Nicholas Smith

Introduction

It’s time to talk about Deere & Company (NYSE:DE). In May, I wrote an article titled “Deere’s Bumpy Road To New Highs”. Since then, the stock is down roughly 14% as we’re indeed on a very bumpy road thanks to various headwinds like slower economic growth expectations, volatile crop and energy prices, as well as an aggressive Federal Reserve eager to damage economic demand in order to control inflation. In this article, I’m going to discuss why I added to Deere as the company is in a good spot to not only benefit from an attractive risk/reward given economic conditions but also because it will have to play a major role in a situation where long-term food supply is barely expected to keep up with demand. It helps that Deere is not only the world’s largest producer of agriculture equipment but also focused on next-gen technologies aiming to boost yields.

Moreover, I highlight the many benefits this stock brings to the table when it comes to dividend growth investing, which is why I own the stock in the first place.

With all of this in mind, let’s look at the details!

The Agriculture Bull Case

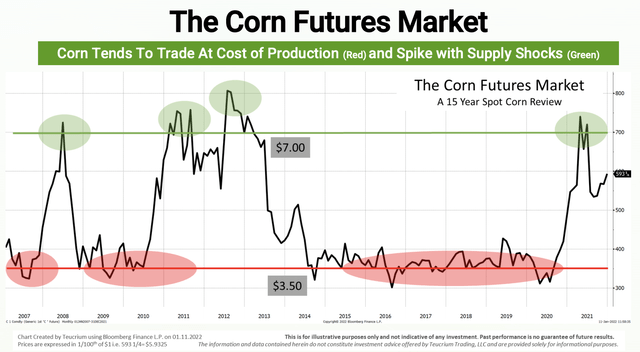

The agriculture bull market is something I’ve covered since early 2020 when I turned bullish after COVID-related lockdowns had done a number on agriculture and energy prices. After these lockdowns, demand for energy came back, restaurants reopened, China started to rebuild its hog herds after the African Swine Fever (on top of building inventories in general), and fertilizers became more expensive. This bull case further accelerated when Russia lowered natural gas exports to Europe in 4Q21 as it was preparing for war. It caused fertilizer production to become unprofitable and both energy and crop prices started to rise. Again, I’m mentioning both energy and agriculture crop prices in the same sentence as crop prices tend to trade just barely above production costs (outside of supply shocks). Production costs are driven by energy.

Speaking of a supply shock, that’s exactly what happened when Russia invaded Ukraine, causing its exports to drop off a cliff while it reduced fertilizer exports.

The chart below shows what the market is facing as important supplies of wheat and sunflower seeds are stuck in the country.

With that said, on June 29, 2022, the OECD-FAO released its agriculture outlook for the 2022-2031 period. This 363-page-long report provided me with some numbers that I missed in my research.

The report mentioned subdued global economic growth expectations of 2.7% per year over the next decade (IMF estimates, and below pre-pandemic levels), which is based on normalizing energy prices after 2022.

Moreover, the report expects global food consumption (mainly agricultural commodities) to rise by 1.4% per year over the next ten years. This is mainly driven by population growth. Growth in poorer countries will be partially offset by an aging population in many developed countries.

With that said, the report also estimates supply. According to the OECD, global agriculture production is projected to increase by 1.1% per year during the next ten years. According to the OECD:

[…] the additional output to be predominantly produced in middle- and low-income countries. The Outlook assumes wider access to inputs as well as increased productivity-enhancing investments in technology, infrastructure, and training as critical drivers of agricultural development. However, a prolonged increase in energy and agricultural input prices (e.g. fertilisers) will raise production costs and may constrain productivity and output growth in the coming years.

With these numbers in mind, we’re dealing with a situation where supply is incredibly tight. For example, using corn as an example, we’re starting to encounter an increasing number of years where demand is coming in higher than supply.

CME Group

This is what the OECD commented on the need for supply:

Investments in raising yields and improved farm management are foreseen to drive growth in global crop production. Assuming continuing progress in plant breeding and a transition to more intensive production systems, yield growth is projected to account for 80% of global crop production growth, cropland expansion for 15%, and increasing cropping intensity for 5%.

In a world where agricultural (arable) land (per capita) has rapidly fallen, there’s not a lot of room to expand agriculture production beyond focusing on yield.

OurWorldInData

On top of that, and with a focus on shorter-term developments, JPMorgan is becoming bullish again on agriculture commodities. In a recent report, the bank said that:

Global grain markets appear immensely oversold.

During the past few months, both corn and wheat – to name two key crops – have lost roughly a third of their value. The reason is lower energy prices, which lowers production costs and ethanol demand (corn is a key “energy” commodity as well), as well as good news from Ukraine as there appears to be a trade deal with Russia. The problem is that exports won’t be higher than 10 million tonnes of wheat and 5 million tonnes of corn. It’s a start, but investors have more or less priced in a free pass for export ships. Both wheat and corn are now below the levels when Russian tanks entered Ukraine earlier this year.

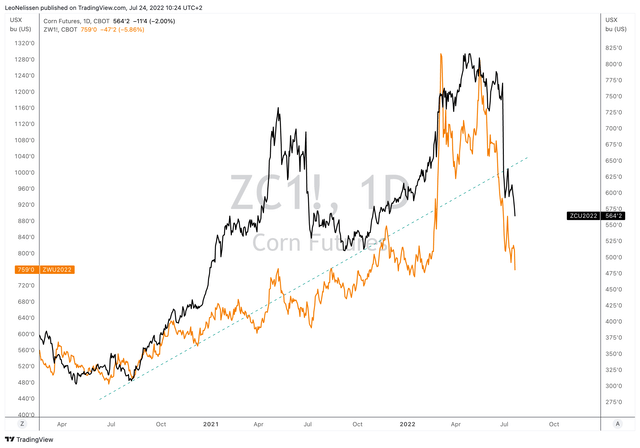

Trading View (Black = Corn, Orange = Wheat)

Moreover, Russia bombed the port of Odesa (the most important port for agriculture exports in Ukraine), which destroys any credibility this export deal has.

Adding to that, fertilizer markets are set to remain tight as I explained in a recent article, which will keep tremendous pressure on agriculture supply for at least another 1-2 years.

The Market Is Punishing Deere

I own a lot of industrial stocks. In some cases, this comes with a lot of volatility. For example, Deere quickly lost roughly 30% of its market cap after working its way towards $450 per share earlier this year. In 2021, Deere briefly was my largest dividend growth position. This has now changed, and I’m thrilled as I get to buy more at better prices.

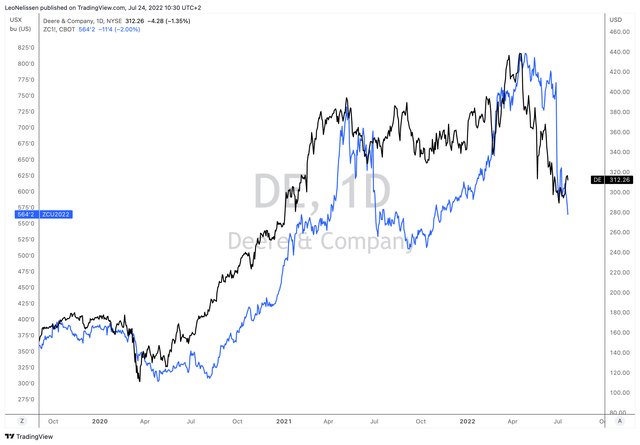

As the chart below shows, agricultural weakness has provided a fertile ground for sellers. While Deere started to fall faster when corn was still strong, we’re dealing with a situation where the market as a whole has priced in lower long-term prices. For example, the December 2023 corn contract is trading at $5.4 per bushel. Down from $6.7 in 1Q22.

TradingView (Black = DE, Blue = Corn)

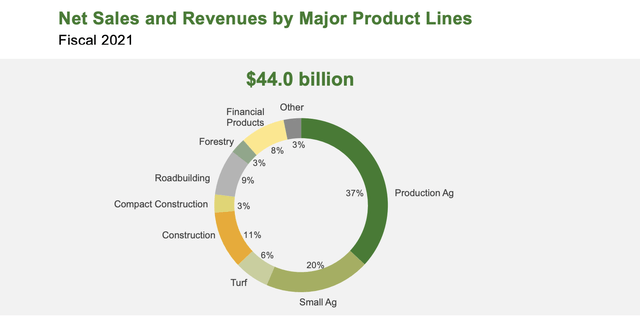

Adding to that, Deere remains an industrial player with non-farming exposure. Its largest segment, production agriculture, which is homes to its combines, large tractors, and planters, accounted for 37% of 2021 sales. Total agriculture accounted for 57% of total sales. Construction is bigger than some may believe given what Deere is mostly known for.

While I mainly focus on agriculture, construction/road building have become terrific segments as well. In the past, Deere has expanded via acquisitions like the German Wirtgen Group, which not only significantly expanded its non-farming footprint but also its geographic focus.

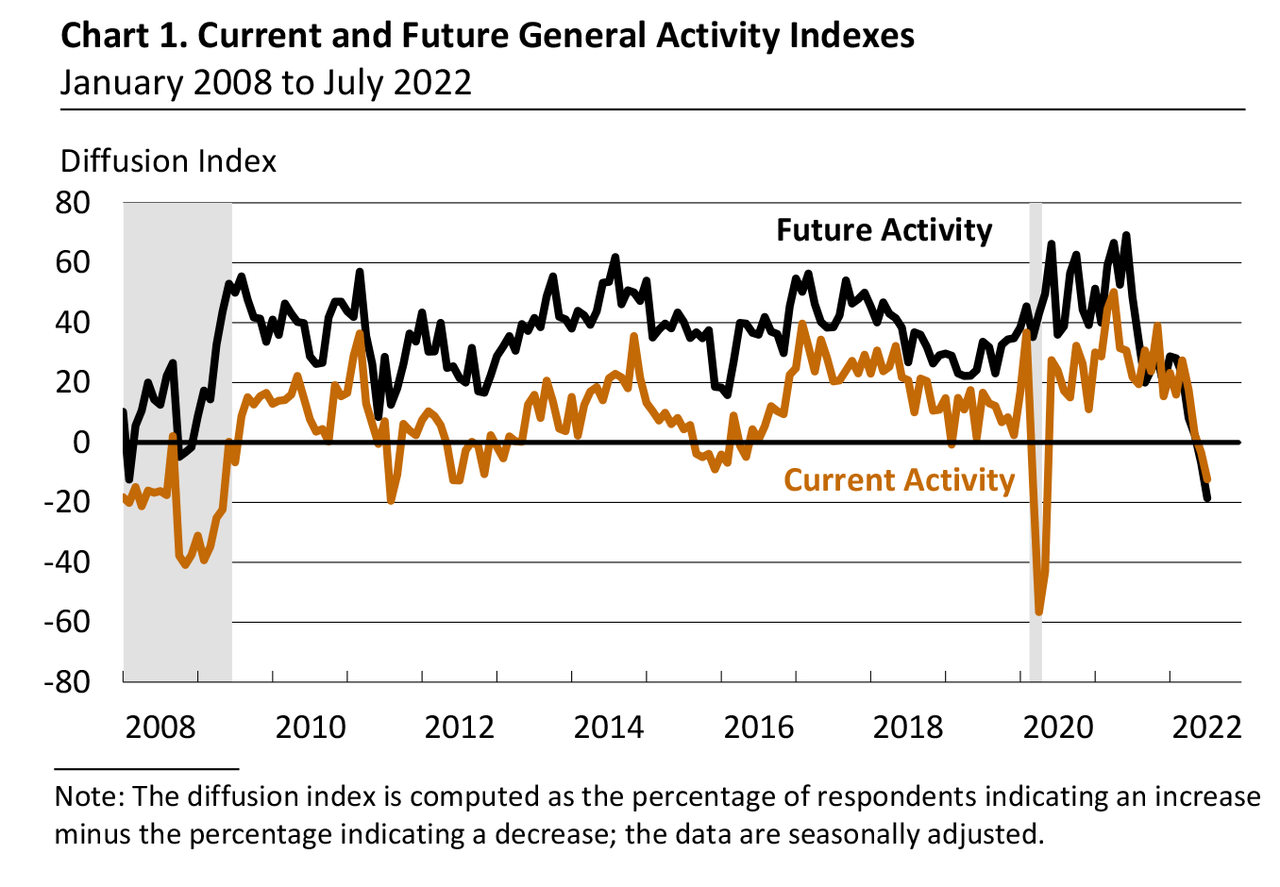

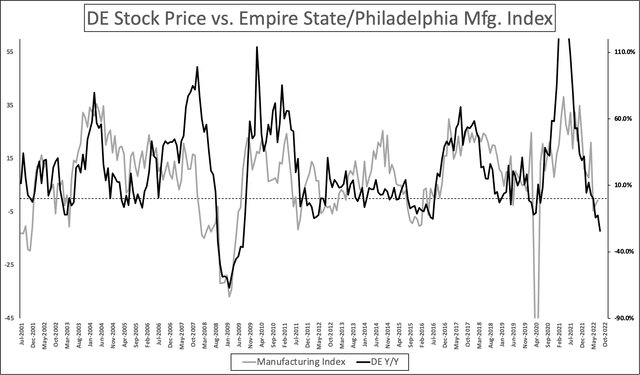

What I’m getting at here is that Deere is highly correlated to leading economic indicators. Deere is currently 25% below its all-time high, which marks the worst sell-off (on a monthly closing price basis) since the Great Financial Crisis. In this case, the stock fell in lockstep with indicators like the Empire State and Philadelphia Fed manufacturing indices.

While the Empire State index rebounded a bit in July, this is what the Philadelphia Fed index looks like. Both current activity and future activities have plummeted.

Federal Reserve Bank of Philadelphia

Hence, it’s no surprise that investors like large funds have “de-risked” their portfolios. It’s often simply math based on stock characteristics instead of long-term company fundamentals. That’s why I’m not worried at all.

If anything, this once again offers new opportunities.

New Investor Opportunities

I’m not making the case that weakness isn’t justified. Deere is in a challenging environment. For example, in 2Q22, the company got a $627 million production cost headwind in its large agriculture segment. This more than wiped out $564 million in pricing and currency tailwinds.

In small agriculture and turf, higher production costs of $330 million more than offset pricing gains of $277 million causing operating profit to drop from $648 million to $520 million despite 5% higher net sales.

The construction and forestry segment was stronger as net sales soared 9%, providing outperforming pricing gains, which boosted operating income from $489 million to $814 million.

Overall, investors hated these numbers. Again, it makes sense as reporting higher sales in agriculture but suffering from lower margins feels like a “waste of time”.

However, demand is strong, and supply chain issues are expected to ease going into next year. This is what the company mentioned with regard to demand:

Given the strong fundamentals in agriculture, coupled with the underlying supply constraints, we do not see the industry being able to meet all of the demand that exists in 2022. While difficult to quantify exactly the impact of this, we expect 2023 to be another strong year of industry demand.

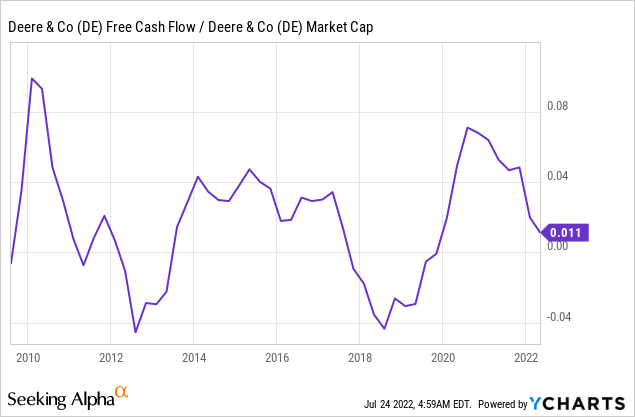

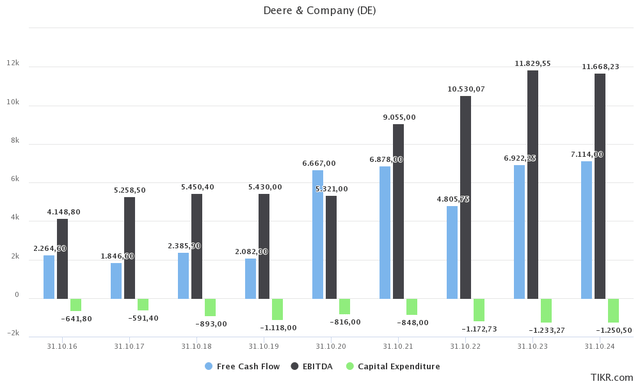

Hence, I like to focus on the longer-term – the big picture. This year, the company is still expected to do $10.5 billion in EBITDA followed by more than $11.6 billion in EBITDA in both FY2023 and FY2024. Free cash flow is expected to average roughly $7.0 billion in these years.

To put things into perspective, this implies a 7.3% free cash flow yield using the company’s $95.4 billion market cap.

While we’re working with implied numbers here, it would suggest the highest free cash flow yield since the Great Financial Recession. In other words, even if expectations come down, the risk/reward is actually good this close to $300 per share.

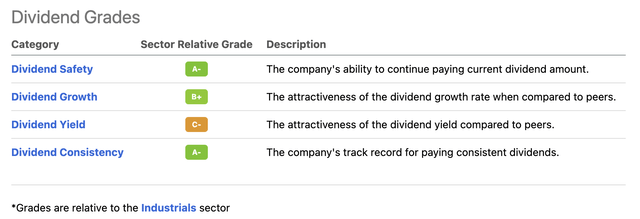

What matters as well is that Deere is now offering a somewhat decent yield again.

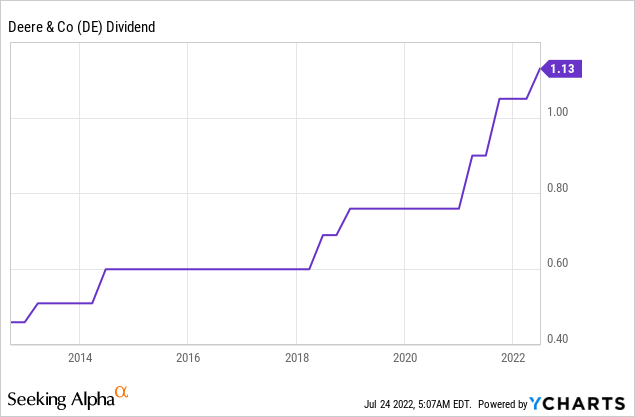

After raising its quarterly dividend by 7.6% on May 25, the company is now offering a $1.13 quarterly dividend. That’s $4.52 per year or 1.4% of the current stock price.

While 1.4% isn’t an eye-catcher for many yield-seeking investors, it’s a decent number and fueled by the company’s focus on long-term dividend growth and financial health.

In other words, not only are we dealing with a >7% implied free cash flow yield that indicates both dividend safety and a lot of room to grow payout, we’re also dealing with a company that is expected to lower net debt to $30.8 billion next year, lowering the leverage ratio to 2.6x. Note that the company had a rather high leverage ratio of consistently more than 6x EBITDA in the years prior to the pandemic when low crop prices and somewhat slow growth put pressure on the company’s balance sheet.

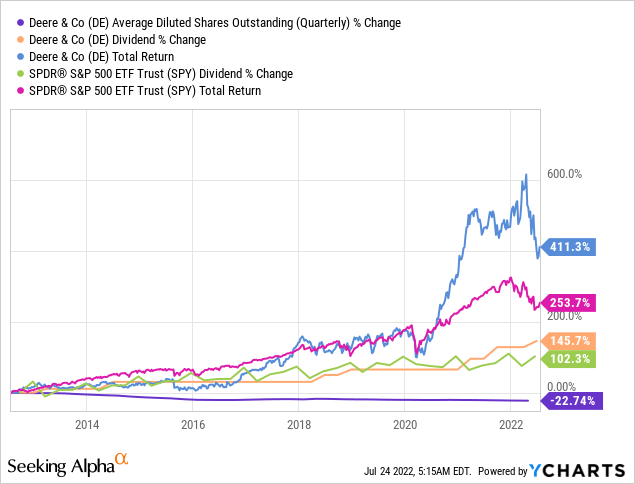

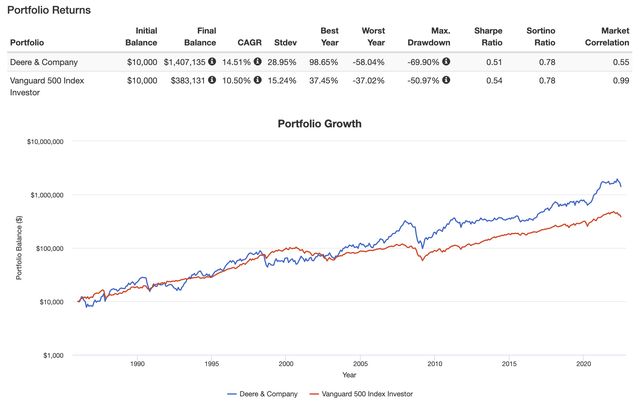

Over the past 10 years, the dividend has been raised by 146%. The company also bought back 23% of all shares outstanding, providing the company with the chance to achieve a 411% total return. This beats the S&P 500 by a wide margin.

Moreover, this isn’t unique. Combining all business cycles since 1985, Deere has returned 14.5% per year, outperforming the S&P 500 by 400 basis points. Although the standard deviation is much higher than the S&P 500 standard deviation, Deere was able to keep up on a volatility-adjusted basis as well (Sharpe/Sortino ratio).

With that said, it helps that the implied FCF yield isn’t the only indicator saying that Deere is undervalued.

The company has an enterprise value of $129.3 billion based on its $95.4 billion market cap, $30.8 billion in expected FY2023 net debt (to price in the use of free cash flow), $3.0 billion in pension-related liabilities, and a mere $100 million in minority interest.

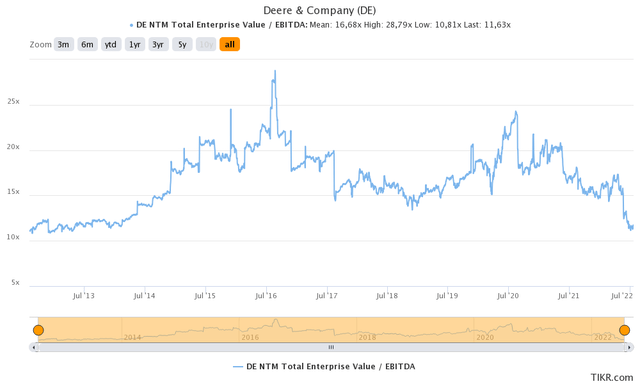

That’s 11.1x adjusted EBITDA if we assume that Deere can do $11.6 billion in EBITDA in the years ahead – I believe the company will beat that number.

This valuation is the cheapest NTM EBITDA valuation since the end of the Great Financial Crisis.

This valuation makes sense as Deere is in a very tricky spot – from a trader’s point of view. It benefits from a huge agriculture bull case that will accelerate EBITDA the moment supply chain problems ease. However, investors also need to price in lower expected economic growth as economic indicators have plummeted.

On top of all of this, the company benefits from its leading position in precision and yield-enhancing agriculture.

The company has revealed a fully autonomous tractor, and a highly advanced spraying system for pesticide and fertilizer optimization, which were adopted by the highly successful Farming Simulator game as well.

I have to admit that I wasn’t aware of how advanced Deere already was before it announced these new technologies. According to VentureBeat:

The 2010s brought the mobile and cloud revolutions, which accelerated the ability to innovate on digital tools. By 2016, Moore’s Law (the principle that the speed and capability of computers can be expected to double every two years) brought a resurgence in the opportunities of what could be done with AI. At the time, John Deere had several small teams that had already been working on robotics concepts for at least 10 years. “We had been working with some of the top robotics universities in the country,” Sanchez said. “So we could essentially pour gasoline on our evolution to build on AI.”

Moreover, and with regard to my comments earlier:

The agricultural industry has reached an “asymptote of value you can add by going bigger and faster,” Sanchez continued. “The opportunity for value has really pivoted to being very precise – you have to be able to see what you’re doing, whether you’re placing a seed in the ground, harvesting a kernel of corn or applying herbicides.”

By 2030, Deere wants to offer fully autonomous production systems. While I would not make the case that this will trigger a sudden stock rally, it does address requirements of the future like labor shortages and the need to farm as many acres as possible with the limited resources we have. If Deere remains a leader in this, I foresee high market share gains.

Takeaway

In this article, I explained why I am adding to one of my all-time favorite dividend growth stocks. The Deere company has lost roughly a quarter of its market value as investors have reacted to falling economic expectations and lower crop prices as a result of lower (temporary) tensions in Ukraine.

The problem – for the global population – is that agricultural commodities are oversold. A steep rebound is likely as fertilizer supply remains tight, tensions in Ukraine are higher than investors initially thought, and global demand is likely to outpace global crop supply in the years ahead.

Not only does this provide farmers with the opportunity to benefit from higher prices on a long-term basis, which allows for a longer machinery replacement cycle, but it also emphasizes the need for high-tech precision farming tools. That’s where Deere shines – on top of being a leader in every agriculture segment already.

From an investor’s point of view, we’re dealing with a very favorable risk/reward, a very low valuation that comes with a large margin of safety, high expected free cash flow, and (related), a lot of room for the company to boost both dividends and buybacks.

As a result, I remain bullish and believe that investors are in a terrific spot to benefit from long-term outperforming total returns.

(Dis)agree? Let me know in the comments!

Be the first to comment