courtneyk/E+ via Getty Images

This article was published on Dividend Kings on Monday, February 13th, 2023.

—————————————————————————————

2023 has been a confusing year for investors. As Bloomberg’s Jonathan Farrow put it, “if you’re not confused, you’re not paying attention.”

On the one hand, we have 98% of global CEOs expecting a recession this year, according to a January Ernst & Young survey.

On the other hand, 54% of those CEOs are still planning to invest in growth in 2023.

We have the bond market, via the most inverted yield curves since 1981, screaming that a recession is a 100% certainty by July.

The Bloomberg and FactSet economist consensus both agree, recession starts in Q2, just weeks away.

On the other hand, those same blue-chip economists expect full-year 2023 growth to be 0%, the mildest recession in US history.

Bloomberg Consensus S&P Bear Market Bottom Scenarios…Less Scary The Longer It Takes To Go Into Recession

| Earnings Decline In 2023 | 2023 S&P Earnings | X 25-Year Average PE Of 16.8 | Decline From Current Level |

| 0% | $217.25 | $3,656.32 | 10.6% |

| 5% current consensus | $206.39 | $3,473.50 | 15.1% |

| 10% | $195.53 | $3,290.69 | 19.6% |

| 13% (average since WWII) | $189.01 | $3,181.00 | 22.2% |

| 15% | $184.66 | $3,107.87 | 24.0% |

| 20% | $173.80 | $2,925.05 | 28.5% |

(Source: Dividend Kings S&P Valuation Tool, FactSet, Bloomberg)

The overall consensus for the stock market has become less bearish, as the economic data comes in better than expected.

However, a 10% to 15% correction sometime in 2023 is still likely.

Since 1985, the average peak intra-year decline has been 15% regardless of the economy. So this is hardly a surprising forecast.

And, of course, we can’t forget the red-hot jobs market driving the Federal Reserve to keep hiking to levels that just a year ago seemed absurd.

In early 2022, Deutsche Bank and Bridgewater predicted that the Fed might have to hike from 5% to 6% in a worst-case scenario and cause a severe recession.

- with a peak decline in the S&P of -40%

Given that the bond market was pricing in just 0.5% worth of rate hikes in 2022 at the start of last year, this seemed like a truly absurd “worst-case” scenario.

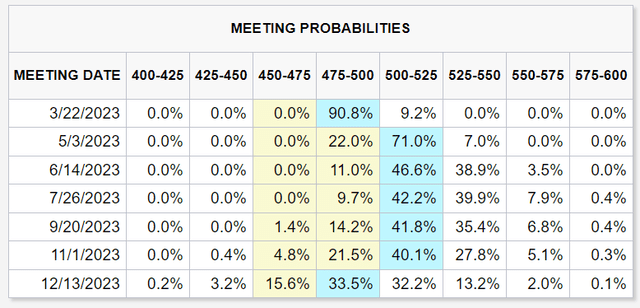

But thanks to a labor market that just won’t quit, with the lowest unemployment in 54 years, and economic data that’s starting to improve, the bond market is now pricing in a base case of the Fed stopping at 5.25% in July.

And the strongest QT (reverse money printing) in history adds an extra 2% to that, according to the San Francisco Fed.

Or, to put it another way, according to the bond market and San Francisco Fed, the Fed won’t quit hiking until rates have gone from 0% to effectively 7.25%.

Imagine a time traveler had told you all this was going to happen on January 1st. How much do you think you would have guessed that the S&P would have crashed in January?

Morgan Stanley, the #1 most accurate forecaster of 2022, was literally predicting a 20% decline for stocks in Q1, possibly by the end of January.

Charlie Bilello

Instead, the market soared 7%, in the 8th best start to the year in US history.

I deal in facts, not forecasting the future. That’s crystal ball stuff. That doesn’t work.” – Peter Lynch

The economy isn’t the stock market, and the stock market isn’t the economy.

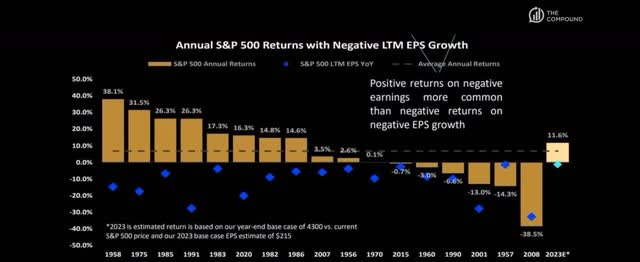

Do you know how many years the S&P has reported negative earnings growth since 1950?

17 years. And in 11 of those years, stocks went up.

Does it seem like none of this makes sense? That the stock market is a casino, and no expert knows what is going on?

In the short-term, the market is a casino where anything can and does happen.

- meme stocks can go up 150% one day and then crash 50% the next day

- thanks to zero-day options, a single-day purely speculative bet on the most volatile stocks in the world

But what about the long-term? There too Wall Street is a casino. But not the way most people think.

The Venetian Macau is the world’s largest casino, costing $2.4 billion to construct. Do you think such palaces are built on the backs of gamblers’ winnings?

No, it’s based on pure math and the fact that in the long-term, the house always wins.

The same is true on Wall Street, where in the long-term stocks always go up.

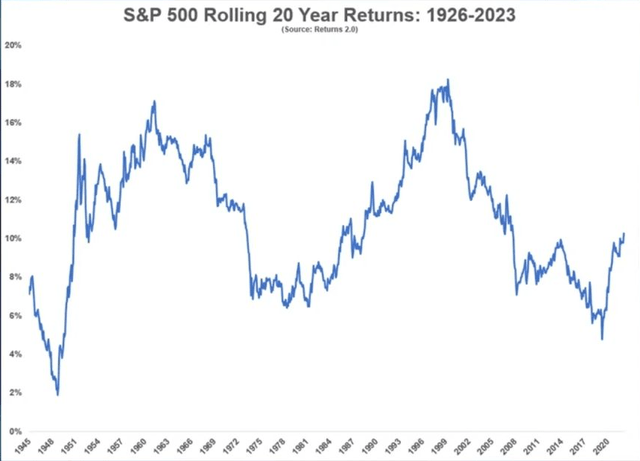

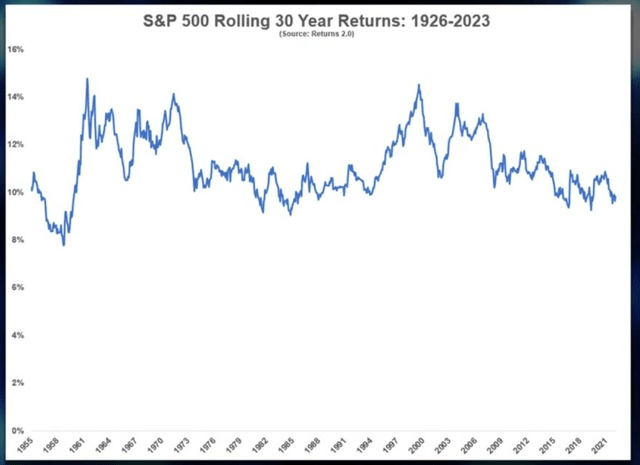

Since 1926 the worst rolling 20-year annual return for stocks was 2%, and that was if you bought before the Great Depression’s 86% crash.

The worst 30-year return? 7% annual returns.

Given that anyone age 70 or less should have a 30-year time horizon (according to the Social Security Administration), this means that almost all investors, even the most conservative retirees, should own some stocks.

High-Yield Dividend Aristocrat Income Dream Machines For These Crazy Times

If you’re collecting safe income of at least 4% from your portfolio, then you can potentially retire on dividends alone.

Suppose your dividends are safe and growing and can cover your expenses in retirement (when combined with Social Security and private pensions). What does it matter that the S&P went up 7% in January?

Heck, had it crashed 20% like Morgan Stanley thought it would, it still wouldn’t make a difference to your standard of living.

If you never have to sell stocks, then price volatility is not a risk to you, at least not if you can avoid becoming a forced seller for emotional reasons.

Short-term prices are vanity, cash flow is sanity, and dividends are reality.

For the smart high-yield investor the only things that ever matter are the fundamentals of their portfolios.

And this is where high-yield aristocrats can be the ultimate safe retirement income dream machines.

Not just for great economies and markets like 2021, but crazy times when no one knows what the heck is going on, like today!

So let me show you how to find four high-yield aristocrat retirement dream stocks, in 60 seconds.

How To Find 4 High-Yield Aristocrat Retirement Dream Buys In 60 Seconds

Let me show you how to screen the Dividend Kings Zen Research Terminal, which runs off the DK 500 Master List, to find the best dividend growth blue-chips with exceptional return potential in 2024.

The Dividend Kings 500 Master List includes some of the world’s best companies, including:

- every dividend champion (25+ year dividend growth streaks, including foreign aristocrats)

- every dividend aristocrat

- every dividend king (50+ year dividend growth streaks)

- every Ultra SWAN (as close to perfect quality companies as exist)

- the 20% highest quality REITs according to iREIT

- 40 of the world’s best growth blue-chips

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Dividend Champions (25+ Year Dividend Growth Streaks) | 133 | 26.60% |

| 2 | Reasonable Buy Or Better | 69 | 13.80% |

| 3 | None Speculative | 59 | 11.80% |

| 4 | 10+ Quality (Blue-Chip Or Better) | 53 | 10.60% |

| 5 | 10+% long-term return potential | 28 | 5.60% |

| 6 | 4+% yield (4% rule on dividends alone) | 4 | 0.80% |

| Total Time | 1 Minute |

(Source: DK Research Terminal)

From 500 of the world’s best companies to the four that specifically meet our goals of the most dependable high-yield aristocrat retirement dream stocks in one minute.

Dividend Kings Zen Research Terminal

Potentially very safe 6.2% yield, 12.3% long-term consensus return potential, and 11% to 15% long-term income growth potential. How reasonable is that total return estimate?

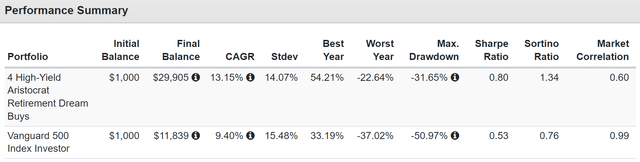

Total Returns Since 1995

Seems pretty reasonable, given that over the last four decades, these aristocrats have delivered 13% annual returns.

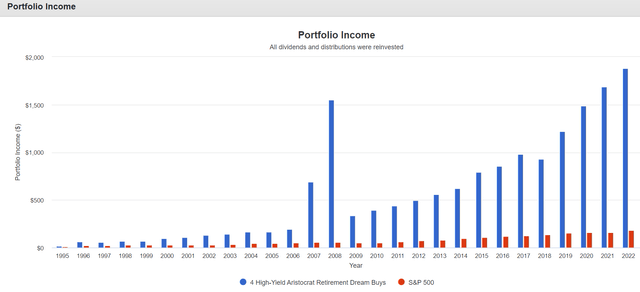

14.0% Income Growth Over The Last 26 Years = 188% Yield On Cost

Since 1996 the S&P has delivered 8.1% annual income growth, while these high-yield aristocrat retirement dream stocks delivered 14% annual income growth.

Why You Should Consider Buying These Four High-Yield Aristocrat Retirement Dream Buys Today

Here are the high-yield retirement dream aristocrats in order of highest to lowest yield.

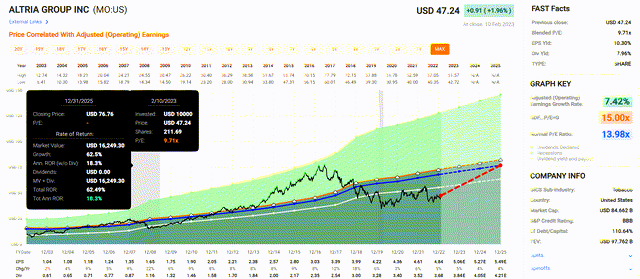

Altria (MO): The King of Dividend Kings

Further Reading

Dividend Growth Streak: 53 years

DK Quality Rating: 98% medium risk 13/13 Ultra SWAN dividend king

Current Price: $47.24

Fair Value: $69.68

Discount: 32%

DK Rating: Potentially very strong buy

Yield: 8.0%

Long-Term Growth Consensus: 5.5%

Long-Term Total Return Potential: 13.5%

(Source: FAST Graphs, FactSet)

If MO grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 62% or 18% annually.

- 2.5X more than the S&P 500 consensus

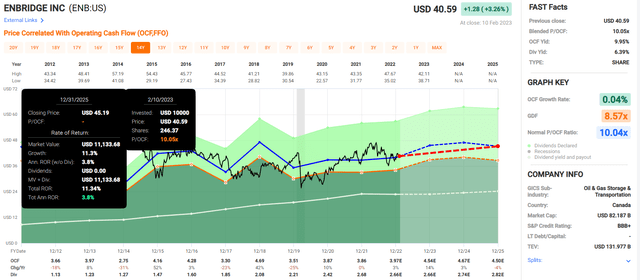

Enbridge (ENB): The Risk Management King Of Midstream

Further Reading

Dividend Growth Streak: 28-year streak

DK Quality Rating: 99% very low risk 13/13 Ultra SWAN

Current Price: $656.35

Fair Value: $705.73

Discount: 15%

DK Rating: Potentially strong buy

Yield: 6.6%

Long-Term Growth Consensus: 3.3%

Long-Term Total Return Potential: 9.9%

(Source: FAST Graphs, FactSet)

I’m skeptical that ENB will deliver negative growth in 2025, but ENB’s upside potential in the next few years is limited to about 8% CAGR through 2024.

- 50% less than the S&P 500 consensus

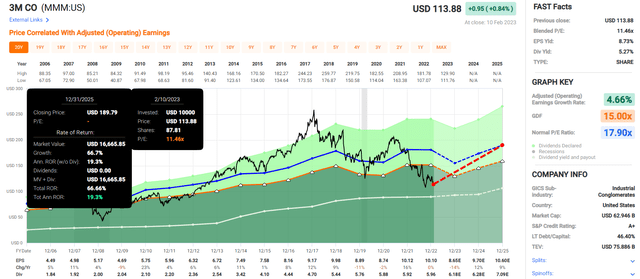

3M (MMM): A Dividend King That Is Potentially Too Cheap To Ignore

Further Reading

DK Quality Rating: 96% very low risk 12/13 Super SWAN dividend king

Current Price:$113.88

Fair Value:$182.24

Discount: 38%

DK Rating: Potentially ultra-value buy

Yield: 5.3%

Long-Term Growth Consensus: 7.0%

Long-Term Total Return Potential: 12.3%

(Source: FAST Graphs, FactSet)

If MMM grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 66% or 19% annually.

- 2.5X more than the S&P 500 consensus

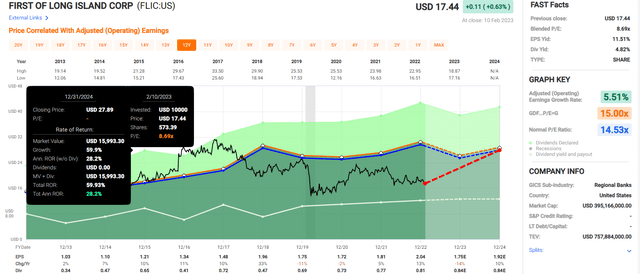

First of Long Island Corp. (FLIC): One Of The Best Banks You’ve Never Heard Of

Further Reading

Dividend Growth Streak: 29-year streak

DK Quality Rating: 75% high risk 10/13 blue-chip dividend champion

Current Price:$17.44

Fair Value: $26.84

Discount: 35%

DK Rating: Potentially strong buy

Yield: 4.8%

Long-Term Growth Consensus: 7.0%

Long-Term Total Return Potential: 11.8%

(Source: FAST Graphs, FactSet)

If FLIC grows as expected and trades at historical market-determined fair value by the end of 2024, investors should earn 60% or 28% annually.

- 3X more than the S&P 500 consensus

Bottom Line: High-Yield Dividend Aristocrat Retirement Dream Buys Can Keep You Sane And Safe In These Crazy Times

Let me be clear: I’m NOT calling the bottom in any of these blue-chips (I’m not a market-timer).

Aristocrat status or even 13/13 Ultra SWAN quality does NOT mean “can’t fall hard and fast in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about MO, ENB, MMM, and FLIC.

These are some of the most dependable high-yield dividend growth stocks on earth.

Their 6.2% potentially very safe yield, along with 12.3% long-term return potential and 11% to 15% long-term income growth potential makes them a fine choice for anyone looking to escape the rat race.

If you can be confident in your ultra-yield, and that’s what’s paying the bills, stock price becomes irrelevant.

The Fed, interest rates, inflation, and what Putin does next becomes irrelevant.

The only thing that you have to care about is the fundamentals of your companies, and that’s what I’ve spent eight years studying and building tools to do.

Ultimately financial freedom is something everyone deserves, and how to achieve it can be summed up in a single sentence.

Short-term prices are vanity, cash flow is sanity, and dividends are reality.

Be the first to comment