Obradovic

ESAB Corporation (NYSE:NYSE:ESAB) is one of the market leaders in welding and cutting equipment. As a recent spinoff, the stock is valued well below its main rival despite a similar level of profitability. Extrapolation of its steady historical operational performance presents the stock as attractively priced. However, if a global recession hits the earnings, there could be better opportunities to buy ESAB stock in the future. Meanwhile, ESAB seems to have a lot of capacity to grow its dividend.

The trend for reshoring manufacturing and reducing dependence on China could support ESAB’s business in the long term. The likely winners such as Mexico, Vietnam and Eastern Europe are well within reach of ESAB, which generates half of its sales in emerging markets. Lack of skilled labor requires the company to advance faster in its welding robotics initiative while the competition has tapped into the opportunity in greater extent.

Company overview

ESAB is a recent spinoff from Colfax, or Enovis (ENOV) as it is known today. The trading commenced in April 2022 at $50 per share. Colfax acquired ESAB in 2012 as a part of a deal to acquire Charter International. At the time, the revenue of ESAB was approximately $1.8 billion, and Colfax named ESAB as its new growth platform. Plans change, and since the spinoff Enovis is now focusing on medical technologies.

ESAB is a truly global company established in 1904 in Sweden. Today, the company employs approximately 9,300 people in six continents. In 2021, the revenue was $2.4 billion. Although the main brand of the company is ESAB, its portfolio includes several regional brands.

ESAB manufactures welding, cutting, and gas control equipment and various consumables and accessories that welders need to get a job done. The company aims to grow by welding robotics, digital and software sales and continuous introduction of new products.

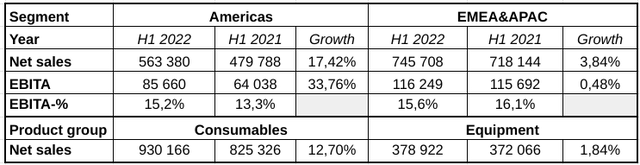

The company performed well in the first half of the year, posting great growth, especially in the Americas segment and consumables. The struggling Europe and modest new equipment sales growth could be the first signs of a slowdown.

H1 performance of ESAB. (10-Q, author’s own calculation)

ESAB against the competition

The welding and cutting equipment industry is a $20 billion market, according to Lincoln Electric (LECO), a key competitor of ESAB. According to ESAB, its core markets are $25 billion in size and the total addressable market (“TAM”) is around $30 billion if ESAB’s growth areas, gas control, digital solutions and welding robotics, are included. The latter segments are expected to grow faster, at a pace of 6-8% per year, compared to 2-3% expected growth for core businesses.

With a turnover of $3.2 billion, Lincoln Electric is a tough competitor. 58% of Lincoln’s sales is consumables. Lincoln is ahead of ESAB in terms of welding automation. It aims to double the automation offering sales to $1 billion by 2025. In the last three years, Lincoln’s ROIC has averaged over 20%. Geographically, Lincoln is a market leader in the USA, where it generates 57 % of its revenues.

ESAB declares itself as a market leader in all other major geographies. ESAB has entered the emerging markets early. The winning strategy has been to localize product offering, achieve the widest sales and distribution reach, and educate local welders. The long-term goal of ESAB is to reach sales of $3-3.5 billion. ESAB seeks growth and profitability through innovation and manufacturing footprint optimization. It expects to generate a significant amount of automation and digital solutions sales in the future.

ESAB plans to utilize the basic elements of the capital allocation playbook: disciplined acquisitions, organic investments to new products and aforementioned growth areas and dividend. After raising $1.2 billion of debt as a part of the spinoff arrangement, ESAB’s debt position currently stands at the higher end of its targeted range of 2-3xEBITDA.

In addition to Lincoln, another formidable competitor is Illinois Tool Works (ITW), which operates in the industry mainly under Miller and Hobart brands. ITW’s revenues in welding segment were $1.65 billion in 2021 and operating margin was 30%. Geographically, 80% of the revenues were generated in North America. ITW posts incredible operating margins for its welding unit, averaging 27% in the past six years.

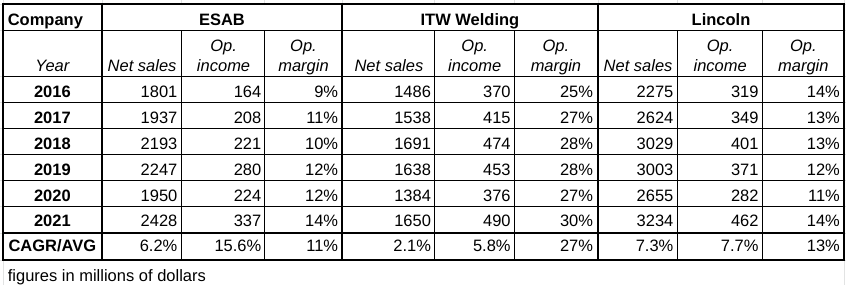

The following table presents how ESAB has fared against key competitors. Coming out of a lower profitability level, ESAB has managed to grow its operating margin faster than both Lincoln and ITW. In terms of sales growth, Lincoln has performed the best and ESAB has grown faster than ITW.

Financial performance of ESAB against its key competitors. (10-Ks, Author’s own calculation)

The stock is fairly valued if earnings growth slows down

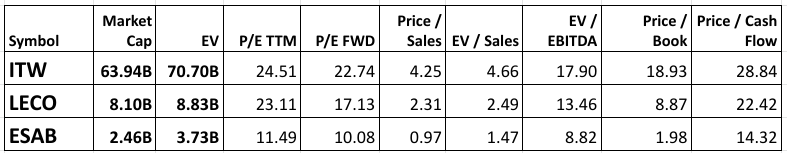

Considering its growth profile presented above, market-leading position, and strong brand, ESAB is moderately valued compared to its peers. By all multiples, ESAB is valued lower than Lincoln. The comparison to Illinois Tool Works is less relevant due to the fact that welding represents only 11% of the total sales of the company. Worth pointing out is the $210 million of free cash flow that the company is guiding for 2022, which would bring the P/FCF multiple down to 11.7.

Valuation of ESAB and its competitors. (Seeking Alpha)

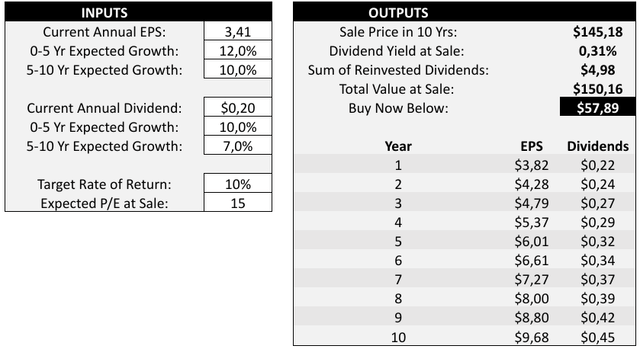

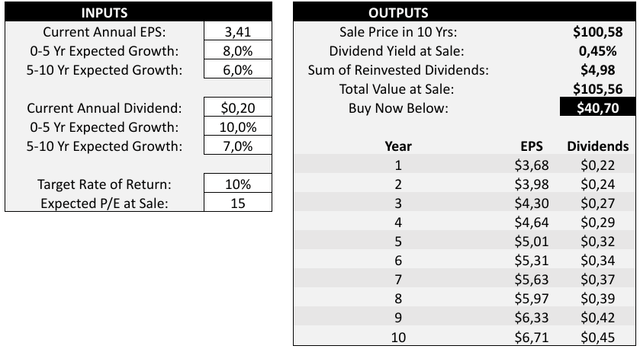

By taking the lower end of the guided revenue of $2.45 billion and applying an 8.5% net income margin realized in H1, we arrive at an EPS of $3.41 for 2022. Analyst consensus currently stands at $4, but considering the current and potential headwinds, it’s not advisable to be too optimistic.

If ESAB would continue to grow its earnings at a slightly lower pace than historically, considering, e.g., interest and independent company expenses, ESAB would grow the dividend at a similar pace than Lincoln. If valued at a multiple of 15, slightly below Lincoln, the stock would be significantly undervalued. By these assumptions, the upside would be around 40%.

Valuing the stock based on historical growth rates. (Author’s own calculation, model by Lyn Alden Schwartzer)

However, in the current macroeconomic landscape, using more cautious assumptions is justified. By lowering the EPS growth rates we can see what is priced in the stock currently. The market is expecting still rather high growth rates continuing. An EPS growth of 8% would be a great challenge in a recession, as we will see in the section below.

What is priced in the stock. (Author’s own calculation, model by Lyn Alden Schwartzer)

If leaving out the multiple expansion and using a P/E multiple of 12 or if the EPS gets halved in a case of recession and jumps back to the original level, the stock would be a buy at $33 per share.

In conclusion, the relative valuation of ESAB is attractive, but the current share price expects the earnings growth to continue at a relatively high level. Considering risks in the event of a global recession, the stock looks fairly valued at the moment.

Plenty of room to grow the dividend

ESAB recently initiated a modest dividend of $0.05. Considering the latest quarterly earnings of $0.92 per share, there’s a lot of room to grow the dividend. The current quarterly dividend translates only to a dividend yield of approximately 0.5%.

It’s likely that ESAB wants to reduce its debt position to a targeted level before committing to a higher dividend. For 2022, the company has guided to deliver $210 million of free cash flow and the current dividend is only $12.2 million annualized.

LECO has been raising its dividend for 19 years, with a five-year average growth rate of 10%. Looking at ESAB’s historical performance and fundamentals, it is difficult to argue why ESAB could not be in the beginning of its streak of dividend increases.

Currency headwinds and manufacturing slowdown pose a threat

In the last major recession year, 2009, the earnings per share of Lincoln plummeted 77%. It took two years to return to a level preceding the recession. The sales declined 30%, almost fully explained by a decrease of volumes. Consumables are recurring revenue as welding equipment companies state, but that revenue is dependent on the manufacturing volume of the industrial companies. Therefore, a major slump in the manufacturing industry would most likely hurt ESAB to a serious extent, as its business profile doesn’t differ much from Lincoln.

Another key question about consumables is the nature of them. The consumables are not proprietary, but to some degree interchangeable between different manufacturers. Additionally, there are many more producers of consumables other than the welding equipment manufacturers. However, the quality matters, and the customers who want higher welding quality use ESAB products, as stated by an interviewed welder.

Due to the fact that ESAB generates most of its revenues outside the United States, there’s a risk that currency headwinds will hit ESAB’s income statement. In the second quarter, the company increased its guidance of negative impact to 3-4%. Additionally, pulling out of Russia hurt ESAB’s top line by $40 million and adjusted EBITDA by $8 million.

To a limited degree, a potential long-term threat to welding equipment companies is 3D-printing, which enables manufacturers to produce parts without welds. Welds are the weakest point of every part manufactured, so having them removed has many advantages, from stronger parts to fewer individual parts required to be produced. Naturally, the technological shift in manufacturing is slow and unlikely to make welding obsolete.

Conclusion

If one turns his or her back to a looming risk of global recession, ESAB is an attractively priced market leader with a great dividend growth track ahead of it. Being a recent spinoff, the stock seems to get relatively little amount of attention from investors, creating an opportunity to find fairly priced securities.

Reduction of debt, increasing the dividend, and succeeding in its higher margin business opportunities are the potential catalysts driving the ESAB share price higher in the medium term. If the economy doesn’t fall into a recession, the stock is a great buy. An investor requiring a larger safety margin would initiate a position around $36 per share.

Be the first to comment