George Frey/Getty Images News

Generac Holdings, Inc. (NYSE:GNRC) shares have been absolutely decimated and now barely trade above the $100 level. This represents a huge plunge from the 52-week high of just over $500 per share. As a maker of backup power systems, this company has been a big beneficiary of the housing boom and pandemic which fueled lots of spending as people stayed and worked from home. It’s clear that the housing and stay-at-home boom is over, as well as the bull market in stocks. It’s also clear that investors got carried away to the upside when this stock surged to over $500 per share. But, it also now looks like there is an overshoot to the downside, which is typical with stocks as emotion and sentiment create extremes in both directions. Let’s take a closer look:

The Company:

Generac Holdings is a leader in the power systems industry. It is the top-selling brand of home backup generators and it also makes products for the commercial market. Home backup generators have become increasingly popular in recent years. This growth has been fueled by adverse climate events like hurricanes in Florida and wildfires in California, which has led to rolling blackouts. With climate events ongoing and the electrical grid looking strained in many states, it is easy to see why homeowners and businesses are looking for the stability that a generator can provide.

The Chart:

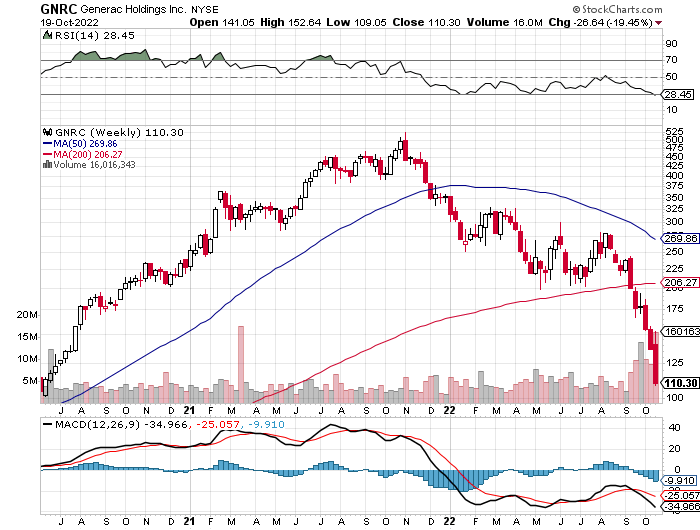

There is a very interesting pattern going on whereby many stocks and other assets have already returned to or appear to be on the way to their pre-pandemic levels. With the huge recent plunge in Generac shares, this stock has been decimated and now trades back to where it was before the pandemic. Clearly, investors got too excited when they were buying this stock for $500, but it seems like this stock might now be a buying opportunity with the shares now erasing all of the gains of the past couple of years. As you can see in the chart below, this stock was trading for about $100 per share in July 2020, (and now it is once again around that level). It then surged to over $500 per share in November 2021. But, right about then, the Federal Reserve started talking about tightening, which ended the bull market. In addition, we now see that the rapid pace of interest rate increases has dramatically impacted and ended the housing bubble.

I highly recommend that all investors look at a chart that goes back a few years in order to see if a stock surged under the pandemic as Generac did, because there is a good chance that stock will be heading back to pre-pandemic levels, just like Generac. This stock has made a round-trip, and many others are going back to the levels seen in 2020, and that could also be true for all the major market indices.

StockCharts.com

The Earnings Warning That Just Caused A 25% Plunge On October 19:

On October 19, Generac announced an earnings warning in which it cut its full-year outlook and reduced revenue guidance for Q3. Generac is going to announce Q3 results on November 2, 2022, but it now estimates that net sales for the quarter will come in at about $1.09 billion, which is far short of the consensus analyst estimates of $1.34 billion. It is now guiding for Q3 net income to total around $58 million or 83 cents per share, which is a big drop from the year ago period where net income totaled $132 million or $1.93 per share. Finally, it reduced EBITDA margin estimates from 18%-19%, which is down from 21.5%-22.5%.

While this is definitely disappointing, but not unexpected news, the bright side is that, as noted in this Seeking Alpha article, analysts at CFRA Research still expect earnings of $9.35 per share for 2022 and $12.21 per share for 2023. I would not even count on these newly reduced estimates since the level of economic uncertainty is likely to remain elevated throughout 2023. However, even if this company only earns about $8 per share next year, this stock looks like a potential bargain at just around $100 per share.

Potential Downside Risks:

The macro is no longer favorable for this company with multiple headwinds that range from a deepening housing market bust and recession to reduced consumer confidence. We are likely to see more layoffs in the coming weeks and months as the Federal Reserve tries to regain control of inflation. If you get a layoff notice, you are not likely to buy a backup generator. Even if you stay employed but start to have family and friends that are no longer employed, you are likely to cut back on big ticket purchases as well.

The founder of Amazon (AMZN), Jeff Bezos recently said it’s time to “batten down the hatches” and other top corporate leaders have made similarly bleak comments which could influence many Americans to tighten their belts. The rapid pace of interest rate increases by the Federal Reserve has been dramatic and historic, and this experiment might not end well. Aside from these major macro risks, management execution is a big risk because it is far easier to manage when everything is going your way, but now that the tide is going out, the real test of management skills awaits.

My Buying Strategy:

At this time, there is way too much economic uncertainty to take a major position in this stock. There is also no way to know how much homeowners and consumers will cut back on spending as the economy weakens. People will also feel less wealthy as home values and 401(k)s plunge. It remains to be seen how Generac management will perform in this downturn. Because of this, I am going to keep my purchases of this stock very limited and only buy in stages over the next few months. This will keep this investment to a level that is a rounding error in my portfolio for now, and also let me take advantage of further weakness in this stock that might be caused by a market plunge or additional company specific issues. I expect the economy and the stock market to remain rocky for at least the next several months, but this could be a time to build positions in high quality stocks that can offer long-term upside.

In Conclusion:

With such a huge decline in the share price, and with the stock now trading at just about 9 times earnings estimates for 2023, I have to buy some shares at just around $109. However, this stock and the stock market in general could and likely will continue to be weak. We are in uncharted waters in terms of the aggressive rate hikes from the Federal Reserve. We have to be able to play the long game and position ourselves so that if a stock or the market plunges, we have buying power left to take advantage of the decline. Generac is a top brand and the market it addresses, and it appears poised for growth in the long term.

Be the first to comment