Black_Kira

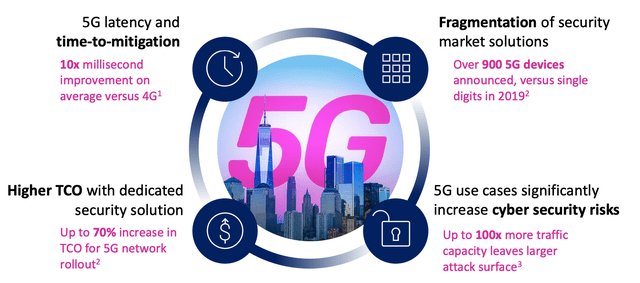

A10 Networks (NYSE:ATEN) is a leading cybersecurity company that is poised ride the growth across at least three major trends. The first is the increasing amount of website traffic which has been driven by increased smartphone penetration, Internet of Things [IoT] devices (think Alexa), and more cloud applications. Approximately two-thirds of the global population is forecasted to have Internet access by 2023, which is a staggering 5.3 billion total Internet users. More internet users and more devices mean a larger attack surface and has resulted in more cybersecurity attacks. Cybercrime costs are expected to increase by 15% per year up until 2025, reaching an eye-watering $10.5 trillion annually. Surprisingly Cyberattacks are more likely to bring down F-35 jets than missiles. The third major trend is the 5G industry, which is forecasted to grow at a blistering 49.8% growth rate and is expected to reach $80.5 billion by 2028. A10 networks is poised to ride the growth across these three industries and was even named as a sample vendor for 5G Network security by Gartner.

The company recently beat both revenue and profit expectations for the second quarter. Thus in this report I’m going to breakdown the company’s business model, financials and valuation for the juicy details, let’s dive in.

Secure Business Model

A10 Networks has its products divided into four main sections;

1. Application Delivery

2. 5G security

3. Distributed Denial of Service [DDoS] Security

4. Traffic Visibility

Application Delivery Controllers [ADC] are their flagship product range and are sold under the Thunder ADC brand. An ADC basically balances the load between various servers, to help prevent overload on a particular one and improve performance. A very simple analogy is to imagine a retail store with multiple cashiers, without a load balancer, the traffic (people) may just clump at one cash register and form a long line. Whereas a load balancer acts as a “concierge” which helps to “balance” the traffic.

The Application Delivery Controllers [ADC] industry is forecasted to grow at a steady CAGR of 9.63% up until 2026, reaching a value of $3.78 billion by the end of the period. This is driven by trends such as increasing website traffic and the increasing number of cybersecurity attacks. A10 Networks and its Thunder product offer load balancing, in addition to a Web application firewall [WAF] and domain name system [DNS], all rolled into one.

A10 Networks also offers a cloud-native ADC called Lightning. This is ideally suited for cloud or hybrid environments as it offers “elastic load balancing”. This is a game changer as it means a business can scale its computing needs with the cloud but doesn’t have to worry about hardware overloads.

The company is also highly regarded for its carrier-grade NAT [Network Address Translation] service. To explain this service in a basic manner, every internet-connected device must have an IP address. However, the world has effectively run out of IPv4 addresses and thus NAT must be used. Uber is a customer of A10 networks and have found great value in its NAT service.

5G security is another major service A10 networks offers. 5G is expected to bring with it a 100X increase in traffic, which will increase the “attack surface” for hackers. A10 Networks is a leader in this industry and have previously helped the largest telecom provider in South Korea [SK telecom] roll out and secure the first commercial 5G network in the world.

The company sells its products through a combination of;

- Thought Leadership

- Insight Selling

- Partnerships

As of the FY2021 the company had a revenue retention rate of 118% which means customers are finding the product “sticky” and spending more.

Growing Financials

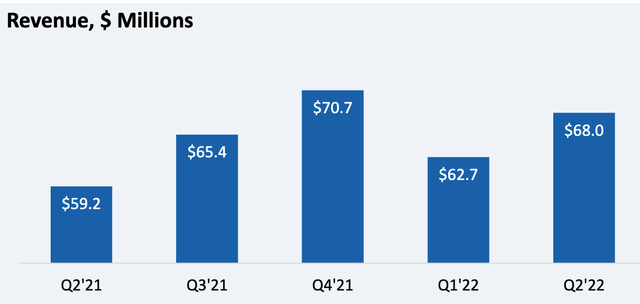

A10 networks generated strong financials for the second quarter of 2022. Revenue was $68 million which increased by 14.9% year over year and beat analyst expectations by over half a million dollars. This was led by strong growth in security-led products. Product revenue which can be used as a leading indicator of future revenue was $41.5 million, popped by a rapid 20.7% year over year which was fantastic. While services revenue was $26.5 million which made up 39% of total revenue.

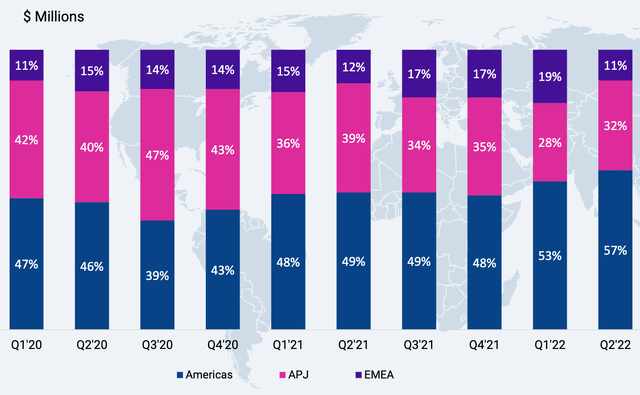

On a geographic basis, the Americas still continues to be the largest (57% of total revenue) and strong performing segment with $38.6 million generated, up 33.7% year over year. While revenue from Revenue from Asia was $21.6 million down 7.1%. EMEA revenue popped by 10.5% year over year to $7.8 million and showed steady growth. Given, a recession is forecasted to be more likely in Europe than in the US, I believe it is positive to see less exposure to this region. In addition, the strong US dollar also acts as a headwind to European revenue and thus earnings in dollars is another positive.

Geographic revenue (Q2 Earnings Report)

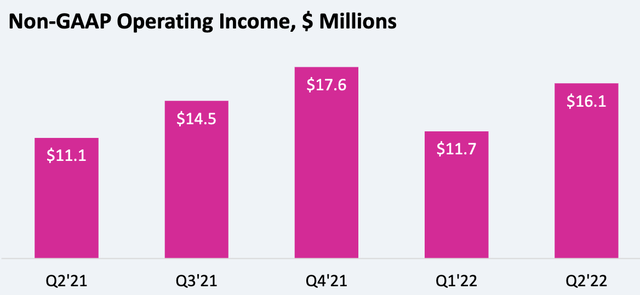

A10 Networks also generated a strong gross margin of 80%, which was fantastic given the supply chain issues globally and input cost inflation. Non GAAP Operating expenses edged up by 10% year over year which was mainly driven by an increase in technology investment and sales and thus I don’t believe this was a negative. Also, sales are growing much faster than operating expenses which demonstrates strong operating leverage for the business. Therefore Non-GAAP Operating income popped by 10.6% year over year to $16.1 million. With Adjusted EBITDA of $18 million or 26.4% of revenue.

Operating Income (A10 Networks)

Earnings Per Share [EPS] was $0.13, which beat analyst expectations by $0.02 per share. Management also showed confidence and bought back 2.4 million shares for $31.8 million. The company has a solid balance sheet with $166.8 million in total cash and cash equivalents, with virtually no debt which is a positive. Moving forward, management is expecting 10% to 12% revenue growth with a 26% to 28% Adjusted EBITDA margin.

Advanced Valuation

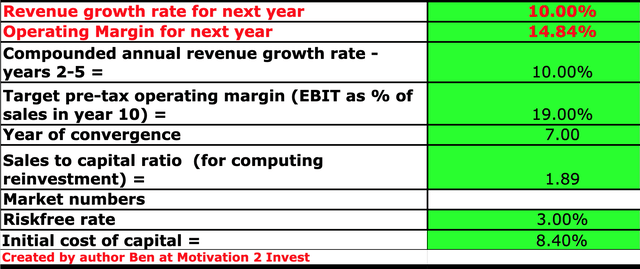

In order to value A10 Networks, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth per year over the next 5 years.

A10 Networks (created by author Ben at Motivation 2 Invest)

I have also forecasted the pre-tax operating margin to increase to 19% over the next 7 years. As the company moves its sales to more of a cloud solution and less to physical hardware. In addition, as supply chain issues and inflation eases over the next few years, I also expect margins to improve. It should be noted my estimate of operating margin includes an adjustment for R&D expenses which I have capitalized.

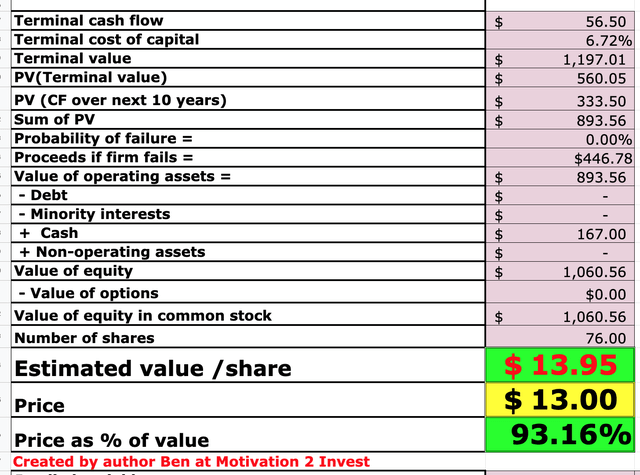

A10 Networks stock valuation (created by author Ben at Motivation 2 invest)

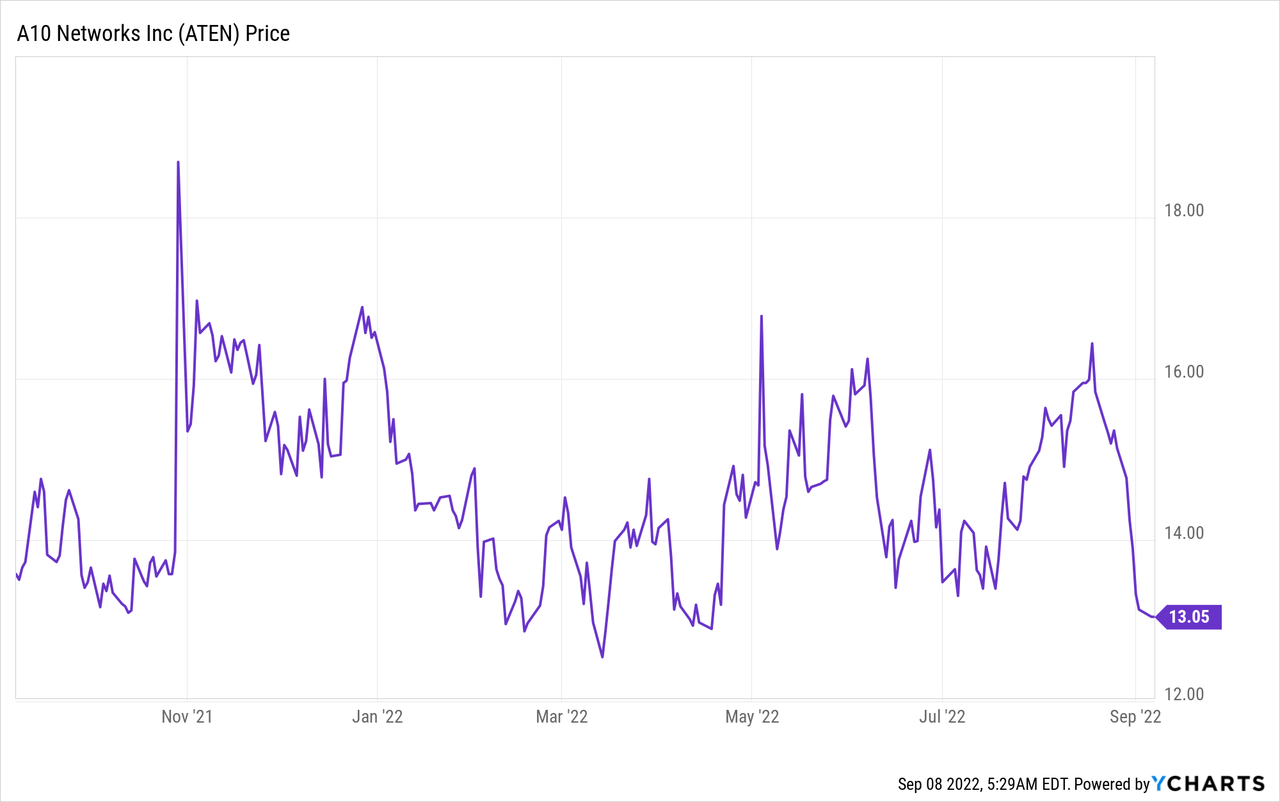

Given these factors I get a fair value of $13.95 per share, the stock is trading at ~$13 per share thus is ~7% undervalued.

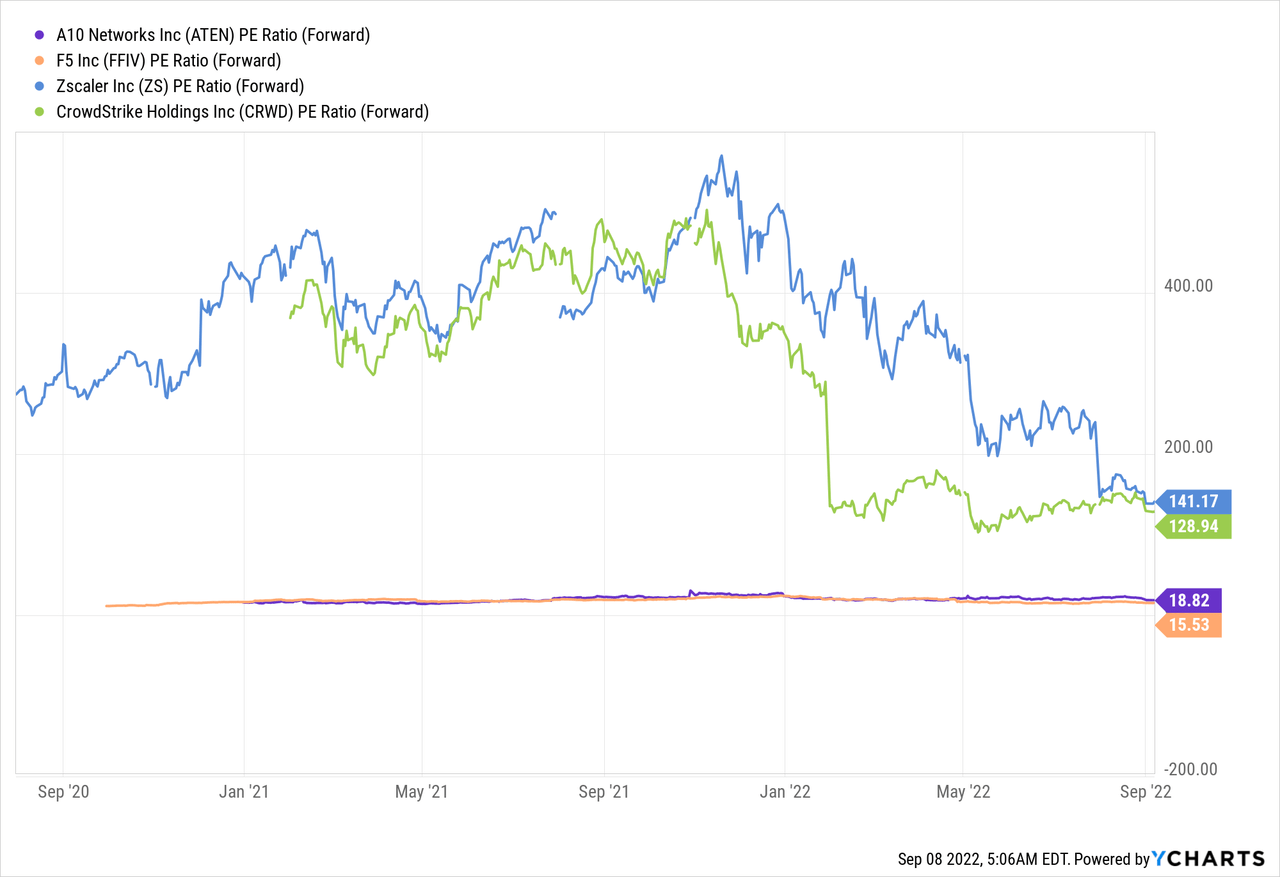

As an extra datapoint A10 networks trades at a Price to Earnings ratio = 10 which is over 54% cheaper than the IT sector and its historical mean. As an extra data point A10 networks is trading at a PE Ratio [forward] = 18.8 which is cheaper than many other cybersecurity companies. However, it is more expensive than close competitor F5 Networks which trades at a PE ratio [forward] = 15.53

Risks

Competition

The cybersecurity industry has seen a huge boost in competition. For A10 networks, its main competitor is F5 (FFIV) which also offers Application load balancing. Cloud providers such as AWS and Microsoft (MSFT) Azure also offer native solutions. For its Zero Trust Network, A10 faces competition from Zscaler (ZS) which is a rapidly growing company, albeit quite expensive. However, management does make the point that they “combine multiple” kinds of product categories “which is a little bit unique” and true for every company.

Recession/IT spending slowdown

As mentioned prior, many analysts are forecasting a recession, due to the high inflation and rising interest rate environment. However, even if we don’t have a recession the expectations of one could cause companies to cut costs and delay spending.

Final Thoughts

A10 Networks is an IT and cybersecurity company that offers best in class solutions for enterprises. It is growing at a steady rate and increasing its profitability. The company is poised to ride growth trends in 5G security and increasing web traffic. The stock is undervalued and thus it looks to be a great one for the long term, in my opinion.

Be the first to comment