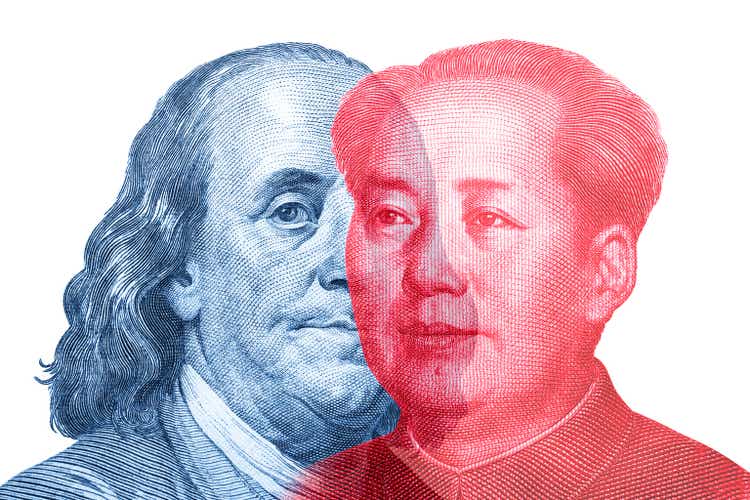

Tast Nawarat/iStock via Getty Images

China has got something else going on, something that the Russian invasion of Ukraine is distracting the rest of the world from its development.

China is generating a revolution in the world of information and the growth and spread of information.

Martin Wolf calls attention to China’s progress in the Financial Times.

Furthermore, two major studies were released at the start of March 2022 by the Hoover Institute at Stanford University.

These two studies are right at the edge of what is going on in the world and I highly recommend them to anyone that is interested in the world of information theory and the innovation in the world of finance and economics.

That is, these two studies are about as up-to-date as far as what is going on in this new era of information and what major thinkers are considering when looking at this global transition to the next stage of world advancement.

The first study is titled “China’s Digital Ambitions: A Global Strategy To Supplant The Liberal Order.”

The second study is titled “Digital Currencies: The US, China, And The World At A Crossroads.“

Basically, what these publications examine is the move by China to dominate the digital world by creating a monopoly in the collection of data, information, and then using this collection of information to “out-create” the rest of the world. and dominate it.

Leading the world in the advancement of digital currencies will provide China with the means of dominating payments.

Both would also give China information to “control the world.”

This world is what China sees for the future.

Information Produces Things

How the world is viewed is changing.

In physics, theorists are claiming that the world is made up of just information because “information is physical order.” According to Cesar Hidalgo, in his book “Why Information Grows”:

“Knowledge is about how the physical order goes together and knowhow is about the means by which this physical order goes together.”

“The economy is the system by which people accumulate knowledge and knowhow to create packets of physical order, or products, that augment our capacity to accumulate more knowledge and knowhow to accumulate more knowledge and knowhow and, in turn, accumulate more information.”

The physicists see this world as one of disequilibrium because it is disequilibrium that generates the need for obtaining more and more information and creating “more packets of physical order, or products.”

In the past, people have defined the factors of production to be land, labor, and capital.

Now, the analysis is moving to where the discussion is placed within the context of a system composed of information and how the economics of such a system works.

A major work, just produced, is titled “Building the New Economy: Data As Capital,” and comes to us from MIT Connection Science & Engineering.

So, we have moved on to a new era, one that defines the period just in terms of information.

Thus, we can look at the world in terms of different eras, first, agriculture, then industrial, and now, information.

China seems to have absorbed this approach to the world and is now moving as fast as it can to build a world around these ideas.

Money As Information

Money is basically information.

Money can be a unit of account and a store of value.

Perhaps, most important, money can be a medium of exchange.

China is building its databases, but China is also building its currency into something that is digital in nature.

And, it is not a cryptocurrency.

Cryptocurrencies as really a subset of digital currencies. So, cryptocurrencies can be considered digital in nature, but there can be digital currencies that are not crypto- in nature.

China’s new creation, the eCYN, is just such a digital currency. China has banned cryptocurrencies in China.

During the Winter Olympics just held in Beijing, China, the eCYN was introduced to the world. From everything I have heard, the introduction went well and there were no real problems connected with its usage.

But, Mr. Wolf, in his Financial Times article, argues that China has very little chance of bringing the eCYN to the point where it comes to dominate the U.S. dollar in global finance.

On the other hand, China has a very good chance of bringing the eCYN into dominance in the trading that takes place between China and China’s many trading partners.

China has developed the Cross-Border Interbank Payment System (Cips). This is a system that is an alternative to the Swift payment system, the cooperative society providing services related to the execution of financial transactions and payments between banks worldwide, and is dominated by dollar transactions.

The fear is that China could develop “a walled garden” for its currency by those closest to it.

The result: the existence of two monetary systems with still the need to interact.

So, Mr. Wolf states, there would be two payment systems operating “in different ways” and “overlapping uncomfortably.”

In essence, Mr. Wolf concludes, this would result in “a new global order built around China.”

And, What Is The U.S. Doing?

Well, the United States does not seem to be worried about building the major database in the world. It has just started thinking about “information” being a source of production and growth.

Furthermore, the United States seem to be resting upon the current payments system existing in the U.S. and the world. The possibility of a U.S. digital currency is still being kicked around in political circles and the financial system, itself, does not seem to be pushing the edge as it considers digital currencies. Cryptocurrencies are just “out there on their own.”

Finally, the United States seems to believe that the position of its currency in the world is pretty secure.

And, the U.S. does not seem to be considering the possibility that China, and the U.S. might have overlapping payments systems.

Once again we see China, focusing upon the longer-run while the U.S. focuses on the mid-term elections coming up.

Investors need to be cognizant of what is going on in this space.

We tend to look at the world as something that has a multitude of currencies and payment systems.

Take a different path for a while. Thing of the world that Mr. Wolf has suggested, a world where there is two, overlapping systems.

Does this picture change the world for you? Could a global system with just two payments exist at some point?

Is this a picture of disorder? How would this change things?

Be the first to comment