Crude Oil Price Talking Points

The price of oil approaches the monthly low ($95.10) as the Organization of Petroleum Exporting Countries (OPEC) forecast a slower rate of consumption for 2023, and crude may face a further decline over the coming days if it fails to defend the April low ($92.93).

Crude Oil Price Eyes April Low as OPEC Forecasts Slower Demand in 2023

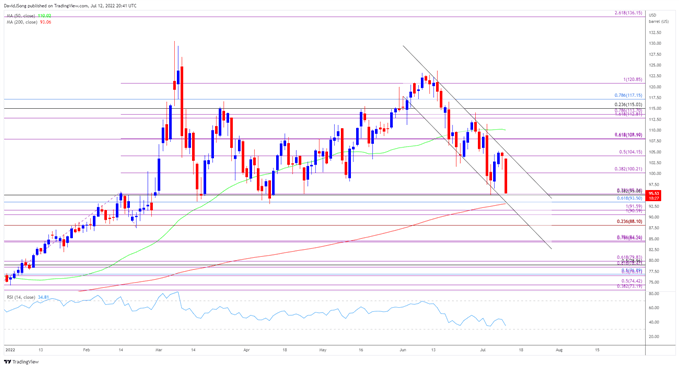

The price of oil appears to be trading within a descending channel as it snaps the series of higher highs and lows from last week, and crude may continue to exhibit a bearish trend over the near-term even as OPEC’s most recent Monthly Oil Market Report (MOMR) reveals that “for 2022, world oil demand is foreseen to rise by 3.4 mb/d, unchanged from last month’s estimate despite some regional revisions.”

However, the forecasts for 2023 states that “world oil demand is anticipated to rise by 2.7 mb/d y-o-y,” and it remains to be seen if OPEC will retain the revised production schedule throughout the remainder of the year as the group plans to “adjust upward the monthly overall production for the month of August 2022 by 0.648 mb/d.”

In turn, the price of oil may face additional headwinds over the near-term as the adjustment in crude output is met with expectations for easing demand, and data prints coming out of the US may influence the price of oil ahead of the next OPEC Ministerial Meeting on August 3 as weekly field production gradually returns towards pre-pandemic levels.

With that said, the price of oil may continue to trade within a descending channel as it snaps the series of higher highs and lows from the monthly low ($95.10), and failure to defend the April low ($92.93) may push the Relative Strength Index (RSI) into oversold territory for the first time in 2022 as crude comes up against the 200-Day SMA ($93.06) for the first time since December.

Crude Oil Price Daily Chart

Source: Trading View

- The price of oil is on the cusp of trading to a fresh monthly lows as it snaps the series of higher highs and lows from last week, and failure to defend the April low ($92.93) may push crude below the 200-Day SMA ($93.06) for the first time since December as it establishes a descending channel.

- Need a close below the Fibonacci overlap around $93.50 (61.8% retracement) to $95.30 (23.6% expansion) to bring the $90.60 (100% expansion) to $91.60 (100% expansion) area on the radar, and a further decline in the price of oil may push the Relative Strength Index (RSI) into oversold territory, with a move below 30 in the oscillator likely to be accompanied by a further decline in crude like the price action seen during the previous year.

- However, failure to test clear the April low ($92.93) may push the price of oil away from channel support, with a move above $100.20 (38.2% expansion) bringing the $104.20 (50% expansion) region back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment