Oleksandr Shchus/iStock via Getty Images

Investment Thesis

We have to thank Mr. Market’s over-pessimism in giving us Qualcomm (NASDAQ:QCOM) at this levels, since it represents a massive discount from its previous 2021 highs despite the exemplary projected growth ahead. The deal is made sweeter by the robust dividend payouts of $3.13B and share repurchases of $4.17B over the last twelve months (LTM), returning massive value to its long-term investors. Nonetheless, we shall further discuss why adding here may not end well, due to the multiple pull and push factors in place.

QCOM Continues To Report Impressive Growth And Partnerships

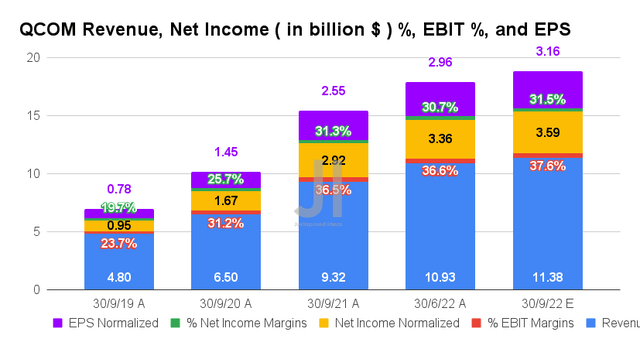

For its upcoming FQ4’22 earnings call, QCOM is expected to report revenues of $11.38B and EBIT margins of 37.6%, representing a decent increase of 4.11% and 1 percentage point QoQ, respectively, despite the perceived demand destruction in the mid-tier smartphone segment. Otherwise, an excellent YoY growth of 22.10% and 1.1 percentage points, respectively.

Naturally, this will contribute to QCOM’s improved profitability, with net incomes of $3.59B and net income margins of 31.5% in the next quarter. It will indicate an increase of 6.84% QoQ and 22.94% YoY, respectively. Thereby, pointing to the strength of its highly profitable licensing business. Despite only accounting for 13.88% of its revenues in FQ3’22, QCOM’s QTL reported an exemplary EBT margin of 71.09% then, representing easily 25.47% of the company’s EBT then.

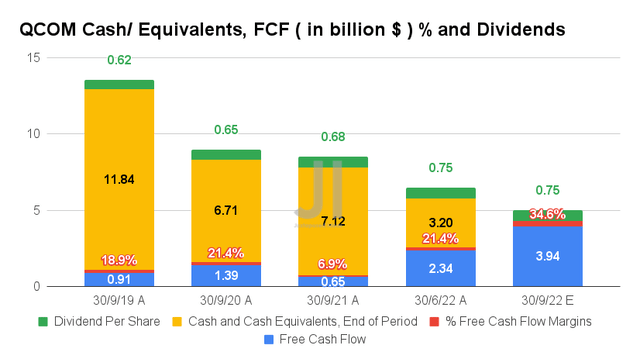

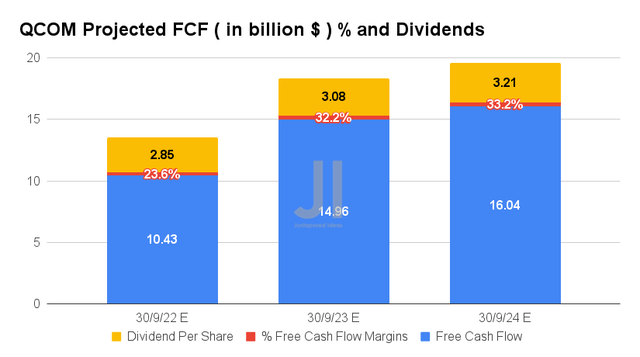

Naturally, QCOM is expected to report impressive Free Cash Flow (FCF) generation in FQ4’22 at $3.94B and an FCF margin of 34.6%, indicating an increase of 68.37% and 13.2 percentage points QoQ, respectively. Otherwise, an exemplary YoY growth of 606.15% and 27.7 percentage points, respectively.

As a result, beefing up QCOM’s cash and equivalents during the worsening macroeconomics ahead, and speculatively improving its dividend payouts ahead, though analysts project an inline $0.75 for the next quarter. This is in view of its elevated capital expenditure of $2.05B in the LTM, representing a notable 13.88% sequential growth.

However, QCOM investors need not worry, since these investments will eventually be top and bottom lines accretive, combined with its aggressive R&D expenses of $7.89B in the LTM, indicating a robust 18.72% of its revenues at the same time. These numbers are almost on par with Nvidia’s (NVDA) investment of 19.18% and Advanced Micro Devices’ (NASDAQ:AMD) of 19.85%.

Impressive indeed, since these strategic efforts would ensure QCOM’s continued leadership in the intensely competitive smartphone, automotive, and industrial segments. We are already starting to see some signs of these returns, with the continued growth in its automotive design pipeline of $19B, up 18.75% QoQ, and its renewed partnership with Samsung for future premium Galaxy products from 2023 onwards.

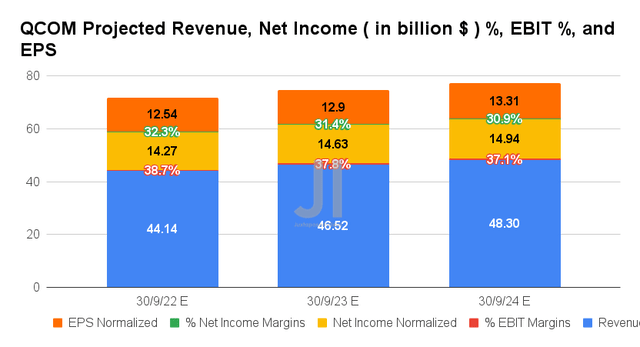

Over the next three years, QCOM is expected to report revenue and net income growth at an impressive CAGR of 12.90% and 15.05%, respectively. Despite the catastrophic estimate cuts experienced by its peers, NVDA, AMD, and Intel (INTC), it is apparent that QCOM does not similar a similar malaise. Consensus estimates continue to upgrade its top and bottom line growth by 4.15%/5.93% since our analysis in April 2022. Its projected FY2022 EPS of $12.54 also indicates a tremendous YoY growth of 46.9%.

The improvement in QCOM’s profitability is excellent too, from adj. net income/ FCF margins of 22.3%/33% in FY2019, 29.3%/25.8% in FY2021, and finally to 30.9%/33.2% by FY2024. Thereby, pointing to the potentially improved dividend payout growth of 6.47% through FY2024, triggering an excellent dividend yield of 2.84% then, compared to its previous 4Y average yield of 2.6% and sector median of 1.47%.

In the meantime, we encourage you to read our previous article on QCOM, which would help you better understand its position and market opportunities.

So, Is QCOM Stock A Buy, Sell, or Hold?

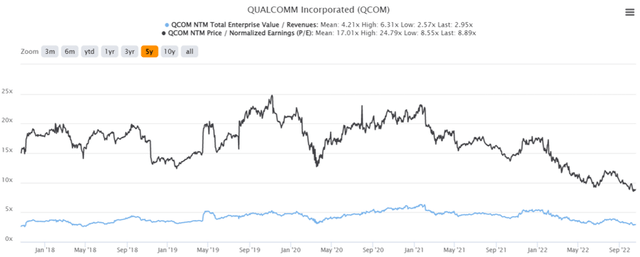

QCOM 5Y EV/Revenue and P/E Valuations

QCOM is currently trading at an EV/NTM Revenue of 2.95x and NTM P/E of 8.89x, lower than its 5Y mean of 4.21x and 17.01x, respectively. The stock is also trading at $112.85, down -41.70% from its 52 weeks high of $193.58, though at a premium of 7.82% from its 52 weeks low of $104.66. Nonetheless, consensus estimates remain bullish about QCOM’s prospects, given their price target of $180.62 and a 60.05% upside from current prices.

QCOM 5Y Stock Price

In the meantime, we expect things to potentially worsen over the next few weeks, given multiple push factors in place:

- The US mid-term election.

- Elevated inflation rate from September CPI and PPI, worsened by the surprisingly robust US labor market.

- The Feds terminal rate hikes to over 5%, in order to tamp down the sticky inflation, beyond the previous projection of 4.6%.

- Worsening geopolitical relations between the US and China with the Chips ban & Taiwan’s status.

- The Chinese Zero Covid Policy, putting a further strain on the recovery of supply chain issues, though President Xi expects to boost the slowing economic growth ahead. Thereby, pointing to the potential recovery of demand in China.

That is a long list indeed, naturally fueling more FUD in the stock market, with the S&P 500 Index already plunging below its previous June low thrice. Therefore, we rate QCOM as a buy only in the $100s range for an improved margin of safety and long-term investing. However, given the massive pullback the stock had experienced, investors with higher risk tolerance may still nibble at current levels, while sizing their portfolio nimbly in the event of massive volatility.

Be the first to comment