chanawin88/iStock via Getty Images

Transcript

Equities have been hit hard this year. But we’re not buying the dip…

We see three reasons we stay neutral on a tactical horizon.

1. Valuations are not cheap

Firstly, stock prices have fallen but valuations aren’t cheap.

We base this on the equity risk premium – our preferred measure of valuations that factors in rising interest rates and future earnings, where we see some risks.

2. Risk of Fed overtightening policy

Secondly, there’s a risk that the Fed overtightens policy to rein in inflation – or that markets believe it will.

3. Unsustainable margins challenge earnings

Finally, we see potential downgrades to consensus earnings. Rising costs, like wages, could create margin pressures.

Wages could increase as firms try to entice back workers who left during the pandemic. That’s good for the economy, but not necessarily for earnings and equities.

We are neutral on equities in the short run. We stay overweight stocks in the long term as we expect central banks will ultimately live with inflation and the sum total of rate hikes will be historically low.

____________

U.S. stocks have suffered the biggest year-to-date losses since at least the 1960s. That’s ignited calls to “buy the dip.” We pass for now. Valuations aren’t much cheaper given rising interest rates and a weaker earnings outlook, in our view. A higher path of policy rates justifies lower equity prices. We also see a risk the Fed will lift rates too high – or that markets believe it will. Plus, margin pressures are a risk to earnings. That’s why we’re neutral on stocks on a six- to 12-month horizon.

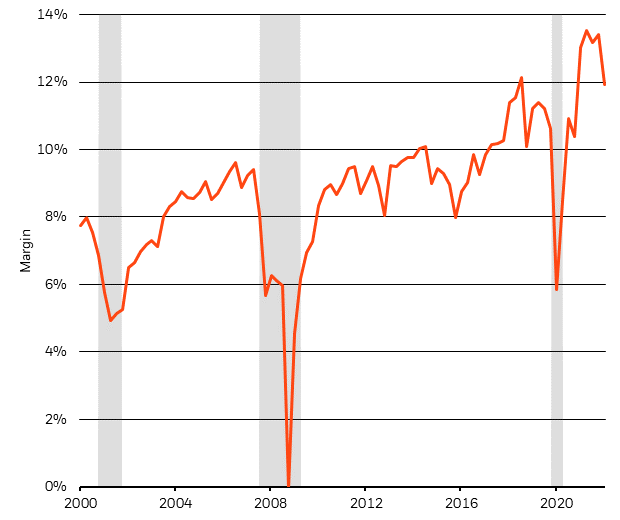

Margin pressure worries mount

S&P 500 Operating Margin, 2000-2022 (S&P, with data as of March 31, 2022, and BlackRock Investment Institute, June 2022)

Notes: The chart shows operating margins for S&P 500 companies.

So we don’t buy the dip. Why? Three reasons. First, profit margins have marched upward for two decades, as the chart shows. We now see increasing risks to the downside. We expect the energy crunch to hit growth and higher labor costs to eat into profits. The problem: Consensus earnings estimates don’t appear to reflect this. For example, analysts expect S&P 500 companies to increase profits by 10.5% this year, Refinitiv data show. That’s way too optimistic, in our view. Stocks could slide further if margin pressures increase. Falling costs like labor have fed the multi-decade profit expansion. So far, unit labor costs – the wages a company pays to produce a unit of output relative to its selling price – haven’t risen much. We see real, or inflation-adjusted, wage hikes to entice people back to work. That’s good for the economy but bad for company margins.

Companies have managed to expand margins over the years through automation and other means, including in the pandemic. Now challenges are mounting. We see easing consumer demand as the restart of economic activity slows. This will reduce companies’ ability to pass on higher costs to consumers, in our view. We also expect a rotation of consumer spending back into services and away from goods as the world normalizes – and see this helping the economy more than equities. Services make up most of the economy, whereas S&P 500 earnings are evenly split between services and goods.

Risks to stocks

The second reason we’re not buying the dip: equities haven’t cheapened that much, in our view. Why? Valuations haven’t really improved after accounting for a lower earnings outlook and a faster expected pace of rate rises. The prospect of even higher rates is increasing the expected discount rate. Higher discount rates make future cash flows less attractive.

Lastly, we’re not pounding the table on buying stocks right now because of a growing risk that the Fed tightens too much – or that markets believe it will, at least in the near term. Signs of persistent inflation, like last week’s CPI report, may fuel the latter risk. That’s all part of why we turned tactically neutral on equities last month. Stocks slumped last week near lows of the year. We don’t see a sustained rally until the Fed explicitly acknowledges the high costs to growth and jobs if it raises rates too high. That would be a signal to us to turn positive on equities again tactically.

We see central banks ultimately opting to live with inflation instead of raising policy rates to a level that destroys growth. That means inflation will likely stay higher than pre-Covid levels. We also think the Fed will quickly raise rates and then hold off to see the impact. The question is when this dovish pivot will take place. This uncertainty is why we’re tactically neutral on stocks but overweight on a strategic, or longer-term, horizon. We think the sum total of rate hikes will be historically low.

Bottom line

We are tactically neutral on stocks and are not buying the dip. First, valuations haven’t really improved when taking into account faster rate hikes than the market had priced. Second, there’s an increasing risk that the Fed overtightens or markets actually believe its tough talk on inflation. Third, a slowing restart and margin pressures spell trouble for heady earnings estimates in 2022 and 2023. We think central banks will eventually make a dovish pivot to save growth or avoid a deep recession. This is why we are overweight equities in the long run but neutral on a tactical horizon.

Market backdrop

U.S. CPI inflation data showed persistently high inflation last week, while the European Central Bank (ECB) announced plans to end asset purchases and carry out a rapid series of rate hikes. Stocks fell and yields rose, showing markets are primed to be hawkish on rates. We think the ECB and markets are underappreciating the risk that the energy crunch could bring the euro area to the brink of recession. We expect the ECB to accept this at some point and rethink its rate path.

The Fed will be front and center this week as it likely raises rates by 0.5%. Markets will focus on updated growth and inflation forecasts, indications of the future policy rate path and whether the Fed acknowledges that reducing inflation back to its 2% target would come at the cost of jobs and growth. We see the Fed hiking rates to a neutral level – one that neither stimulates nor drags on activity – by the end of the year, before pausing.

Be the first to comment