DNY59

Thesis

Fed Chair Jerome Powell delivered a hawkish, direct, yet hopeful message for the market and investors. Notwithstanding, the market reacted appropriately to the FOMC’s intentions to keep financial conditions tight, allowing the Fed’s message to be heard loud and clear.

Terminal rates projections on the Fed Fund rates (FFR) have also moved to 5.1%, up slightly from 5% previously. As a result, 2Y bond yields (4.63%) crept up higher toward their October highs (4.64%) as the market adjusted to the Fed’s messaging about a higher terminal rate than it had previously expected.

The concomitant selloff in the markets yesterday (SPX: -2.5%, DJI: -1.55%, NDX: -3.39%) was appropriate to reflect the increased likelihood of a severe recession, given the Fed’s expectation of a higher terminal rate.

Notwithstanding, we believe Powell performed admirably in yesterday’s press conference. He articulated that while the Fed would rather err on the side of caution (i.e., to overtighten), Powell & team could “use [their] tools strongly to support the economy” if necessary.

Hence, we postulate that the Fed remains focused on combating inflation expeditiously as its first priority and is also concerned about sparking a severe recession (which we highlighted as a critical risk previously) in the process.

As a result, we believe that the reward-to-risk profile at the current levels has likely reflected our mild-to-moderate base recessionary scenario (articulated in a recent article).

We discuss the critical levels for investors to watch, with the sharp pullback from yesterday’s selloff offering brave investors another opportunity to add exposure.

Pivot? Not So Soon, But That’s Ok

We highlighted in our November 1 update to our members that “no pivot is expected from the Fed tomorrow.” We discussed why the price action in the bond yields demonstrated that the market had not anticipated a pivot from the Fed, even as the markets recovered from their October lows.

Therefore, Powell’s commentary that the Fed wasn’t planning on a dovish pivot anytime soon wasn’t surprising to us. However, that wasn’t a deal breaker for us because Powell behaved according to what the bond market had anticipated.

What’s more important is where the FOMC sees the terminal rate moving ahead. Hence, Powell’s commentary suggests that its expectations on the terminal rate needed to be revised upward, as tight labor market conditions remain a critical concern.

However, he left some hope that we could be close to the end of its record hiking cadence, with possibly two more hikes moving forward. Therefore, the Fed’s messaging indicates that it potentially sees another hike in early 2023 after the subsequent one in December, before the Fed moves into “data dependency mode.”

It’s still too early to suggest whether December’s hike would be 50 bps or 75 bps before the release of October’s CPI print on November 10. However, we believe that could be another potential opportunity for market volatility as the current consensus of an 8.1% YoY growth could be too optimistic.

The current Cleveland Fed forecasts suggest an 8.2% print, in line with September’s 8.2% growth. Moreover, core inflation (6.64%) is also projected to be higher than September’s 6.6% growth. Therefore, it’s pretty straightforward to understand why Powell needs to get this right to douse cold water on the bulls before they get overly excited, like in August.

However, that also means that the pullback ahead of the CPI release could help to de-risk the entry levels further and position the markets appropriately for negative surprises.

The Market’s Reward-To-Risk Still Points Up From Here

Analysts’ estimates for the S&P 500 have continued to come down further through October. As a result, the NTM P/E moved upward to 16.7x at the end of last week, given the rally from its October lows.

This week’s selloff has moderated SPX’s NTM P/E back to 16.1x, ahead of its October lows of about 15x (with higher earnings estimates then). However, with the Fed still hawkish, we urge investors to consider adding more positions below 15-16x earnings to de-risk their entry levels.

Moreover, the Fed is expected to keep rates higher for an extended period until inflation normalizes decisively. Hence, buying on pullbacks (where you get a lower P/E) is more appropriate than chasing momentum surges.

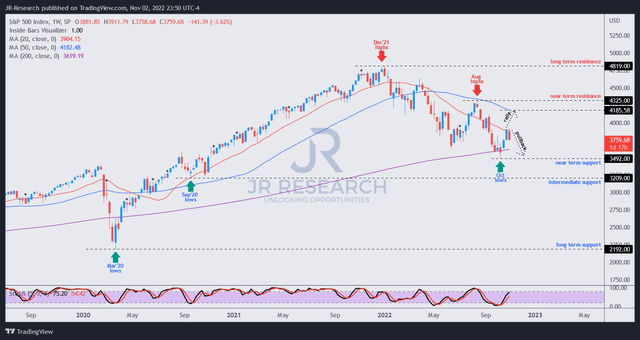

S&P 500 price chart (weekly) (TradingView)

Investors expecting a quick return to August highs could be sorely disappointed. Equity risk premiums have risen sharply. Coupled with the Fed’s hawkish stance, we postulate that the market would not likely re-rate the SPX to levels in August in the near term, as earnings estimates could fall further.

Q3 earnings on the S&P 500 companies (ex-energy) have shown that earnings have continued to fall on YoY terms for the second consecutive quarter, with Q3’s earnings (ex-energy) down 5.1%. Hence, we expect analysts to continue revising their projections downward to reflect the increasing risks of a severe recession.

As such, August’s levels implying a NTM P/E of 18.5x for the S&P 500 are not likely until we see a decisive downward shift in bond yields. For now, we have yet to glean such a move, with momentum still firmly in the clutches of bond sellers. While we believe a mean reversion move would likely occur given the massive battering in the bond markets, it’s premature to call for one, given the price action observed.

As such, investors should be more circumspect with the market analysis and consider adding more positions below a forward P/E of 15-16x.

Accordingly, we view the current pullback as constructive and see reduced entry risks, favoring a better reward-to-risk for investors who didn’t chase the recent rally.

Be the first to comment