gorodenkoff

AC Immune (NASDAQ:ACIU) is a small (~$200 million market cap) clinical-stage biopharmaceutical company focusing on neurodegenerative diseases, including Alzheimer’s disease (or AD) and Parkinson’s disease (or PD). Shares are down 53% year-to-date. Two of their leading drug candidates partnered with Big Pharma (Figure 1) didn’t meet clinical endpoints in mid-stage trials. However, the company is well-funded, may be worth a look at these price points, and could even survive a failure in the upcoming catalyst event.

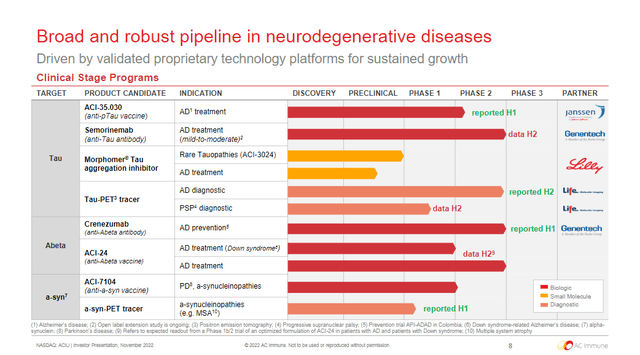

Figure 1. AC Immune Pipeline

Pipeline Breakdown

ACI-35.030

On November 30, Janssen, a unit of Johnson & Johnson (JNJ), selected the anti-pTau vaccine for further development based on Phase 1b/2a interim data and could become first-in-class. Additional details on the trial and current AD landscape are on the JNJ article. Based on their 2014 agreement, AC Immune and Janssen will jointly share research and development costs until the completion of the first Phase 2b trial. After which, Janssen will assume responsibility for further development, manufacturing and commercialization.

Semorinemab

At the 2022 Clinical Trials on Alzheimer’s Disease conference, semorinemab was presented as reducing levels of CSF tau biomarkers associated with AD pathology in the Phase 2 LAURIET study. Topline LAURIET results were the first time a therapeutic effect has ever been seen from a monoclonal anti-tau antibody, which were confirmed in the full data set. However, no further significant effects were observed on the trial’s other co-primary endpoint or the secondary endpoints. The previous TAURIEL study in prodromal-to-mild AD was also negative, although 72 of the 441 subjects missed 112 planned doses due to the COVID-19 pandemic. Therefore, investors shouldn’t expect success from the open label extension.

Crenezumab

In June, results from a Colombian study showed that this monoclonal antibody failed to slow or prevent Alzheimer’s disease in cognitively unimpaired people who carry specific genetic mutations which cause early-onset AD.

ACI-24.060

The vaccine is being evaluated in the ABATE study, a Phase 1b/2, multicenter, adaptive, double-blind, randomized, controlled trial (RCT) in subjects with prodromal Alzheimer’s disease and in adults with Down syndrome. Interim results are expected around year end 2022.

In a previous 96-week multicenter, double-blind, Phase 1b dose-escalation RCT, increased titers were observed in 4 of 12 patients (33.3%) receiving ACI-24 (2 receiving 300 μg and 2 receiving 1000 μg) compared with 0 participants receiving placebo.

ACI-7104

Initiation of a Phase 2 study of the anti-a-syn vaccine in patients with early PD is expected this quarter.

Financials

As of September 30, AC Immune had CHF 140.5 million in cash and short-term financial assets. For the first time in two years, the company received a milestone payment this quarter, CHF 3.9 million from Life Molecular Imaging (or LMI), for moving PI-2620, the Tau positron-emission tomography tracer, into late-stage clinical development. Q3 R&D expenses were CHF 14.4 million, of which nearly half were discovery and preclinical expenses. The Q3 net loss after taxes was CHF 13.5 million. Subtraction LMI’s and not counting potential incoming milestone payments, it is reasonable to believe management’s claims that they can fund operations into Q3 2024.

Risks and Takeaways

The clinical pipeline is realistically down to three vaccine candidates, all in Phase 2, until they or partner Eli Lilly (LLY) decide what to do with ACI-3024, which is in Phase 1. With the partnered antibodies pretty much done for, milestones for those are off the table, but somehow there have been upward revisions to revenue estimates that push the SA Quant Ratings into the Buy category. Ignoring those make AC Immune less attractive to investors as a biotech with no consistent income sources and uncertain prospects for data readouts.

Thus, the ABATE results are critical in the short term (1-3 months). Although clinical or cognitive outcomes are not primary or secondary endpoints for this early-stage trial, there has to be some signal to justify further development and reassure shareholders. There is not much choice in the option chain until further out on February 17, but shares are already close enough to the 52-week lows to be entry points. Given the earlier underwhelming ACI-24 results, a disappointing readout may be already baked in, meaning a positive ABATE or other development could push prices towards the $3-range.

Be the first to comment