Paul Zimmerman

Investment Thesis

Etsy, Inc. (NASDAQ:ETSY) is a leading ecommerce marketplace with a mission to “Keep Commerce Human.” The company operates a two-sided marketplace connecting millions of passionate and creative buyers and sellers around the world. Its global primary marketplace, Etsy.com, is home to unique goods made by independent sellers.

Etsy Q3’22 Earnings Presentation

Outside of its core Etsy marketplace, the company also owns three other marketplaces that make up its “House of Brands.” These include Reverb, a marketplace for buying and selling used and new musical instruments; Depop, a fashion-focused marketplace for buying and selling clothes; and Elo7, which can be thought of as the Etsy of Brazil.

Etsy July 2022 Investor Presentation

It’s a fairly straightforward business to understand. Etsy is a marketplace connecting buyers and sellers, and the company itself takes a “commission” (Marketplace revenue) whilst also upselling additional services to the sellers on its platform (Services revenue).

Marketplace revenue includes listing fees, transaction fees, and a payments platform, whereas the optional Services revenues include advertising, shipping labels, and other additional services. In the first 9 months of 2022, Marketplace revenue accounted for 74% of Etsy’s total revenue, with Services revenue making up the remaining 26%.

Like many ecommerce businesses, the past two years have been a rollercoaster. Etsy saw its sales shoot up during the pandemic, when lockdowns resulted in a huge boost for ecommerce, but this boost for the ecommerce industry didn’t last very long.

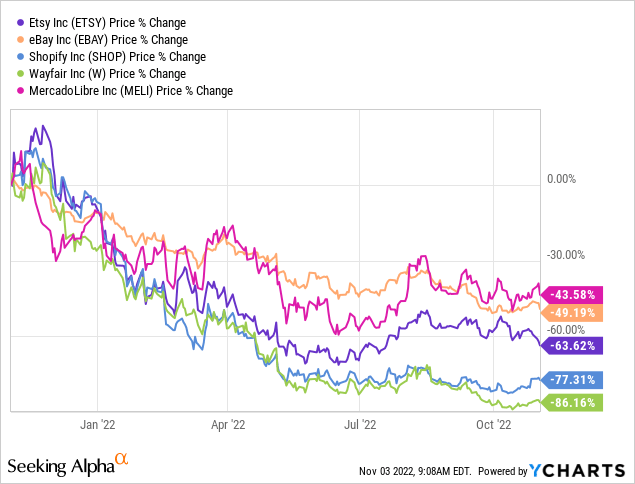

As the world opened up, trends started to normalize as more people went outside to buy their goods (headwind number one), and in 2022 the global macroeconomic climate has sharply deteriorated (headwind number two). Given this, perhaps it’s no surprise that Etsy shares are down by more than 60% over the past twelve months, as it’s been decimated alongside plenty of other ecommerce stocks.

On the plus side, Etsy does have a habit of reporting strong results. The company is profitable, and has shown evidence that it can retain a lot of the new buyers and sellers it acquired during the pandemic.

So, how did Etsy do when it reported its Q3 results on Wednesday? Let’s take a look.

Etsy Q3 Earnings Overview

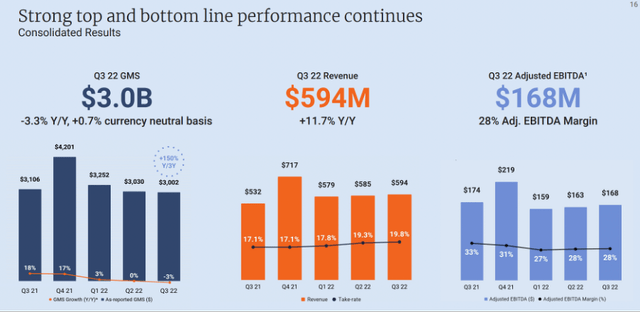

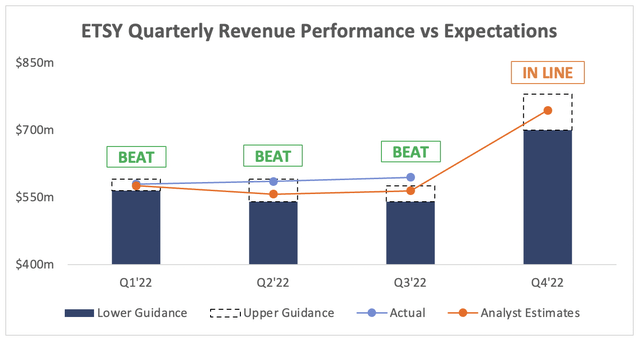

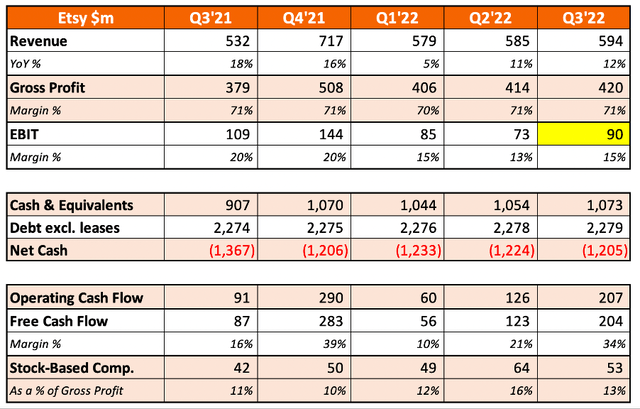

Starting from the top, Etsy’s Q3 revenue grew 9.1% YoY to $594m, coming in ahead of analysts’ estimates of $564m. Whilst this might not seem like substantial growth, it is particularly impressive in a year where ecommerce as a whole has struggled.

Long-term Etsy investors are probably not surprised by this beat, as it is the 12th consecutive quarter where Etsy has reported revenue above analysts’ estimates – not bad at all!

It wasn’t all good news, however, as GMS (gross merchandise sales = the total amount in sales made on Etsy’s platform) declined 3.3% in Q3, although it did grow 0.7% YoY on a constant currency basis. The total GMS for Etsy was $3.0B this quarter, which remains relatively stable despite all the headwinds.

Etsy Q3’22 Earnings Presentation

Looking ahead to Q4 revenue, analysts’ estimates of $744m (representing 3.7% YoY growth) sat pretty much exactly in the middle of management’s $700-$780m guidance. Once again, the growth rates look fairly unimpressive, but remember, Etsy is facing several difficult headwinds – tough YoY comparisons due to the pandemic boost, a 2022 macroeconomic environment that is weakening the consumer, and a strong U.S. dollar that is impacting plenty of U.S.-based global businesses.

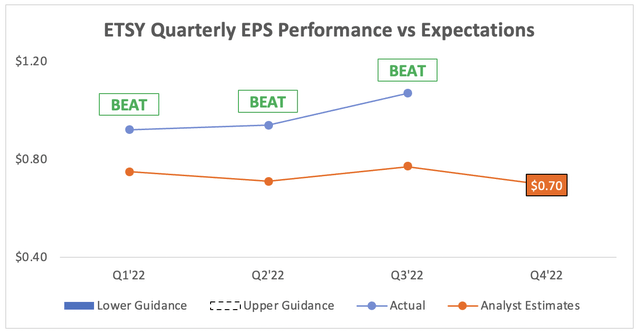

Moving onto the bottom line, and Etsy posted EPS of $1.07, which came in ahead of analysts’ consensus estimates of $1.50.

In this difficult macroeconomic climate, there is more of a demand from investors for companies that are profitable and can control costs whilst delivering strong margins – Etsy achieves this in abundance, as it posted yet another beat on EPS.

Lockdowns Provided A Lasting Boost

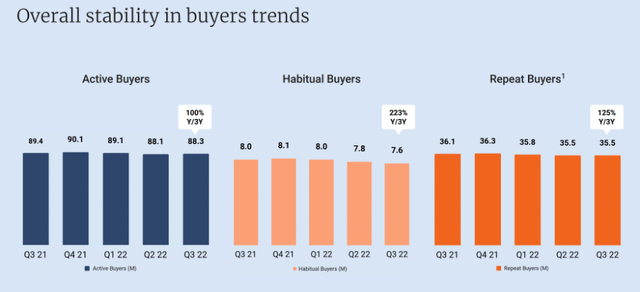

Investors have seen evidence of many ecommerce companies that received a boost during the pandemic and have now come back down to earth. For Etsy, however, the pandemic has provided a lasting increase to the number of people using its marketplace, as CEO Josh Silverman spoke about on the Q3 earnings call:

Not only is the Etsy marketplace over two times bigger than we were three years ago, but overall, we’ve held most of our gains. This speaks volumes to the work done by teams across Etsy, particularly within the context of a fully reopened world and ongoing macro challenges.

This can be seen more clearly in the below graphs, as the trends remain relatively stable for Etsy whilst maintaining incredible growth rates when compared to 2019. The only unfortunate trend in the below graph is that Habitual Buyers appear to be consistently falling at a more substantial rate, which removes a level of recurring revenue from Etsy – but given the environment, it’s a small bone to pick.

Etsy Q3’22 Earnings Presentation

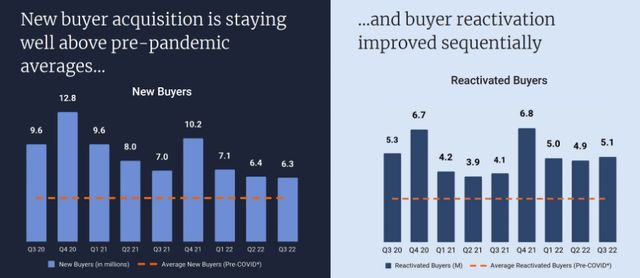

Perhaps the most important aspect of this is the boost to Etsy’s brand awareness throughout the years of lockdowns. Not only is Etsy seeing more new buyers joining the platform than they did before Covid hit, but the number of buyers reactivating their Etsy accounts has been consistently above pre-Covid levels.

Etsy Q3’22 Earnings Presentation

All in all, this a company that has capitalized on the gains it made during the pandemic. 2022 (and perhaps even 2023) will likely be a year of consolidation, particularly given the tough macro environment, but Etsy is now a much stronger business than it was back in 2019.

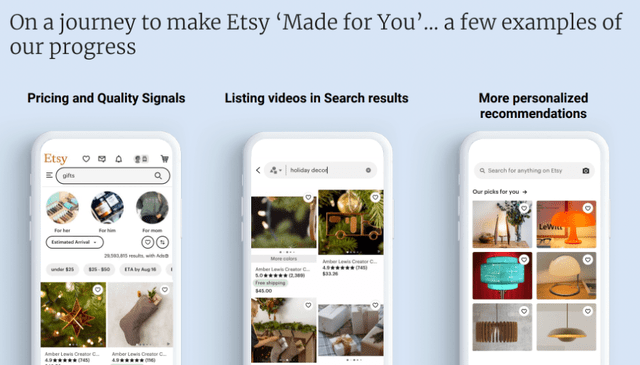

The company isn’t resting on its laurels, either, and continues to innovate within its marketplace in order to make the experience better for its buyers. CEO Silverman spoke about one of the changes he’s most excited about:

One of the needle-moving innovations I’m most excited about is the journey we’re on to leverage personalization to better tailor Etsy to the tastes and needs of each buyer. Etsy buyers struggle with our tyranny of choice. For example, user feedback I saw recently from an Etsy shopper who complained about his search for lamps. ‘400,000 results? Hmm. No, thanks. I’m going to take a hard pass on that.’

One of the issues with a company like Etsy in the past (as is true with the likes of eBay (EBAY)) is that the items can’t easily be pigeonholed due to their unique characteristics, so as a buyer it’s difficult to find precisely what you’re looking for. Etsy has been taking steps to address this, and so far it’s been working.

Etsy Q3’22 Earnings Presentation

There are plenty of positive takeaways for long-term Etsy investors in its Q3 earnings, and the platform looks extremely well-positioned to thrive once the macroeconomic headwinds start to ease up.

Quick Take: Etsy’s Core Financial Metrics

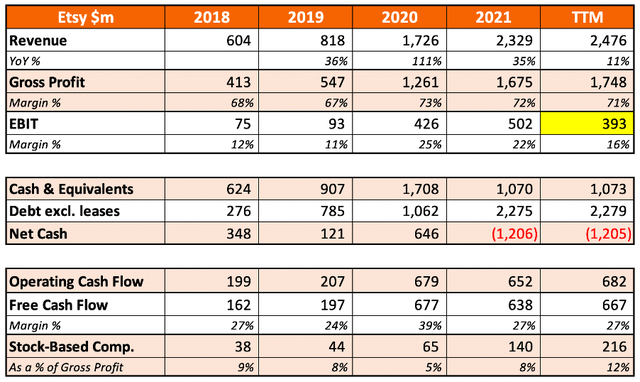

I also think it’s worth seeing what this quarter has done to Etsy’s financials, starting with the twelve-month trend.

Revenue over the past twelve months has grown 11% YoY, and free cash flow margins have remained solid at 27%. My biggest issue with Etsy is the company’s balance sheet; I almost exclusively invest in businesses that have a net cash position, but recent acquisitions have caused Etsy to lower its cash balance and rely more heavily on debt. This isn’t the end of the world, since Etsy is consistently profitable and generates strong free cash flows, but I would certainly like to see that balance sheet turn from net debt to net cash over time.

I’ve also highlighted the EBIT margin for this quarter, and that’s because I’ve adjusted it slightly; well, I say slightly, I’ve adjusted it by $1.045 billion due to a non-cash impairment charge to goodwill. The reason for my adjustment is that the one-off charge does not help investors to understand the underlying business, and it’s more of an accounting item rather than anything that will impact the company.

Another concern is margin compression. However, I expect this trend to start reversing in 2023; it’s been driven in 2022 by investments in headcount growth and increased compensation, which I expect to ease up in 2023, with revenue growth starting to outpace the growth of expenses once again. Etsy’s three other brands are also reducing its margins, and over time these should become more profitable and help to boost the overall financial profile.

All in all, Etsy’s financial picture remains strong. As long as Etsy remains free cash flow positive, I don’t really have any serious concerns about the balance sheet for now.

ETSY Stock Valuation

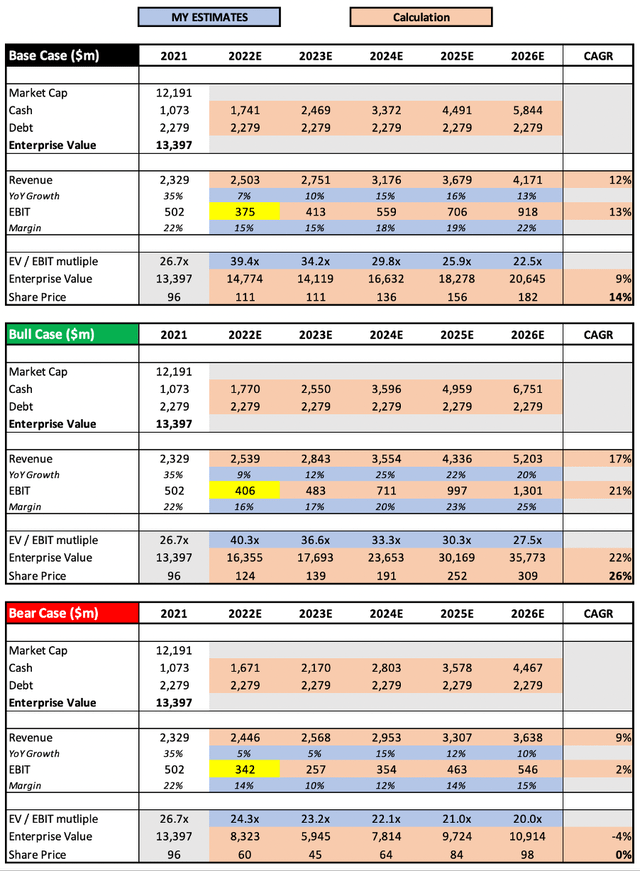

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Etsy is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have made use of analysts’ estimates to create my base case scenario, which assumes that Etsy can achieve a revenue CAGR of 12% through to 2026 alongside meaningful margin expansion from 2023 onwards. I’ve also used an appropriate final EV / EBIT multiple in each scenario, given Etsy’s growth and margin expansion prospects from 2026 onwards.

My bull case scenario assumes that Etsy’s revenue rebounds strongly in 2024, and achieves a 17% CAGR. I’ve also assumed that EBIT margins hit 25% by 2026, which I believe to be extremely achievable given the capital-light business model that Etsy has.

My bear case scenario effectively assumes the opposite; in fact, I think it is extremely negative. It assumes that a recession will also substantially impact Etsy’s growth in 2023, and that its revenue will only achieve a 9% CAGR through to 2026. Alongside this comes margin compression, as Etsy loses the benefits of scale.

Put all this together, and I can see Etsy shares achieving a CAGR through to 2026 of 0%, 14%, and 26% in my respective bear, base, and bull case scenarios.

Bottom Line

There are still going to be plenty of headwinds coming Etsy’s way, but it has demonstrated its ability to be resilient in the face of macroeconomic difficulties. The company continues to manage its costs and investments well, and has achieved a fine balance between growth and profitability that some of its ecommerce competitors have not (I’m looking at you, Shopify (SHOP)).

Despite the short-term macroeconomic difficulties, I think Etsy has all the hallmarks of a high-quality business with great long-term potential. I also think the current share price looks attractive, and the combination of all these factors lead me to rate Etsy shares as a “Buy.”

Be the first to comment