Sometimes things can change quickly in the stock market. As recently as the end of January we had written about our concerns with McDonald’s Corporation (MCD). At the time, the stock was trading near 52-week highs and its high valuation combined with its increasing debt load pointed to sub-par returns (in our view). Now, just a month and a half later, shares are paving new 52-week lows as the Coronavirus-driven crash of the markets has taken McDonald’s along with it. This is deserved, as containment protocols worldwide are restricting consumer activity, decreasing traffic to restaurants. Below we address what McDonald’s is currently working through in regards to the outbreak, another look at valuation, and why we think that McDonald’s will pull through in the long term – making it a stock that investors should monitor as the price continues to fall.

Coronavirus Crash Especially Damaging For McDonald’s

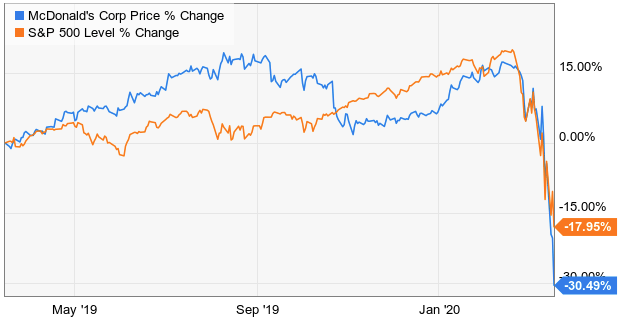

Despite the sharp plunge of the broader indices, shares of McDonald’s have actually outpaced the S&P 500 in losses. This makes sense because the restaurant sector is an obvious casualty of social distancing and other mitigation measures currently being enacted around the globe.

Source: Ycharts

Source: Ycharts

McDonald’s has thus far declined to try and quantify the disruption, but the severity of the damage will likely be significant. The company is currently considering deferring rent payments for financially distressed franchisees.

The good news is that McDonald’s isn’t at a complete standstill. While many countries (outside of the US) and states (within the US) have issued numerous mandatory closures on dining establishments, McDonald’s has been able to at least continue to function. They have done so by closing their lobby and moving to drive-thru and delivery services exclusively.

Time To Revisit Valuation

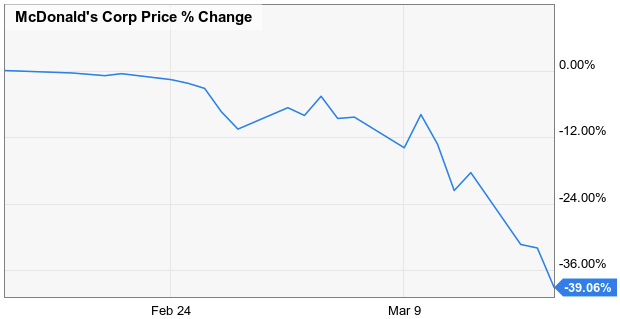

When we last looked at McDonald’s, the company’s stock was trading at a steep earnings multiple of almost 27X what analysts have projected for 2020 EPS at the time. Since then, shares have plunged more than almost 40% and counting.

Source: Ycharts

Source: Ycharts

Valuation metrics have to be taken with a grain of salt now, because the near-term operating results are going to be heavily skewed. If we go off of FY2019 EPS of $7.88, the stock’s current earnings multiple is a much more modest 17.2X. The stock was drastically overvalued a month ago, but has since fallen to below its historical multiple (10-year median PE ratio of 18.85X).

Given the incredible degree of disruption that is currently facing the business, there certainly isn’t a large margin of safety present – even after such a large drop. We can agree however, that what would have likely been a long-term reversion to valuation norms – has definitely been sped up by this crash. So what do investors do now? Before we answer that, let’s look at why we believe that McDonald’s will be OK in the long run.

McDonald’s Should Be OK In The Long Term

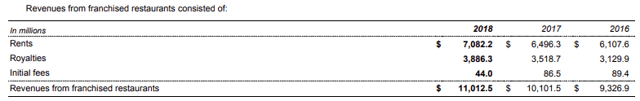

To gauge McDonald’s and its potential resiliency, we looked at three primary areas of concern. That being each of its two primary revenue streams, and its balance sheet. McDonald’s generates revenues through two primary streams: the rent it collects from franchisees, and its royalties on restaurant sales. More than 90% of the global McDonald’s population are franchised.

Source: McDonald’s Corporation

Source: McDonald’s Corporation

The rent payments that McDonald’s collects account for approximately a third of the company’s overall revenues. While nothing is a certainty in this environment, McDonald’s being able to avoid complete shutdowns with drive-thru and delivery services should give most locations some sustainability in our view. McDonald’s is a “cheap” and easy meal that many consumers will opt for in this environment. Grocery stores are crowded in many cases, and the drive-thru aspect is both a convenience option, as well as a means of avoiding contact with other people. The combination of a cheap meal, established footprint and drive-thru/delivery services will position McDonald’s to fare better than many of its competitors.

There is no doubt however that McDonald’s will see some sort of drop in traffic. Many workers are losing their jobs/hours, and will strive to avoid eating out. We expect McDonald’s to see a drop in revenues via reduced royalties, and reduced sales at its corporate-owned stores.

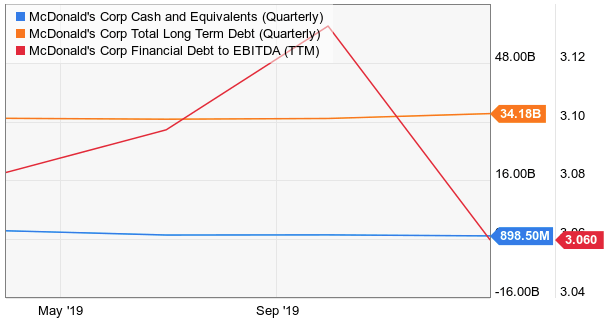

McDonald’s will likely need to pull some other financial levers to help fill these gaps. The company does have more debt on its balance sheet that we would have liked to see.

Source: Ycharts

Source: Ycharts

With less than $1 billion in cash against total debt of $34 billion, McDonald’s is levered to 3X EBITDA – circumstances that will worsen as operating results decline. The company currently maintains investment grade ratings by S&P and Moody’s, so despite the higher than ideal leverage – McDonald’s could borrow some to help if needed. Before doing so, we expect McDonald’s to cut back CAPEX (projected at $2.4B for 2020), and stock buybacks (more than $4B spent over past year). It might not be pretty, but McDonald’s is structured to maintain a pulse through this – and has just enough levers to pull that we believe the dividend payout can be maintained. The overall risk in this is the obvious fact that we don’t yet know just how bad this is going to hit the company’s financials – or for how long.

Wrapping Up

The uncertainty of the situation has obviously hit shares of McDonald’s and while the stock has dropped a staggering amount, we don’t yet see the right opportunity to accumulate shares. As we mentioned earlier in the article, the current share price represents just a modest discount to historical multiples. Given the coming pain in the weeks/months ahead, we would like to see at least a 20%-25% margin of safety to historical norms. Working off of 2019 EPS, that would mean a potential target of $111-$118 per share. It’s important to remember that this is a very fluid situation and that a longer duration of mitigation efforts would increase the severity of damage to McDonald’s and others. The above target price is a potential accumulation point, but we would encourage a gradual entry into any potential position. With such chaos rattling the markets, investors that maintain a long-term view on things will spot opportunity among the noise.

If you enjoyed this article and wish to receive updates on our latest research, click “Follow” next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment