The verdict is in. We nailed the book value estimates, nailed the buy rating, and helped our readers generate alpha yet again. Wavebreakmedia/iStock via Getty Images

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

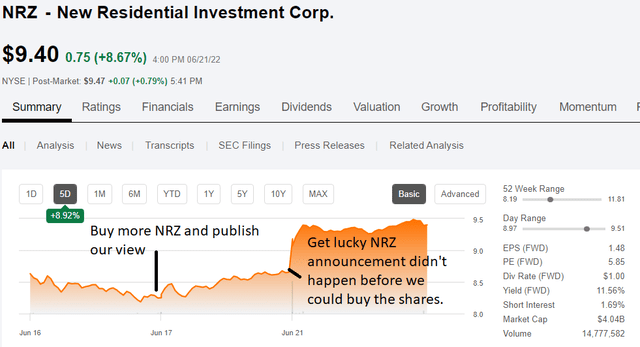

How wild have things been in June? Even the last few trading days have been wild. Take a look at the chart for NRZ:

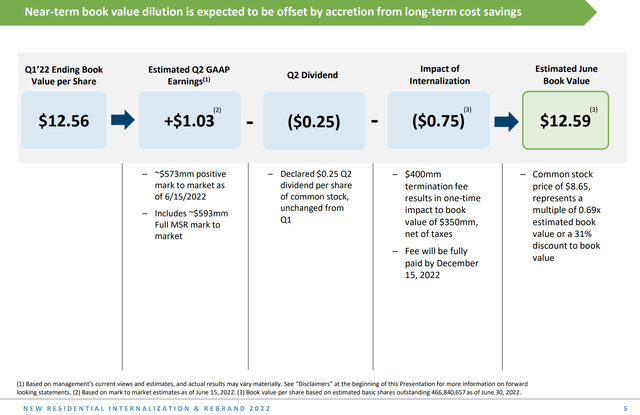

We named NRZ first in our blockbuster article on 11% to 18% dividend yields, along with 4 other picks. Great timing, though we’ve been bullish for a bit on NRZ. Further, our bullish outlook was not based on predicting management internalization. I’m not convinced that the internalization is the biggest factor moving markets today either. NRZ’s presentation included this slide:

Our estimates indicated book value per share was up for the quarter. That was part of our thesis as we wrote:

NRZ trades at a price-to-estimated book ratio of .62, using our estimates from last weekend. Even if book value took a hit this week, it would still be a huge discount. For NRZ, that’s an unusually large discount. NRZ comes with a 12% dividend yield. That yield might be increased, though I’d be interested in seeing NRZ simply use any excess capital to buy back shares at these prices.

While I would’ve liked to see some share buybacks at this point, the fact remains that NRZ just previewed a very successful quarter. Despite writing off the expenses from internalizing management (as opposed to recording a huge value for Goodwill), book value per share is still up. For the people who weren’t paying attention, when book value goes up, that means it is higher. While share prices tanked and some investors flew into a panic, NRZ’s book value actually increased.

This isn’t a surprise for us. The value for NRZ prior to internalization is very similar to the value we had predicted for subscribers. However, management posting that estimate publicly may have generated some extra confidence from investors who didn’t have access to quality estimates.

Dividends

NZR also continued quarterly dividend rate of $.25 per common share. No surprise there.

A Bit of Luck

We couldn’t know about this transaction in advance or predict that NRZ would provide the public with an updated estimate of book value (prior to the regular quarterly report). Had they made this decision two days earlier, we wouldn’t have had the opportunity to buy those extra shares. Which extra shares? The ones we disclosed in the article published Friday morning:

NRZ has been absolutely wrecked over the last week and we believe the market is precisely wrong about NRZ. We’re backing up that view with a significant investment. We bought another 3,358 shares today. That’s worth about $27,703 at today’s closing price of $8.25 (6/16/2022, when this is prepared rather than 6/17/2022 when it will likely be published). If we’re wrong, this article certainly wouldn’t be enough to cover my losses. Are we wrong? Probably not. It hasn’t happened often. Well, it hasn’t happened often in stock analysis. I’m wrong about other things all the time. Fortunately, I don’t need to be a jack of all trades to succeed.

Do you like analysts who post ratings but don’t have the conviction to buy something they just called out as a strong buy? Me neither. That purchase brings our total up to 7,930 shares of NRZ.

If anyone wants to see the trade confirmations, I’ll link them in the comments. We always screenshot them for the trade alerts.

Commentary from Scott

Over the weekend, Scott Kennedy included commentary on NRZ in his weekly sector update for members of The REIT Forum. NRZ was still at $8.65 at that point. I’ll quote a portion of that for you here:

NRZ is within my/our STRONG BUY recommendation range. As such, NRZ is very attractively valued; especially with the acquisition of Caliber Homes which “came on the books” during the third quarter of 2021. This event immediately drove earnings per share growth which was constantly pointed out to subscribers since April 2021. After the market close on 6/17/2022, along with a declared unchanged dividend of $0.25 per common share for the second quarter of 2022 (largely as anticipated; low probability of an increase to $0.30 per common share [probability lowered even further with the recent market volatility]), NRZ announced an internalization of management (amongst a future name and stock ticker change to RITM on or around 8/1/2022). As part of this internalization process, NRZ will be paying the company’s previous external manger, an affiliate of Fortress Investment Group LLC, $400 million (the termination fee). $200 million was paid/accrued for on 6/17/2022, $100 million will be payable on 9/15/2022, and $100 million will be payable on 12/15/2022. While this is not the most “ideal” development around an internalization event (no termination fee would be the best outcome), this near-term “pain” per se (the termination fee) will be NRZ’s gain over the longer-term (no more external management fee moving forward; will lead to lower-related costs moving forward). NRZ was paying the company’s external manager approximately $25 million quarterly via base management fees. This approximate figure excludes any additional performance-based incentive fees and reimbursed expenses.

He also writes:

Overall, I believe this event is a net positive for shareholders. However, one part of the disclosed event I was not a “fan of” was the name of the new company, Rithm Capital. Bit of an odd name in my personal opinion. When reviewing subscriber comments from this disclosed event, most were in agreement via their bewilderment/unsatisfaction with this particular new name. That said, this new name will just be something I/we get use to as time passes. The new name (and new ticker) does not impact my overall thoughts on NRZ’s internalization of management.

I couldn’t agree more. Strange name. Doesn’t change the investment thesis, but I really wonder how many people were consulted on that idea. They have one of the best overall records in the mortgage REIT space and they decide to change their name to a misspelling of a word that feels like a hipster term from 2013. On a positive note, they probably spent their time continuing to generate money for shareholders, which is more important than the company name anyway.

A Few Other Notes

- Most of the market rallied on Tuesday 6/21/2022. Mortgage REITs were no exception with most of them moving higher and gaining even more than the S&P 500. The two major mortgage REIT ETFs were up 3.71% and 3.37%, which beats the S&P 500 with their rally of 2.45%.

- Was it due to interest rates? No, there wasn’t much action there. The curve steepened a tiny bit. It’s not enough to consider it as a major factor.

- Are mortgage rates still high? Obviously.

- Are there still bargains in the sector? Yes, plenty of them.

- How about the preferred shares? Absolutely. Lots of value there as well.

- Does the gain in book value for NRZ mean most mortgage REITs will report gains for Q2 2022? No, absolutely not. NRZ had a materially different position than most mortgage REITs.

- Are all mortgage REITs going to die? No, that’s stupid.

- How many of the ones we covered went out of business during the pandemic? None.

- Is this environment worse? No.

- Is this like the Great Recession? No.

- Are home prices going to get demolished? Probably not.

- Do you still think inflation will cool off (compared to 8.6%) during the second half of 2022 or first half of 2023? Yes. The current rate is not the “new normal”.

- Was this the absolute bottom for mortgage REITs? I don’t make that kind of prediction. I’m focusing on the risk/reward and many mortgage REITs and preferred shares still offer very favorable risk/reward profiles.

I think that wraps it up. Plenty of other REITs to write about, but that should do it for now. I expect NRZ was going to be the most common question if I focused on anything else in this article, so I decided to tackle it first.

The rest of the charts in this article may be self-explanatory to some investors. However, if you’d like to know more about them you’re encouraged to see our notes for the series.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

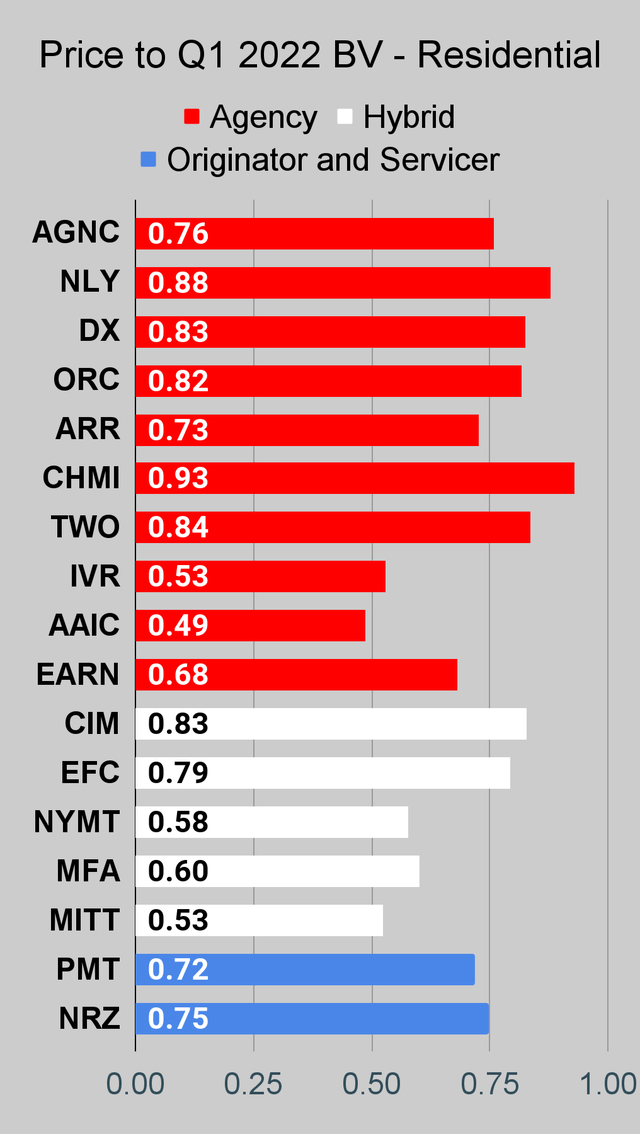

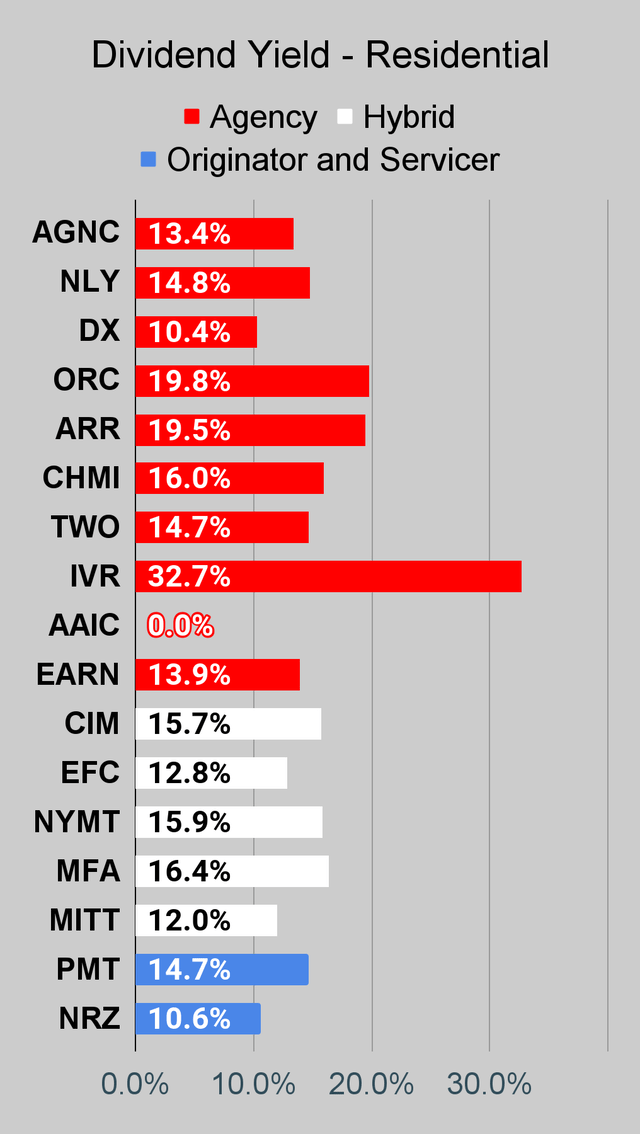

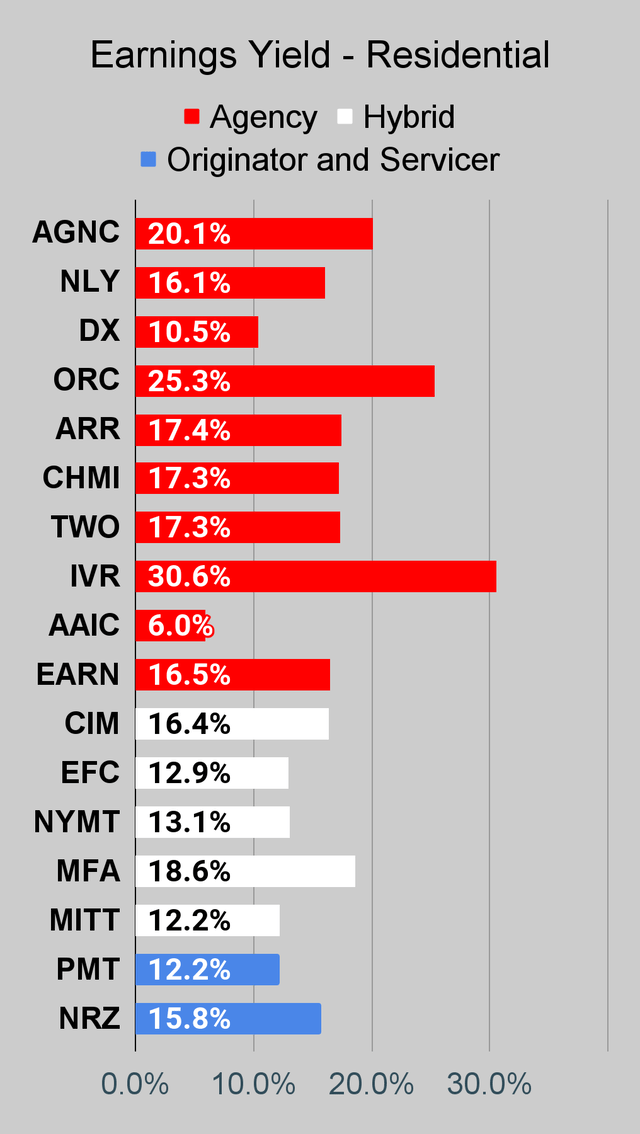

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It is available in our service, but those estimates are not included in the charts below.

The REIT Forum |

The REIT Forum |

The REIT Forum |

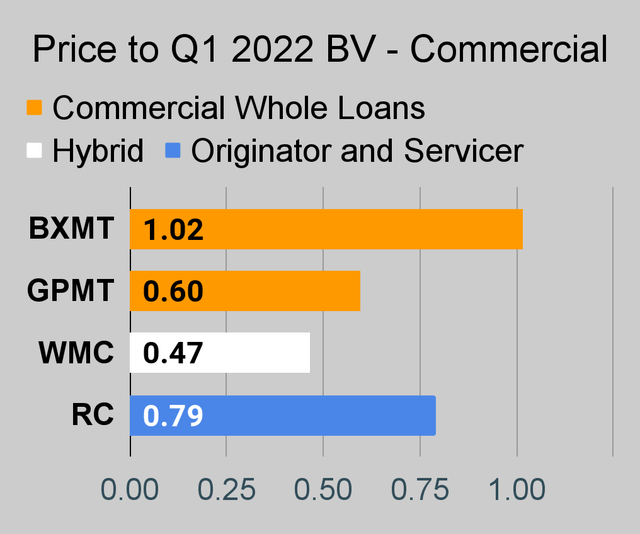

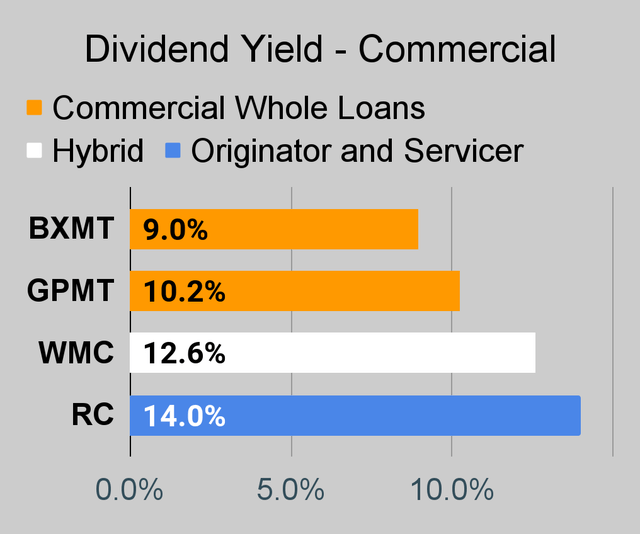

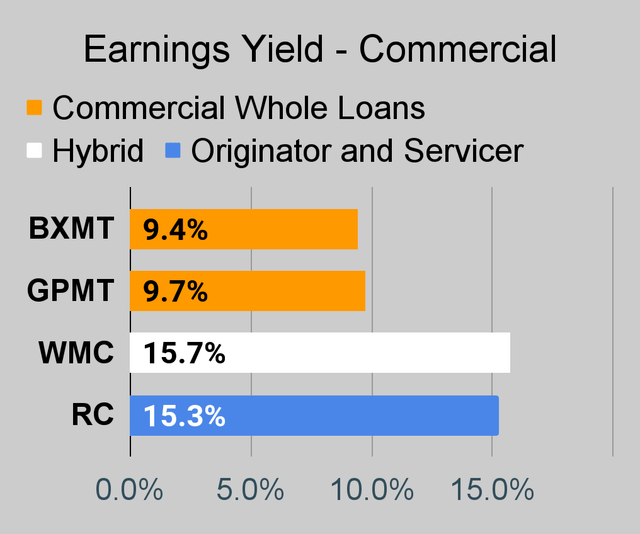

Commercial Mortgage REIT Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

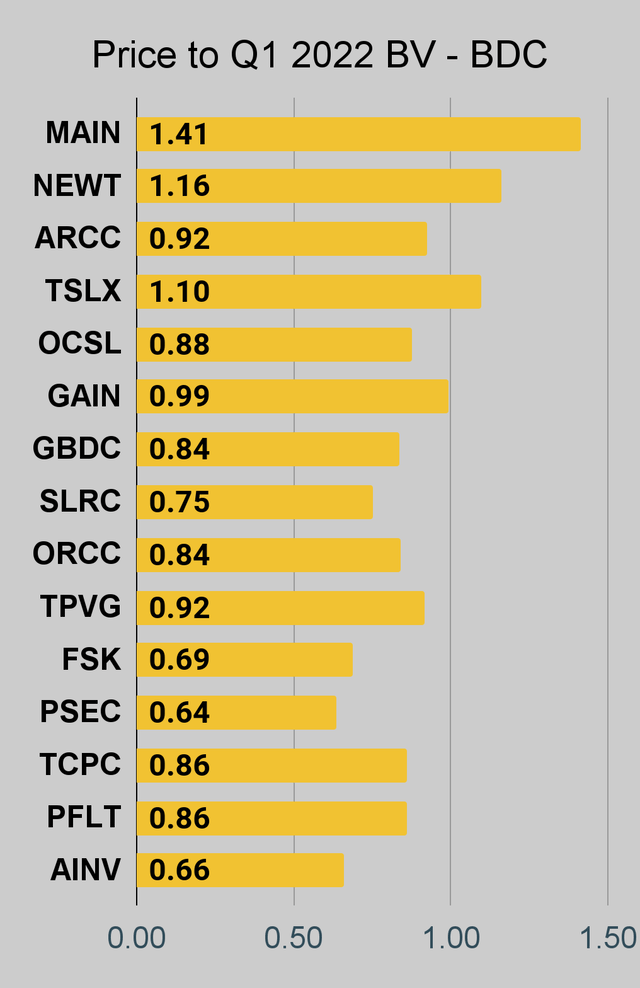

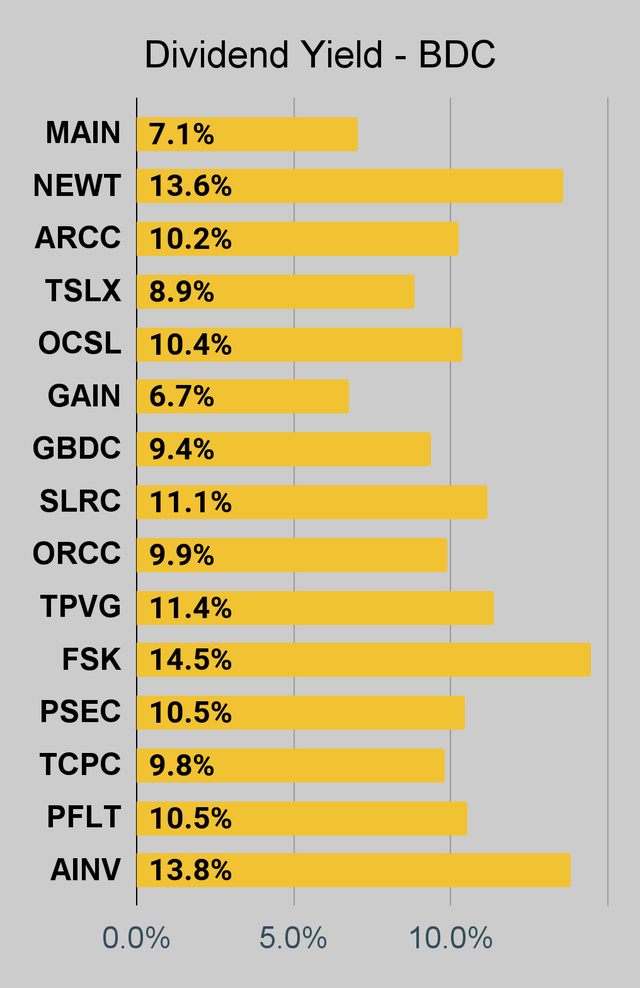

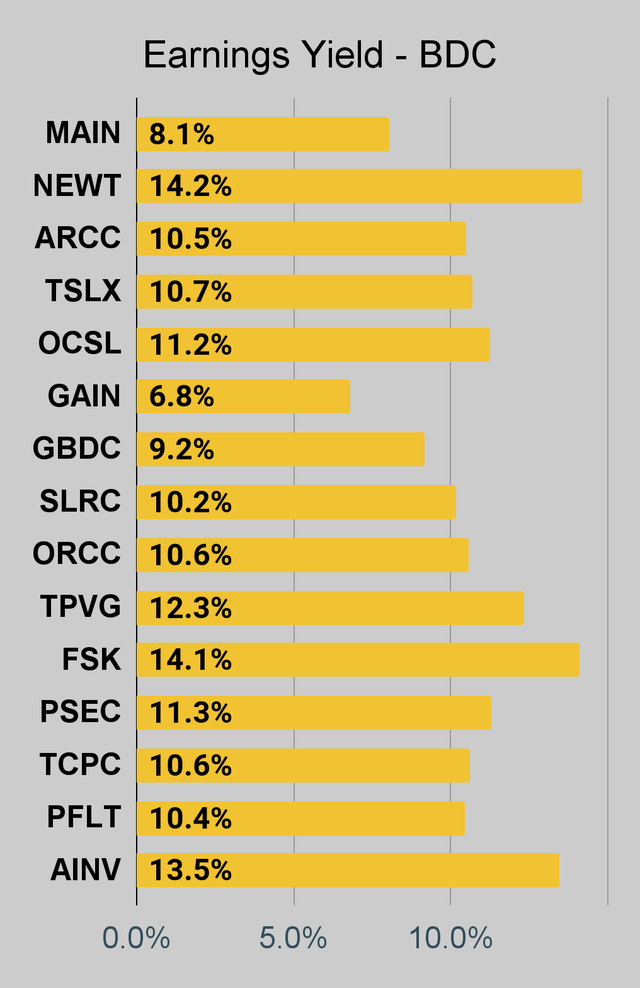

BDC Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

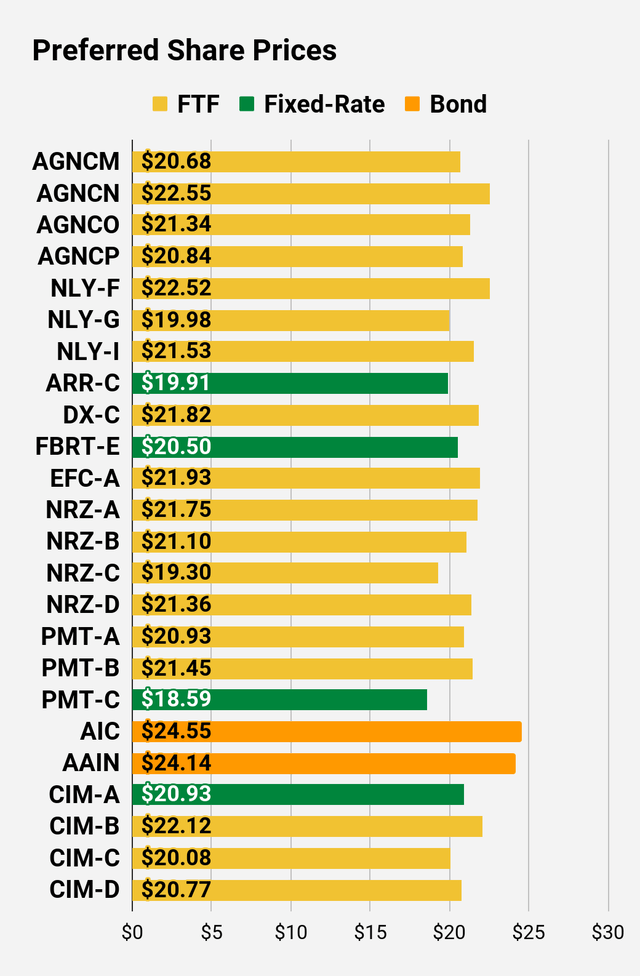

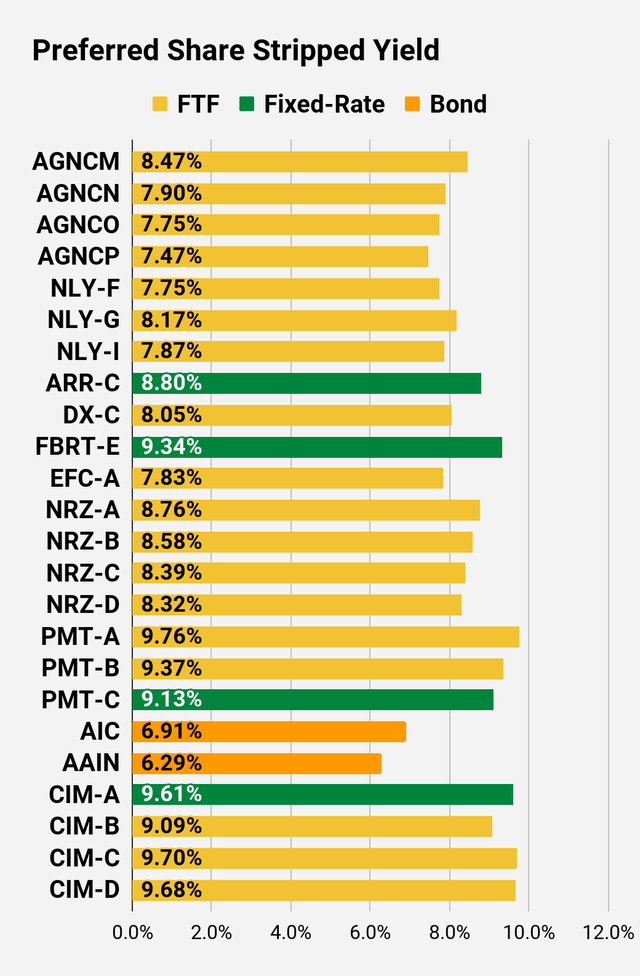

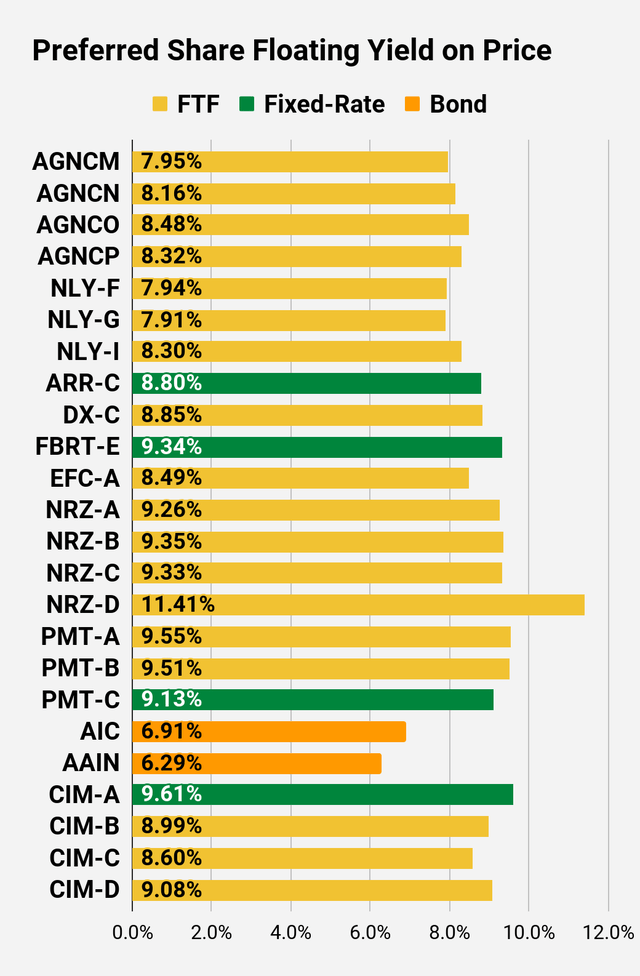

Preferred Share Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

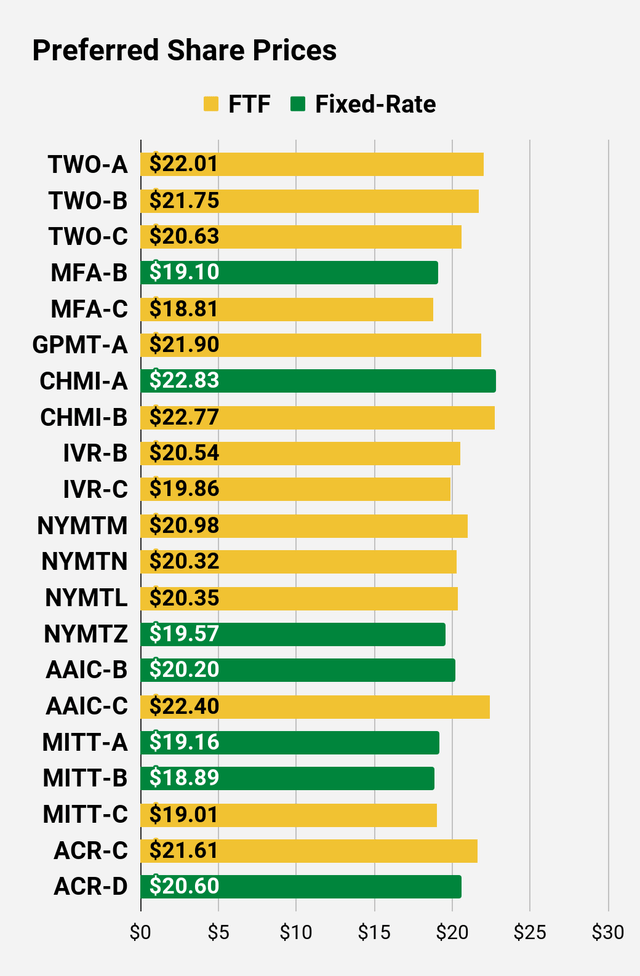

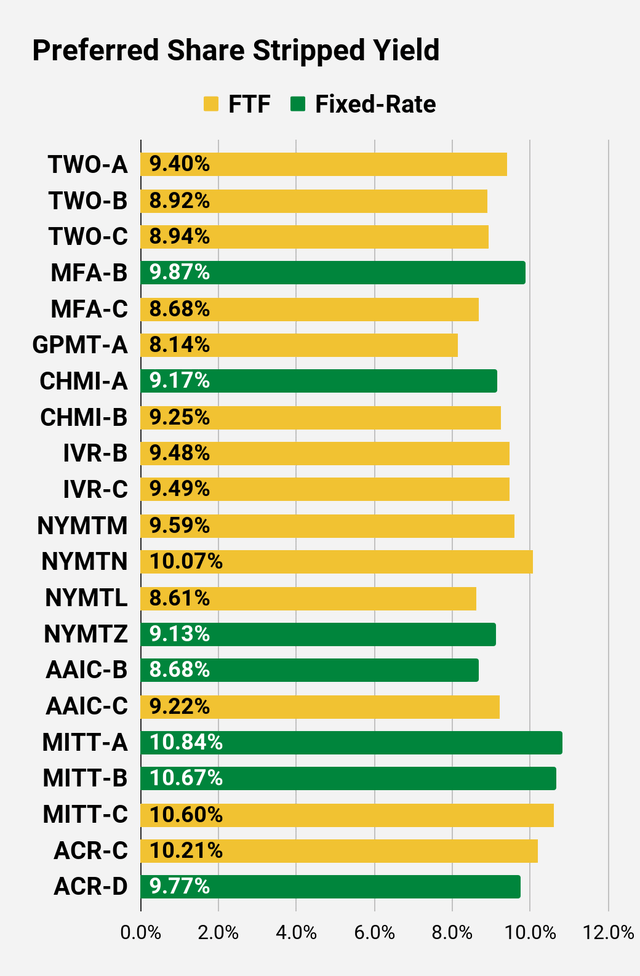

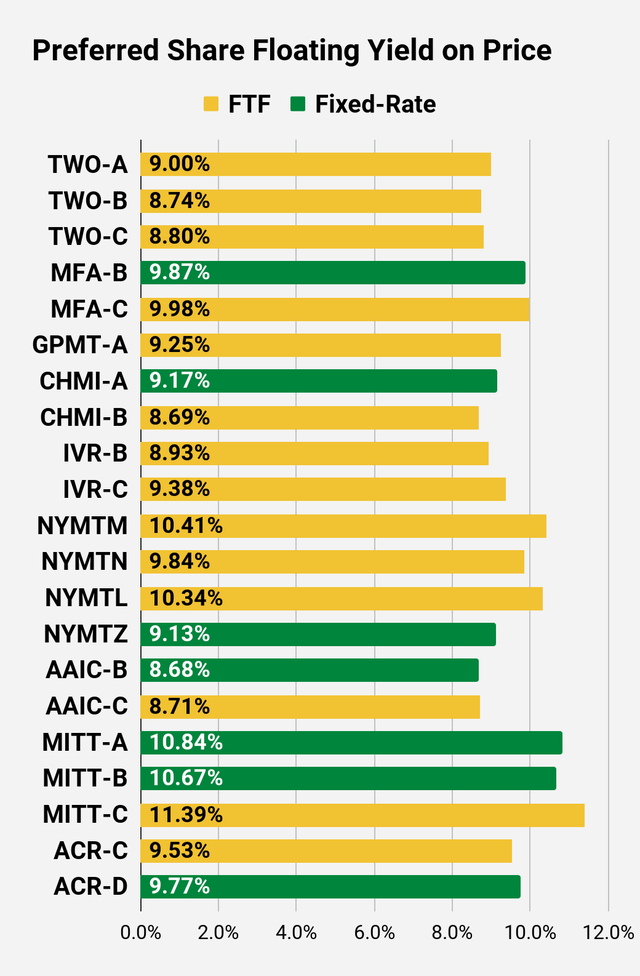

Preferred Share Data

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long-term, share prices generally revolve around book value.

- Short-term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

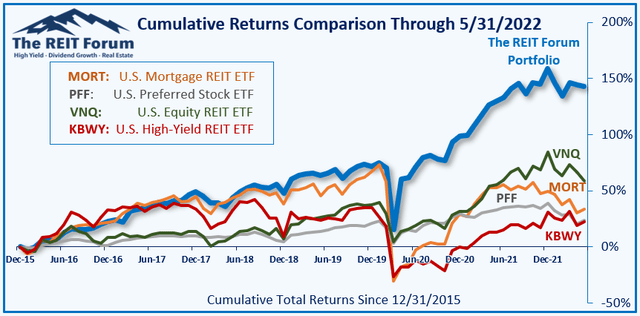

Performance

We compare our performance against 4 ETFs that investors might use for exposure to our sectors:

The 4 ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Ratings:

- Still bullish on NRZ. Not as overwhelmingly bullish as we were around $8.25, but there should still be plenty of upside from $9.40. My decision to go dramatically overweight was based on the absurdly attractive risk/reward profile of buying shares around $8.30.

Be the first to comment