designer491

- 1 dividend raise

- 3 sources of passive income

- $485.71 from dividends

- 6 stocks/units dripped in May

Hey, Everyone

As we enter the month of July, I think it’s safe to say you can’t time the market once again. Morgan Wallen says it best – we going up down, up down, up down! While headlines make things sound so terrible all over the world, the market pops a couple hundred points one day and then drops the next. Who knows. This is why I love the dividend growth investing approach, sit back and collect those dividends. Enjoy the raises and hey even kind of enjoy lower prices as they may produce more drips!

Hey, maybe I’m too positive, but I really think we need to look at the glass half full vs half empty.

Alright, Let’s Get To Our June 2022 Passive Income

Raises

Got 1 raise that I wasn’t expecting. Woot, woot!

- General Mills (GIS) raised their dividend 5.9%. This added $17.40 to our dividends.

Total Added Income from Dividend Raises in 2022 – $320.11

General Mills isn’t a consistent dividend grower, but their dividend is safe and continues to grow for us. Love the brands and even their dog food. The kids have been eating those Fruitsations gummies. They are so good, and I was surprised to recently find out they are General Mills as well. Got to love it!

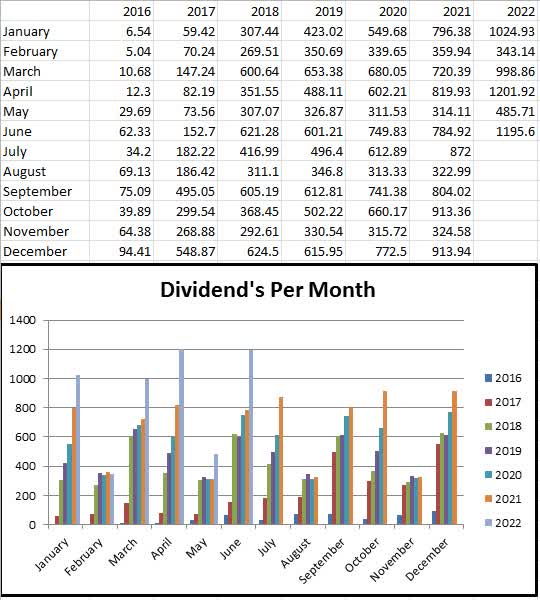

June 2022 Dividend Income

13 companies paid us this month.

| Stocks | June 2021 Income | June 2022 Income |

|---|---|---|

| IBM (IBM) | 45.92 USD | sold |

| 3M (MMM) | 32.56 USD | sold |

| Canadian Utilities (OTCPK:CDUAF) | 93.24 (2 DRIPs) | sold |

| Inter Pipeline (OTCPK:IPPLF) | 8.32 | sold |

| Microsoft (MSFT) | 10.64 USD | 18.60 USD |

| Home Depot (HD) | 19.00 USD | |

| Smart Centers | 32.38 (1 DRIP) | 34.23 (1 DRIP) |

| Lockheed Martin (LMT) | 36.40 USD | 61.60 USD |

| RIT ETF | 64.94 (3 DRIPs) | 67.37 (4 DRIPs) |

| Canadian National Railway (CNI) | 59.04 | 70.32 |

| J&J (JNJ) | 45.58 USD | 75.71 USD |

| XAW ETF | 38.19 (1 DRIP) | 75.62 (2 DRIPs) |

| Fortis (FTS) | 0 | 94.70 (1 DRIP) |

| Brookfield Renewable (BEPC) | 82.23 (1 DRIP) | 109.28 (2 DRIPs) |

| Manulife Financial (MFC) | 136.95 (6 DRIPs) | |

| Suncor (SU) | 177.66 (3 DRIPs) | |

| Enbridge (ENB) | 235.48 (5 DRIPs) | 254.56 (3 DRIPs) |

| Totals | 784.92 | 1195.60 |

22 stocks Dripped in June, beautiful!

$410.68 more than last year, or a 52.32% increase. Just amazing. Our first time these months clear 1k in dividends. It’s a fantastic feeling. The proof is in the pudding, Stick to the plan and watch it grow.

If you’re interested, check out our Previous Dividend Income Reports.

Our DRIPs (Dividend Reinvestment Program) added $35.18 to our yearly forward dividends this month. Sweet!

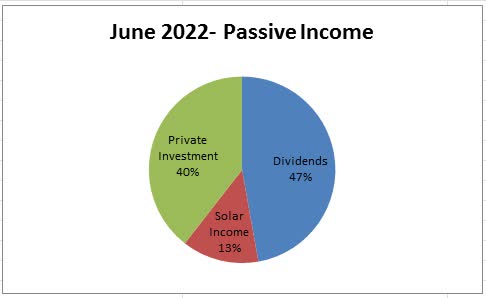

Other Income

Private Investment Payment – $1000.00

1k a month, Straight to the HELOC.

Solar Panel Income

In May (we always get paid a month later), our solar panel system generated 1,191 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One (OTCPK:HRNNF) deposited $337.87 into our chequing account this month.

Last May, the system generated $330.91, so we are slightly higher this year again. Great to see.

Total Income for 2022 – $930.61

System Installed January 2018

Total System Cost —$32,396.46

Total Income Received —$10,815.83

Amount to Break even — $ 21,580.63

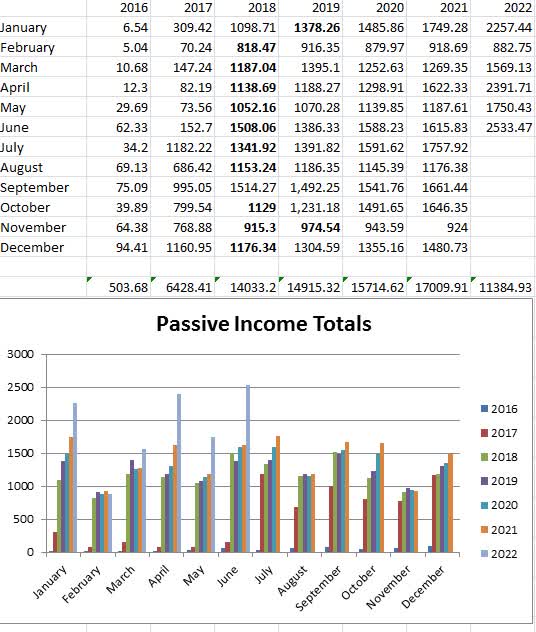

Total June 2022 Passive Income – $2,533.47

June 2021 Passive Income – $1,615.83

Did we just break $2,500? Bam! That’s one of those things you got to pat yourself on the back for. Good job guys. Ha-ha, seriously though, wow that feels good. Six years ago, we started this journey, we brought in 62 bucks in June 2016. If we can do it, you can as well. Maybe not this high, maybe way higher. But you need to focus on growth. Any growth is good and puts you ahead of where you were when you started, the compounding effect will only propel things faster.

I really believe financial habits are more important than income. Get in the habit of paying yourself first, it really is that simple. Of course, if you have a larger income that helps as well though.

Totals For 2022

Dividends Year-To-Date Total – $5,250.16Other Passive Income Year to date – $6,134.77Total Passive Income for 2022 — $11,384.93Year-End Goal – $25,000

June Stock Purchases

We continue to dollar cost average into positions. We maxed out one TFSA this month and will continue to work on the remaining one. 18k left to max that one.

Telus (TU)

We added 2 separate tranches this month. I have always wanted to grow our position but was waiting for a pullback. Unfortunately, the pullback happened after we made our 2 purchases. Ha-ha, long term hold though, I’m pretty sure we will be okay in 10 years

- 65 Telus at 31.62 per share

- 64 Telus at 31.24 per share

These purchases add $174.81 in forward income.

Texas Instruments (TXN)

I’ll gladly keep growing our position in TXN. It’s currently cheaper and offers over a 3% starting yield. Great dividend growth history and some monster raises. While short term the industry may get hurt, long term we need more and more semiconductors. Everything is getting smarter and needs more chips.

- 10 more shares at $158.36 per share

This added 46 bucks in forward income.

Proctor & Gamble (PG)

The stock I have always wanted to add to but couldn’t get myself to pay over 150 a share. They dropped to 130 for a short period, and we jumped on the opportunity. Got to love adding to the kings!

- 10 shares of PG at $130.79 per share

- Added income – $36.53

National Bank (OTCPK:NTIOF) (OTC:NTIFF) (OTCPK:NBKCF)

We have grown this position quite a bit this year. One of the best performing banks with some of the highest dividend growth rates. These bank stocks have pulled back quite a bit and I’ll gladly continue growing our bank holdings. BNS currently yields over 5.5%!

- Bought 46 additional shares at $85.95 per share.

- This added $169.28 in forward income.

Overall, we added $426.62 to our forward dividend income last month. A mix of growth, yield and defence this month. 3 of these stocks are currently cheaper than when we purchased them. I’ll continue to drip and dollar cost average into them.

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada of $85.

Increase Dividends by $4285.81 this year (bringing our forward income from dividends to $13,000 a year)

The goal for 2022 is to have a forward passive income of $27,500 thousand by the end of the year. I plan on doing this by refinancing our house and taking advantage of these low interest rates. I want to max out some accounts and let compounding do their magic. It’s a big goal and will almost double our current passive income.

- With New Purchases, Drips, and Dividend Raises, we continued to grow the size of our dividend Portfolio. Total increase so far in 2022 is $2,965.89

ETF Monthly Minimum Purchase of $250

- This month we added 11 more units of XAW ETF.

- Questrade* is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

June 2022 Passive Income Conclusion

A great month overall. Love that we finally maxed one TFSA and we surpassed the $2,500 mark. Life has been good to us. July looks to be a busy month full of some more outdoor adventures with friends and family. What’s not to like?

I hope you all are doing your best to go out there and live your best life. What have you been up to? Buying anything lately? Or stacking cash?

Cheers!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment