jetcityimage/iStock Editorial via Getty Images

Introduction

Morgan Stanley (MS) downgraded AGCO Corp. (NYSE:AGCO) to “Equal Weight”, a fact that – alongside with the other major farm equipment manufacturers like Deere & Co. (DE) and CNH Industrial N.V. (CNHI) – saw the stock plunge 8.58%. The reasons behind the downgrade are quite clear: fears of a recession make investors operate a multiple contraction. When a recession takes place, many companies will cut spending and machinery manufacturers will be hit. I recently covered AGCO, highlighting that favorable long-term macro trends and a better focus on the North American market should make the company grow its margins and gain a better diversification that will balance its main exposure to Europe. The downgrade news made me think about some further considerations about my investment thesis that I would like to share with the Seeking Alpha community.

What happened during the Great Recession?

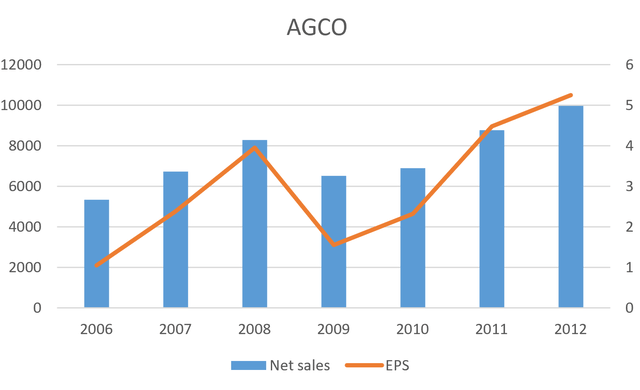

The downgrade made me go back and take a look at how AGCO performed during the last recession. I gathered the data from 2006 to 2012 in order to end up where Seeking Alpha starts providing data. AGCO’s net sales did decrease in 2009 but in 2010 they were already recovering and by 2011 the company was already at new highs. The same trend was followed by EPS.

Author with data from AGCO Annual Reports

The company was managed very well and worked to lower its inventories and control capex, in order to have a strong balance sheet. This allowed AGCO to invest keenly and be ready for the recovery. In particular, AGCO’s exposure to Brazil helped it offset the slower recovery in Europe during 2009 and 2010.

Now, so far nothing new. It is quite obvious that during a recession a manufacturing company’s net sales decrease to then recover and reach new highs. However, we should consider that during these times, some companies are wiped out. AGCO wasn’t and it actually came out stronger, becoming one of the three major players in the industry. Investors should consider the quality of AGCO’s management and its track record.

What is happening now?

Every recession, though similar, has its own way of unwinding. The Great Recession was triggered by the financial crisis, the following could be linked to high inflation aggressively dealt with by the Fed together with the energy crisis. Let’s consider, however, that after the pandemic, the recovery was so strong that many manufacturers, included AGCO, saw so many incoming orders that the 2022 order book is well covered and Mr. Hansotia, AGCO’s Chairman, President and CEO, during the last earnings call said that the company was already receiving orders for 2023, reassuring investors that demand is still strong.

Now, my new point is the following. Many manufacturers are seeing their inventories go up, as supply chain constraints hinder or slow down production and deliveries. This is loading up these companies with orders that will take more time than usual to be fulfilled. Meanwhile, demand is strong and is being postponed to the second half of the year or even 2023. Given the high prices manufacturers are able to sell their products at, if inflation will be cooled off by the Fed, we should still see strong results with high margins for the remainder of the year and at least part of the next.

In other words, my point is that, if a recession begins, a company like AGCO will enter into it with the advantage of strong tailwinds that are still in action. The long lead time that we see for machinery could play in favor of these manufacturers, as they will begin the difficult part of the cycle with an order book built during the previous peak. It would so be a very particular recession, as it would take place very close to one of the best performing years in the last 50 years.

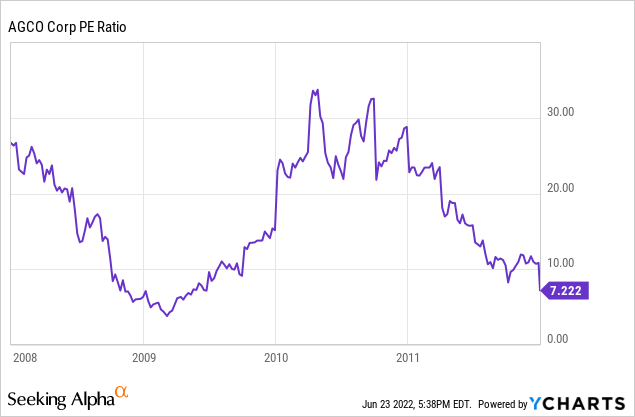

I am not saying that AGCO will not suffer from a recession, but I think investors should factor in the different situation. In addition, AGCO already trades at lower multiples compared to its multiples during the last recession. For example, its PE is now below 9, that between 2008 and 2012 would have already been very near the bottoms. As soon as the recovery started, AGCO’s PE skyrocketed to over 30, as the price went up thanks to huge future earnings expectations.

Risks

True, orders can be canceled and AGCO could find its order book destroyed. But, when we talk about farming machinery, investments are planned well ahead as the equipment is expensive and farmers often need to borrow money or lease the machines. These financing actions take time and require a certain commitment from the borrower. This is why I expect order cancellations to be very low in case a recession takes place already in the next two quarters.

Valuation

Compared to my last discounted cash flow valuation, I would change only one parameter to be more conservative. At that time I used a discount rate of 8% which gave me a target price of $160. If I raise it to 10%, and lower the perpetual growth rate to 1%, the target price is still very interesting as it is $138, which is almost a 30% upside from today’s. Thus, the opportunity has even increased. Seeking Alpha’s Quant Rating seems to signal the same thing, as it rates AGCO with an overall B- valuation grade.

Conclusion

AGCO may see some downward pressure and I think the call from Morgan Stanley is short-term focused. I have learned that trying to time the market is quite hard and that long-term oriented investors can weather bear markets and actually use them to pick up solid companies that are set to perform well during the next cycle. I don’t see any of AGCO’s fundamentals hurt by the recent downgrade and this is why I keep on considering AGCO a buy.

Be the first to comment