Kelvin Murray/DigitalVision via Getty Images

Thesis

Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB) is a buy-write closed-end fund who has current income as a primary objective. A buy-write CEF that focuses on equities buys a basket of equities mirroring an index (in this case the S&P 500) and writes call options on the underlying stocks or index in order to generate income.

As per the fund’s literature:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes

By virtue of writing call options, if they expire without getting triggered, the fund pays the premium as dividends, or conversely if the market rallies the fund pockets a capital gain that is disbursed as dividends.

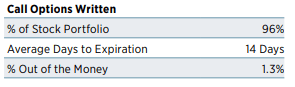

Currently, ETB has 181 equity holdings and writes options on 96% of the portfolio. The options have a maturity date that is 14 days out and are 1.3% out of the money:

Call Options (Fund Fact Sheet)

A significant portion of market participants now expects a recession in the U.S. and a stock market which is going to rebase lower to price in lower earnings and a lower P/E ratio. We believe we are currently in a bear market rally, and we will see a resumption in a decline in stock prices in the upcoming months. While ETB is great to dampen lower prices via the realized options premiums, it will not escape the pull lower in the overall market, similar to what we have seen in June when ETB hit a price of $14.09.

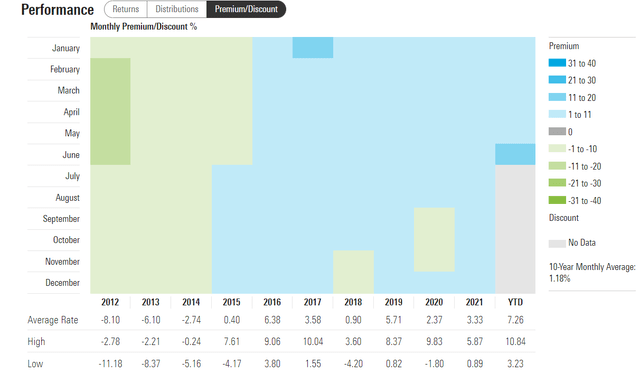

What is the most concerning aspect for ETB is its historic high premium to NAV that currently stands at 15.06%. When looking at the Morningstar data, the historic high prior to this month was realized in 2017 when the fund had a 10% premium to NAV. We are much higher now, and the reason for that is the realization of market participants around the benefits of a “buy-write” option strategy in a decreasing market with high implied volatility. That does not justify to us the enormous premium now embedded in the fund. We expect the premium to normalize to something closer to 5%-7%. We also expect the stock market to resume its downtrend after this bear market rally.

Let us not mince our words – we like ETB, we feel it is a great fund with a very robust management team and a great long-term performance. It is, however, currently overpriced. Even a great asset needs to be sold when overpriced. We feel the premium to NAV will move lower from a decade-long high and that the overall market will resume a downtrend after the current bear market rally. We are targeting a $14.25 price for ETB in the next three months, after which we are going to revisit the name. We are rating it a Sell only for holders of the fund with the above short-term target in mind. ETB will most certainly become a buy later in the year, but it is now unfortunately overpriced.

Performance

ETB is up a shocking 2.8% year-to-date versus the S&P 500:

We can observe a similar performance to the S&P 500 up to May 2022. As the implied volatility increased in the market and the manager increased the proportion of the fund that had sold call options against it, the market participants increased the premium to NAV for the fund.

On a 5-year basis, ETB lags the index due to the give-up in upside:

Like any buy-write fund, long term, the CEF will lag the index given the lack of upside when the market rallies. Please keep in mind that the fund sells call options on the underlying stocks, hence, as the index rallies, the fund will only pocket the option premium.

Premium/Discount to NAV

The fund now sports a decade-long high premium to NAV of 15%:

Premium/Discount to NAV (Morningstar)

We can see from the Morningstar data that the prior high in premium to NAV was realized in 2017 when the fund had a 10% premium to its net asset value. We believe the current state of affairs resides with the realization of many market participants around the benefits of writing call options in a down market. We do not think that a 15% premium justifies the benefits. An investor can just actively replicate this strategy in their own portfolio.

Holdings

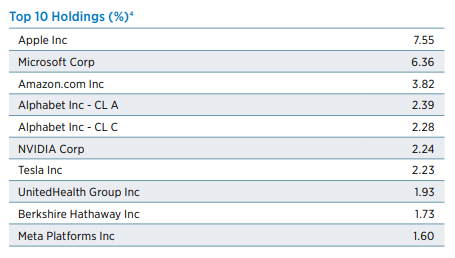

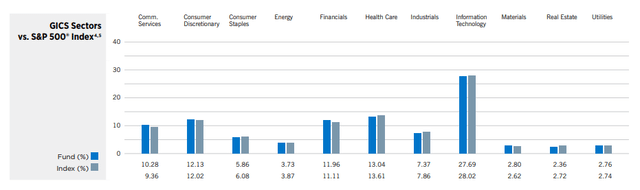

The fund holds a portfolio that closely resembles the S&P 500 index:

We can see from the above table that the sectoral allocations are very similar to the index composition with +/- 1% divergences in discrete sectors.

The fund’s top holdings are as follows:

Top Holdings (Fund Fact Sheet)

Conclusion

ETB is a “buy-write” fund that purchases a portfolio of stocks that closely mirror the S&P 500 and then writes call options on the underlying basket. Currently, ETB has 181 equity holdings, and writes options on 96% of the portfolio. The options have a maturity date that is 14 days out and are 1.3% out of the money. The fund is now up +2.8% year to date due to the monstrous increase in premium to NAV. The premium to NAV is now at a historic high of 15%. We believe we currently are in a bear market rally and the downward move in stocks will resume. We expect the premium to NAV for the fund to normalize to a 5% – 7% range. We like the fund long term, but we see it overpriced now and lower in the next three months. We are targeting a $14.25 price for ETB in the next three months, after which we are going to revisit the name.

Be the first to comment