Imilian/iStock via Getty Images

We may have to reacquire our position in Celsius Holdings, Inc. (NASDAQ:CELH), after previously getting stopped out, so that we have some skin in the game, pending the outcome of the speculative fever that is catching investors by surprise on Wall Street.

Most likely, we will initiate a bullish position through the purchase of out-of-the-money calls in the options market. We might even consider creating a synthetic stock position by going long calls and short puts on CELH.

When news of a note by Stifel analyst Mark Astrachan speculating on a buyout of Celsius Holdings, Inc. (CELH) by PepisCo (PEP) began circulating among traders and subsequently hit the newswires on Thursday, shares of Celsius Holdings, Inc. began a meteoric rise in price that ended with the shares up almost 15% on the day. The news also appeared on Seeking Alpha’s website.

The Motley Fool soon joined the fray with an article on their website, resulting in more speculative fuel being thrown on the fire.

Friday, produced another 5% price gain on the day as more investors jumped on the bandwagon, after having ample time to discover the news on CELH and digest the potential outcomes noted in Mark Astrachan’s report.

To many investors, the possibility of a buyout of Celsius Holdings, Inc. by “Big Beverage” probably never crossed their minds, but for us, it just seemed like a natural progression of events, resulting in a potential new pathway for a company that has experienced blistering growth over the last few years.

Altitrade Partners has written about Celsius Holdings, Inc. extensively on Seeking Alpha for many years.

In fact, of the 79 articles that we have authored as a regular Seeking Alpha contributor, 43 of them, or more than half of the total, have been about CELH, with 4 articles suggesting that the company would eventually be acquired.

January 2015: 10 Compelling Reasons Why Big Beverage May Want To Keep Their Eyes On Celsius Holdings

On Friday, a story appeared on the Benzinga website, and was picked up by many news feeds across Wall Street’s cadre of broker-dealers, where it was disseminated to clients around 2:00 PM EST.

PepsiCo/Celsius Investor Alert (Benzinga)

Shares of Celsius Holdings, Inc. finished up near 5% for the trading day.

Daily Chart of CELH 6-24-2022 (Fidelity Active Trader Pro)

On May 11, 2022, Astrachan lowered his price target on CELH to $67 a share from $73 and maintained a buy rating on the shares.

Then just a month later, he did an about-face and raised his target for CELH from $67 a share to $77.

Why the sudden change of opinion in less than a month?

Perhaps, he was expecting the early termination of Bang Energy’s distribution contract with PepsiCo, announced last October, to open the door for a purchase of Celsius by the beverage behemoth.

Other Wall Street analysts remain in the bullish camp with 7 of the 8 analysts that follow CELH have the shares rated a buy. There is also one hold and no sells among the analyst community according to Tip Ranks.

Or perhaps, Astrachan feels that the scorching pace of revenue growth will be too hard for big beverage to ignore (they certainly will be unable to replicate it) much longer, especially after a 50% correction in share price of Celsius from an all-time high of $110.22 reached on November 8, 2021, down to $38.31 on May 10, 2022 before rebounding back to around the $55.00 mark just a week ago.

Either way, his speculation that CELH could soon be in play caused investors to bid up the shares.

Shares of Celsius Holdings finished the week up 21%, going from a closing price of $55.43 on Friday, June 17th to $67.00 at the end of today’s trading session.

A few years ago, the thought of another company acquiring CELH would have been a difficult task, given the company’s capital structure.

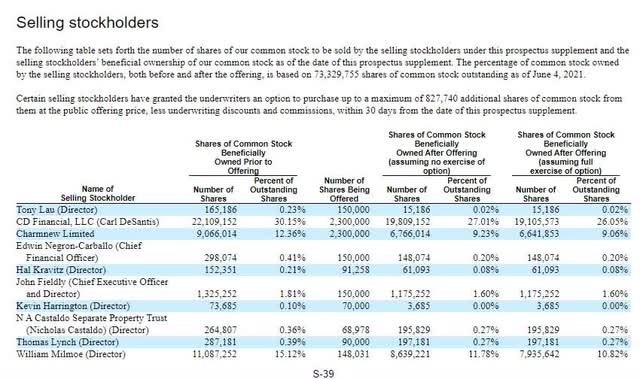

Prior to a secondary offering in June of 2021, at a price of $62.50, insiders had a stranglehold on CELH shares, with Carl DeSantis, through his CD Financial LLC, holding a majority stake.

CELH Secondary Offering June 2021 – Insider Ownership Capital Structure (Edgar – SEC Filings)

Additional insider selling, since the June 2021 offering, has resulted in CELH insiders now controlling slightly over 13% of the outstanding shares, while Institutional investors account for just over 45% of the current share count.

CELH Insider Ownership (Market Beat) CELH Institutional Ownership (Market Beat)

The number of shares outstanding of the registrant’s common stock, $0.001 par value, as of May 13, 2022 (the latest 10-Q filing) was 75,361,705 shares.

You can view the entire history of insider transactions in CELH shares here.

As a result of the decline in CELH insider ownership, along with an increase in Institutions holding the shares, any attempt to acquire the company should be relatively easier than it was in years past, when insiders owned more than 50% of the outstanding number of shares.

Celsius CEO, John Fieldly, has gone on the record in a CNBC interview stating that it was the company’s intention to go it alone and not partner with any of the big beverage companies. We’re not sure that he has this option anymore.

The company continues to fire on all cylinders and has consistently beat analyst expectations along with Wall Street consensus numbers. We see no reason for that to slow down anytime soon, given that Celsius energy drinks control only 14% of the market.

A Coca-Cola (KO), Keurig Dr. Pepper (KDP), or PepsiCo (PEP) may look to acquire Celsius Holdings before they lose any additional market share to this little beverage upstart.

There is no question that with Celsius’s revenues, energy drink market share and popularity among consumers growing exponentially, the company would be a very attractive addition to any beverage portfolio of both domestic and international CPG companies.

Here are a few excerpts from the last two CELH investor conference calls which highlight the strong fundamental story behind Celsius Holdings, Inc. and why, perhaps, the company would likely be an attractive buyout candidate by several companies in the CPG (Consumer Packaged Goods) space.

Sales for the first quarter of 2022 totaled $133.4 million, up 167% from $50 million in the prior year quarter. As mentioned, domestic revenues increased 214% to a record $123.5 million, up from $39 million in the prior year quarter. International sales decreased proximately 10% to $9.9 million for the quarter, with Nordic sales down approximately 18% to $8.5 million as a result of timing of trade campaigns, flavor launches as well as supply chain delays, and other international sales grew approximate 114% to $1.4 million.

Gross profit for the quarter increased $162 million to $53.9 million up from $20.6 million in the year ago quarter and gross margins totaled approximately 40.4% of net sales and excluding outbound freight totaled 42.8% of revenues for the 3 months ending March 31, 2022 and from 41.1% or 49.5% when excluding outbound freight for the prior year quarter.

Source: CELH Q1 Investor Conference Call – May 11, 2022

Total sales for the quarter of $104.3 million, up 192% from $35.7 million in the fourth quarter of 2020. Our domestic sales increased 238% to a record $95.9 million, up from $28.4 million in the fourth quarter of 2020. With both of these percentage growth rates the highest in our history, we continue to see our two hardest-hit channels from COVID in 2020, our fitness and vending channel, not only rebound but drive growth in sales.

Fitness was up 91% for the year, and vending was up 186%, which when combined, contributed approximately $14.7 million of incremental revenue for the full year. International sales grew 15% to $8.3 million for the quarter and 17% for the year, with record annual revenues from the Nordics.

Consumer data for Celsius accelerates through the fourth quarter of 2021 and through February of 2022 to record levels, with the most recent Nielsen scan data as of February 12, 2022, showing Celsius sales were up 233% year-over-year for two weeks, up 234% for the four weeks, up 227% for the 12 weeks, with a 3% share of the energy category over the last two weeks.

And on Amazon, as I said, Celsius is the second-largest energy drink with a 20% share of the energy category, an approximately 7% share ahead of Red Bull at a 13% share and moving closer to the number one spot, just four share points behind Monster at a 24% share.

This is according to the last four weeks’ data ending February 12, 2022, stack line energy drink category, total U.S. In addition, Celsius has a year-over-year growth rate of about 94% compared to Amazon’s energy growth rate of 37%. That’s just over 2.5x the category for the last four weeks ending February 12, 2022, and according to Stackline.

Our U.S. store count now exceeds 135,000 locations nationally, growing over 53,000 doors or 65% from 82,000 at the beginning of 2021, with additional expansion plans throughout 2022 as retailer resets take place. On our co-packing front, we continue to expand with our partners in scaling at existing locations, improving our line time priority. Our total U.S. co-packer footprint now totals over 13 that are active, which will help protect for future out-of-stocks and support our massive growth as we continue to improve efficiencies in our supply chain.

Source: CELH Q4 Investor Conference Call – March 1, 2022

Besides the obvious three big beverage players in the Unites States, there are many CPG companies located outside of the U.S. that could benefit from an acquisition of Celsius Holdings.

A company like Nestle SA (OTCPK:NSRGY), Unilever PLC (UL), Danone SA (OTCQX:DANOY), or even a company like Mondelez International (MDLZ) could all be interested in acquiring a fast-growing CPG company like Celsius.

It used to be that, at one time, we were the only Seeking Alpha contributor writing about Celsius Holdings, Inc. Now, there are a total of fourteen (14) individual contributors on Seeking Alpha writing articles about the company.

These Seeking Alpha contributors include Euphoric Investments, WY Capital, Elias Kaplan, Zachary O’Brien, Wealth Insights, The Value Analyst, Alexander Ebbinghouse, StockBros Research, Eric Groovenhoff, H Tianshan, NorEast Invest, Kyle Repar, Vladislav Kolomeets and BOOX Research.

We have read our fellow contributors’ articles and have found something of value in each of these authors’ insightful commentary. We encourage you to take a look at them also to gain a better perspective on CELH.

In closing, we would like to thank all of the above authors that have written about Celsius Holdings, Inc. You have added to the mosaic of information available to Seeking Alpha readers to make an informed investment decision.

If, in fact, Celsius Holdings, Inc. does become the target of U.S. Big Beverage, or a global CPG company, I doubt that there will be an opportunity for any of us to continue writing articles for Seeking Alpha on Celsius Holdings, Inc.

That said, there are always good investment ideas hiding under the rocks, just waiting for someone to discover them.

Be the first to comment