Pekic

By Jeff Spiegel

Fintech Is Accelerating Digital Transformation And Benefitting As A Result

Digital Everything

Digital payment and banking solutions, as well as personal finance tools, are revolutionizing how we transact and manage our finances, while solutions geared toward the financial sector are drastically enhancing how financial institutions operate.

Fintech’s impact extends beyond the financial system, serving as both a core component and catalyst of digitalization. E-commerce, the gig economy, consumer finance, retail investing, and countless other disruptive innovations can attribute their rapid and recent growth to the fintech enablers that power them.

Amid remote business operations and stay-at-home measures, the world embraced the full gamut of fintech services and solutions. To put this into perspective, the annual value of global digital transactions grew 33% in the first year of the pandemic.1 This adoption is not only still intact but is continuing to grow, with transactions expected to reach $14.2 trillion by the end of 2022, 107% more than 2019’s pre-pandemic levels.2

While much of fintech’s growth is coming from its transformative impact in developed markets, an even larger piece of this growth, and a key area of future growth, is the formative nature of fintech for developing economies. From China to India to Eastern Europe and Africa, historical financial infrastructure is limited. As a result, solutions such as mobile payments do not have, for example, checking or credit card infrastructure to displace; in these locales, financial infrastructure is built, or is being built, digitally to begin with. This presents leapfrogging opportunities for emerging economies, as well as much needed solutions for the 1.7 billion people in the world without access to bank accounts, credit, and other essential financial services.3

With digital adoption set to continue around the world, from the transformative to the formative, we expect that future fintech could be more pervasive, benefitting related companies as a result.

Fintech Investments Can Target A Wide Range Of Products And Solutions

Digital Payments & Wallets

Payment solutions that enable the electronic exchange of money, usually over the Internet, between businesses (B2B), individuals (P2P), and businesses and consumers (B2P). Digital wallets store payment information, removing the need for physical wallets.

Fintech For Businesses

Software and platforms that optimize how businesses manage their finances, often through automation. Examples include spend management and accounting software, as well as payroll management solutions.

Digital Banking

End-to-end or specialized banking services delivered over the Internet, including digital deposits, business and consumer lending, and mortgage and insurance services.

Fintech & Banking Infrastructure

Spans a wide range of products serving traditional financial institutions and fintech firms, enabling payment processing, account linking, data transfer and processing, and underlying processes for digital banking services.

Personal Finance & Investments

Tools that help users manage their finances, typically assisting or automating budgeting, saving, and financial planning. Also includes digital platforms that offer individuals and professionals the ability to buy, sell, and/or manage investments over the Internet.

Enterprise Fintech

Software and platforms for financial institutions that streamline and/or automate operational and business processes. Examples include third party financial services software and regulatory and compliance applications.

Digital Payments And Wallets

Slim Enough To Fit Comfortably Inside Your Smartphone

Consumers and businesses are increasingly adopting digital payments and wallets as the primary way they pay each other. For consumers, the ability to pay digitally affords greater flexibility to make payments, no matter the time and setting, as well as the opportunity to dispute fraudulent charges. Consumers are embracing these benefits. In 2021, 82% of Americans reported using these technologies for browser-based or in-app online purchases, contactless in-store checkouts, and person-to-person (P2P) payments, up from 72% in 2016.4 And for businesses, digital payments mean access to more customers, increased revenues, and lower transaction costs. According to Visa, businesses that accept digital payments generate 17% more revenue and save 28% on digital transactions compared to cash ones.5

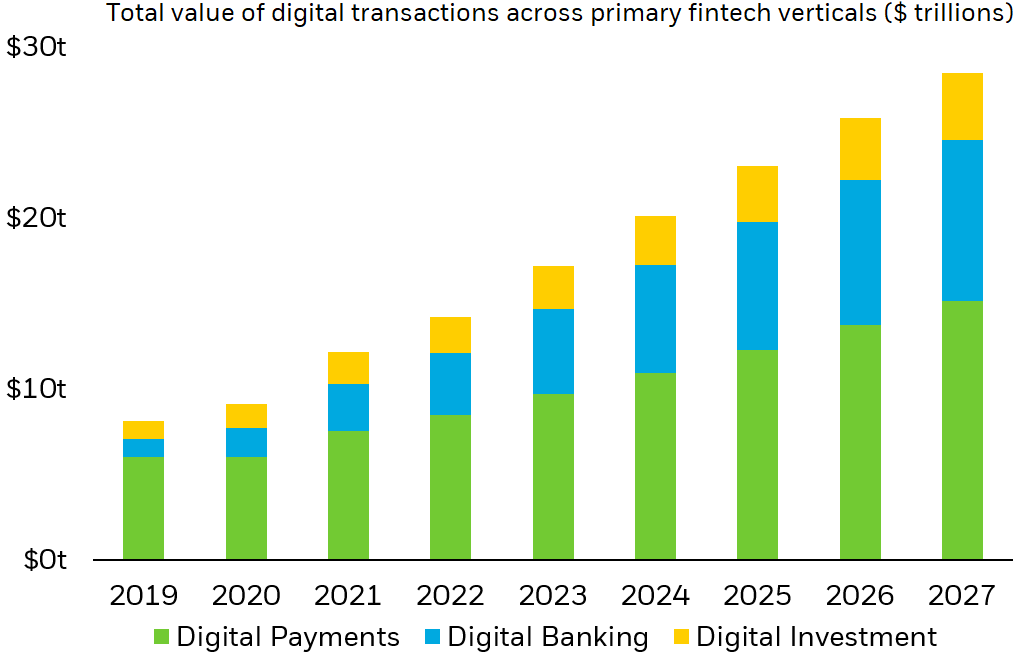

Though recent adoption is impressive, there is still room for significant growth within the category: 37% of global consumption expenditures are still paid through cash or check.6 With more transactions moving online every year, and new digital payment options like “buy now, pay later” (BNPL) seeing greater use, we expect that digital payments and wallets could capture additional market share, driving revenue growth for digital payment and wallet fintech companies. In fact, the total annual value of digital transactions is expected to grow 100% over the next five years, reaching $28.4 trillion in 2027.7

Digital transactions are expected to grow significantly across all major fintech verticals, illustrating greater adoption

Stacked column chart showing the annual total value of fintech transactions across major fintech verticals. The chart shows how, moving forward, digital payments are expected to drive significant transaction dollars, while transactions related to digital banking and investments are expected to grow and gain share. (Statista, 2022.)

Note: Digital banking = alternative (digital) financing 8: lending, neobanking; digital investment = digital investment, digital assets.

Digital Banking

No More Lines, No More Deposit Slips

Fintech innovators are driving significant disruption across the banking industry. Digital-only newcomers are challenging traditional banks for new business as incumbents struggle to modernize. These companies often offer end-to-end, a la carte, digital banking services with lower fees and simpler processes or specialize in a single services like business lending or insurance. Many customers of these firms prefer their user-friendly and specialized platforms as compared to the complexities of full-service banking providers who have been slow to adapt.

As a result, adoption of these technologies is surging. Digital banks’ share of primary banking relationships is up 80% since 2019, today representing 21% of all relationships.8 Moreover, 80% of people prefer online banking over visiting a brick-and-mortar establishment, while 59% of millennials will switch or have already switched to digital-only banking.9 Beyond capturing existing market share, digital banks can expand the reach of financial services to unserved populations. As a core fintech service, digital banking presents an opportunity to connect the unbanked to the global financial system and empower them financially.

Personal Finance And Investments

So Much More Than Memes

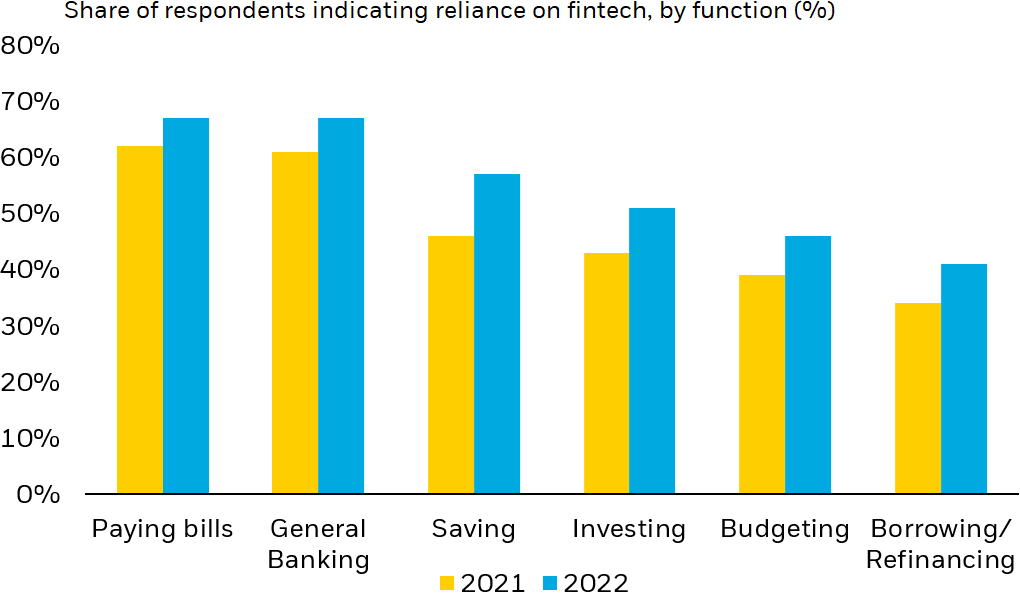

Fintech also includes solutions for managing personal and business finances. Individuals are increasingly looking to these tools to manage and grow their wealth, and to great effect. Last year in the US, the share of people’s money managed digitally jumped 10%, reaching 65%, while trades initiated by individual investors grew to 25% of all equity trading volumes, up from the 10-15% range experienced in the 2010s.10,11 Among those using these tools, 70% report greater overall confidence around their finances and approximately 90% plan on adopting additional products for saving, budgeting, and investing.12

Individuals are increasingly relying on fintech to improve financial wellness

Clustered column chart the share of Plaid survey respondents’ indicated reliance on financial technology for a range of functions. The chart shows how fintech users are increasingly relying on fintech to provide key financial services (Plaid, 2021)

Note: Survey conducted by Plaid from 7/6-7/20/2021, n = 2,000 US consumers; Some survey questions simplified for illustration, saving = “starting a savings habit, saving more of my money,” budgeting =”making & sticking to a budget,” borrowing/refinancing = “securing or refinancing a loan,” general banking = “banking.”

Fintech For Business

Do Accountants Dream Of Electronic Software Innovation?

Businesses are also using fintech to manage their finances. Innovative new offerings, driven by artificial intelligence and machine learning across spending management, accounting software and payroll management solutions are seeing heighted adoption as firms adapt to the virtualized nature of the post-pandemic world – a catalyst to be sure, but efficiencies and cost savings are the true drivers. That is why global business spending application sales, for example, are expected to reach $31 billion by 2029, growing at a 10.5% compound annual growth rate (CAGR) over the coming years, while accounting software sales are expected to reach $70 billion by 2030, growing at a 20% CAGR.13,14

Fintech And Banking Infrastructure

The picks and shovels for an entirely different kind of gold rush

Many point to the transatlantic cable as the first true instance of transformative fintech – enabling the first electronic fund transfer and making it possible to transact over long distances.15 Beyond the products and services that are disrupting how consumers and businesses interact with money, today’s fintech innovations include less visible, but equally powerful, technologies rewiring and optimizing global financial systems. Digital banks, payments, and platforms that provide investment, insurance, and consumer finance services require significant infrastructure to operate, relying on systems and applications that can dependably process and handle transactions and customer data.

Payment processing platforms, for example, are essential to ensuring successful digital transactions. They connect payments companies to check clearing and settlement systems and offer the ability to track money movement in real time. Equally important, data transfer networks make it possible to directly connect to customers’ bank accounts and are vital to processing and transmitting consumer data. Finally, a variety of solutions can use this data to deliver vital supporting functions like fraud prevention, risk management and underwriting. With digital payment and banking services expected to grow in the coming years, we believe fintech companies that provide the infrastructure solutions underpinning these services could experience significant revenue growth in turn.

Enterprise Fintech Innovators

To Boldly Go Where No Financial Institution Has Gone Before

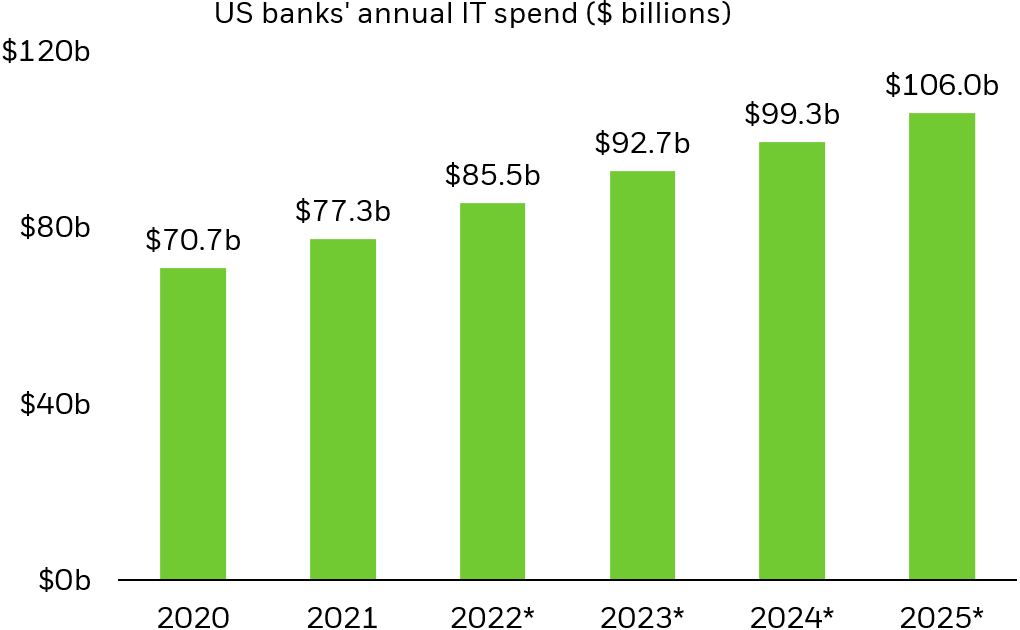

Enterprise fintech software is rapidly becoming a key priority for financial firms. Legacy IT systems are extremely costly to maintain and present meaningful risk, while new systems are expensive to implement and subject to future obsolescence. Enterprise fintech, or outsourced fintech solutions, can address this without subjecting companies to either option. For example, zero-code software platforms, which allow companies to integrate financial software without the need for their own coding, can deliver complex custom applications and systems for financial companies that can be easily deployed and integrated. Currently representing an $18 billion market, outsourced fintech software is expected to capture $26 billion in revenues by 2025, growing at a 10% CAGR from 2021.16

IT spending among banks is expected to grow significantly. Enterprise fintech solutions could capture much of this market

Column chart showing expected annual IT spending among US banks in billions of dollars. The chart shows the significant market size enterprise fintech solutions could capture through disruption (Insider Intelligence, March 2022)

*Forecast

How To Invest In Fintech Stocks

Regtech, or regulatory technology, is a particularly fast-growing enterprise fintech vertical. It encompasses solutions that improve or automate regulatory and compliance processes. Operating in one of the most regulated industries, financial firms dedicate significant time and resources to fulfill their regulatory obligations. As a result, errors can lead to financially damaging penalties. Regtech offers an effective means of mitigating this risk and is fast becoming a key priority for financial operators – but is only one of the many examples in which fintech is helping financial services players streamline processes while simultaneously reducing costs and risk.

Investors looking for exposure to fintech via public equities may want to consider ETFs that invest in fintech companies across the full spectrum of fintech solutions.

The breadth and scale of fintech makes it unique as a theme. The sub-themes in this paper – from payments to banking to enterprise fintech – have truly different players, not to mention barriers to entry, technology, and regulatory regimes. Moreover, these sub-themes themselves are multifaceted: for example, personal finance solutions encompass accounting, investing and budgeting, each of which has a range of diversified and specialized fintech innovators. So, we believe investors may want to consider investments that can rotate across fintech sub-themes, add new ones, and seek to uncover not just disruptors but also the nimbler, better-prepared incumbents who are positioned to have the greatest growth potential amidst the overall theme’s rise.

Conclusion

We expect fintech to become increasingly important as the boundaries of the digital and physical worlds blur further. Fintech offers the ability to move seamlessly between these worlds by unifying our digital and physical wallets and identities, facilitating commerce and economic activity. We expect this potential to translate to immense revenues for fintech stocks – the global fintech market is expected to reach $332.5 billion by 2028, representing a 20% CAGR from 2021’s $112.5 billion market.17 Therefore, investors looking for opportunities in fintech may want to consider ETFs that provide exposure across the fintech value chain.

© 2022 BlackRock, Inc. All rights reserved.

1 Plaid, “The Fintech Effect” 2021 Fintech Report.

2 Statista, “Digital Markets: Fintech – Transaction Value,” 2022.

3 The World Bank, “The Global Findex Database 2021.”

4 McKinsey & Company, “New trends in US consumer digital payments,” October 2021.

5 Visa, “Every business global, every payment digital,” October 2021.

6 Barclays, The transition to cash-light societies, June 25, 2020.

7 Statista, “Digital Markets: Fintech – Transaction Value,” 2022.

8 PwC, “PwC’s 2021 Digital Banking Consumer Survey,” 2021.

9 Juniper Research, “DIGITAL BANKING: MARKET FORECASTS FOR BANKING-AS-A-SERVICE, OPEN BANKING & DIGITAL TRANSFORMATION 2021-2026,” July 2021.

10 Plaid, “The Fintech Effect: Fintech’s mass adoption moment,” October 2021.

11 BNY Mellon, “The Rise of Retail Traders,” 2021.

12 Plaid, “The Fintech Effect: Fintech’s mass adoption moment,” October 2021.

13 Data Bridge Market Research, “Global Business Spend Software Market – Industry Trends and Forecast to 2029,” April 2022.

14 Allied Market Research, “Accounting Software Market,” April 2022.

15 The Payments Association, “Fintech: The History and Future of Financial Technology,” October 2020.

16 Temenos, “Capital Markets Day,” February 2022.

17 Vantage Market Research, “Insights on the $332.5 Bn Fintech Market is Expected to Grow at a CAGR of over 19.8% During 2022-2028,” May 2022.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Performance of companies in the financials sector may be adversely impacted by many factors, including, among others, government regulations, economic conditions, credit rating downgrades, changes in interest rates, and decreased liquidity in credit markets.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technology companies may be subject to severe competition and product obsolescence.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0822U/S-2382727

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment