hapabapa

Zillow Group (NASDAQ:Z, NASDAQ:ZG) has a solid plan for creating a “housing super app”, but the company faces a housing recession as mortgage rates soar with the Fed rate hikes. The Fed continuing to press for more rate hikes makes the stock untouchable in the next year. My investment thesis is Neutral on the stock due to the tough operating environment in housing expected for the next year as housing prices fall and crucial transaction volumes plunge.

Tough Market

Zillow reported Q3 revenues fell 12% from last year to $483 million. Key adjusted EBITDA fell to $130 million from $156 million in the prior year quarter.

Sure, Zillow beat analyst estimates, but the real estate tech company faces a tough market with Fed Chairman Powell targeting the housing price gains of the prior couple of years in his rate hikes. On the Q3’22 earnings call, CFO Allen Parker highlighted this dire outlook:

While our results this quarter were better than expected, trends deteriorated at the end of September and into October as we’ve seen another rapid increase in interest rates. This has pushed the median US household as a new buyer into the realm often considered housing burden, which occurs once household spend more than one-third of their income on housing.

As a result, the industry is continuing to decelerate, bringing towards a decline of 25% to 35% year-over-year in Q4. As we pointed out last quarter, we suggest that investors pay close attention to the directional trends in the MBA mortgage purchase application index and the average purchase loan amount, which would multiply to become a leading indicator for total transaction dollar volume growth.

In recent weeks, this has trended to down more than 40% year-over-year.

The company guided to Q4’22 revenues of $410 million versus consensus up at $434 million. Revenue will fall 15% sequentially typical of the seasonal housing weakness during the holiday season.

The problem is that the key Premier Agent revenue is forecast to dip 27% in the quarter compared to last year. Some strength in the Rentals and Mortgages segment helped offset the weakness in the primary business line of working with real estate agents.

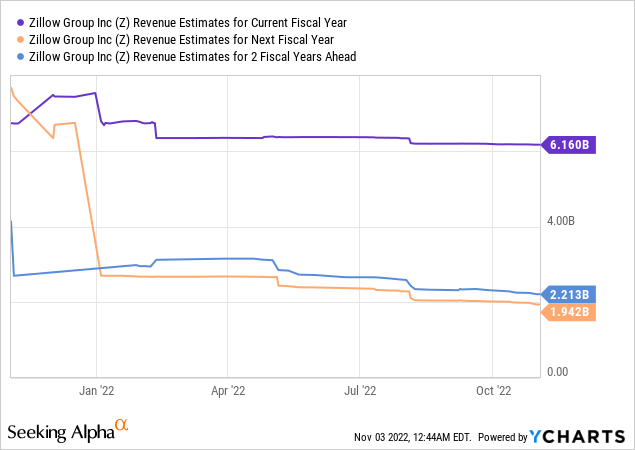

The problem with Zillow is that 2023 is set up to be a tough year. The end of the IBuying business this year combined with the dip in the housing market will push annual revenues down to $1.9 billion 2023.

The general consensus prior to Q3’22 earnings was that Zillow would generate $480 million in revenue next Q3. Remember though, this target was before Zillow guided down the Q4 targets by over $20 million, or nearly a 5% reduction from expectations. The best outcome for next year would be relatively flat revenues with 2022.

Zillow’s Future Business Plans

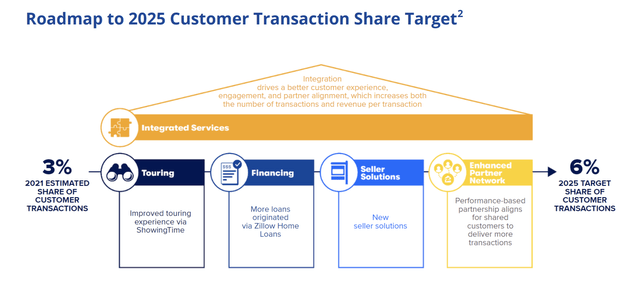

The housing market is a mess right now, and Zillow has already initiated a new business roadmap through 2025. The company has pivoted from the disastrous IBuying concept where Zillow was horrible at buying houses to return more to their roots of being a real estate tech play. After all, the company has 236 million unique MAUs with 2.8 billion visits during the quarter to feed any new services on their mobile apps and website.

The whole goal is to double the share of customer transactions from 3% currently to 6% in 2025. The first service offered under the new roadmap is Touring with further services to be launched over the period.

Source: Zillow Q3’22 shareholder letter

The Touring service was launched in Atlanta with some initial success. The company predicts improvements to the in-person tour and enhancements to tour scheduling will entice more buyers to utilize Zillow services.

The concept sounds great, but Zillow has struggled for years to execute. The housing market boomed over the last couple of years, yet Zillow now finds their revenue base below the 2019 levels.

The company has a large cash balance of $3.5 billion with $1.7 billion in convertible debt for a net cash position of $1.8 billion. Zillow has $0.7 billion remaining on the authorized share buyback, though one can argue the stock isn’t exceptionally cheap for an aggressive share buyback here. A stock focused on a housing market set to crash while the company tries to execute a new business model isn’t a place to aggressively invest.

The stock has a market cap of $7.5 billion and an EV of $5.8 billion. Zillow isn’t exactly cheap for a company reporting a revenue decline and transitioning to an unproven business model in the volatile housing segment.

Takeaway

The key investor takeaway is that Zillow has a promising roadmap through 2025, but the real estate tech firm lacks a recent history of executing. Due to the tough housing market expected over the next year, investors should watch the developments on the sidelines and look for lower stock prices to being an investment into the new roadmap.

Be the first to comment