Ian Tuttle

Investment Thesis

Roblox’s (NYSE:RBLX) core business is slowing down. Bookings growth, engagement, and profitability have all experienced headwinds in recent quarters. I think the company will tout strong results at their upcoming investor day, but their growth outlook for the next few years is still very unclear.

The company trades at a premium valuation. Since there is little guidance from management, the risk is very difficult to assess. But I think it’s likely that the risk to reward is extremely unfavorable. For these reasons, I recommend avoiding this stock for the time being.

Growth Is Slowing Down

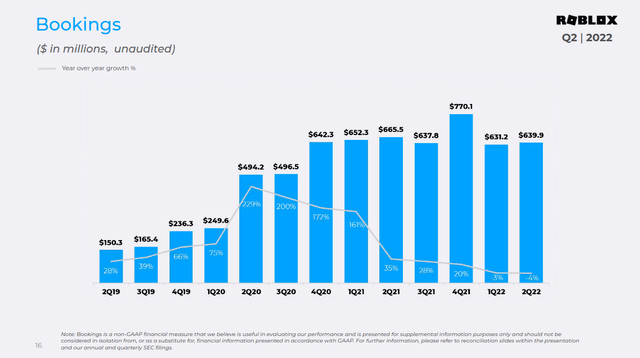

After reporting fantastic growth since the start of the pandemic, Roblox’s business is slowing down. The company reported its second negative quarter of bookings. This indicates a coming slowdown in the business’s top line growth. This could be a huge risk to a company that is trading at such a high valuation.

Roblox Q2 2022 Supplemental Materials

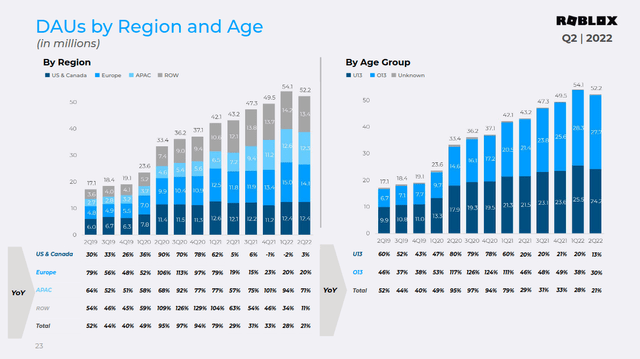

Daily active users dipped sequentially across age groups. This marks the first decline since the start of the pandemic. The United States and Canada segment is a specific point of concern. Both daily active users and hours engaged have been flat to negative in this cohort. This is when most of the world outside the US is experiencing foreign exchange headwinds. The increase in the dollar’s value can cause revenue from international users to decline. The company outlined this as a risk in its last 10-K filing.

Roblox Q2 2022 Supplemental Materials

There are some positive trends as well. The company’s user age mix has improved in recent months. For the past few quarters, the company has shown strong growth from older users. Daily active users over 13 years old increased by 30% year over year, compared to 21% for all users. This is important since a major criticism of Roblox has been its reliance on young customers. It can be a headwind when companies rely on customers who cannot make or spend their own money. It’s promising that the company has been able to make inroads into older demographics.

I think that management will likely release some strong results at their upcoming investor day. They started off their last earnings call by immediately showing off their positive July 2022 results. These included a 10% year over year increase in bookings. Additionally, August is a seasonally strong month. During their fourth quarter earnings call, management discussed this seasonality.

Just think a little bit that Q3 is July, August and September. July and August are just peak for us. Like this is absolutely high-level time of activity. September back-to-school and things slow down, it’s a shorter month. And then October and November are actually pretty quiet for us.

This dynamic could cause a short term bounce in the company’s shares. Unfortunately, it’s difficult to project these results further into the future.

Forward Momentum Is Unclear

Some of these trends are concerning, but management seems unfazed. They’re continuing to predict a return to solid top line growth in 2023. The pandemic’s influence on their results will have lessened by then. But it’s difficult to project trends based on management’s commentary. The company does not issue guidance, and their earnings calls can be very vague.

For example, the company has discussed the balance of user engagement by day. On their fourth quarter earnings call, management discussed growth rates on weekdays and weekends.

The biggest [factor] in the growth in bookings really has to do with the rates of growth on weekdays and weekends. So if we just look at the United States and the United Kingdom, in particular, when COVID started, every day, Monday through Friday, we had super high growth because people weren’t at work or at school versus our normally high rates of growth, mostly focused on the weekend. Now we’re kind of unwinding that trend that people are going back to work, our growth rates necessarily are going down on the weekdays. But the weekend growth is still significant.

In the company’s latest earnings call, an analyst asked for an update on this dynamic. Management didn’t give a direct answer, instead saying they didn’t think it mattered in the long term.

I want to just highlight that our long-term growth has so much opportunity, it’s not predicated on weekdays or weekend. Even in our most healthy long-term cohorts, which would be US, Canada in nine through 12, there’s a lot of headroom there given that traditional Roblox users aren’t using Roblox every day as a communication tool. So, there’s a lot of room on frequency within our traditional audience.

It’s possible that the specific days of the week don’t matter for engagement anymore. But these types of answers make it more difficult for me to analyze the company as an investment. A common trend in these calls is for management to discuss their vision for the Roblox platform as a daily utility. They believe their “human co-experience platform” will eventually be used for basic communication, entertainment, and learning across age groups.

But this is a distant, long term vision. Currently, Roblox is a gaming platform with two thirds of its audience under the age of 16. I respect the company’s leadership for aiming for the moon, but I don’t think these indirect answers inspire confidence in Roblox shares as an investment at the current time.

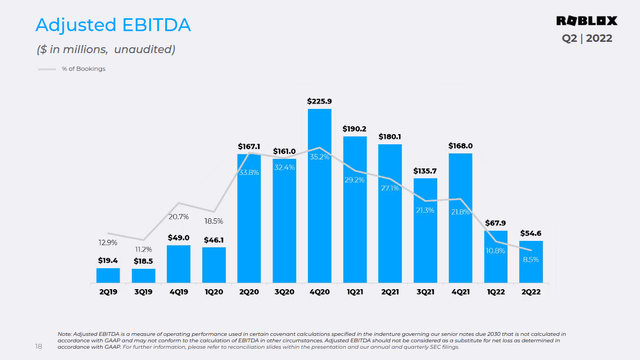

Profitability Is In Decline

The company’s profitability has been in decline for some time. But personnel costs and infrastructure spending have continued to march higher. As a percentage of bookings, these cost categories are up 56% year over year. Adjusted EBITDA margins have declined to the lowest point they’ve been in over three years.

Roblox Q2 2022 Supplemental Materials

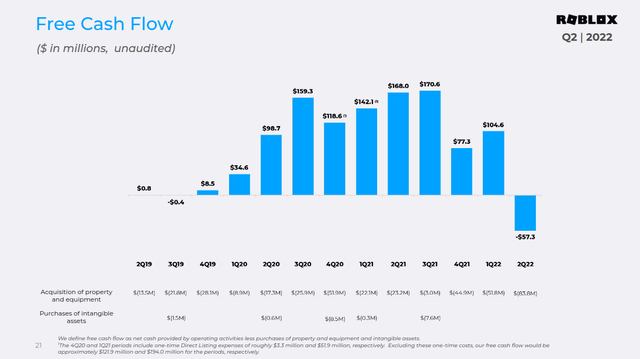

Free cash flow is also at its lowest level in three years, turning negative in the most recent quarter. The company’s cash from operations has decreased by 85% year over year.

Roblox Q2 2022 Supplemental Materials

Even as engagement stays relatively solid, the company’s bookings have suffered. Average bookings per daily active user have dropped to $12.25, a decline of 21% year over year. The company’s first half ABPDAU were at their lowest levels since the start of the pandemic.

This is why Roblox’s focus on increasing its userbase’s age diversity is so important. I like that the company’s leadership is focusing on the 17 to 24 age demographic. Management says this cohort monetizes even better than their core 9 to 12 age group. It’s important for the business to recruit users who have control over their spending.

Nonetheless, it is becoming clear that the pandemic margins of over 30% were not sustainable. I think management was clear about this at the time, but I don’t think many investors predicted Roblox’s profitability falling as far or as fast as it has. This is something I recommend watching carefully in upcoming quarters.

A Very Expensive Valuation

It’s difficult to value a company like Roblox when growth is so uncertain. Shares are trading at a price to bookings of about 9 times, which is quite expensive. For me to buy a company with this profile, I’d want bookings growth of at least 20% annually. This compares unfavorably to companies like Take-Two Interactive (TTWO) and Electronic Arts (EA). Both of these companies are profitable with comparable analyst estimates for revenue growth.

Also, the company’s adjusted operating metrics don’t account for high stock-based compensation levels. The company has an annual run rate of almost $600 million in stock-based compensation. This is a rate almost three times higher than last quarter’s adjusted EBITDA.

Fortunately, management does seem to be carefully watching dilution. They’ve reiterated their commitment to keep dilution levels under 5%. It’s refreshing to see a growth company that takes this seriously.

Final Verdict

Roblox’s growth and profitability have fallen off significantly in recent quarters. It’s possible that the company enjoys a short term bounce from summer results. The company’s management is making some good moves, but their guidance is very vague. I simply don’t think there’s enough solid information to take a position in the stock.

At a valuation of over eight times bookings, there’s significant potential for downside if a high growth rate does not materialize. For these reasons I strongly recommend avoiding this stock. The risk is hard to evaluate, but it’s likely very high relative to the potential upside for a $23 billion company.

Be the first to comment