udra

Apple (NASDAQ:AAPL) reports its fiscal fourth-quarter results on Thursday, October 27. Analysts currently estimate that Apple will report a quarterly profit of $1.27 a share on $88.8B in revenue. During the same period a year ago, Apple earned $1.24 a share on sales of $83.4B. Last quarter, Apple didn’t provide official guidance for Q4 2022.

Apple has had a strong showing against Android competitors in the past three years. In this article, I focus on Apple’s flagship iPhone sector and the competitive factors that are impacting sales. I also discuss headwinds and tailwinds based on macro and micro issues.

Apple iPhone Performance

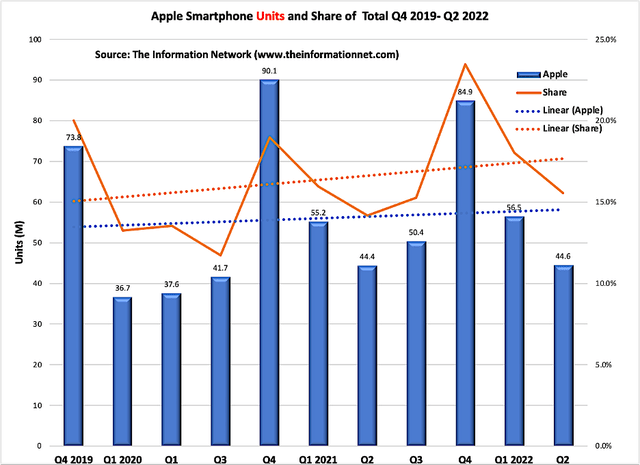

Smartphone shipments have stalled lately, first amid Covid and lockdowns, and now from high inflation, recession, and layoffs as consumers choose between food or fuel. Nevertheless, Chart 1 shows that over the last 11 quarters, Apple has increased its share in the global smartphone market.

Chart 1 shows UNIT shipments (blue column) and its cyclical peak in Q4 following iPhone introductions in September-October of each year. While difficult to discern, the computer generated trendline (blue dotted line) shows a positive trend in shipments.

More importantly, Apple’s share of the smartphone market has increased at a greater rate, as shown as the orange dotted trendline.

Chart 1

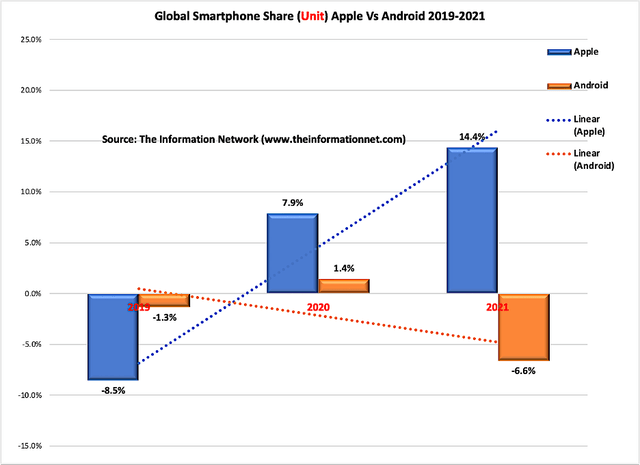

On a yearly basis between 2019-2021, Apple has significantly increased its UNIT share of smartphones versus Android phones, also further illustrated by the trendlines.

Chart 2

Tailwinds Changing to Headwinds As Qualcomm Improves AP Chipset Performance

Qualcomm (QCOM) has been criticized lately for delivering sub-par performance and poor battery life with its flagship AP (application processor) chipsets. Samsung’s Exynos 2200 and Mediatek Dimensity 9000 are being touted as better mobile chips than Qualcomm’s offerings.

To be clear, Qualcomm leads the Android AP chipset market for premium (>$500) smartphones with more than a 50% share, followed by Samsung with a 30% share and HiSilicon with a 20% share. The premium sector is where Apple competes.

But Qualcomm’s Snapdragon recent high-end APs have been problematic in the past few years from overheating. These are:

- Snapdragon 888 – overheating and built on Samsung 5nm process

- Snapdragon 888+ – overheating and built on Samsung 5nm process

- Snapdragon 8 Gen 1 – overheating and built on Samsung 4nm process

- Snapdragon 8+ Gen 1 – built on TSMC 4nm process

Qualcomm launched the Snapdragon 8+ Gen 1 in May 2022 as a mid-year upgrade. Qualcomm switched from Samsung (OTCPK:SSNLF) to TSMC (TSM) for manufacturing, claiming a 30% efficiency gain and 10% CPU clock speed improvements across the board as a result. The refreshed chipset, built on TSMC’s 4nm process node, also gains a 10% GPU clock speed boost and an apparent 20% boost to performance-per-watt.

The power consumption of Snapdragon 888 and Snapdragon 8 Gen 1 has also been an issue on the Samsung processed chips, resulting in poor sales of Android high-end computers. According to several evaluation bloggers, Android phones equipped with Snapdragon 8+ processors have greatly improved their power consumption, and their daily heat, endurance and game performance have been greatly improved.

Apple Cutting Corners on iPhone Processor

The iPhone’s A16 chip was introduced in 2022 but it is only put on the higher end iPhone 14 Pro. The mainstream iPhone 14 retains last year’s A15 chip with some upgrades, which was used in the iPhone 13 and iPhone 13 Pro. The A16 Bionic features a 4nm manufacturing process instead of the 5nm of the A15 Bionic.

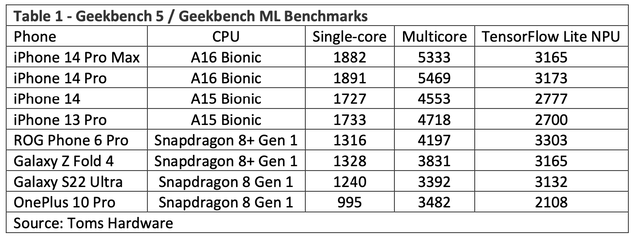

Table 1 compares the performance of Snapdragon 8 Gen 1 and Snapdragon 8 Plus Gen 1 to Apple’s chipset. As shown in Table 1 above, the A16 Bionic chip outperforms all others and is only available on the Pro and Pro Max. Clearly telling is that the benchmarks of the iPhone 14 and iPhone 13 Pro are nearly identical and may be the reason for the lackluster sales of the iPhone 14. The standard iPhone 14 models are basically slightly upgraded versions of the iPhone 13 – they run on the same processor (A15 Bionic), the upgrades to the camera system are minor, and the displays still don’t support Apple’s high-refresh-rate, ProMotion.

Geekbench measures CPU efficiency, both in single-core and multicore applications. Geekbench ML measures the neural processing unit’s capabilities with machine learning.

Investor Takeaway

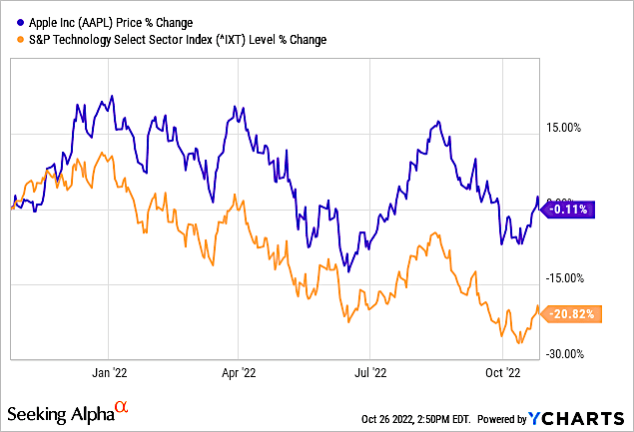

Apple may not be the right stock for investors who are looking for beaten down stocks, because as show in Chart 3, it has beaten the S&P Technology Select Sector Index (^IXT), which is -20.8% for the 1-year period compared to AAPL at -0.1%.

YCharts

Chart 3

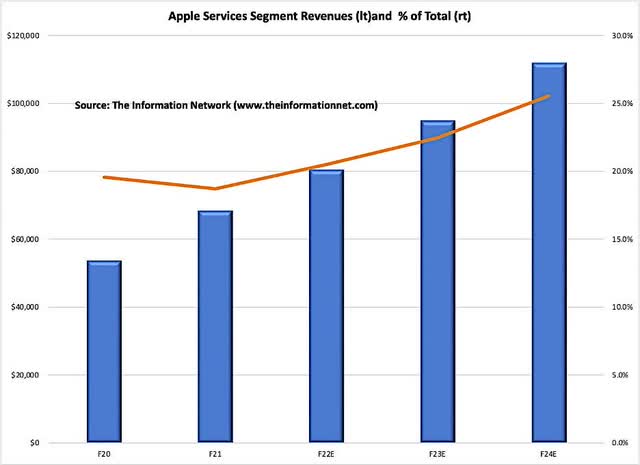

Apple achieved record June quarter “Services Sector” revenue of $19.6 billion, up 12% and including all-time revenue records for Music, Cloud Services, Apple Care and Payment Services. Apple now has more than 860 million paid subscriptions across the services on its platform, which is up more than 160 million during the last 12 months alone.

Chart 4 shows Apple’s services revenue reaching $112 billion in FY 2024. Importantly, services will grow (orange line) to 25.6% of total revenues in FY2024, up from 18.7% in FY2021.

Chart 4

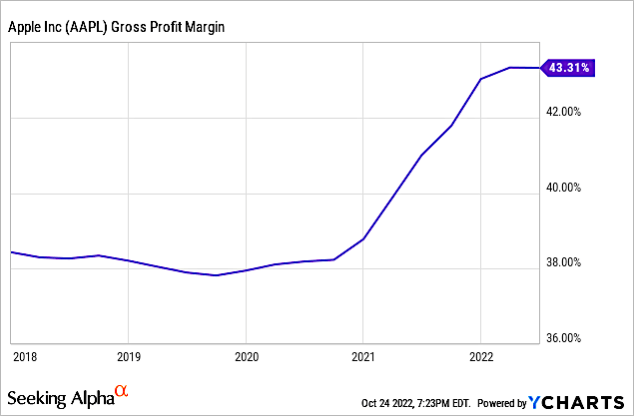

Chart 5 shows Apple’s meteoric rise in gross margins over the past five-year period reaching 43.3% in the past quarter. It’s gross profit margin for fiscal years ending September 2017 to 2021 averaged 38.9%.

YCharts

Chart 5

A main question mark going forward for AAPL is the performance of the QCOM Snapdragon 8+ Gen 1, and the Snapdragon 8+ Gen 2, which will be formally announced at its annual Snapdragon Summit event in mid-November 2022. Chinese smartphone sales have been stymied in the past year due primarily to Covid lockdowns, but also because of the underperformance of APs made at Samsung’s foundry. The move by QCOM to TSMC’s foundry, which is the same foundry making Apple’s A16 Bionic processor, could be a strong headwind for Apple.

Be the first to comment