halbergman

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 22nd.

Real Estate Weekly Outlook

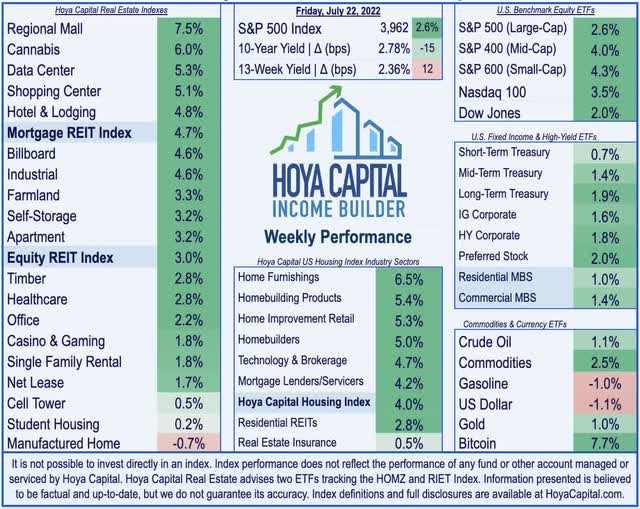

“Bad news is good news” was again the theme this past week as U.S. equity markets delivered broad-based gains after weakening economic data in the U.S. and Eurozone pulled benchmark interest rates to two-month lows ahead of a critical Federal Reserve interest rate decision in the week ahead. Weaker-than-expected PMI and housing market data – together with a lukewarm start to the second-quarter earnings season – showed that economic activity contracted materially across both the U.S. and Eurozone over the past four weeks, but market participants and Fed officials increasingly believe that recession may indeed be the best and quickest “medicine” to cure inflation.

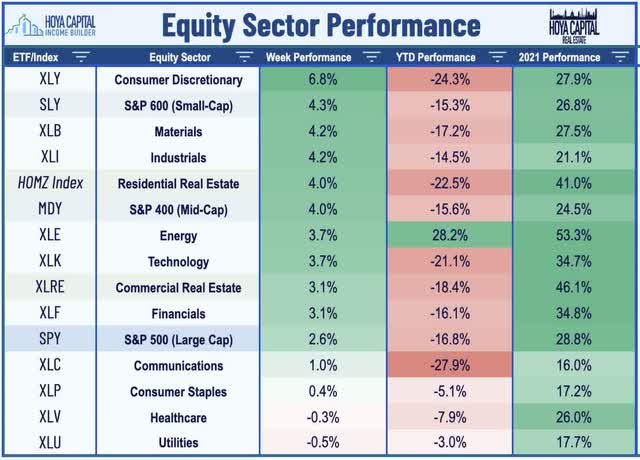

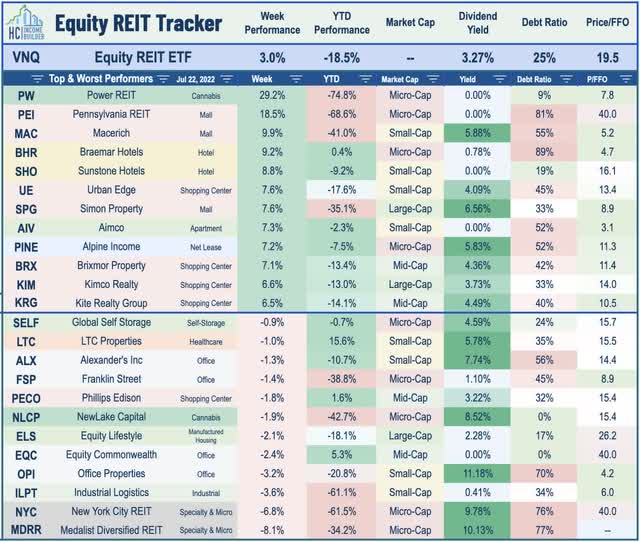

Delivering just its fourth “up-week” in the past sixteen weeks, the S&P 500 (SP500) advanced 2.6% – its best week in over a month – while expectations of U.S. economic leadership amid a broader global slowdown powered the Mid-Cap 400 and Small-Cap 600 to gains of over 4% each. The tech-heavy Nasdaq 100 posted gains of 3.5% in a choppy week ahead of key reports from several tech heavyweights. Real estate equities and other yield-sensitive sectors were among the outperformers on the week, lifted by the moderation in interest rates and a strong start to real estate earnings season. The Equity REIT Index advanced by 3.0% on the week with 17-of-18 property sectors in positive territory while the Mortgage REIT Index rallied by nearly 5%.

With the Atlanta Fed’s GDPNow data now indicating that the U.S. has indeed been in recession since early 2022, all eyes will be on the Federal Reserve in the week ahead as weakening conditions have rapidly shifted the narrative from the Fed being “behind the curve” to potentially “ahead of the curve.” The benchmark 10-Year Treasury Yield slid to the lowest level since late May – barely above the upper-end of the expected Fed Funds overnight rate next week. With inflation and higher rates seen as the “greater enemy” to the long-term earnings outlook – and the driving force behind the plunge in both consumer and investor sentiment to historically low levels – market participants have been content with emerging signs of cooling growth and inflationary pressures. Nine of the eleven GICS equity sectors finished higher on the week with a particularly strong week from homebuilders and the broader Hoya Capital Housing Index following decent results from a pair of the largest builders and amid hopes that moderating rates can soften the landing in the critical U.S. housing sector.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

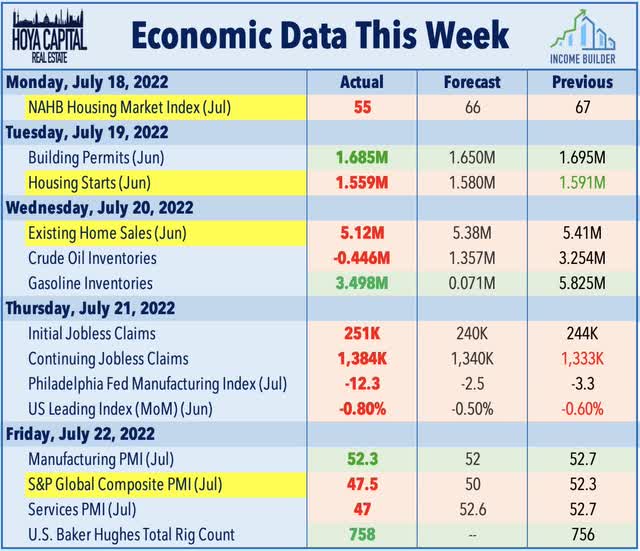

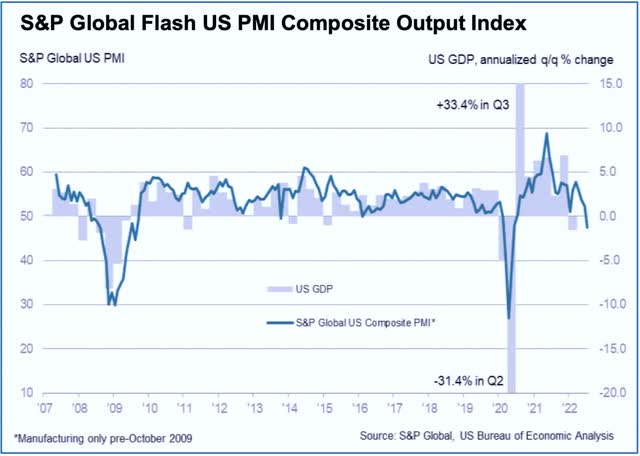

Economic activity contracted sharply in both the U.S. and Eurozone in July according to Flash PMI data from S&P Global released this week. The US PMI Composite Output Index dipped to 47.5 in July, down notably from 52.3 in June – marking the sharpest decline since May 2020 as both manufacturers and service providers reported subdued demand conditions. The Euro Area PMI fell to 49.4 in July from 52.0 in June – the lowest since February 2021. Of note, companies cited “severe inflationary pressures and hikes in interest rates” for the demand weakness, two forces that may be “self-correcting” to a degree. The rate-driven demand slowdown has clearly started to bleed into the “real” economy in recent weeks as employment data this week was similarly soft with Initial Jobless Claims rising to the highest level since last November.

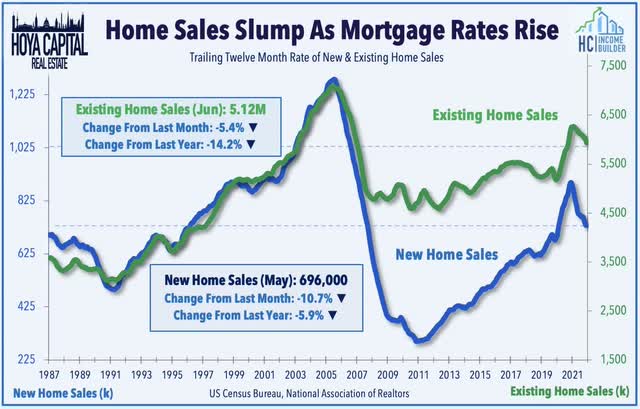

The U.S. housing sector has so far taken the brunt of the impact of rising rates – but also stands to potentially benefit the most from a peaking in inflation and rate hike expectations – as surging mortgage rates have poured cold water over the previously-red hot housing market. Data this week showed that Existing Home Sales declined to the slowest pace since early in the pandemic in June while mortgage demand has been similarly weak. Single-family home construction dipped to two-year lows as well according to Housing Starts data this past week, consistent with the sharp decline seen in homebuilder confidence with the NAHB’s Homebuilder Sentiment Index dipping 12 points to 55 – the largest single-month decline on record. Notably, some regions continue to see resilient housing demand with the South region seeing the strongest conditions – the region where publicly-traded homebuilders are most concentrated – while the Midwest has been the weakest.

Homebuilders: D.R. Horton (DHI) – the nation’s largest homebuilder with nearly two-thirds of its inventory in the southern U.S. – rallied more than 5% on the week after reporting results that were not as weak as analysts feared, commenting that its “still seeing a very good level of core demand out there.” Notably, while DHI brought down its full-year outlook, it continues to see revenue growth of 23% for the full-year. DHI noted that its cancellation rate “increased sharply in June” and stayed elevated in June but “has not continued on a trend much higher.” Investors remain historically bearish on homebuilders with DHI currently trading with a P/E below 5x based on updated EPS estimates. Tri Pointe (TPH) finished lower by about 3% after its results were relatively solid – meeting or exceeding its prior guidance across all metrics – but indicated a more cautious outlook than DHI, withdrawing its full-year outlook citing “quickly changing market conditions and the significant uncertainty related to the broader economy.”

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

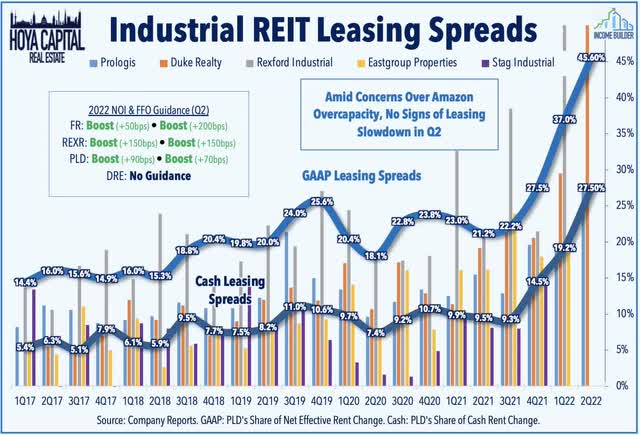

Industrial: No signs of slowdown here. Industrial REITs kicked off REIT earnings season with impressive results from the four largest names in the sector which had been slammed over the past quarter following Amazon’s (AMZN) announced plans to cut costs in its logistics network. First Industrial (FR) rallied more than 5% on the week after reporting stellar results and significantly raising its full-year outlook. Citing strong leasing trends, FR now sees FFO growth of 11.2% this year – up 200 basis points from its prior outlook. Prologis (PLD) also advanced nearly 5% after also boosting its full-year NOI and FFO outlook while recording an acceleration in renewal rates with a record-high 45.6% increase in effective rents. Rexford Industrial (REXR), meanwhile, reported incredible leasing spreads of 83% GAAP and 62% cash while maintaining a 99% occupancy rate. REXR also raised its full-year FFO and NOI growth outlook, noting that “tenant demand continues to exceed supply.”

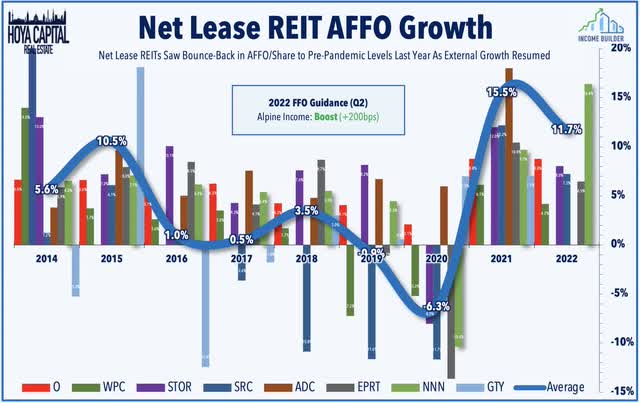

Net Lease: Alpine Income (PINE) surged more than 7% on the week after reporting strong results and raising its full-year outlook citing “attractive asset pricing” that has resulted in “attractive net investment spreads and improved earnings growth.” PINE – which recorded nearly 30% FFO growth last year – boosted its full-year FFO outlook by 200 basis points to 0.9%. PINE expects to accelerate its disposition activity which reflects its “continued confidence in our ability to sell assets at attractive valuations.” PINE noted that despite the jump in interest rates, private markets pricing of net lease properties remains firm, commenting “on the smaller property sales, you’re really seeing a lot of high net worth in and some institutional investors, buying these properties at Cap rates that really haven’t changed too much from six months ago.”

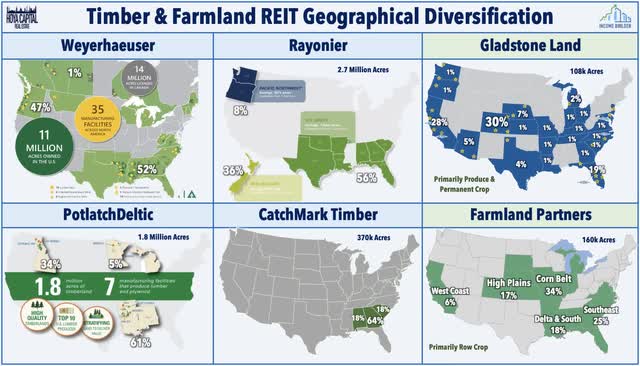

Farmland: Gladstone Land (LAND) rallied nearly 4% on the week after it boosted its monthly dividend by 0.4% to $0.0456/share – its third dividend hike this year. Farmland REITs – which were the best-performing sector in the first quarter of this year – have sold off over the past quarter as concerns over inflation have been superseded by recession concerns. LAND dipped nearly 50% from its all-time highs in mid-April to its recent lows in mid-June as worries over drought conditions in the west amplified the macroeconomic-related pressures. California, in particular, continues to struggle with a multi-year drought as snowpack levels, year-to-date precipitation, and reservoir levels are all below historical averages, pressure farmland valuations at farms with limited water supply. Farmland Partners (FPI) – which has more limited West Coast exposure – has posted more modest declines of roughly 15% over the past quarter.

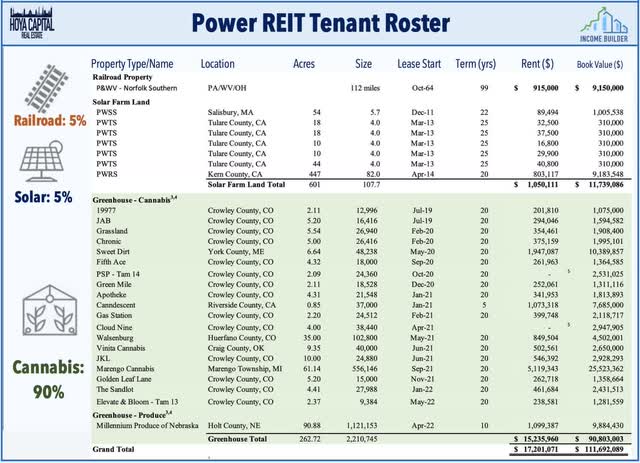

Cannabis: Sticking with the agriculture theme, small-cap cannabis REIT Power REIT (PW) – which had slid more than 75% this year on tenant rent payment concerns – rallied nearly 30% on the week after providing an update on the status of lease negotiations with its largest tenant Marengo Cannabis, noting that after a long delay that it has successfully secured a certificate of occupancy for the property which PW noted was a “significant hurdle” after the town initially refused to issue the CO. The annual straight-line rent based on the amended lease translates to incremental Core FFO per share of approximately $0.38 per quarter. Last week, Innovative Industrial (IIPR) – which has also slid this year on tenant concerns – indeed confirmed that one of its tenants – Kings Garden – stopped paying rent in July. IIPR has commenced discussions with other operators regarding the re-leasing of the properties.

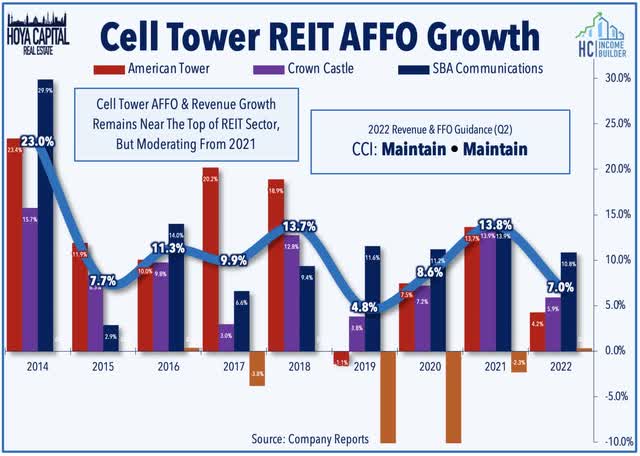

Cell Tower: Crown Castle (CCI) was roughly flat this week after reporting in-line results and maintaining its full-year outlook calling for FFO growth of 5.9% and revenue growth of 9.5%. Of note, CCI reiterated its belief that the “U.S. represents the highest growth and lowest risk market in the world for communications infrastructure ownership” and has dropped the “International” from its company name. CCI also reiterated its long-term guidance for annual dividend per share growth of 7-8%. Far more than its peers American Tower (AMT) and SBA Communications (SBAC), CCI continues to invest heavily in small-cell deployment and high-capacity network fiber, noting that it expects to double the rate of new small cells in its portfolio in 2023. Small-cell co-location is expected to be the driving force behind the faster roll-out- consistent with our long-held belief that municipalities and zoning authorities would be reluctant to approve single-tenant “mini-cell towers.”

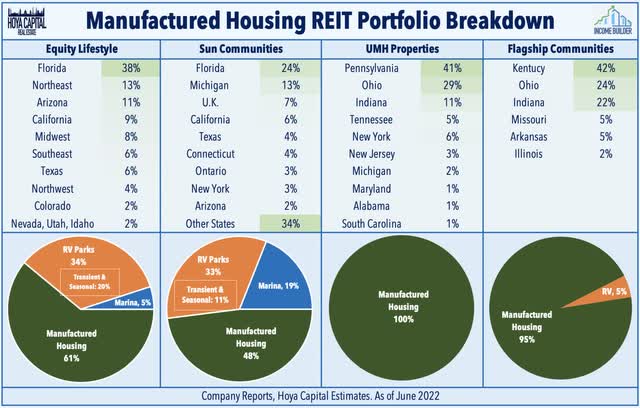

Manufactured Housing: Equity LifeStyle (ELS) was among the laggards this week after reporting mildly disappointing results – a rare “miss” for a manufactured housing REIT amid a record-10-year streak of outperformance over the REIT Index. While ELS maintained its FFO outlook of 7.9% growth, it downwardly revised its revenue and NOI outlook due to a slowdown in RV seasonal and transient demand citing “poorer weather, inflationary pressures, and a continued shift in demand for annual sites.” The slowdown appears to be specific to the transient segment as ELS significantly increased its rent growth guidance on Annual RV rents to 6.5% from 6.0% and also raised its outlook for core MH rent growth to 5.3% from 5.2%. These issues appear to be somewhat ELS-specific – which has nearly 2x the amount of transient revenues as Sun Communities (SUI) – which is further along in a multi-year strategy to convert these slips into annual memberships.

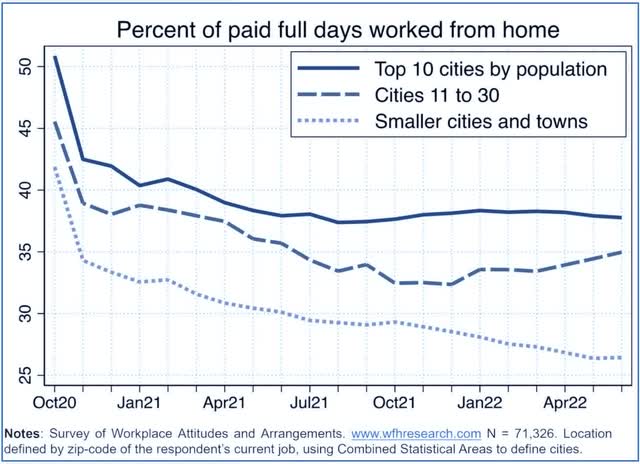

Office: This week, we published Office REITs: It’s All About The Commute on the Income Builder Marketplace which discussed our updated outlook and recent allocations in the office REIT sector. The ‘Return to the Office’ is here – but it’s underwhelming. Despite 80% of employees currently in post-pandemic work arrangements, office utilization rates have remained 40-60% below pre-pandemic levels. Office leasing activity has remained surprisingly resilient at just 10% below pre-pandemic levels – as have office REIT earnings results – but corporations won’t pay for half-empty space indefinitely. As projected, commute times have been the key variable explaining significant differences in WFH adoption across regions. Workers don’t necessarily dislike the office, but long commutes more than offset any productivity gains. The outlook remains far sunnier in the Sunbelt and in secondary markets with net population growth, shorter commute times, and a more favorable industry mix.

Mortgage REIT Week in Review

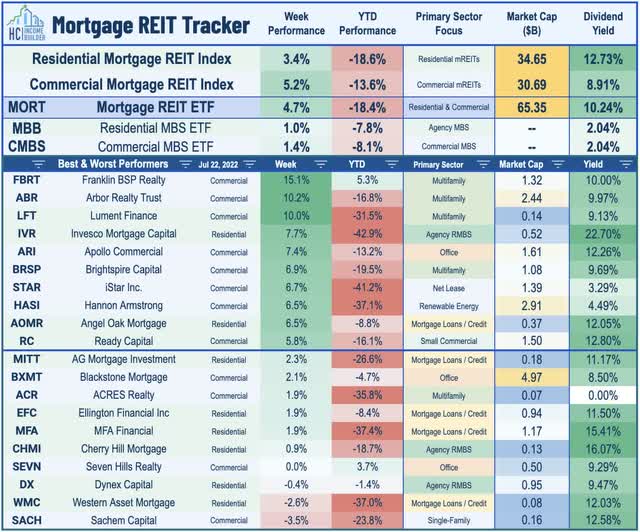

Mortgage REITs delivered broad-based gains for the week with residential mREITs advancing 3.4% while commercial mREITs gained 5.2%. Mortgage-backed bonds continue to be notable outperformers in the fixed income market as the iShares MBS ETF (MBB) advanced another 1% on the week to push its gains over the past month to nearly 4%. Mortgage REIT earnings season kicks off next week, which covers the period that included the sharp bond market sell-off from mid-April through mid-June. Analysts expect that residential mREITs will report average BVPS declines of around 8-10% in the quarter while commercial mREIT BVPS are expected to be roughly flat, but Book Values likely reached a near-term bottom in late June as mortgage-backed bond valuations are on-pace for one of their best months on record in July.

Infrastructure mREIT Hannon Armstrong (HASI) remained in focus this week after a second firm – Jehoshaphat Research – released a short report on the renewal energy lender. The report – which focuses on the impact of rising interest rates on HASI’s ability to cover its dividend – follows a Muddy Waters report in the prior week focused on its accounting practices that had sent HASI plunging by over 15%. HASI called the Muddy Waters allegations last week “deceptive” and said that it believes that its accounting is fully compliant and is an accurate representation of its financial performance. HASI also said it has sufficient portfolio cash flow to pay its dividend. Elsewhere, Ellington Financial (EFC) gained 2% on the week after announcing that its estimated book value per share (“BVPS”) was $16.22 as of June 30th, down about 4% during the month and 8% for the quarter as interest rates reached a recent peak in mid-June before retreating over the past several weeks. Commercial mREITs Arbor Realty (ABR) and Franklin BSP Realty (FBRT) were also notable outperformers this past week with double-digit gains.

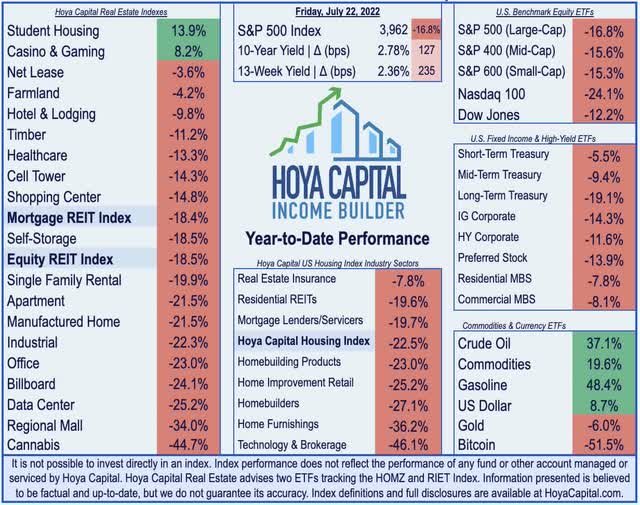

2022 Performance Check-Up

Three weeks into the back half of 2022, Equity REITs are now lower by 18.5% on a price return basis for the year while Mortgage REITs have slipped 18.4%. This compares with the 16.8% decline on the S&P 500 and the 15.6% decline on the S&P Mid-Cap 400 as well. With the exception of the student housing and casino REIT sectors, every property sector is in negative territory for the year while eight property sectors are lower by over 20%. At 2.78%, the 10-Year Treasury Yield has climbed 127 basis points since the start of the year, but has been under pressure after briefly breaking through the prior post-GFC-high rate of 3.25% reached in 2018 and touching a high in June of 3.50%.

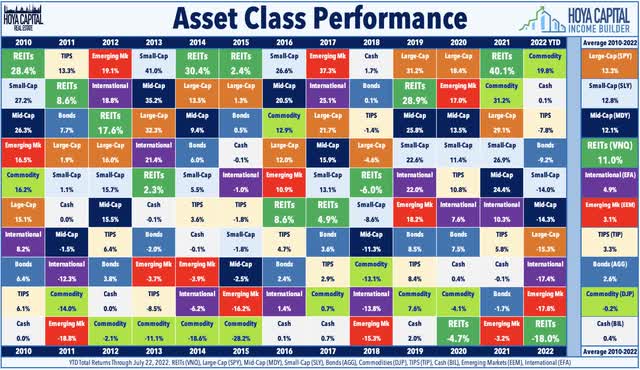

REITs are back in the basement of the performance tables among the ten major asset classes following the underperformance over the past month. Among these ten asset classes, Equity REITs (VNQ) finished 2021 as the best-performing asset class with total returns of 40.1% – the best year of returns for REITs since 1976 – which came after a rough 2020 in which REITs were the worst-performing asset class with total returns of -4.7%. REITs are now the fourth best-performing asset class since the start of 2010, producing superior total returns to Bonds (AGG), TIPS (TIP), Commodities (DJP), Emerging Markets (EEM), and International (EFA) stocks.

Economic Calendar In The Week Ahead

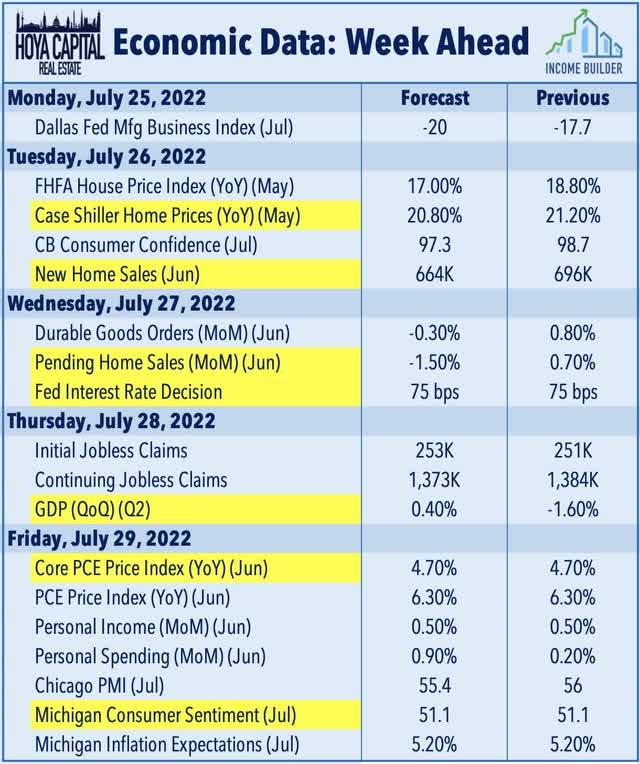

The week ahead will be jam-packed with earnings reports, economic data, and a critical Federal Reserve interest rate decision. On Tuesday and Wednesday, we’ll see New Home Sales and Pending Home Sales data for June which is expected to reflect the significant summer slowdown seen in Existing Sales and Housing Starts data this past week. We’ll also see home price data on Tuesday with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cooldown in home sales activity may not yet be seen. On Wednesday afternoon, we’ll see the FOMC Interest Rate Decision in which the Fed is expected to hike rates by 75 basis points, but could signal a “wait and see” approach to future hikes given the recent deterioration in global economic growth conditions. Whether or not we’re truly in a recession will be determined on Thursday with Gross Domestic Product data. While the Atlanta Fed’s GDPNow Forecast sees -1.6% growth in Q2, analysts still expect the economy to record a 0.4% increase in growth and narrowly avoid a technical recession. On Friday, we’ll see another critical inflation report with the Core PCE Index – the Fed’s preferred gauge of inflation – which has been one of the early indicators showing signs of peaking price pressures in recent months.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment