QUICK TAKE: A Year on Since the COVID Crash, Are the ECB Tolerating Euro Strength?

Equities: What a difference a year makes. This time last year marked the end of the longest bull market in history. The onset of the coronavirus crisis had been met with a tsunami of stimulus from global central banks and governments, most of which remains in place and will continue to do so for the foreseeable future. The chart below shows the performance of global equities since Feb 19th 2020.

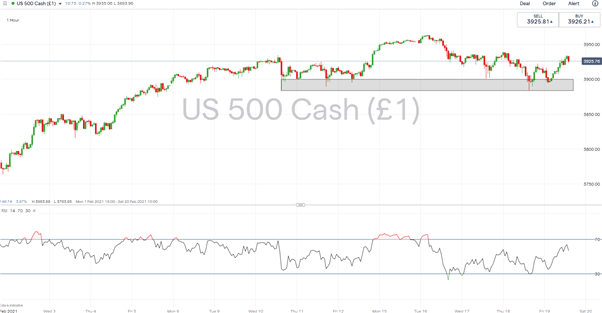

In terms of today’s price action, markets have been a touch firmer with PMI’s on the whole relatively encouraging. That said, the S&P 500 has been catching my eye recently with frequent tests of 3885-3900 finding support. However, markets are going through a seasonally weak period (since Feb 17th), while today’s US equity option expiries will see forced buying of stocks to dissipate in the next few sessions, therefore increasing the focus on the aforementioned area, while the 20DMA is also a key level to watch, should the S&P pullback.

S&P 500 Chart: Hourly Time Frame

Euro Stoxx 50 Sector Breakdown

Outperformers: Financials (1.3%),Basic Materials (0.3%), Technology (0.9%)

Laggards: Healthcare (-0.6%), Energy (-0.1%), Utilities (0.1%)

US Futures: S&P 500 (0.2%), DJIA (0.2%), Nasdaq 100 (0.2%)

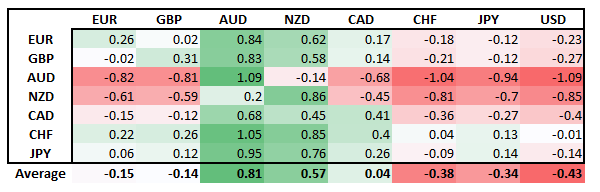

Intra-day FX Performance

FX: GBP bulls continue to take charge as GBP/USD breaks 1.40 for the first time since April 2018. The narrative behind the GBP bull case remains unchanged with a successful vaccine program and reduced political uncertainty with Brexit now behind us. That said, this morning’s data has been mixed overall with soft retail sales and better than expected PMI data shrugged off. Going forward, while the current narrative remains in play for GBP, given the substantial rise since the beginning of the year and with the psychological 1.40 barrier being taken out, I wouldn’t be surprised to see some profit taking occur, particularly as GBP crosses trade at overbought levels.

USD: The greenback has come under pressure throughout much of the morning with USD majors breaking key levels and thus the greenback is back at weekly lows. The Euro had largely been playing catch up with the recent strong performance in GBP as EURUSD climbed back above 1.21. Yesterday’s ECB minutes signalled that the central bank may be more comfortable with a higher Euro as members highlighted the impact of exchange rate movements on inflation might be overestimated in standard models. Keep in mind, that the trade-weighted index has pulled back from its recent highs.

EUR TWI Trading Around July Levels

| Change in | Longs | Shorts | OI |

| Daily | -19% | 6% | -5% |

| Weekly | -5% | -10% | -8% |

Looking ahead: With little else scheduled on the economic calendar. Market attention will turn to next week.

Be the first to comment