jetcityimage/iStock Editorial via Getty Images

Introduction

In some cases, it makes sense to have a look at the preferred shares issued by banks. While those preferred shares don’t offer the same capital gains potential like the common shares do, they usually do provide a slightly higher dividend yield and the knowledge owning senior equity may be more comfortable as well. In this article, I wanted to have a look at the M-series of the preferred shares issued by JPMorgan (JPM), trading at (JPM.PM). This was a rather sizeable issue with $2B in preferred shares issued, at a preferred dividend yield of 4.2%.

A quick look at JPMorgan’s financial results and balance sheet

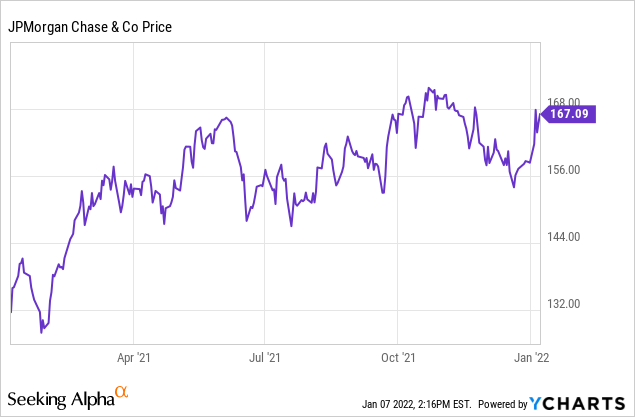

Before diving into the specifics of the preferred shares, let’s first have a look at how JPM is performing so far. The bank will release its FY 2021 results later this month so we will have a look at the financial results in the first three quarters of 2021.

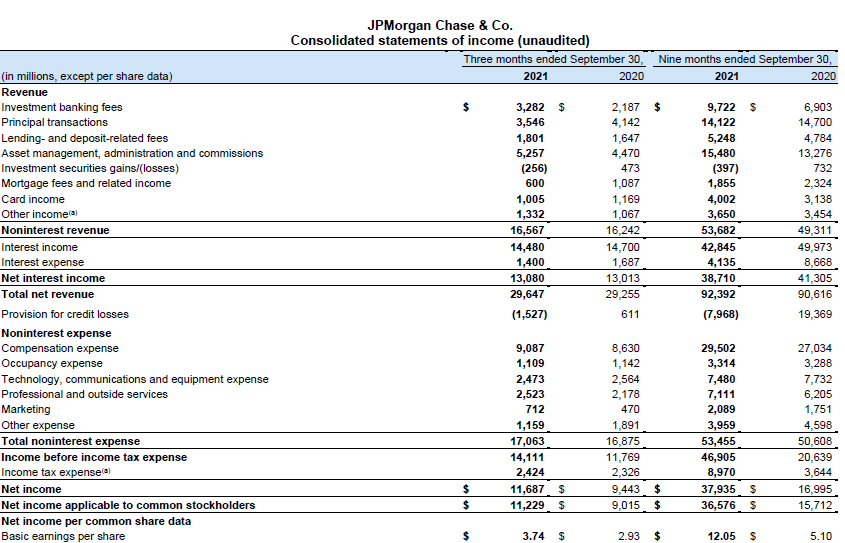

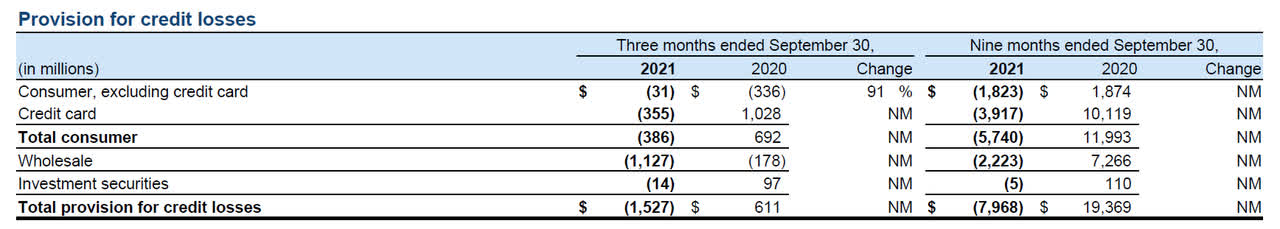

In the first nine months of the year, JPMorgan generated a net interest income of $38.7B and generated an additional total non-interest expense of $53.5B. This resulted in a pre-tax and pre-loan loss provision of $38.9B. as you can see on the image below, JPMorgan also was able to recoup almost $8B in previously recorded loan loss provisions which further boosted the pre-tax income to $46.9B and the net income to approximately $37.9B.

Source: SEC filings

From the reported net income, we still need to deduct the preferred dividend payments and end up with a net income of $36.6B attributable to the shareholders of JPMorgan. This represents an EPS of $12.05 based on the average share count in the first nine months of the year. As the current share count has dropped to approximately 2.95B shares, the attributable EPS would be approximately $12.38. Keep in mind however that taking back the loan loss provisions will be a non-recurring tailwind.

Source: quarterly report

Adjusted for the contribution from taking back the provisions, the underlying EPS in the first nine months of the year is approximately $10.20 (again using the current share count rather than the average share count during the first three quarters).

JPMorgan is currently paying approximately $400M per quarter in preferred dividends, which means that based on the 9M 2021 results, the preferred dividend coverage ratio was approximately 3,150% (the attributable income to common and preferred shareholders totaled $37.8B of the reported net income of $37.9B). Even if we would remove the benefit from taking back the loan loss provisions, the preferred dividends still require just around 4% of the total income. So the dividend coverage ratio for all series of the preferred shares is pretty good.

The series M preferred shares: Non-cumulative but plenty of safety

In the third quarter of 2021, JPMorgan issued 80 million units of its Series M preferred shares. The M-series are a non-cumulative preferred share with an annual preferred dividend of 4.20% per year which results in $1.05 per share, paid in quarterly installments. The 80 million units have a total value of $2B, so this was a relatively sizeable issue by JPMorgan.

While the yield of 4.20% may be low and the fact the issue is a non-cumulative issue may be a deterrent for some investors, there are also some positive features here.

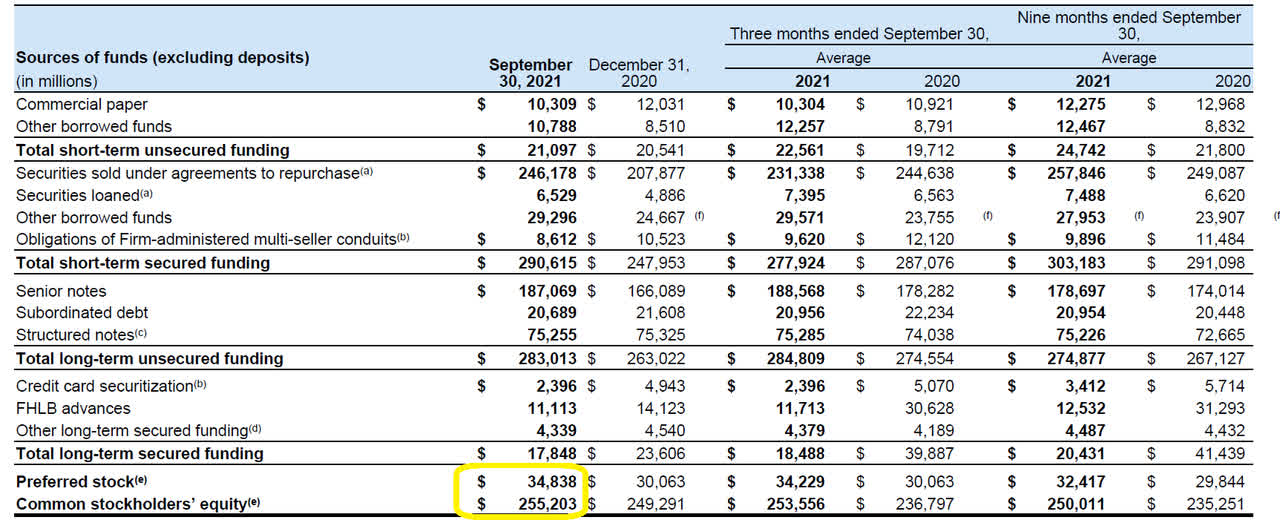

Looking at the balance sheet, the total equity portion consists of approximately $290B, of which just under $35B is represented by preferred equity. This means that there’s about $255B of equity that ranks junior to the preferred shares. That adds an additional layer of safety. Of course, if a bank would collapse having senior equity may not mean much. But assuming normal operations, there’s plenty of junior equity to absorb the first shocks.

Source: quarterly report

On the topic of the M-series being non-cumulative: I usually stay away from non-cumulative issues as I like the additional protection offered by cumulative preferred shares as the issuer would have to make the preferred shareholders whole on missed preferred dividends before it can declare dividends on the common shares. In JPMorgan’s case, however, the risk of the bank not paying dividends to the common shareholders appears to be rather low as there will be so much pressure on the bank to continue to distribute cash to its shareholders.

Investment thesis

While the yield of the preferred shares is rather low, it does handsomely beat the dividend yield of the common shares as JPMorgan currently has a dividend yield of approximately 2.44%. Compared to that yield, the preferred shares Series M are somewhat attractive and should basically seen as a trade-off between giving up potential capital gains in return for a (currently) higher yield and the additional layer of safety provided by owning more senior securities. Whether or not holding JPM preferred shares is interesting also depends on the taxes, especially for overseas investors. In my case, my “take home” yield would be 2.68% which is a bit low and means I’d likely only be interested in picking up the preferred shares below the par value of $25/share and I would only do so as a diversification in my portfolio.

In conclusion, the M-series preferred shares are “somewhat” attractive for some types of portfolios and it depends on if you’d like to give up capital gains potential on JPM stock and potential (likely) dividend increases for a fixed preferred dividend of just 4.20%.

Be the first to comment