Marco Bello/Getty Images News

Palantir Technologies Inc. (NYSE:PLTR) is a $15 billion company, with an impressive portfolio of software assets. The company’s share price has dropped almost 80% since its early 2021 highs. However, despite this share weakness, we see the company continuing to execute on its growth plans to drive substantial shareholder returns.

Palantir’s Q3 2022 Results

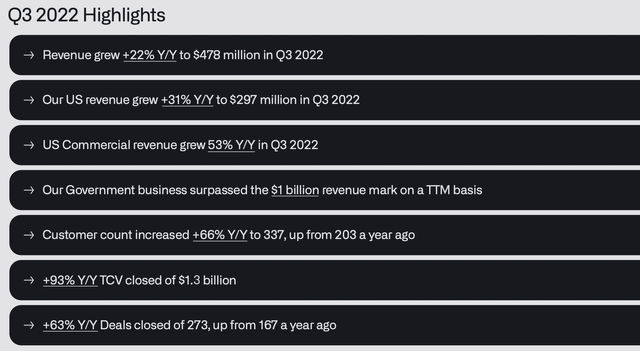

Palantir continued to fire on all cylinders in Q3 2022, as it outperformed throughout the quarter.

Palantir Investor Presentation

The company grew revenue 22% YoY to $478 million in 3Q 2022. It also managed to grow U.S. revenue even faster at 31% YoY as the country’s economy outperforms many other economies elsewhere in the world. U.S. revenue continues to make up more than half of the company’s annualized revenue.

The company’s strength is visible as well through growing customer accounts, the government business surpassing $1 billion in TTM revenue, and strong U.S. commercial revenue. An increased number of deals closed is essential, as the company has a strong pipeline from both attracting new customers to increasing the revenue from existing customers.

The company’s continued outperformance through the quarter should help drive future cash flow and returns.

Palantir’s Customer Value

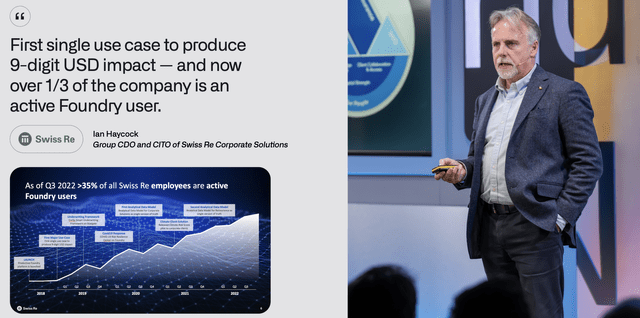

At the end of the day, the essential importance of Palantir’s thesis is how much value can it generate for customers.

Palantir Investor Presentation

There was a time when we wondered why Amazon’s (AMZN) Amazon Web Services (“AWS”) has outperformed. Companies with incredibly strong technical workforces, such as Netflix (NFLX), were moving essentially their entire businesses to AWS. That’s despite having both the capital and the technical expertise to replicate AWS’ functions locally, and AWS prices meant the move would raise base costs.

However, it turns out there are a lot of other advantages. Server requirements vary dramatically. The ability to dynamically pay for usage while having access to peak usage is invaluable, as is the support of new services being developed. The same sort of dramatic shift is being seen with Palantir in our view, and now is the early game.

Maintaining the ability to gather and effectively process massive amounts of data is incredibly expensive. Interpreting it in a useful way is also extremely complicated. For individual companies, where synergies can’t be accomplished, it’s not necessarily worth it, and that’s where Palantir steps in. This is already seen in Swiss Re, with a 9-digit USD impact and 35% of the company using it.

Palantir’s Financial Performance

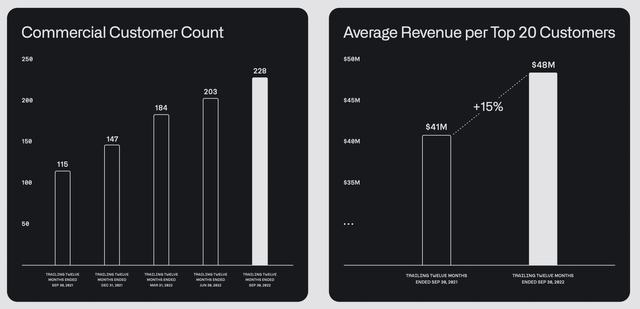

Financially, Palantir performed incredibly well, with annualized revenue from the quarter hitting almost $2 billion.

Palantir Investor Presentation

Palantir has managed to grow its commercial customer count substantially YoY compared to 2020, with average revenue per top 20 customer growing to $48 million. That shows how the company is growing in every sense, with average revenue per customer and customer count both increasing significantly. That results in much faster growth in overall revenue.

The company has $4.1 billion in remaining deal value and $1.4 billion in remaining performance obligations at the end of the year, both up significantly YoY. At the same time, gross margins have remained incredibly high at 80%, showing the company’s high-margin software business and its continued ability to earn profits.

More importantly, the company earned almost $40 million in free cash flow (“FCF”) for the quarter, showing a continued ability to profit during growth periods, while maintaining a $2.4 billion net cash position. The company is currently trading at a 1% FCF yield, or 1.2% out of net cash, which is relatively strong when considering the company’s growth rate.

Palantir’s Shareholder Return Potential

Palantir has substantial long-term shareholder return potential as long as the company continues to execute as it has been.

For FY 2022, the company is expecting $1.9 billion in revenue and $385 million in income from operations. For 4Q 2022, the company’s expectation for quarterly income is almost $510 million or up roughly 5% QoQ. We expect the company to continue aggressively growing revenue while maintaining strong margins for cash flow.

The company has a 1% FCF yield, and, given its growth rate, we expect that to hit 2% by the end of next year. We expect continued growth past that level, which give the company the ability to hit a level where it can begin to ramp up shareholder returns.

Thesis Risk

The largest risk to our thesis is that Palantir’s future success is based on continued rapid growth. As we stated above, the company is at only a 1% FCF yield, which makes it a poor investment without a path to 5x-10x its FCF. While we expect that the company can comfortably do so, assuming it can’t, its ability to drive returns will be much worse.

Conclusion

Palantir has an impressive portfolio of technology assets, as the company is becoming for data what AWS became for the datacenter/server market. We expect that trend will continue as a result of Palantir’s impressive portfolio of assets. The company has been rapidly growing revenue to almost $2 billion annualized.

At the same time, the company continues to maintain strong margins. It’s currently at a 1% FCF yield, and we expect the company will be able to expand that substantially going forward. That continued performance makes Palantir Technologies Inc. a valuable investment that should pay off handsomely in the long run for investors.

Be the first to comment