ferrantraite/E+ via Getty Images

A Quick Take On Sight Sciences

Sight Sciences, Inc. (NASDAQ:SGHT) went public in July 2021, raising approximately $240 million in gross proceeds from an IPO that was priced at $24.00 per share.

The firm is developing surgical and nonsurgical technologies for the treatment of various serious eye diseases.

SGHT continues to generate higher operating losses, a big negative in the current rising cost of capital environment.

Until management can make a meaningful turn to operating breakeven while growing revenue in a challenging reimbursement environment, I’m on Hold for SGHT.

Sight Sciences Overview

Menlo Park, California-based Sight Sciences was founded to develop eye care medical devices for widely prevalent eye diseases.

Management is headed by Co-founder, President and CEO Paul Badawi, who previously obtained a B.S. in Biological Sciences from the University of Chicago and an MBA from UCLA.

The company’s primary offerings include:

-

OMNI Surgical System – Glaucoma

-

TearCare System – Dry eye disease

-

SION – bladeless goniotomy device

The firm sells its glaucoma treatment device and dry eye disease products through ophthalmologists and optometrists.

Management estimates that there are around 40,000 optometrists and 20,000 general ophthalmologists who regularly see patients with dry eye disease in the U.S.

Sight Sciences’ Market & Competition

According to a 2020 market research report by Verified Market Research, the global market for the treatment of glaucoma was an estimated $6.9 billion in 2018 and is forecast to reach $12.7 billion by 2026.

This represents a forecast CAGR of 6.94% from 2019 to 2026.

The main drivers for this expected growth are increased prevalence of glaucoma owing to an aging of the global population.

Also, the North American region is expected to remain the largest market by demand for glaucoma treatment due to increased patient demand and better healthcare infrastructure for delivering services.

Major competitive or other industry participants include:

-

Glaukos

-

Ivantis

-

AbbVie/Allergan

-

Novartis

-

Johnson & Johnson

-

Alcon

-

Aerie Pharmaceuticals

-

Bausch and Lomb

-

MST

-

New World Medical

-

Nova Eye

-

Kala Pharmaceuticals

-

Sun Pharmaceutical Industries

-

Others

The global dry eye syndrome market was an estimated $5.2 billion in 2019 and is forecast to reach $6.5 billion by 2027, representing an expected CAGR of 4.7% from 2020 to 2027, according to a report by Fortune Business Insights.

Sight Sciences’ Recent Financial Performance

-

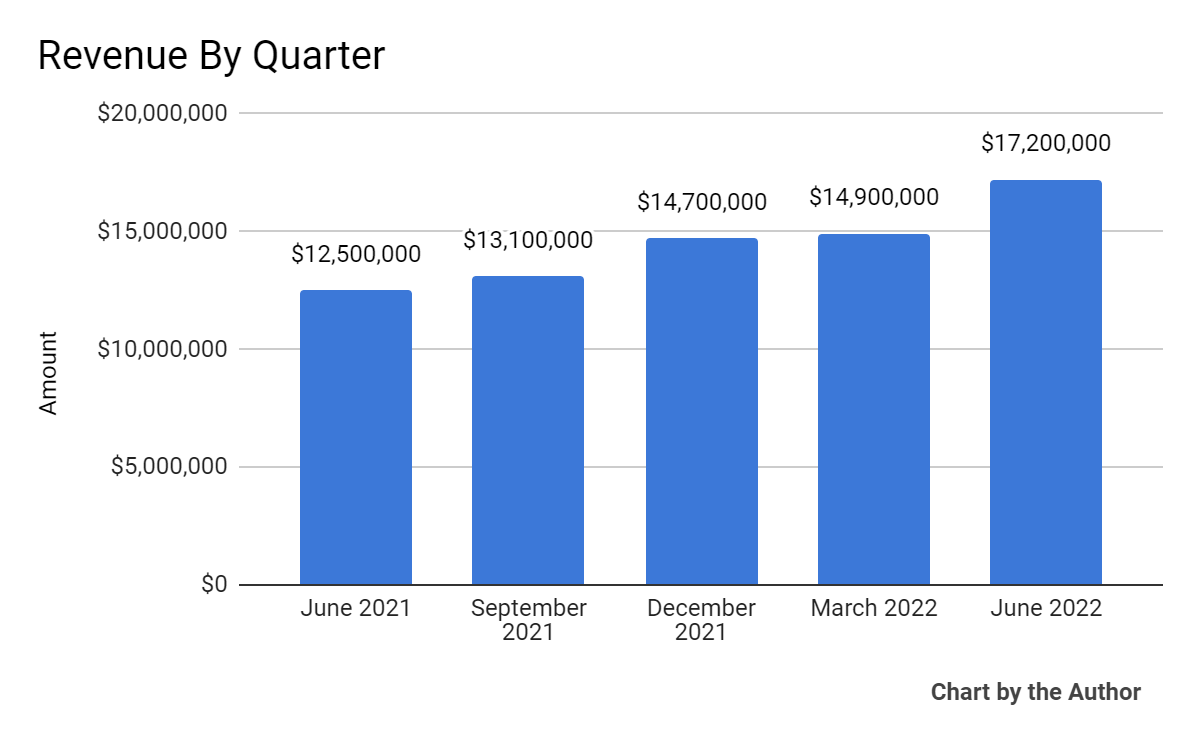

Total revenue by quarter has risen in the past 4 quarters, as shown in the chart below:

5 Quarter Total Revenue (Seeking Alpha)

-

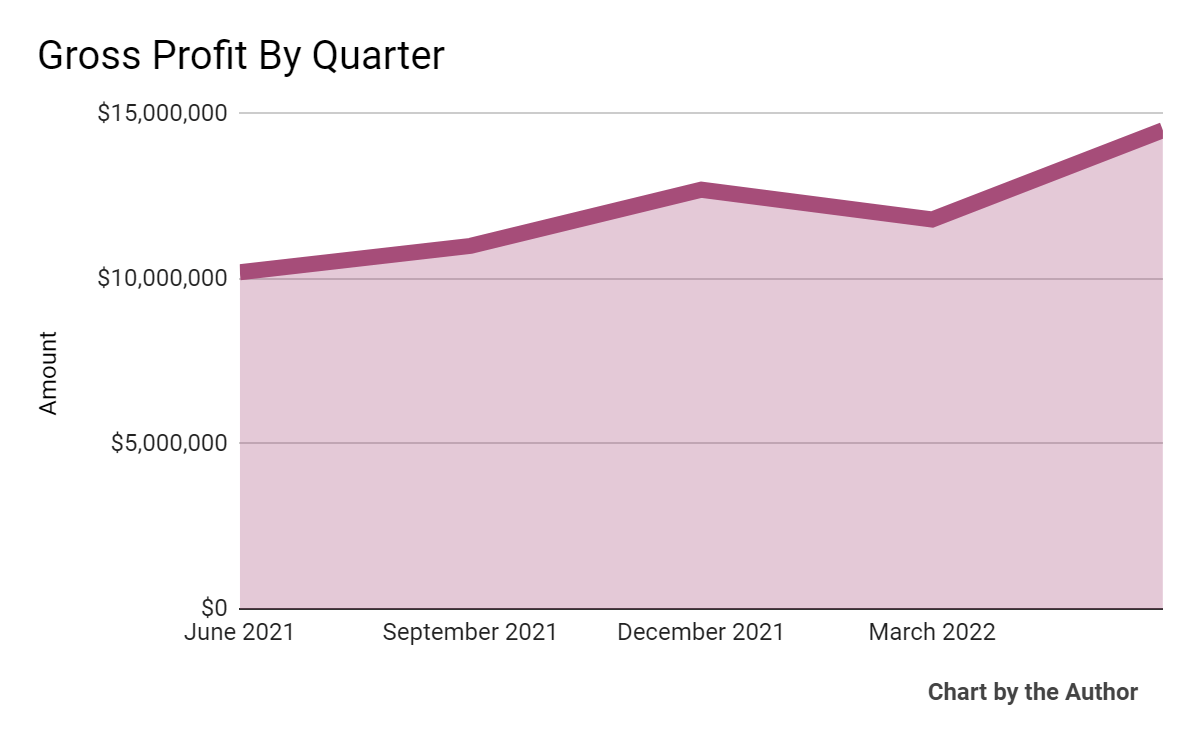

Gross profit by quarter has also grown, although unevenly:

5 Quarter Gross Profit (Seeking Alpha)

-

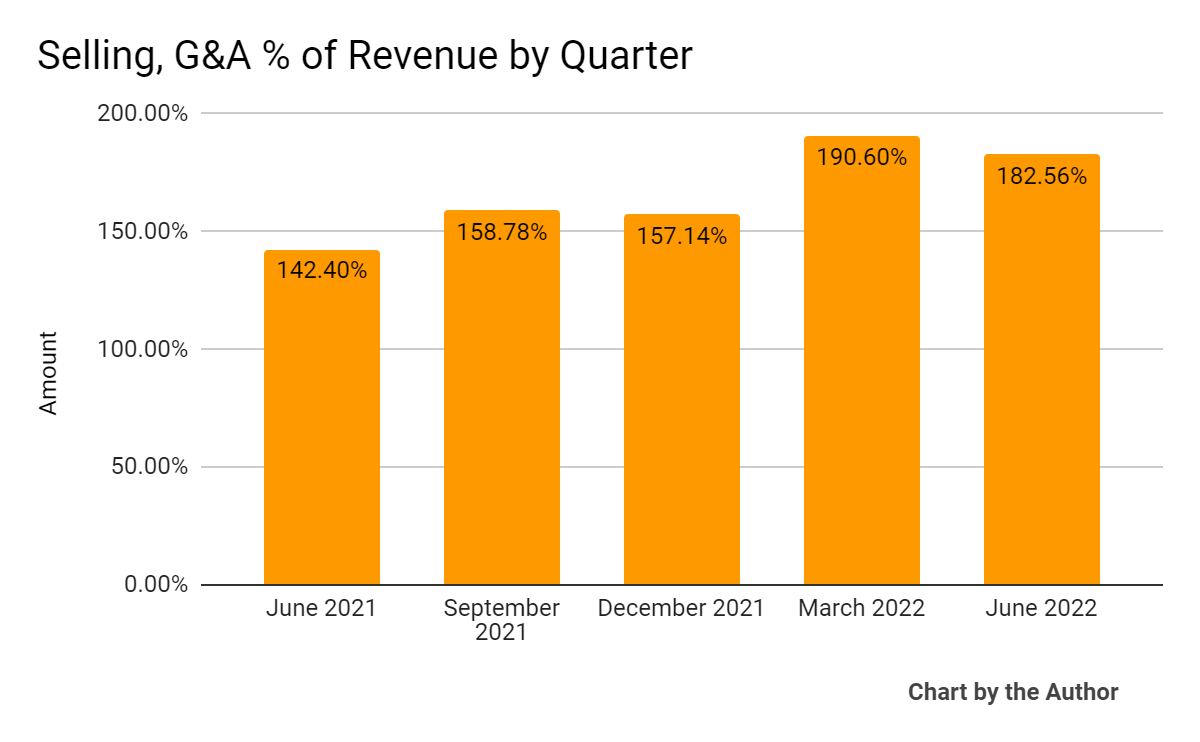

Selling, G&A expenses as a percentage of total revenue by quarter have remained high and well above revenue:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

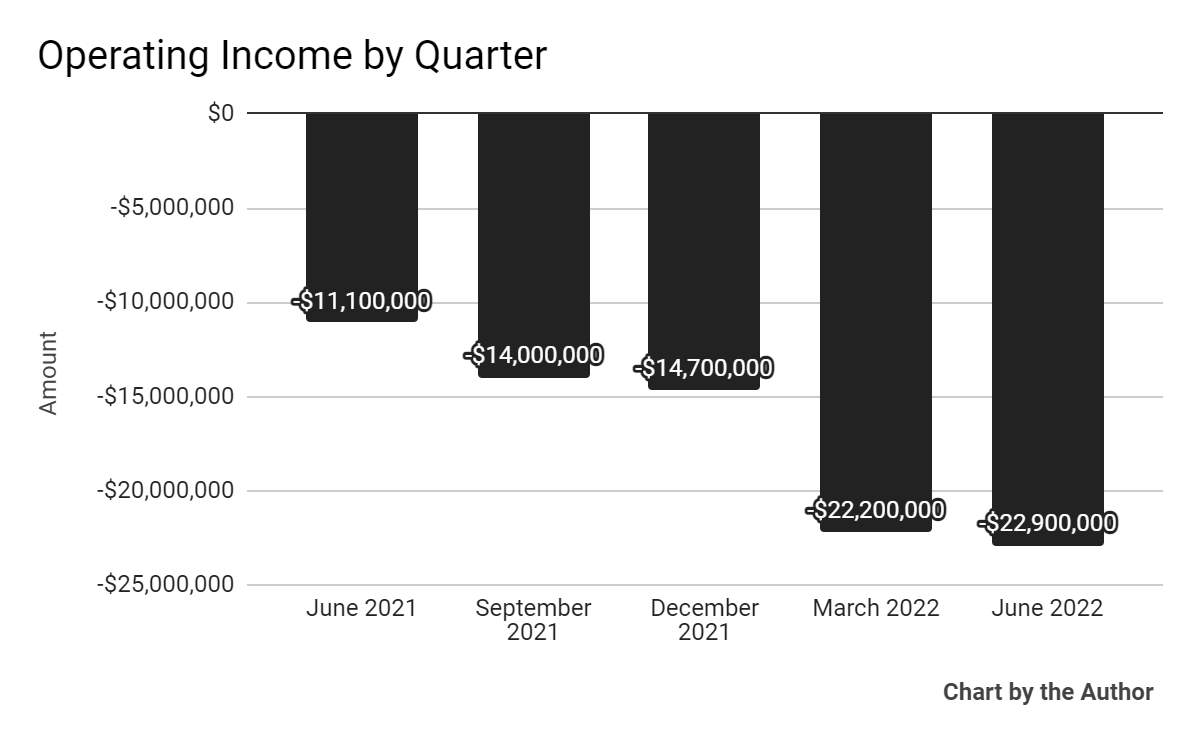

Operating losses by quarter have worsened as shown here:

5 Quarter Operating Income (Seeking Alpha)

-

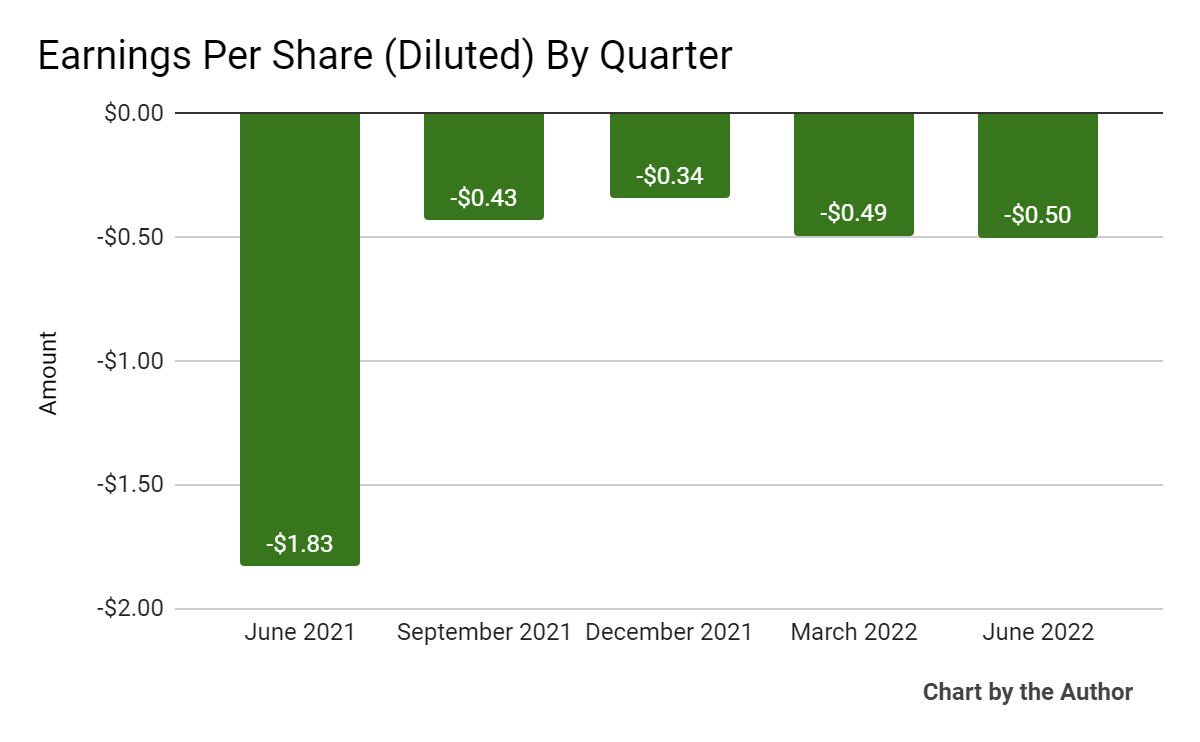

Earnings per share (Diluted) have also produced increasingly negative results in recent reporting periods:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

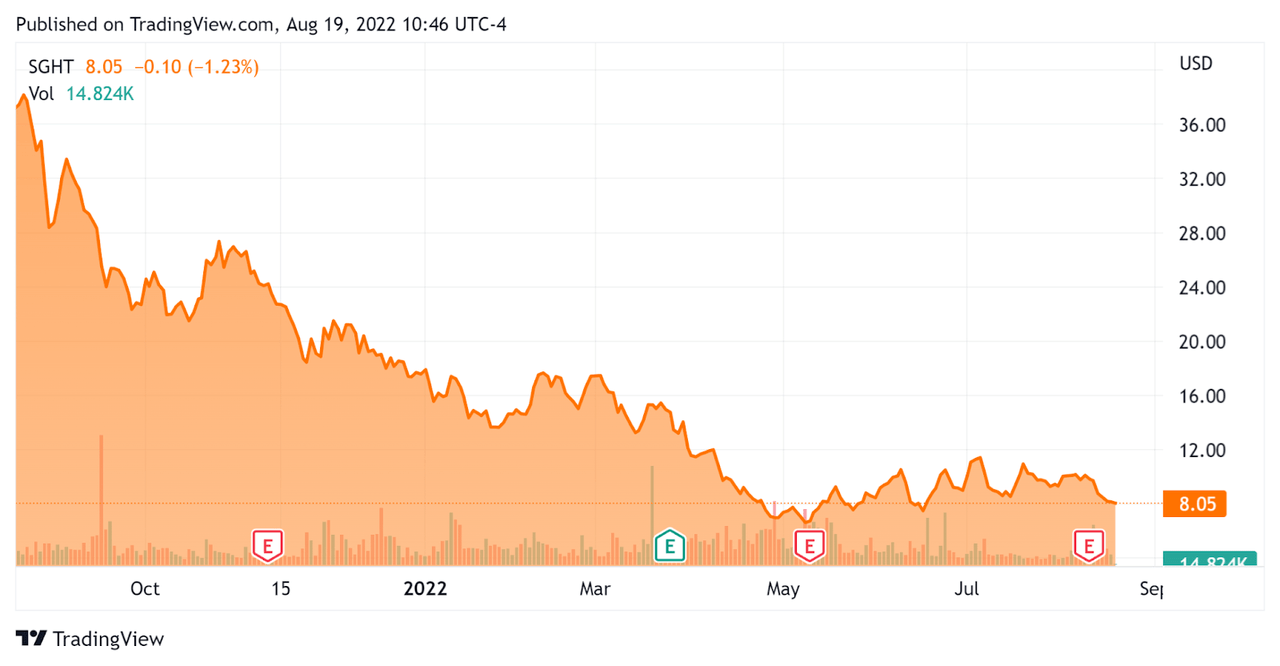

In the past 12 months, SGHT’s stock price has dropped 78.5% vs. the U.S. S&P 500 Index’s drop of around 3.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Sight Sciences

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value |

$203,980,000 |

|

Market Capitalization |

$389,780,000 |

|

Enterprise Value/Sales |

3.41 |

|

Revenue Growth Rate |

54.3% |

|

Operating Cash Flow |

-$67,510,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.76 |

|

Net Income Margin |

-133.9% |

(Source – Seeking Alpha)

Commentary On Sight Sciences

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the prominence of its solution in the microinvasive glaucoma surgery market.

The company is seeking to grow adoption of its OMNI system within the existing combination cataract segment as well as ‘pioneering the $4 billion US market for standalone MIGS.’

This expanded focus may be a result of increasing competition in its primary market from new market entrants creating “confusion in the marketplace.”

Also, the firm has seen reduced Medicare payments for its reimbursement code, from $950 in 2021 to $750 in 2022 and ultimately to $600 in 2023, a significant deterioration.

As to its financial results, topline revenue grew 37% year-over-year and gross margin rose to 84% from 82% last year.

Notably, management says that the growth in surgeons trained in its product is a key leading indicator for growth in product sales and the company has trained 2,000 surgeons on OMNI while it cites a Market Scope report that ‘over 5,600 US surgeons perform MIGS procedures,’ so the company has some runway ahead.

However, operating losses have worsened markedly in the two most recent quarters, rising 75% year-over-year in part due to investment in headcount for growth purposes and increasing stock-based compensation, diluting shareholders in the process.

R&D also rose as the company continued its development and commercialization efforts, including soft launching its SION device this month and expected to more formally launch in Q4 2022.

For the balance sheet, the firm finished the quarter with $220.1 million of cash and equivalents and $33 million of long-term debt.

Looking ahead, management guided topline revenue growth to 43% over 2021 at the midpoint of the range.

Regarding valuation, the market is valuing SGHT at an EV/Revenue multiple of 3.4x, which is below the Healthcare Equipment sector median of 15.5x. The Health Care sector on Seeking Alpha consists of a variety of large and medium-sized equipment companies in the U.S.

The primary risk to the company’s outlook is the dropping reimbursement rates for its OMNI system.

A potential upside catalyst to the stock could include strong uptake of its new SION system once it is fully launched in Q4 2022.

In the interim, the company continues to generate higher operating losses, a negative in the current rising cost of capital environment.

Until management can make a meaningful turn to operating breakeven while growing revenue in a challenging reimbursement environment, I’m on Hold for SGHT.

Be the first to comment