vzphotos

Q3 recap and thesis

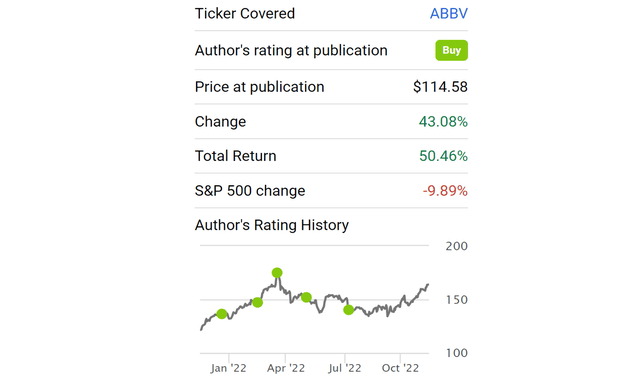

I am a long-time and also shareholder of AbbVie (NYSE:ABBV). I wrote my first bull thesis on ABBV more than one year ago (back in August 2021) and I had been holding its shares even before that. That article, entitled “AbbVie: Similar To Equity Bond With 12.5% Yield”, explained my thoughts under the framework of Buffett’s 10x pretax rule. Quote:

Paying 10x EBT (earnings before taxes) for a business that will stagnate forever is like owning a bond with a 10% yield. In ABBV’s case, its current valuation is significantly lower than 10x EBT. It was only 8x EBT, equivalent to purchasing a bond yielding 12.5%. And there is a good prospect of 6%~8% long-term growth. As such, an investment here is similar to owning an equity bond with 12.5% yield and at the same with a coupon payment that increases 6~8% per year.

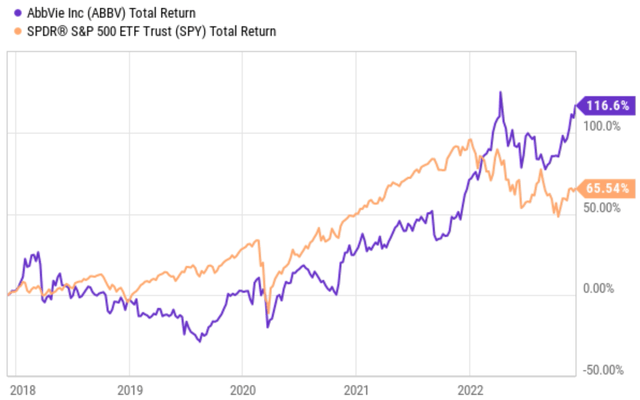

Its strong results since then have dramatically accelerated the pace of the return. The stock returned a total of 50.4% since then as you can see from the chart below (while the S&P 500 lost almost 10%). Such a strong and rapid price rally has certainly shortened my planned holding period. And in the remainder of this article, I’ll explain why I feel comfortable holding my shares for another 5 years or until its PE reaches 14x, whichever comes sooner. And I will start with a brief recap of its recent Q3 results.

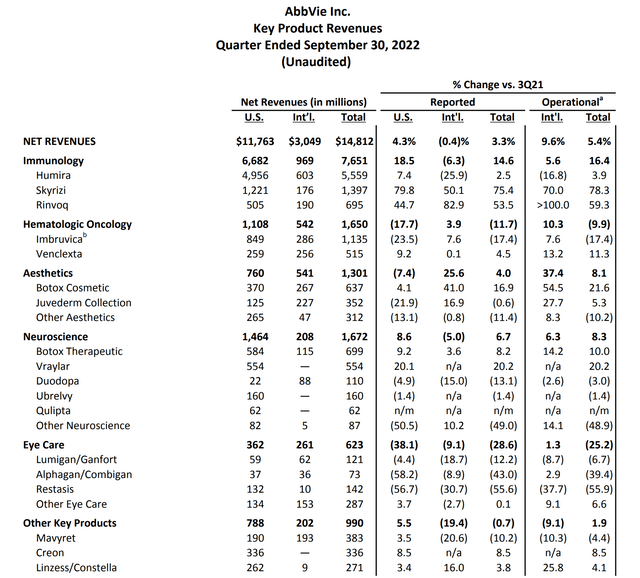

ABBV released its Q3 earnings report (“ER”) at the end of Oct 2022. Although its revenue ($14.81B) narrowed missed consensus estimates (by $130M, or less than 0.7%), it still represented a healthy YOY growth rate of 3.3%. And its Non-GAAP EPS dialed in at $3.66 beats, beating consensus estimates by a good margin of $0.10. Humira, the elephant in the room, kept reporting growth (7.4% YOY increase) in the U.S. as the patent expiration approaches, while its international net revenues kept decreasing (by 25.9% YoY in Q3) due to biosimilar competition.

My thesis from day 1 is that the market has overacted to the impact of the Humira patent cliff and overlooked its other newer assets. Indeed, its immunology sales, which account for almost half of its top line, have benefited from strong momentum in its newer drags. Notably, Skyrizi reported 79.8% YoY growth in the U.S. and 50.1% internationally. And Rinvoq posted similar growth rates (45% in the U.S. and 83% internationally).

Given these strong catalysts, I am optimistic that its PE would expand to my target of 14x within 5 years, as detailed next.

A historical perspective

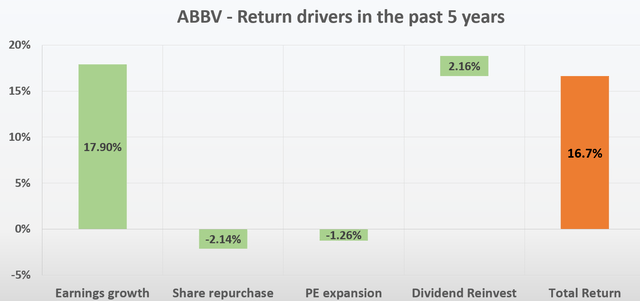

ABBV not only outperformed the overall market in the past 1 year only. It has led the S&P 500 by a large margin in the past 5 years too, as you can see from the following chart. It delivered a total gain of 116% in the past 5 years, translating into a spectacular annualized return of about 16.7% CAGR. In contrast, the overall market gained a respectable 66%, or about 10% CAGR.

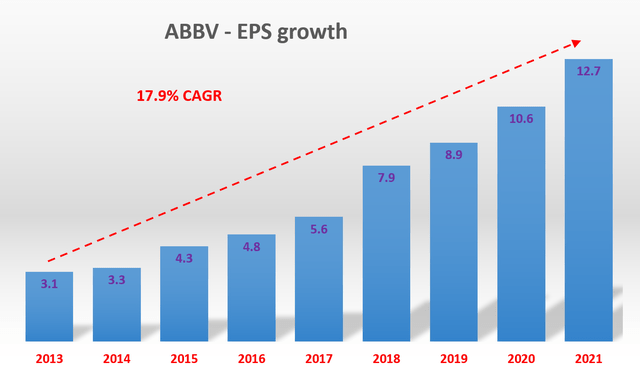

The returns were driven by the following factors summarized in the next two charts. First and foremost, its EPS grew at a remarkable rate of 17.9% CAGR. Its total earnings growth is even higher (20.04%), and the share dilution (about 2.14%) canceled off some of the earnings growth. Second, its PE valuation contracted a bit, causing a negative 1.26% CAGR to the total return. And lastly, its generous dividend, if reinvested, contributed another 2.16% to the total return.

Looking ahead for the next 5 years, I see A) a different mix of return drivers, and B) also a lowered total returns potential with the strong price rallies recently. However, as we will see next, the total return potential is still in the mid-teens (about 14% based on my analysis), far better than the overall market’s potential.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

The P/E driver

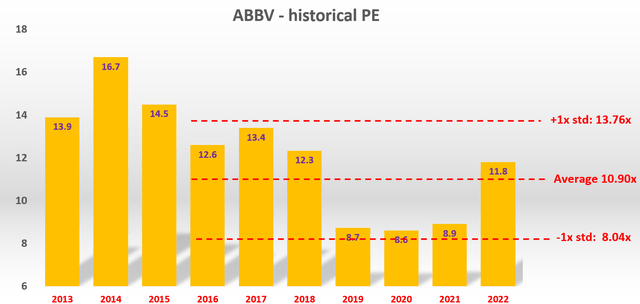

As aforementioned, I expect the PE to expand to my target 14x within the past 5 years given the strong fundamentals. The following chart shows its annual average PE in the past. The average is 10.9x and the standard deviation is 2.86x. Its current PE hovers around 11.8x, slightly above the average by totally within 1-sigma and therefore within the range of normal random fluctuations. Note how ridiculously the PE has been from 2019 to 2021 – they are well below the 1-sigma level for such a bellwether stock.

Looking forward, I see a PE around 14x as totally justifiable. It is only about 1-sigma about its average. And in absolute terms, a 14x is still compressed considering that its financial position, profitability, and growth potential are all far superior to the overall market, as to be detailed next.

Source: Author based on Seeking Alpha data

The EPS growth driver

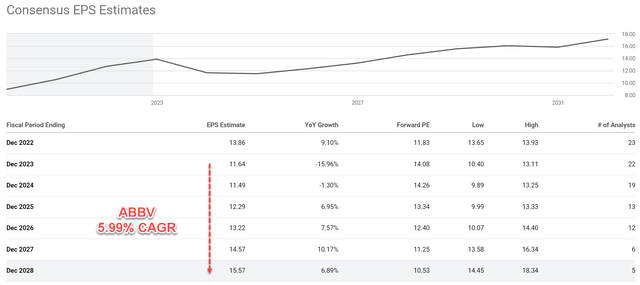

Looking ahead, I certainly expect its EPS growth to slow down compared to the past 5 years. And so do the consensus estimates as shown in the chart below. To wit, the consensus estimates project a 5.99% CAGR in the next 5 years, from an EPS of $11.64 in 2023 to $15.57 in 2028.

Source: Author based on Seeking Alpha data

My own estimate, made independently, gives a projection quite close. For a 5-year timeframe, it’s long enough to estimate the growth rate by the following equation:

Long-Term Growth Rate = ROCE (return on capital employed) * RR (Reinvestment Rate)

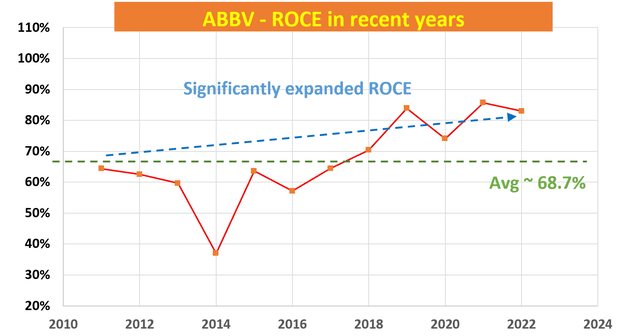

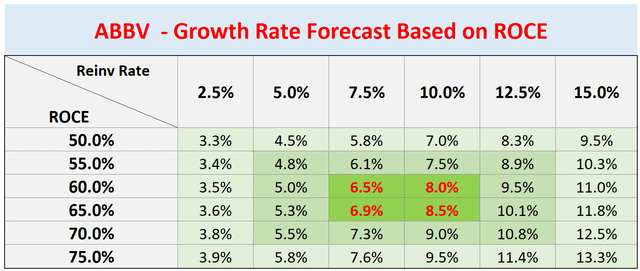

ABBV was able to maintain a robust ROCE on average of about 68.7% in the long-term and its ROCE has been rapidly expanding in recent years (to the current level of 80%+). In terms of RR, ABBV has been sustaining a RR on the level of 10% consistently via R&D, growth CAPEX, and new pipeline development. With its historical ROCE and RR, the table below displays the different scenarios for its growth rates, considering different combinations of ROCEs and RRs. As seen, even if we assume a more conservative ROCE of 60% and an RR of 7.5%, the expected annual growth would be about 6.5% (60% ROCE * 7.5% RR = 4.5% organic growth rate), slightly above the above consensus estimates.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

Projected return drivers for the next 5 years

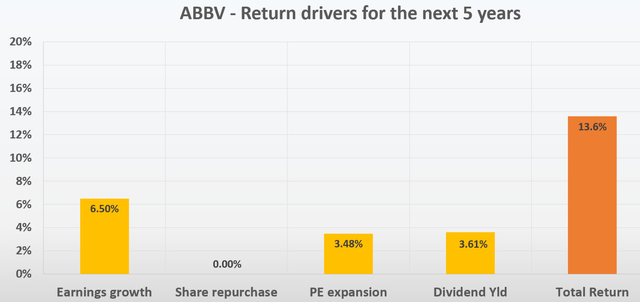

Based on the above analysis of its business fundamentals and return drivers, the following waterfall chart sums up my estimates of its return potential:

- A conservative estimate of 6.5% growth in total profit as just mentioned

- I am projection no change in its share counts.

- A PE expansion to 14x PE as aforementioned, contributing 3.48% of annual return if the expansion occurs in 5 years.

- And finally, I am assuming its dividend to keep rising in tandem with its earnings and stock prices so that the dividend yield stays constant at the current level of 3.61%. And for the sake of simplicity, I am assuming dividends are not reinvested.

All told, the total annual return is projected to be around 13.6%. Not as spectacular as the 16.7% CAGR it delivered to its shareholders in the past 5 years, but still a handsome return and is far better than the overall market’s return potential.

Source: Author based on Seeking Alpha data

Risks and final thoughts

Investment in ABBV entails some risks. ABBV faces some headwinds in the near term. If you recall from an earlier chart, the consensus estimates expect an EPS decline in 2023 to $11.64, and such an expectation is for good reasons. I see headwinds for its aesthetics in particular. The performance here was hurt by significant erosion in the Juvederm franchise, reflecting negative impacts from COVID-19 lockdowns in China and the suspension of operations in Russia. Its Hematologic oncology sales are also suffering from some headwinds, as delayed recoveries in certain markets and increased competition against Imbruvica took a toll.

All told, I am maintaining my bull thesis. I still consider the market has overacted to the impact of the Humira patent cliff and is still underestimating its other newer assets, with Skyrizi and Rinvoq as notable examples. Given these strong catalysts, I am optimistic that its PE would expand to my target of 14x within 5 years. Combined with other return drivers (earnings growth of around 6.5% and generous dividend yield of around 3.6%), I am optimistic that these shares will keep generating market-beating total returns in the years to come.

Be the first to comment