Hailshadow

AbbVie (NYSE:ABBV), a $250 billion cap research-based global biopharmaceutical company, will soon be announcing new data from a Phase 2a clinical trial of ABBV-154, an investigational antibody drug conjugate (or ADC) composed of adalimumab, which is anti-tumor necrosis factor (or TNF), and a proprietary glucocorticoid receptor modulator (or GRM) steroid, which is touted as the highly potent anti-inflammatory payload that can be delivered locally and prevent systemic adverse effects. Adalimumab is better known as the brand Humira, the cornerstone of AbbVie’s $25 billion immunology portfolio. Another adalimumab-steroid ADC, ABBV-3373, passed its own proof of concept study in 2020. With that pedigree, the likelihood is excellent that ABBV-154 will show efficacy (higher levels of response) across the board.

Background

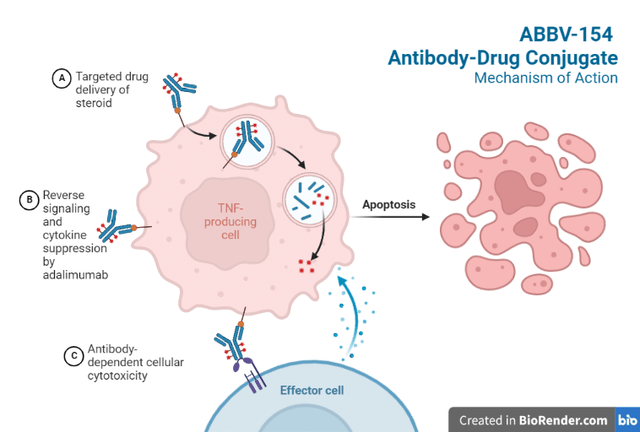

Research on ADCs typically arm antibodies with toxic molecules; pioneer Seagen (SGEN) has brought 3 such ADCs to market and has several upcoming milestones. AbbVie has taken a non-traditional approach, with a non-cancer indication, non-tumor cell target, and an anti-inflammatory payload (Figure 1). Adalimumab is a monoclonal antibody that binds to TNF-alpha and blocks its interaction with cell surface TNF receptors. The antibody also kills surface TNF-expressing cells in the presence of complement effectors.

Figure 1. Adapted from “Antibody-Drug Conjugate Mechanism of Action”, by BioRender.com (2022). Retrieved from BioRender.

Adapted from “Antibody-Drug Conjugate Mechanism of Action”, by BioRender.com (2022). Retrieved from BioRender.

The current evaluation for ABBV-154 (M20-466) in treating rheumatoid arthritis (or RA) includes a 12-week placebo-controlled period. The primary outcome measure is the percentage of participants achieving American College of Rheumatology 50% (ACR50) Response (see Appendix). One of the secondary outcome measures is change in Disease Activity Score (DAS) 28 C-reactive protein (or CRP) from baseline. The ABBV-3373 proof of concept trial had DAS28 as its primary outcome measure, and the ADC group demonstrated a significant improvement (-2.65) than Humira based on historical data (-2.13; P=0.022) or in-trial + historical (-2.29; probability 90%). ABBV-154 and ‘3373 have translatable biology with the difference in linker technology leading to ‘154 being chosen for improvements in manufacturability and ability to formulate at high concentration.

Financial Implications

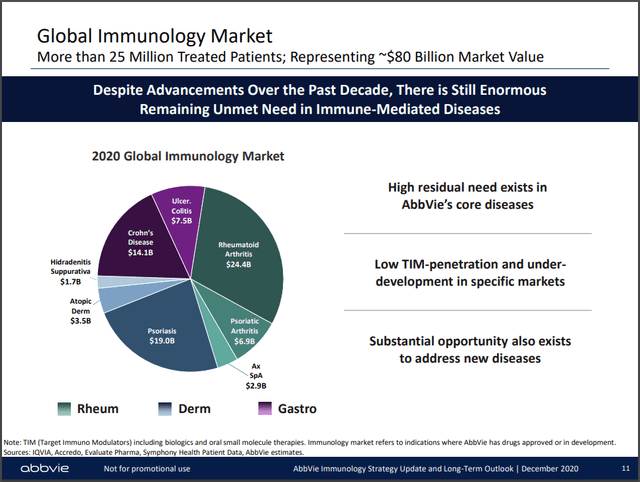

In 2020, AbbVie dominated 3 segments of the immunology market (Figure 2) with Humira and two newly launched products. At the time, both were only approved in the US, Skyrizi for psoriasis and Rinvoq for RA. The franchise totaled $22.2 billion in net revenues or 28% of the worldwide market. AbbVie stated that Rinvoq had the fastest first-year launch in the RA setting, propelling it to the top of the leaderboard for in-play patient share (representing both new and switching patients) with 16%, barely overtaking Humira. Rinvoq also cornered 4% of the US market, with Humira still commanding 22%.

AbbVie Immunology Strategy Update and Long Term Outlook

Skyrizi and Rinvoq have since become blockbusters, but two headwinds threaten AbbVie’s position. In September 2021, the FDA required warnings about increased risk of mortality, major cardiovascular events (or MACE), malignancy, and thrombosis for Janus kinase (JAK) inhibitors such as Rinvoq, meaning they can only be used after patients fail TNF blockers. Secondly, since 2016, there have been seven FDA-approved biosimilars to Humira. None of them are sold in the US yet, but four are anticipated to be available in 2023. The first factor may have slowed down Rinvoq’s revenue growth, leaving AbbVie to again be more reliant on Humira, which has accounted for 47.5% of the company’s 2022 net revenues of $28.1 billion. Therefore, AbbVie will be more vulnerable to loss of income from biosimilars in the coming years.

If positive, ABBV-154 will be evaluated in Phase 3. Rinvoq was approved for RA after 5 Phase 3 studies. The first (SELECT-EARLY) also took the longest to complete (751 days), in fact, finishing after the other 4. Top-line results were announced 82 days later on June 5, 2018. The Food and Drug Administration (FDA) accepted and granted Priority Review to Rinvoq’s New Drug Application (NDA) in February 2019 and approved the NDA on August 16, 2019. Thus, if AbbVie follows the same timeline, it will take 3.5 years from Phase 3 initiation to a potential ABBV-154 approval in late 2026 or 2027. However, the process could be sped up.

All patients in the Rinvoq pivotal trials had moderately to severely active RA (Table 1). Study M20-466 recruited patients who had an inadequate response to at least one prior biologic and/or targeted synthetic disease-modifying anti-rheumatic drug (b/tsDMARD) treatment for RA. The only tsDMARDs for RA are JAK inhibitors. So, if AbbVie focuses on the most-restrictive label as a second/third-line RA agent, perhaps only a single Phase 3 (plus conditional long-term safety study) would be needed. SELECT-BEYOND only took 384 days to complete.

Table 1. Rinvoq pivotal trial demographics

|

Trial |

Patient Population |

|

SELECT-EARLY |

Naïve to methotrexate (or MTX) |

|

SELECT-MONOTHERAPY |

Had inadequate response to MTX |

|

SELECT-NEXT |

Had an inadequate response to conventional DMARDs (cDMARDs) |

|

SELECT-COMPARE |

Had inadequate response to MTX and naïve to JAK inhibitors or Humira |

|

SELECT-BEYOND |

Had an inadequate response or intolerance to bDMARDs |

|

cDMARDs: |

MTX, sulfasalazine, hydroxychloroquine, chloroquine, and leflunomide |

AbbVie may have trouble fulfilling the $15 billion sales guidance for 2025, especially the $8 billion for Rinvoq. By this point, Humira sales could be down to $4-5 billion. This means that although the company is profitable, long-term investors should be prepared for flat revenues from immunology for the next 3 years and hope that other product areas can help pick up the slack. But if AbbVie can shave one year off and bring ABBV-154 to market by early 2026, and meanwhile get quick Phase 3’s going for earlier lines of treatment, all will be forgiven. ABBV-154 could very well eclipse Rinvoq’s launch numbers. After all, everybody knows how safe and effective Humira is, and once approved, the most likely scenario is that prescribers will try a biosimilar first, then move on to ABBV-154. And if the monotherapy trials are good, Humira 2.0 will likely return as the first option.

Appendix:

Participants who met the following 3 conditions for improvement from baseline were classified as meeting the ACR50 response criteria:

- ≥ 50% improvement in 68-tender joint count;

- ≥ 50% improvement in 66-swollen joint count; and

- ≥ 50% improvement in at least 3 of the 5 following parameters:

- Physician’s Global Assessment of Disease Activity measured on a Numerical Rating Scale (NRS) of 0 to 10

- Patient’s Global Assessment of Disease Activity (NRS)

- Patient’s Assessment of Pain (NRS)

- Health Assessment Questionnaire – Disability Index (HAQ-DI)

- High-sensitivity C-reactive protein (hsCRP).

The DAS28 is a composite index used to assess RA disease activity, calculated based on the ratios of tender joint count (out of 28 evaluated joints), swollen joint count (out of 28), Patient’s Global Assessment of Disease Activity, and high-sensitivity CRP. Scores on the DAS28 range from 0 to 10, where higher scores indicate more disease activity.

Be the first to comment