a total return of roughly 30% on the $95 Microsoft cash offer over approximately six months.

Valuation Setup

The basic summary of business results in Activision remains one of the highest-margin cash flow machines, with only minor liabilities vs. other companies in the entertainment and software world. Plus, valuations are cheaper than the vast majority of peers. If the merger with Microsoft fails, shareholders have a generous backstop to hold up price over the near term.

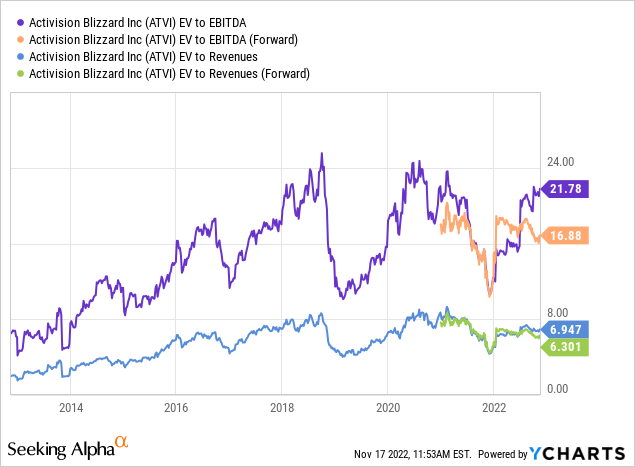

There have been extra costs and charges related to ongoing merger preparation in 2022 business results. So, the best way to review the company’s overall worth may be on generic EBITDA generation (earnings before interest, taxes, depreciation and amortization) and revenues. Using enterprise value to accurately account for its clean balance sheet (EV = equity capitalization + debt – cash), Activision appears to have a truly strong backing for shares. Pictured below on a decade-long graph, “forward” estimated EBITDA and sales are valued very close to 5-year averages.

YCharts – Activision Blizzard, EV to EBITDA and Revenues, 10 Years

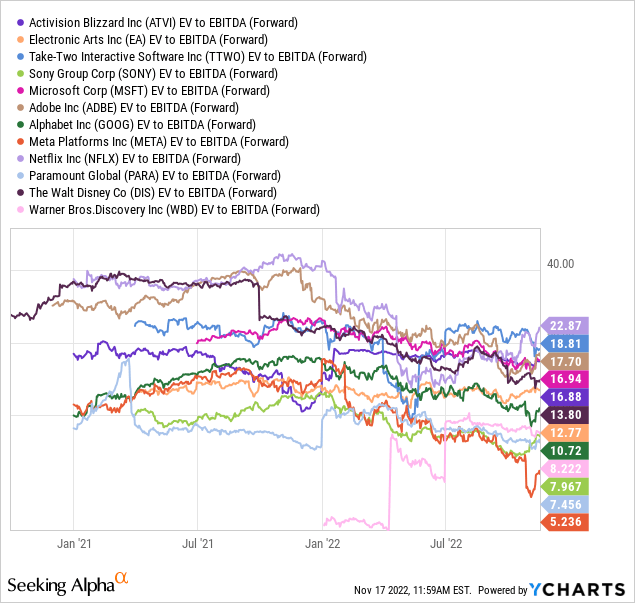

When we compare these ratios with the major players in U.S. entertainment, gaming, and software, ATVI looks even smarter as a long-term investment. The peer and competitor group includes Electronic Arts (EA), Take-Two (TTWO), Sony (SONY), Microsoft, Adobe (ADBE), Alphabet/Google (GOOG, GOOGL), Meta Platforms (META), Netflix (NFLX), Paramount (PARA) Walt Disney (DIS), and Warner Bros. Discovery (WBD). Activision’s 16.9x EV multiple on 2023 EBITDA estimates is near the middle of the pack, just above the 13x median average.

YCharts – Major U.S. Entertainment Firms, EV to Forward EBITDA Forecast, Since December 2020

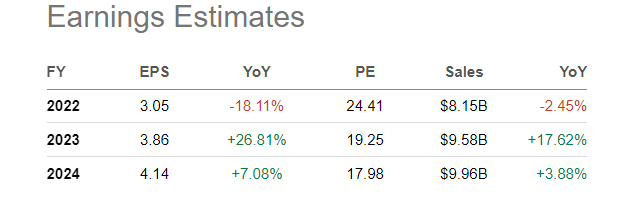

The good news is EPS and sales are estimated to rise nicely after 2022’s slowdown, even if the U.S. economy hits a mild recession next year. Fortunately, gaming demand is relatively recession-proof. The standard P/E ratio of less than 20x EPS for 2023 is hovering near current estimates of 18x for the S&P 500, despite far superior margins and long-term business growth prospects for ATVI.

Seeking Alpha Table – Activision Blizzard, Analyst Estimates 2022-24, November 17th, 2022

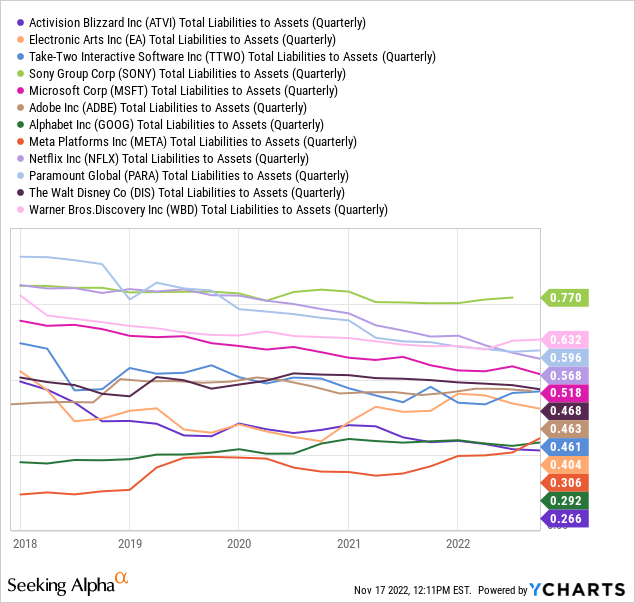

In addition to above-average growth, Activision today holds the least leverage on its balance sheet vs. the main gaming, entertainment and software firms. Falling from middle of the pack five years ago, the company now sports the most conservative total liability to asset setup, giving it far better financial flexibility in a recessionary environment.

YCharts – Major U.S. Entertainment Firms, Total Liabilities to Assets, Since 2018

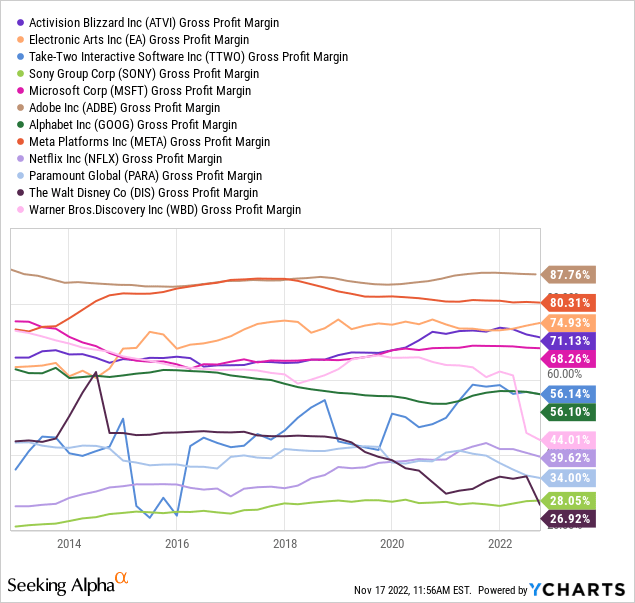

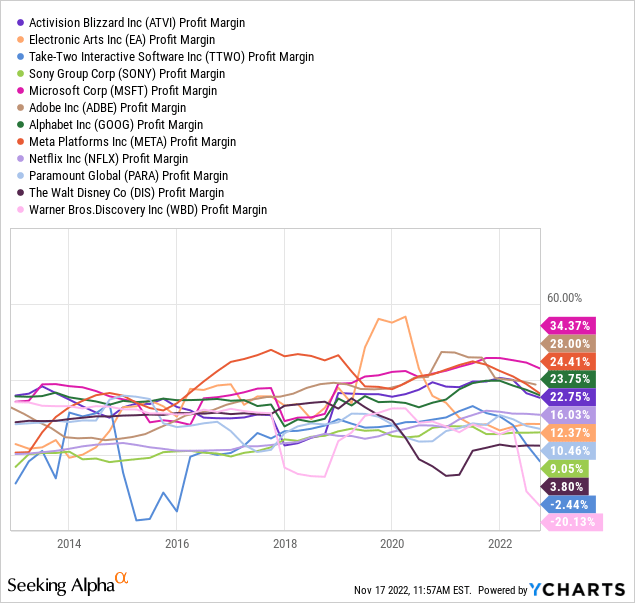

Gross profit margins are top-tier in the peer group, meaning final net income should survive a recession just fine, with minimal negative impact if sales decline slightly below estimates. A net profit margin above 20% is exceptional vs. the sector and U.S. businesses in general. In contrast, the S&P 500 companies generate a median average under 10% for net income margins.

YCharts – Major U.S. Entertainment Firms, Trailing Gross Profit Margins, Since 2012 YCharts – Major U.S. Entertainment Firms, Trailing Net Income Margins, Since 2012

Final Thoughts

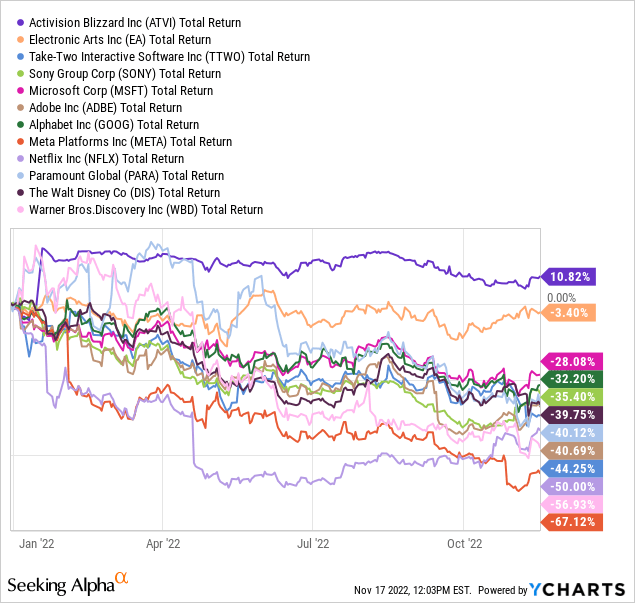

Following the takeover offer by Microsoft in January, Activision Blizzard has been the leading total return performance choice in the major entertainment sector of Wall Street during 2022. Against a median average loss of -40% for the peer group, ATVI has outlined a +10% gain.

YCharts – Major U.S. Entertainment Firms, YTD Total Returns, November 17th, 2022

My feeling is the current risk-reward setup at $74 could be equally positive for investors over the next year. Let’s assume the odds of government approval are 50/50 for the Microsoft offer. If the deal is consummated, buyers/owners can harvest a 6-month return of almost +30%. If the deal terms are refused, forcing Microsoft to drop its offer, ATVI may initially decline $5 to $10 per share. However, I am still modeling a $70 to $100 price range of possibilities for the share quote 12 months into the future, as a standalone venture. Assuming earnings and sales increase meaningfully in 2023, Wall Street is not going to run away from this name for long.

Seeking Alpha’s Quant Ranking puts Activision in the Top 30% of its entire 4,761 equity universe, and Top 25% position in the interactive entertainment sector. If Microsoft’s offer was not on the table, I would agree with this computer-sorting assessment. However, the potential for a rapid 30% gain on Microsoft’s closing of the deal may bring a Top 5% total return into June, DURING a bear market and recession. In my mind, a combination of the arbitrage opportunity and chance to ride rising business profitability regardless represents a Top 10% to 15% risk-reward forecast for investors.

Seeking Alpha Quant Rank – Activision Blizzard, November 17th, 2022

Will Activision become a roaring winner next year? I don’t think that’s the future. But, if you are searching for decent odds of solid investment gains, Activision deserves your attention. An $85 price target in 12 months, delivering 15% in gains (current dividend yield is 0.6% annually), may turn out to be a substantially better total return vs. sizable losses in the S&P 500, assuming a recession is next. Remember, the risk side of the equation for Wall Street may soon become the overriding stock pricing/valuation focus on declining business earnings overall.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment