24K-Production/iStock via Getty Images

U.S. equities began the week on a painful note with 495 of the S&P 500’s components lower at Monday’s close. The broad-based declines resulted in the index finishing 20% below its January record, putting the index in a bear market for the first time since 2020.

Markets were further spooked by a surge in the 10-year Treasury yield to 3.4% from 3.16%, its largest one-day gain since March of 2020. Some investors were also shaken by turbulence in the cryptocurrency markets after the Celsius Network, one of the largest crypto lenders, paused withdrawals, swaps, and transfers between accounts.

Losses continued into Tuesday, though the change was more muted, with the S&P essentially flat for the day. Advance reports from The Wall Street Journal of a 75 basis point interest rate increase from the Fed, in addition to a data release showing a 10.8% increase in wholesale prices, added to negative sentiment during the day.

Indexes snapped back on Wednesday following the release of the Fed’s monetary policy decision and subsequent commentary from Fed Chairman Jerome Powell. Gains, however, were concentrated in the DJIA and the Nasdaq, with both up about 300 points and 270 points, respectively, at close. The S&P, on the other hand, finished just 50 points higher.

In a stark reversal, volatility reigned supreme on Thursday as equities broadly tumbled, with the DJIA down over 700 points at close and below the 30K level, which was last seen in January 2021. In premarket hours early Friday, futures were higher but not high enough to cover the steep losses incurred during the week.

As more stocks continue to hit new 52-week lows, attractive buying opportunities abound for many components within the major indexes. For long-term investors seeking to deploy available capital, there are five laggards this week that offer reliable dividend growth and operational staying power.

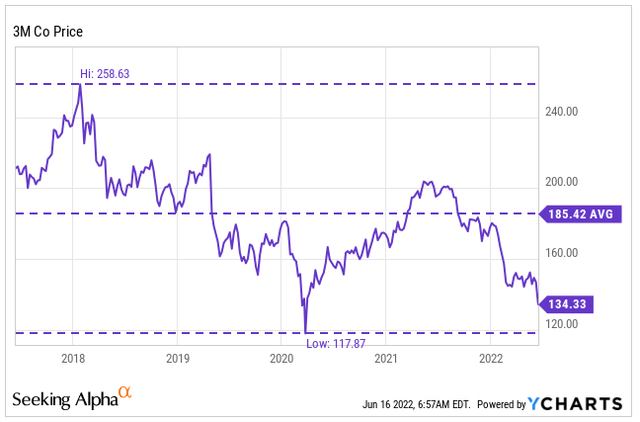

3M Company (MMM)

MMM is a global conglomerate that has over 60,000 products in their portfolio. Popular consumer brands such as Command, Post-It, Scotch, and Ace are all products from MMM. The company operates in four business segments: Safety and Industrial; Transportation and Electronics; Health Care; and Consumer.

Over the past five days, MMM is down about 5% and is now nearing its lows from the early days of 2020.

As of March 31, 2022, the company had over +$3B in cash on hand and generated nearly +$600M in FCF during the quarter. Additionally, the company increased their dividend for the 64th consecutive year. At current trading levels, the nearly $6.00/share annual payout is yielding about 4.5%, which is higher than it has ever been in recent years. At just 65% of net income and full coverage through cash flows, the payout appears safe for the foreseeable future.

As a Dow component with viable long-term staying power, MMM is fit for any portfolio. The company does face its challenges, such as ongoing supply chain issues, in addition to their continuing litigation battles. MMM, however, has been operating for over a century and has successfully navigated through past downturns. At just over 12x forward earnings, MMM is worth a further look as a staple portfolio holding.

Lowe’s Companies, Inc (LOW)

LOW is the world’s second largest home improvement retailer with +$96.3B in total net sales as of the full year ended January 28, 2022. Their operations include nearly 2K home improvement and hardware stores located primarily in the U.S.

In the most recent quarter ended April 29, 2022, LOW reported total net sales of +$23.7B. This was 3.1% lower than the same period last year and +$60M short of estimates. On a two-year basis, however, sales were up 19.7%.

In the current period, a delayed start to the spring selling season contributed to the lower comparable topline figure. This was due to a record setting cold spell in the month of April, in addition to one of the wettest in recent memory.

Though revenues were down, gross margin of 34% came in 74 basis points higher than last year, due in part to strong pricing power and disciplined cost management strategies. This ultimately contributed to a beat of $0.28 on GAAP EPS.

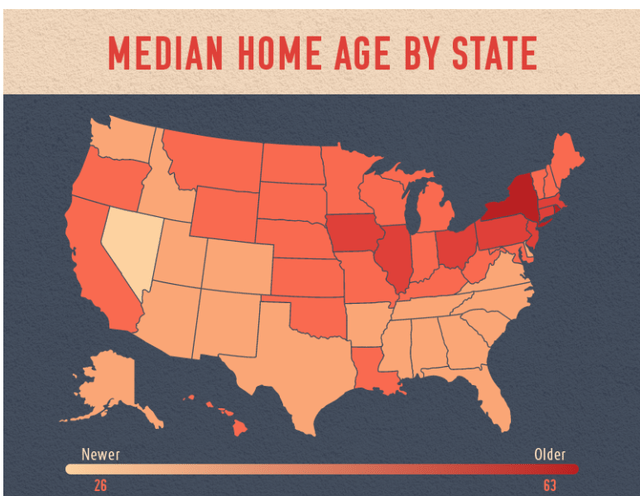

With interest rates on the rise, new home sales down, and an increasing number of layoffs in the sector, investors are rightfully concerned. The company, however, is supported by favorable long-term fundamentals, such as homeowner balance sheet strength and an aged housing stock, to name two.

Housemethod – Median Home Age by State

Having just increased their dividend 31%, the payout is now growing at a five-year CAGR of 18%, which is a testament to their earnings potential and balance sheet strength. For long-term investors, this retailer is one to surely keep on the radar.

Equity Residential (EQR)

EQR is a REIT and S&P 500 component that is focused on the rental of high-quality residential properties located in dynamic cities that attract affluent long-term renters. The company has interests in over 300 properties consisting of approximately 80K apartment units, with an established presence in key markets, such as Boston and New York, as well as an expanding presence in growth markets, such as Denver and Atlanta.

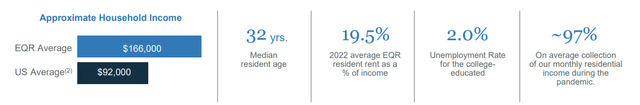

Exposure to an affluent population of renters provides the company flexibility to enact continuous rate increases with little pushback. During recessionary periods, this also serves as protection, as this cohort is among the most likely to retain their current jobs and income through any business cycle. For additional context, the approximate household income of an EQR renter is $166K versus the U.S. average of $92K.

EQR June 2022 Investor Presentation – Tenant Statistics

Despite a solid track record of success, EQR has been one of the worst performers in the S&P 500, down nearly 25% YTD. Continued leasing strength and affordability constraints on home ownership, however, provide a long runway for share price recovery. In addition to upside, investors would receive an annual payout that is current yielding over 3.5% and is growing at a durable CAGR of 6.4%

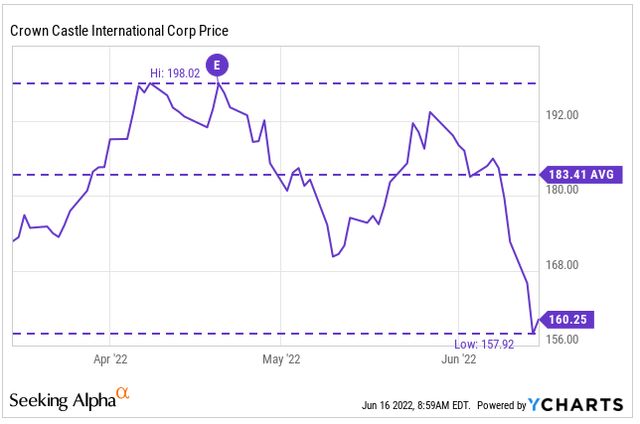

Crown Castle International Corp (CCI)

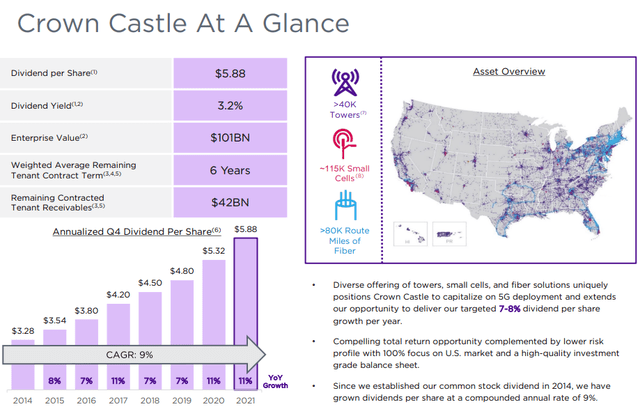

CCI owns, operates, and leases shared communications infrastructure throughout the U.S. This includes more than 40K towers and other structures and 80K miles of fiber supporting small cell networks and fiber solutions. Their core business is providing access to their shared communications infrastructure via long-term contracts in various forms. Their largest tenants include T-Mobile US, Inc (TMUS), AT&T Inc (T), and Verizon Communications Inc (VZ), who collectively accounted for approximately 75% of full year 2021 consolidated site rental revenues.

CCI Investor Presentation – Corporate Summary

In the most recent quarter ended March 31, 2022, CCI reported total site rental revenues of +$1.6B, which was up 15.3% from last year but +$120M short of expectations. Shares dipped following the release but were salvaged from further losses due to an increase in their full-year guidance.

Still, shares are nearly 20% lower from their highs reported at the time of release. Over the past five days, alone, the stock is down almost 10%. While the current pricing multiple of 20x forward FFO seems high, it is reasonable for critical infrastructure. Additionally, the current share price is at odds with the company’s estimated dividend growth rate of 7%. Inputting this rate into a dividend growth model would imply an intrinsic price near their pre-earnings trading levels.

Federal Realty Investment Trust (FRT)

FRT is a REIT that has interests in high quality retail and mixed-use properties. As of March 31, 2022, the company owned 104 properties consisting of 3,100 commercial tenants. In total, these properties were 93.7% leased and 91.2% occupied as of period end.

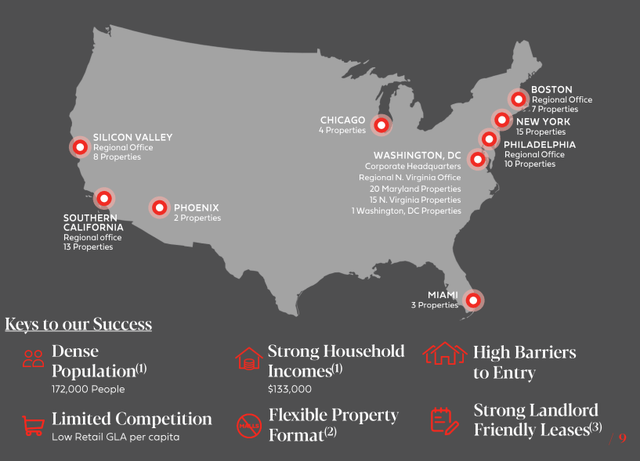

FRT Investor Presentation – Competitive Strengths

Some of FRT’s competitive advantages include the location of their properties, which are concentrated in 1st ring suburbs in nine major high-barrier markets, and strong household incomes of $133K, which enables greater discretionary spending at the company’s retail properties.

In addition, FRT’s tenant base is highly diversified, with the top 25 tenants accounting for just 26% of total ABR and no single tenant accounting for greater than 2.7% of the total. Notable tenants occupying FRT’s properties include The TJX Companies, Inc (TJX), The Home Depot, Inc (HD), and The Kroger Co. (KR), among others. Furthermore, 75% of FRT’s centers have a grocery component, which supports the essential nature of the company’s properties.

In the most recent filing period, FRT reported total revenues that were nearly 20% greater than last year and about +$7.5M better than expected. The company also increased their guidance by $0.10 at the midpoint. Despite the positive updates, shares in the stock continue to sell-off along with the broader market. However, with 54 years of dividend growth and management nimbleness in navigating through challenging operating environments, FRT is well-positioned to weather any near-term setbacks in the macroeconomic environment.

Conclusion

Three of this week’s laggards have been increasing their dividends for over 50 years. During that time span, there have been wars, recessions, and public health emergencies. Those past events all failed to deter the ability of the companies to return excess earnings to shareholders.

While EQR and CCI don’t have as long of a record increasing their dividends, each have had a continuous run of impressive growth of at least five years with a CAGR of over 5%. Additionally, these two companies each provide unique downside protection during recessionary cycles. EQR, for instance, benefits from their exposure to affluent residents who are among the least rent burdened individuals, while CCI is protected by their specialization in critical nationwide infrastructure.

The ability to continuously pay and grow an annual dividend is evidence of a company’s staying power over the long-term. While investors are rightly concerned over the dramatic declines over the past few days, an investment in any one of this week’s laggards has the potential to provide generous long-term rewards.

Be the first to comment