Zerbor

The investment landscape of 2022 has been rather bleak. U.S. indices are in bear market territory and European indices are doing even worse. Other foreign country indices like Brazil (EWZ) and South Africa (EZA) have done well in the first quarter but have quickly collapsed in the second quarter.

In the U.S., the YTD best performing sectors have been energy, utilities, staples, and healthcare. The last three are particularly inelastic and recession proof sectors. With rising gas prices, it’s been very hard to miss the developments in energy. The growth stocks of 2021 and much of the market have been crushed by inflation and rising rates. That said, there are always opportunities in investing. I will discuss the current market environment, sensible investment themes for today, and a few extremely different, high-yield, low-risk positions you should consider.

One Hot Mess

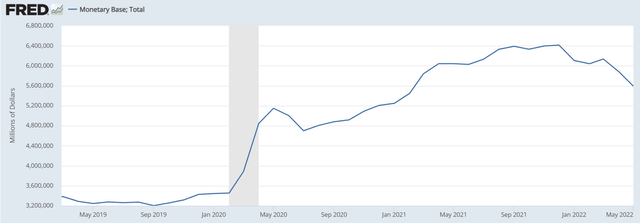

A quick recap of how we got here should start at the bottom of the 2020 market crash. The unprecedented monetary stimulus in mid-March 2020 was what took us out of the bear market in one of the quickest market recoveries ever. Since January 2020, the monetary base has increased just over 60%. Over a third of dollars today were created in the last 2.5 years.

This instantly pushed up the price of financial assets. Prices of goods and services also increased because of persistent pandemic-related supply chain issues throughout 2021. Russia’s invasion of Ukraine in early 2022 has exacerbated the preexisting inflation.

First, Ukraine is a huge producer of agricultural commodities. The war makes this supply unavailable which increases price. Because agricultural commodities are all in some ways substitutes or inputs for food (for example, you can eat grains or chickens, or you can feed the grain to chickens to get more chicken), an increase in the price of agricultural commodities raises the price of most food everywhere.

Second, the war has led to Western countries responding with serious sanctions against Russia. These sanctions force people to find alternatives to previously functional (albeit stretched) supply chains. This creates enormous friction in the production process, which are all costs passed off to consumers in the form of inflation.

Third, the sanctions have led to what many regard as a fracturing of globalization and a weakening of the U.S.-led world order. The controversy surrounding India’s and China’s seemingly neutral or Russian-leaning stance reinforces this concern. This third point should be most alarming from an investment perspective. The Western economies are at this point mostly service economies. Manufacturing and raw material extraction have been slowly outsourced to other countries over the last 50 years. This works well under globalization, but could get very ugly if global trade falters and the West loses the foreign manufacturing base it thought it had access to. If markets price in this scenario, the only possible effect is lower asset prices.

The Fed has been increasing rates to tame inflation. This has led to a rotation away from speculative investments like high growth but profitless companies, crypto, and higher-multiples stocks in general. The market is likely pricing in multiples contraction and lower earnings, a two-tier effect that leads to falling stock prices. It’s important to note that today, the Fed’s hands are slightly tied. The U.S. debt is too big to sustain high interest rates, and inflation is showing little sign of stopping.

Going Back to Basics

Given the current outlook, it’s important to consider which businesses will remain prominent despite the macroeconomic headwinds. Preferably, we want very different business models and price movement. This ensures diversification and a lower total portfolio volatility.

Real assets are safe bets in inflationary times. This includes infrastructure, physical property, and real estate. Real estate is particularly well known as a high cash flow sector with everlasting demand. Businesses and people will always need to pay rent and real estate owners can easily pass off rising maintenance costs to tenants. Furthermore, while demand for housing has increased substantially, supply has not. As mortgage rates increase with interest rates, many buyers who wanted to buy would be forced to rent, which raises the price of rent.

Also, lower-multiples stocks with solid balance sheets and cash flows should benefit from further rotations into value. Preferably, we want product lines whose prices can be passed off to the consumer so profit margins are not affected by rising costs. Also, we want secular tailwinds which support demand of the product. Another good factor is operating leverage, where most of the costs are fixed but the top line can scale quickly.

And, because this article is about higher yields, I am focusing on assets which pay a high but sustainable dividend. In general, we are not strictly looking for price increases, but we do not want the principle to fall substantially. The dividend should also rise over time or at least not drop.

Realty Income Corporation (O)

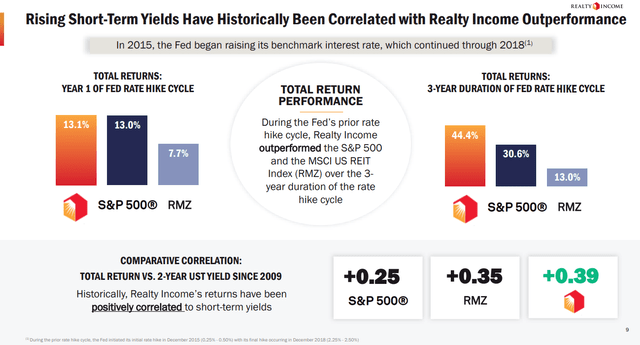

O is a tried-and-true dividend stock. As a REIT, it owns over 11,200 commercial properties all in the U.S., UK, and Spain. Since its public listing in 1994, O has increased its dividend 116 times. The businesses which pay rent to O operate in many different sectors, which really diversifies the income source of O’s property portfolio. O’s resilience under rate hikes is another selling point:

Rate Hikes on Realty Income Performance (Realty Income Investor Presentation )

Given all the priced in rate hikes for this year, this historical outperformance makes O very attractive at this time. As inflation pushes up the price of everything, the extensive range of properties in O’s portfolio must also gain value. Therefore, O’s portfolio NAV should increase along with the rent it can pass on to tenants.

O pays a 25-cent monthly dividend which is likely to grow in the future as rents increase and O acquires new properties. Thus, though its yield is 4.2% if purchased today, the effective yield the investor locks in will grow over time as the dividend grows.

Also, O has a real opportunity to use the ensuing European recession to acquire more European properties. The euro has been declining against the dollar, which increases O’s purchasing power in Europe. A lot of very timely tailwinds.

As far as risks, O has very few. Thanks to its broad diversification, a very serious economic downturn is the only realistic thing that could cause a substantial decrease in earnings. However, O would almost certainly still outperform the market. Any businesses which survive such a downturn will still pay rent and eventually leases can be switched over to other businesses looking to expand their operations.

Whirlpool Corporation (WHR)

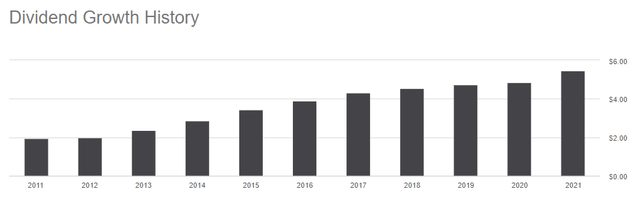

WHR produces and sells home appliances (refrigerators, washers, dryers, cooktops, etc.) all over the world. It has a very sustainable 24% payout ratio giving a 4.3% dividend yield. WHR has raised dividends each year since 2011, with a 10-year dividend CAGR of 12%. WHR also uses share buybacks to return cash to investors. As you hold WHR, the buybacks grow your stake in the company and increase earnings per share.

WHR dividend history (Seeking Alpha)

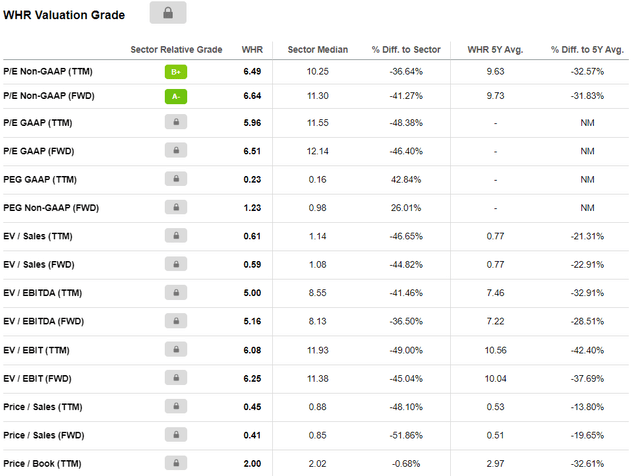

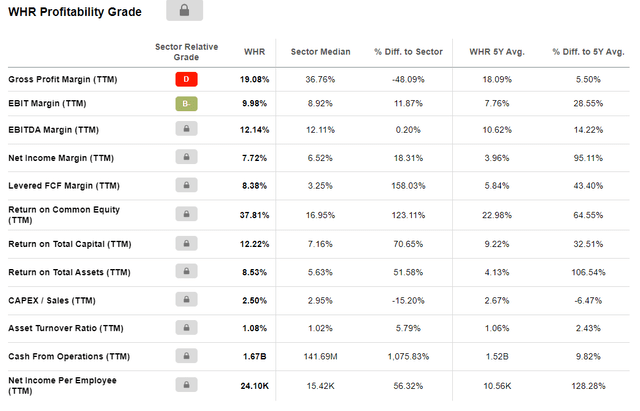

What makes it a buy right now is that the market seems to have overreacted to WHR’s decreasing sales and earnings. Because WHR’s supply chain is global, the Russia/Ukraine conflict has negatively impacted demand in Europe. Also, demand was lower year over year in North America and Asia. In the short term, WHR price may continue to decrease. However, it is has already become cheap, trading just under 6x earnings, well below its sector median. Yet, it has substantially higher return on equity and slightly higher margins.

WHR Valuation (Seeking Alpha ) WHR Profitability (Seeking Alpha)

The numbers speak for themselves. This stock is oversold and undervalued. Unless something goes very wrong with the business, locking in WHR at the current yield is a bargain. Historically, its yield quickly retreats to around 3% after coming down from over 4%. Today, the yield is at 4.3%. With its dividend rising each year, its price will need to increase quite a bit to bring the yield back down to 3%.

This implies the current share price is very favorable. Two more quarters of decreasing earnings could send the price lower, but the margin of safety is already quite large. At the end of the day, home appliances are needed by most people. They break over time and require replacement. As more people set out to live on their own, they will naturally acquire more home appliances. The business has guaranteed long term demand. WHR will also grow its business in India and in commercial appliances. Both are distinct and large markets, which add to the top line.

Perhaps WHR’s most serious risk is competitors taking market share by outcompeting on price. However, WHR has very strong brand recognition and is known for quality. Based on its long-term outlook, safe dividend, and large margin of safety, WHR is a buy for a dividend portfolio.

Simplify Volatility Premium ETF (SVOL)

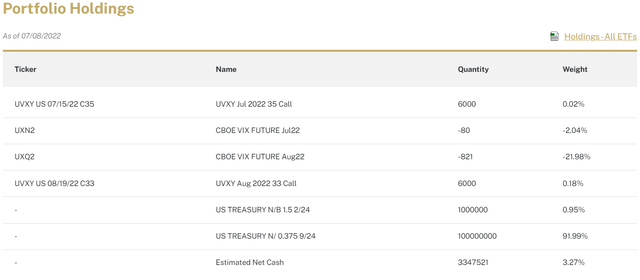

SVOL is very different from the other two picks. It is a systemic short volatility strategy with a tail hedge for protection against extremely high volatility. SVOL shorts the near month VIX futures, which is normally higher than the spot VIX, to earn a yield. Investors buy VIX futures as a hedge against high volatility. SVOL’s strategy is basically selling insurance to these investors. In the long run, volatility risk premium tends to favor volatility sellers, so this strategy can reliably earn high yields over time. SVOL’s tail hedge are extremely far OTM call options on the ProShares Ultra VIX Short-Term Futures ETF (UVXY), which goes long the near month VIX futures. If the VIX surges, these calls will protect the portfolio from a complete liquidation.

Admittedly, SVOL’s strategy is complicated and riskier than the other picks. However, the investor is compensated with an 18% SEC 30-Day Yield on a monthly dividend distribution. The monthly dividend fluctuates over time but has never ceased since the fund started paying dividends.

SVOL is a solid consideration in today’s low interest rate environment where treasuries cannot provide a good return. Its dividend is noticeably different from that of equities because it comes from trading the volatility market. Despite the “picking up pennies in front of a steamroller” perception commonly ascribed to short volatility funds, I do not view this income as carrying substantial risk. For one, SVOL’s exposure to VIX futures is meant to range from -0.2x to -0.3x the VIX futures index. Extreme events are mitigated by the tail hedge. Any other spikes in the VIX will be subject to the quick mean reversion tendency of volatility, which means shorting volatility at these spikes has an elevated chance of profit.

Even in regimes of high volatility (let’s say VIX consistently over 25), SVOL will quickly regain its ability to generate yield. This is because VIX futures term structure will always, except under extreme cases, be in contango, allowing for positive roll yield month to month. VIX futures expiring later will trade at higher prices than those expiring sooner because of volatility’s role as insurance and investors’ risk aversion. Risk aversion means people would give up their expected value return, preferring a lower, certain return (called the certainty equivalent), so VIX futures gain a premium over the spot VIX. Even in high volatility regimes, risk aversion still exists, so the term structure will shift upward and eventually return to contango. This is exactly what has happened this year. SVOL’s dividend has been unaffected, though its share price has decreased substantially since the start of the year. By total return YTD, it is still outperforming the S&P 500 by 7.6% with less volatility.

SVOL YTD Total Return vs SPX TR (Seeking Alpha)

Virtu Financial, Inc. (VIRT)

VIRT’s business is facilitating trades on various exchanges. When trading volumes increase or bid-ask spreads widen, VIRT makes more money. Therefore, market volatility tends to be great for VIRT’s share price because volatility is generally accompanied with increased volume and widening bid-ask spreads. One could consider VIRT an imperfect but convenient opposite of SVOL. More volatility hurts SVOL but is great for VIRT.

VIRT boasts a 4.3% dividend yield with a 25% payout ratio. Since 2019, VIRT has done stock buybacks each quarter. Its business has high operating leverage because its technological infrastructure and employees are mostly fixed costs, while the number of trades it makes is theoretically boundless. Recently, VIRT has announced plans to expand into cryptocurrency markets, which would be another source of trading revenue.

VIRT’s earnings clearly depend on the popularity of trading in specific markets. Therefore, its biggest risk is a reduction in trading volume, potentially due to the bear market diminishing retail interest in trading. However, even if smaller volumes led to a 50% drop in earnings, VIRT’s current dividend would theoretically remain safe. This would lead to a big drop in share price, which would be a good time for the company to do buybacks and increase earnings per share. Inevitably, earnings will rebound as more trading follows renewed interest in markets. Though it easily has the highest volatility of the four picks, VIRT is a safe dividend stock with a built-in protection against broader market volatility.

Conclusion

These four picks are very different from each other, but all exhibit a safe dividend yield with strong prospects for dividend or price growth. They all feature unique tailwinds and are relatively uncorrelated to each other. The three stocks each have yields over 4% at the time of writing. O and WHR are known for consistent dividend growth. VIRT offers a unique positive response to market volatility, and SVOL monetizes the volatility risk premium for yield. Together, these four high-yield names are apt considerations for the current bear market.

Be the first to comment