Call Options Can Maximize Return and Minimize Risk lucky336

Foreword

This is part 3 of our covered call ETF series. Before reading this article, We highly recommend that you familiarize our previous covered call studies:

- “QYLD: The One Market Condition That Justifies It” (here)

- “XYLD: Volatility-Adjusted Distribution Provides More Excess Return Than QYLD” (here)

And our thesis on Bitcoin:

- “Actions Recommended By Bitcoin’s Decade-old Cycle” (here)

Background

Over a year ago, we published our thesis that Bitcoin (BTC-USD) has entered a bear market. That thesis is still relevant today. The 2 main findings of our study were:

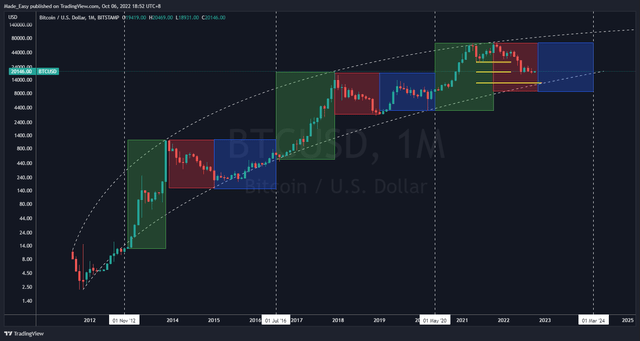

- A typical Bitcoin halving cycle has 3 very distinct stages: a 1 to 1.5-year bull market, a 1-year bear market, and a 2-year recovery stage (Fig 1).

- The 1-year bear market typically consists of 5 sequences of events (Fig 1).

Fig 1. Dissecting The Bitcoin Halving Cycle (Author, TradingView)

We updated our thesis back in June 2022 stating that we expect Bitcoin to break below $20,000 to reach $10,000. Bitcoin did break below but reclaimed the historic $20,000 support. The $20,000 price level is historic because it represents the former ATH and Bitcoin has never broken below the former ATH during a bear market (Fig 1).

We’ve abided by our thesis and refrained from investing in any Bitcoin mining companies. This has greatly minimized our losses. Given the distinctiveness of the 3 stages of a halving cycle, we could’ve minimized our losses by 50% with just 1 additional action.

That action is no other than the Covered Call Strategy.

Why Haven’t We Thought Of It?

When we published our bearish thesis on Bitcoin, we had no access to call options on Bitcoin. Call options for Bitcoin were only accessible after the launch of the ProShares Bitcoin Strategy ETF (BITO) on 19th October 2021. We did not realize such an avenue only after we started our recent series of studies on covered call options. During that period, we were only focused on covered call options on Bitfarms (You can read about it here, it’s a rather interesting series of trade and journey).

Although it’s a little too late to be selling call options, we can always be prepared for the next bear market. Therefore, the aim of this study is to propose a proven call option strategy for trading Bitcoin.

Why Call Options On Bitcoin even though It Is Risky?

Read the appendix to know why call options are risky.

The answer is simple: the 3 stages within a halving cycle are distinct and well-defined (Fig 1). So let’s see how we can deploy call options in each stage of the cycle.

Call Option Strategies In A Bitcoin Bull Market

We find that the premium of an at-the-money (‘ATM’) 1-year Bitcoin call option ranges between 20% to 30% of its market price depending on the implied volatility at that time (expectation: between 60% to 75%) while a similar 1.5-year call option will cost around 30% to 35%. Notice that you only pay an extra 5% to extend the expiration date by 50%.

The 35% premium represents for maximum loss on the investment. Since the Bitcoin bull market typically spans 1 year to 1.5 years while appreciating anywhere between 800% to 4000% (Fig 1), a 35% maximum loss will provide you with a reward-risk ratio of 29:1 to 115:1. Not bad right?

Timing is everything for options. Hence we recommend going with the known. Since history showed us that we can achieve a 29:1 to 115:1 reward-risk ratio from the beginning of the bull market, we’ll only enter once at the beginning of the bull market.

One major risk of this strategy is that the return seems to be diminishing. Based on our Bitcoin thesis, we expect the next ATH will be at $115,000 by March 2025. If everything plays out as expected, the call option strategy would only provide a 2.3:1 reward-risk ratio.

Here’s what we expect:

-

The next Bitcoin halving cycle is expected to be on 21st February 2024. Bitcoin has always begun its cycle with a bull market, so 23rd February will be our entry date. According to the halving cycle (Fig 1), prior to the upcoming bull market is the recovery phase where Bitcoin is expected to recover back to the $69,000 ATH.

-

A 1-year ATM Call option with a $69,000 strike price is expected to cost around $20,000.

-

During the 1-year bull market, Bitcoin is expected to approach the upper resistance (the upper dotted line in Fig 1) to attain a new ATH of $115,000 by March 2025 (1 year from February 2024).

-

By the end of the bull market, the call option is expected to provide a net profit of $46,000 (=$115,000 – $69,000) or a reward-risk ratio of 2.3:1. Without options, the return would only be 67% (=$115k/$69k -1).

What Will It Take To Break Above The $115k Resistance?

According to Cathie Wood, Bitcoin will gain $40,000 in price if every S&P500 company put 1% of the cash on the balance sheet into Bitcoin. Aside from crypto mining companies and other well-known crypto companies such as MicroStrategy (MSTR), we’re unaware of any major adoption by public-traded companies.

If companies begin to adopt Bitcoin, we expect sufficient cash inflow to break Bitcoin above the $115,000 resistance. Therefore, we interpret the 2.3:1 reward-risk ratio as a base-case scenario.

Call Option Strategies In A Bitcoin Bear Market

During this stage, we want to take on the opposite role to become the seller of call options. This way, we can offset the losses from Bitcoin by collecting option premiums.

There are two ways to do this. (1) We could buy Bitcoin and sell a 1-year ATM call option to collect 25% of the Bitcoin market price as the premium just like how we paid 25% of the Bitcoin market price during the bull market; (2) We could buy Bitcoin and sell monthly ATM call options for 12 months.

The difference between the 2 methods is that method (2) has the potential to collect more premiums.

- For Method 1, we could collect 25% ($15.3k per BTC in the current bear market) of the Bitcoin market price at the beginning of the bear market.

- For method 2, we could collect 41% (or $25.2k per BTC in the current bear market) of the Bitcoin market price at the beginning of the bear market (Table 1).

Based on the Black-Scholes options pricing model, the monthly premium for an ATM call option is 6.9% of the asset market price, this annualized to about 84% return. However, this is not feasible because as the Bitcoin market price declines, the premiums we can collect for the ATM options also decrease. Nevertheless, we found that the premium collected from selling monthly ATM call options (Table 1) is more than the annual ATM call option. Therefore, selling monthly ATM call options is preferable.

Table 2 shows that selling monthly call options will incur the least amount of losses, followed by selling annual call options, followed by pure HODLing.

Table 1 Premiums Collectable for Selling Monthly ATM Call Options During Bitcoin 2021 Bear Market. (All units in $USD)

| [1] Date | [2] Close | [3] Unit = [9].lag(1) /[3] | [4] Premium Per Unit = [2] * 6.9% | [5] Effective Premium = [4] x [3] |

| 1/9/2021 | 61318.96 | |||

| 1/10/2021 | 57005.43 | 1 | 4231.008 | 4231.008 |

| 1/11/2021 | 46306.45 | 1 | 3933.374 | 3933.374 |

| 1/12/2021 | 38483.13 | 1 | 3195.145 | 3195.145 |

| 1/1/2022 | 43193.23 | 1 | 2655.336 | 2655.336 |

| 1/2/2022 | 45538.68 | 0.890953 | 2655.336 | 2365.778 |

| 1/3/2022 | 37714.88 | 0.845065 | 2655.336 | 2243.93 |

| 1/4/2022 | 31792.31 | 0.845065 | 2199.134 | 1858.41 |

| 1/5/2022 | 19784.73 | 0.845065 | 1853.792 | 1566.574 |

| 1/6/2022 | 23336.9 | 0.845065 | 1153.637 | 974.8976 |

| 1/7/2022 | 20049.76 | 0.716435 | 1153.637 | 826.5059 |

| 1/8/2022 | 19431.79 | 0.716435 | 991.1405 | 710.0879 |

| 1/9/2022 | 20160.72 | 0.716435 | 960.5916 | 688.2016 |

| 1/10/2022 | 20320.2 | 0.690532 | 960.5916 | 663.319 |

Cont.

|

[1] Date |

[6] Payoff = min(0, [2].lag(1) – [2]) | [7] Bitcoin Holding Profit = [2]-[2].lag(1) | [8] = ([6] + [7])*[3] | [9] Bitcoin Holding Value = [9].lag(1) + [8] |

| 1/9/2021 | 61318.96 | |||

| 1/10/2021 | 0 | -4313.53 | -4313.53 | 57005.43 |

| 1/11/2021 | 0 | -10699 | -10699 | 46306.45 |

| 1/12/2021 | 0 | -7823.32 | -7823.32 | 38483.13 |

| 1/1/2022 | -4710.11 | 4710.109 | 0 | 38483.13 |

| 1/2/2022 | -2345.44 | 2345.441 | 0 | 38483.13 |

| 1/3/2022 | 0 | -7823.8 | -6611.62 | 31871.51 |

| 1/4/2022 | 0 | -5922.56 | -5004.95 | 26866.56 |

| 1/5/2022 | 0 | -12007.6 | -10147.2 | 16719.37 |

| 1/6/2022 | -3552.17 | 3552.17 | 0 | 16719.37 |

| 1/7/2022 | 0 | -3287.13 | -2355.02 | 14364.36 |

| 1/8/2022 | 0 | -617.975 | -442.739 | 13921.62 |

| 1/9/2022 | -728.928 | 728.9277 | 0 | 13921.62 |

| 1/10/2022 | -159.479 | 159.4785 | 0 | 13921.62 |

Source: Author

Table 2. Losses Incurred By Different Strategy ($USD)

| Strategy | Profit (Losses) |

| Monthly Covered Calls | -22150 = 13921.62 – 61318.96 + 25249.25 |

| Annual Covered Call | -25670 = 20160.72 – 61318.96 + 15329.74 |

| HODL | -41000 = 20160.72 – 61318.96 |

Source: Author

Call Option Strategies During Recovery Stage

The call option strategy during the recovery stage is similar to the strategy during the bull market. The recovery stage typically spans 1.5 years (the blue box in Fig 1). Hence, a 1.5-year ATM call options is used.

If there’s 2.5-year ATM call option available, investors could consider buying it to cover both the recovery stage and the bull market. The cost savings would be significant. The theoretical price of the option should be about 37% to 45% of the Bitcoin market price.

For instance:

- Despite the pessimism and fear in current market conditions, the halving cycle dictates that the recovery stage is expected to occur in November 2022 (the feasibility of this matter will be discussed in a follow-up study). The recovery stage is expected to span from November 2022 to February 2024 while the upcoming bull market is expected to span from February 2024 to February 2025.

- Since we couldn’t buy call options on Bitcoin directly, we’ll use BITO. BITO is a Bitcoin-linked ETF that tracks the price of Bitcoin. Hence, we expect the BITO price to move in tandem with Bitcoin.

- Currently, Bitcoin is priced at $20,000 while BITO is priced at $12.50. Hence, a $69,000 Bitcoin would price BITO at $43 (=$69k/$20k * $12.50); Similarly, a $115,000 Bitcoin would price BITO at $71 (=$115k/$20k * $12.50).

- At the time of writing, the last price of a 2.5-yr ATM (strike = $13) BITO option is $4.85 (39% of the market price, which is on the low side).

- If Bitcoin reaches $115,000 (or BITO reaches $71), the call option will provide a profit of $66 (=$71-$4.85) or 13.6:1 reward-risk ratio.

Comparatively, if a 1.5-year ATM (strike = $13) call option is used (which would cost $3.90 at the time of writing) to trade the recovery phase and a separate 1-year ATM (strike = $43, equivalent to a $69,000 Bitcoin) call option (expected to cost $13 = 30% of $43 BITO) is used to trade the bull market, the total profit would be reduced to $54 (=$71-$13-$3.90) due to the additional $13 option premium expense.

Verdict

Although call options can be risky, given how Bitcoin has been moving in clear and distinctive cycles, we can deploy call options with relatively less risk. This study illustrated and laid out the key actions to capture the most return while incurring the least risk via call options.

What investors are required to pay attention to next is the intricacies of option trading such as risk management, open interest, spread, implied volatility, etc.

Please be reminded that call options are riskier than HODL and you could lose more than your initial capital. For instance, NEVER sell call options without holding the underlying asset, especially Bitcoin. This study only aims to illustrate how call options can be deployed to minimize risk and maximize return.

Appendix: Why Are Call Options Risky

Call options are risky derivatives because you lose the premium paid (100% of your invested capital over a predefined time period).

- A call option is an agreement that involves 2 parties: the ‘long/buyer’ and the ‘short/seller’.

- The buyer of the call option (buy side of the agreement) buys the rights to buy the underlying asset (such as Bitcoin) from the seller of the call option (sell side of the agreement) at a pre-defined price (known as the strike price).

- In exchange for such rights, the buyer of the call option will pay the seller of the call option a fee known as a premium (much like an insurance premium).

- This agreement will expire after at a pre-defined date known as the expiration date.

For instance:

- On 1st May 2020, a buyer bought a Bitcoin call option with a $10,000 strike price that expires on 1st May 2021 for $690 (premium).

- On 30th April 2021 (one day before the expiration), Bitcoin was trading at $60,000. Hence, the buyer can exercise the right to buy Bitcoin for $10,000 (strike price) from the seller of the options.

- The buyer could sell the Bitcoin at market price for $60,000 which will net the buyer a total profit of max($60,000 market price – $10,000 strike price, 0) – $690 premium paid.

On the flip side:

- On 1st May 2021, the buyer bought another Bitcoin call option with a $69,000 strike price that expires on 1st May 2022 for $4,761 (premium).

- On 30th April 2022 (one day before the expiration), Bitcoin fell to $38,000. Hence, the buyer won’t exercise the right to buy Bitcoin for $69,000 (strike price) from the seller of the options because the market price is only $38,000.

- Hence, the buyer lost $4,761 for burning the option.

Be the first to comment