Ladanifer

While the number of EVs on the road continues to increase, gasoline remains the fuel that powers most automobiles. While the price of nearby NYMEX WTI and ICE Brent crude oil futures fell short of the 2008 record high in March 2022, the energy commodity peaked at more than $130 per barrel for the first time in 14 years. Meanwhile, crude oil products did not stop at the previous higher and gasoline and heating oil futures exploded to record levels.

Brent and WTI are the world’s two crude oil benchmarks. Brent has a slightly higher sulfur content, making it preferable to process into heating oil and other distillates like jet and diesel fuels. Meanwhile, the lighter and sweeter West Texas Intermediate crude oil produces in the US, and North America is the oil of choice for gasoline refiners.

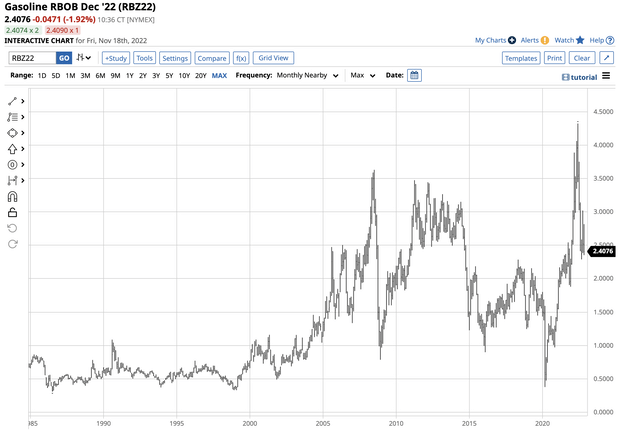

Gasoline prices have come down from the all-time high reached in April 2022, but they remain at the highest mid-November price since 2013. RBOB gasoline futures trade on the CME’s NYMEX divisions, and the United States Gasoline Fund, LP (NYSEARCA:UGA) is the ETF that tracks the futures price.

An all-time high and a correction

In June 2022, NYMEX gasoline futures’ price reached an all-time high of $4.3260 per gallon wholesale.

Long-term NYMEX Gasoline Futures Chart (Barchart)

The long-term chart highlights the rise to over the $3.6310 level, the July 2008 previous record peak, in March 2022 when Russia invaded Ukraine. Gasoline continued to rally, reaching its latest apex during the seasonally strong time of the year in 2022. Since reaching the lofty level, the price has retreated and was sitting at around $2.40 per gallon on Friday, November 18, 44.5% below the June 2022 high on the continuous contract.

Seasonality is critical

Gasoline is a seasonal commodity that tends to peak during the spring and summer months and reaches lows during the winter. Gasoline demand increases when the weather improves during the driving season. Consumers put more mileage on their vehicles during the spring and summer and tend to drive less during the cold and icy winter. Moreover, the summer driving season comes during school and work vacations, when people take more pleasure trips.

The high for gasoline prices in 2008 and 2022 came in June and July. Lows in 2008, 2015, 2016, and 2020 occurred from December through March. In December 2021, nearby gasoline futures fell to $1.8795 per gallon wholesale before breaking above the 2008 record high four months later in March on the back of the war in Ukraine. Russia is a critical crude oil-producing country, and the war threatened global energy supplies.

The bottom line is gasoline is a highly seasonal commodity, and we’re now in the offseason for demand. At the $2.50 level in November, gasoline is at a historically elevated November price level.

Gasoline will begin to reflect more demand in early 2023

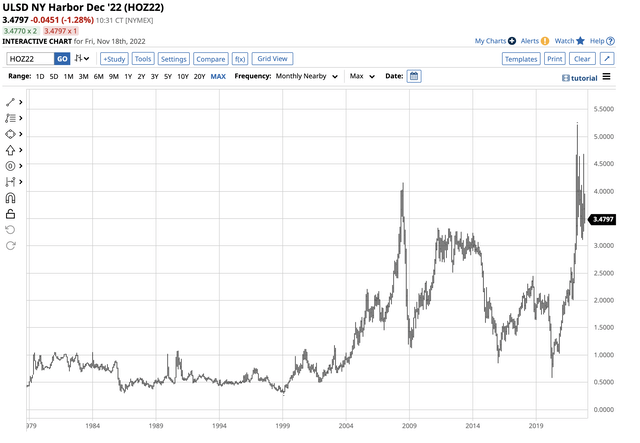

If historical trading patterns hold, the gasoline futures markets will begin to reflect the 2023 driving season demand in early 2023. Meanwhile, heating oil prices, which are a proxy for distillate fuels, remain at a historical high for November as of Nov. 18.

Long-term Chart of NYMEX Heating Oil Futures (Barchart)

The chart dating back to the late 1970s shows heating oil prices at $3.4797 per gallon wholesale are at the highest price in November ever. The previous November high was in 2011 at $3.2004. Heating oil prices reached a record $5.2217 per gallon wholesale in April 2022.

While its name is misleading, heating oil futures are far less seasonal than gasoline futures. Heating oil’s role as a proxy for jet and diesel fuels makes it a more year-round energy commodity.

Meanwhile, since Brent crude oil is the primary ingredient in heating oil refining, and Russia is a dominant force within OPEC, low heating oil inventory levels have been a function of the war in Ukraine and Russia’s use of energy commodities as a weapon against “unfriendly” countries supporting Ukraine. However, the elevated heating oil price is a sign that if the war continues, gasoline prices will likely come storming back during the 2023 peak demand season.

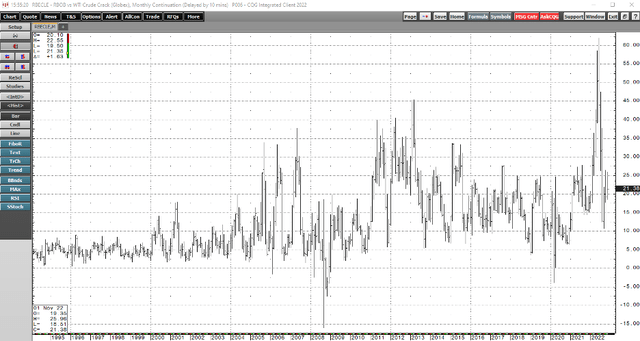

The gasoline processing spread is an indicator of the demand

A crack spread measures the margin for processing crude oil into gasoline or distillate products. Crack spreads are a real-time indicator for the demand for fuels as well as a barometer of profits for the refiners that process the petroleum into oil products.

In November 2022, the gasoline crack spread has traded in a range from $18.51 to $25.96 per barrel. The ranges in the crack spread in November over the past years were:

- 2021- $14.39- $19.17

- 2020- $6.59- $8.59

- 2019- $10.52- $13.75

- 2018- $6.81-$9.83

- 2017- $15.10- $20.87

- 2016- $9.71- $20.71

- 2015- $10.04- $14.75

- 2014- $8.06- $12.36

- 2013- $10.50- $21.60

- 2012- $22.65- $29.02

- 2011- $5.75- $20.07

- 2010- $4.35- $12.23

- 2009- $3.00- $7.63

- 2008- $-3.68 – $-7.45

The chart highlights the level of the crack spread over the past 14 years.

Monthly Chart of the Gasoline Crack Spread (CQG)

The chart highlights the elevated level of the gasoline refining spread in November 2022.

In early 2023, as the market turns its focus to the peak demand season, the odds of higher gasoline prices are high. While the nearby December futures were trading at the $2.40 level on Nov. 18, the June 2023 contract was higher at over $2.51. However, it was nowhere near the highs reached earlier this year. Buying gasoline on a scale-down basis, leaving plenty of room to add on further price weakness, could be the optimal approach in the current environment.

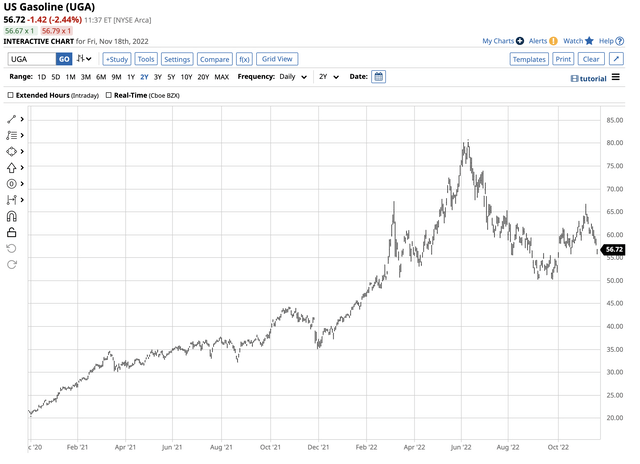

UGA is the gasoline ETF

The most direct route for a risk position in gasoline is via the CME’s NYMEX division futures and futures options contracts. The United States Gasoline Fund, LP (UGA) is the ETF that tracks the futures price for those who seek gasoline exposure without venturing into the futures arena.

At $56.85 per share on Nov. 18, UGA had over $101.5 million in assets under management. The ETF trades an average of 52,762 shares daily and charges a 0.90% management fee. The continuous gasoline futures contract rose from $1.8795 In December 2021 to a record $4.3260 per gallon in June 2022, a 130.2% rise.

Chart of the UGA Gasoline ETF Product (Barchart)

Over the same period, UGA rose from $35.05 to $80.29 per share or 129.1%, as the ETF did an excellent job tracking nearby NYMEX gasoline prices.

We’re now in the heart of the winter season in the gasoline futures market. However, in early 2023, the focus will shift to the 2023 driving season, and gasoline prices will likely rise. As long as the war in Ukraine continues, US energy policy remains on a greener path, and OPEC+ dominates the global pricing, gasoline prices should move higher as the 2023 spring approaches. I’m a scale-down buyer of the UGA ETF, leaving plenty of room to add at lower levels if prices drop during the winter months.

Be the first to comment